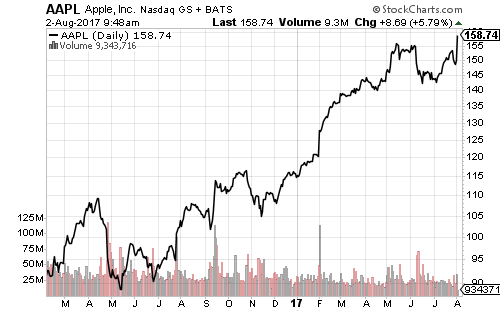

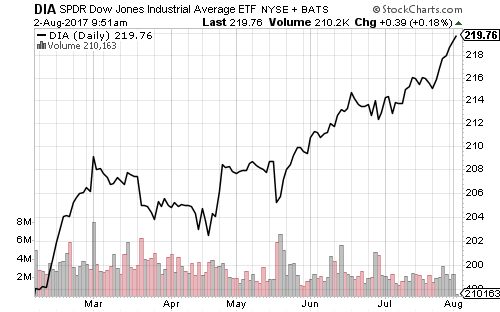

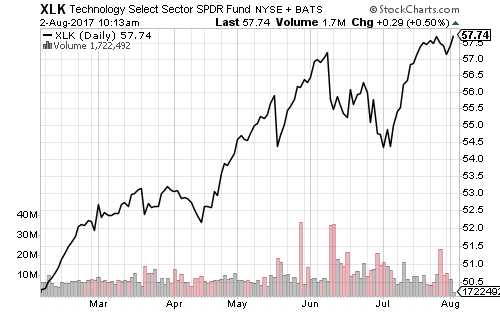

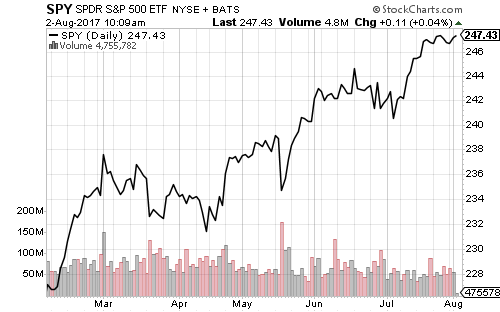

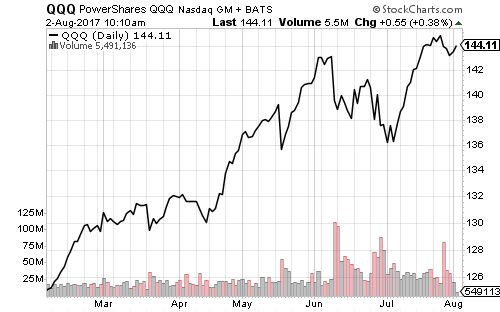

Apple (AAPL) brought the Dow Jones Industrial Average past 2200 to a new all-time high on Wednesday. Apple beat earnings estimates by ten cents and issued promising guidance ahead of next quarter’s iPhone 8 release, lifting the technology sector to a new all-time high as well.

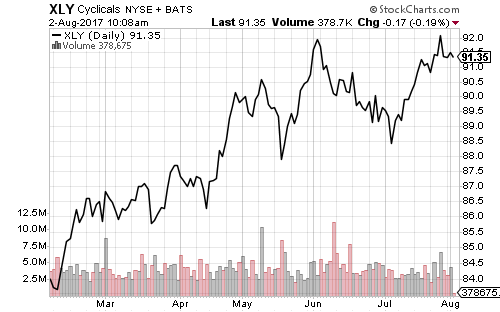

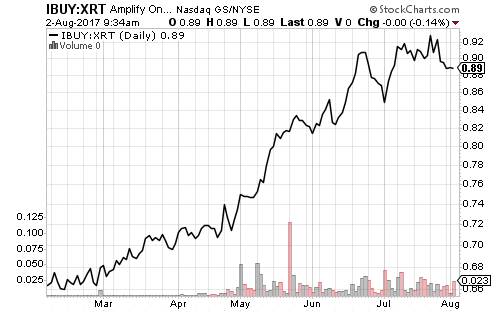

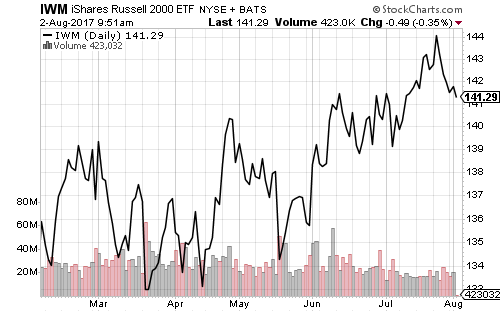

The other major indexes didn’t follow the Dow to new highs because Amazon (AMZN) missed earnings estimates last week and has weighed on the consumer discretionary sector since then. Online retail remains in a general uptrend, but physical retail has not done as well over the past two months.

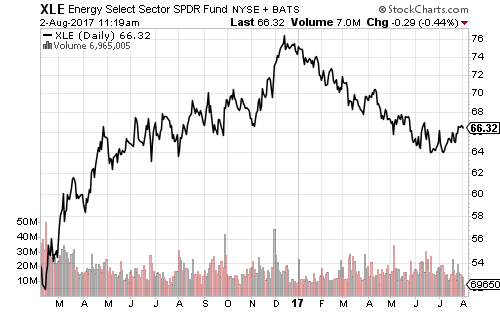

The Energy sector broke its 7-month downtrend in July and has traded sideways over the past two months, but this is merely a slowdown in the overall down trend. Oil prices approached $50 on the risk of U.S. sanctions against Venezuela, but growing inventory sent prices lower.

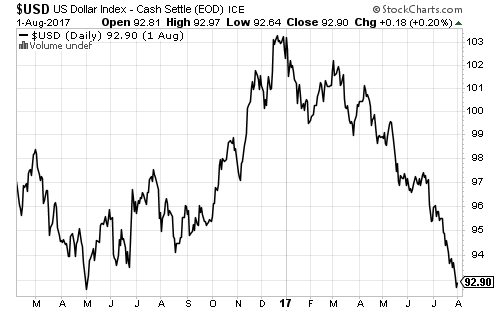

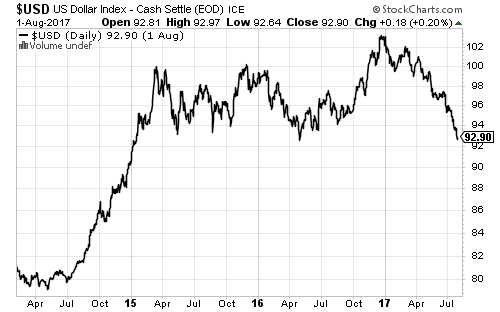

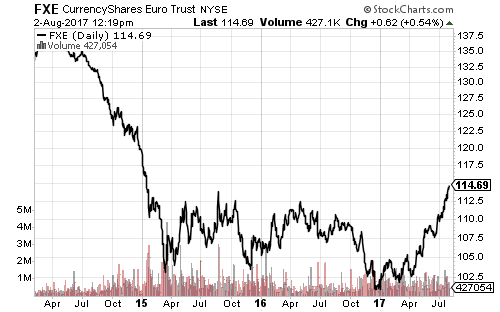

The U.S. Dollar Index is close to a 30-month low, but if the euro keeps strengthening, inflation expectations and GDP forecasts could fall as European exports become less competitive. We anticipate a dollar rally over the coming months.

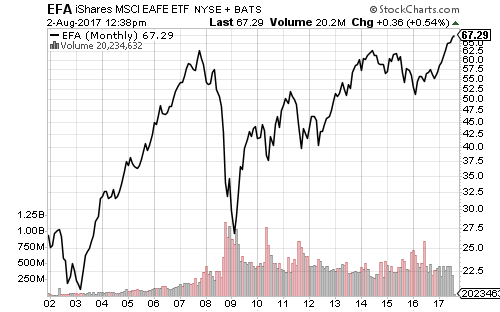

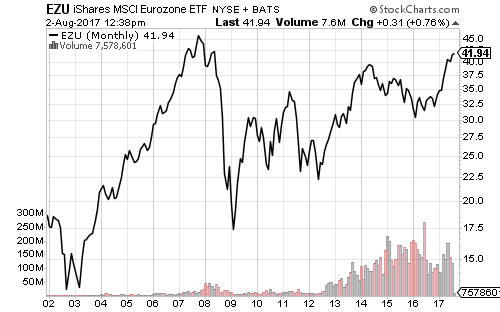

Developed markets (EFA) are at a new all-time high, while the Eurozone and Emerging-market ETFs are nearing 10-year highs. iShares MSCI Eurozone (EZU) has gained 23.12 percent this year versus the 11.39 percent return of SPY.