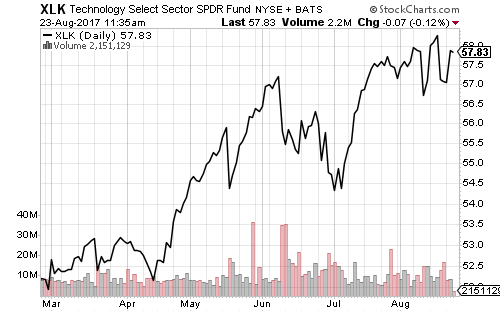

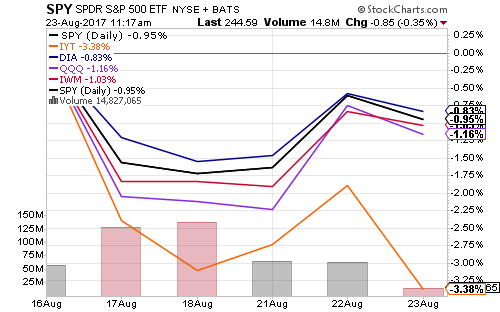

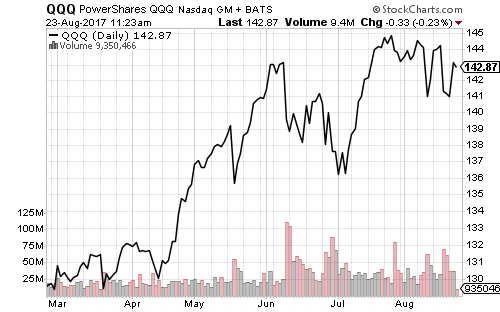

The Dow Jones Industrial Average led index performance over the past week. It was a choppy week for stocks as the technology sector suffered another short downdraft. PowerShares QQQ (QQQ) will likely remain in a consolidation phase until it breaks its current trend.

SPDR Technology (XLK) is trading very close to its all-time high.

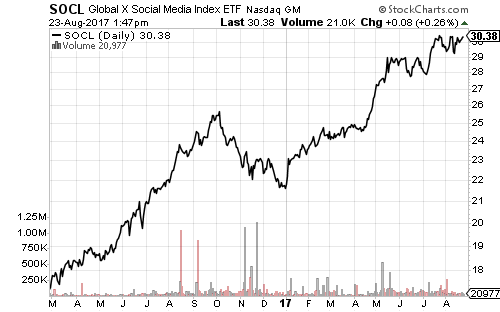

Global X Social Media (SOCL) is on the verge of new 52-week high.

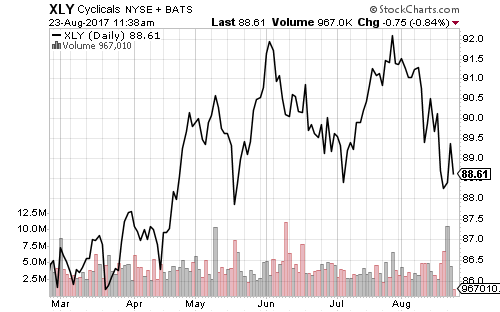

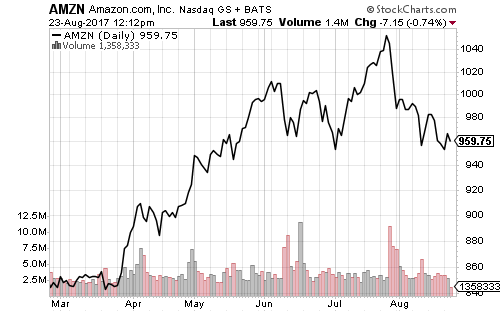

SPDR Consumer Discretionary (XLY), however, has continued to trade lower.

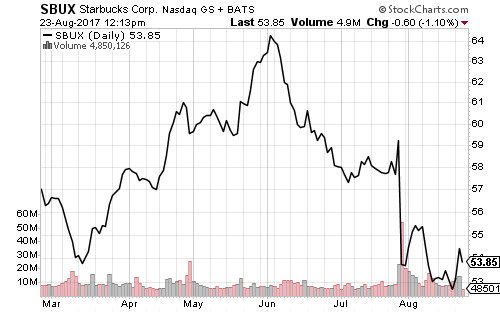

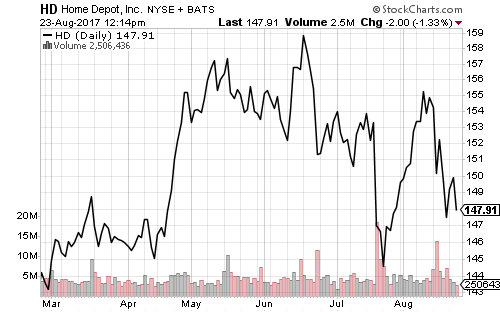

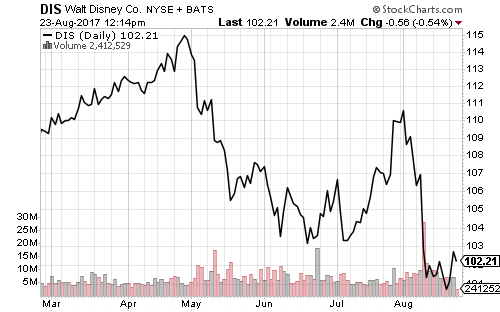

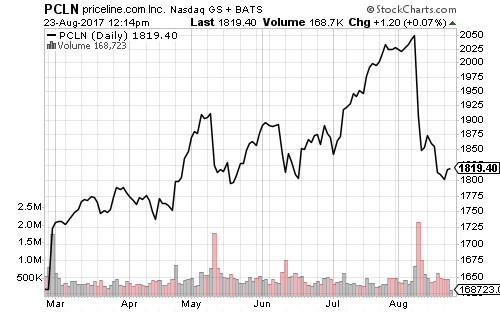

Amazon (AMZN), XLY’s top holding, has weighed on the sector, along with other top-10 holdings Starbucks (SBUX), Home Depot (HD), Disney (DIS) and Priceline (PCLN).

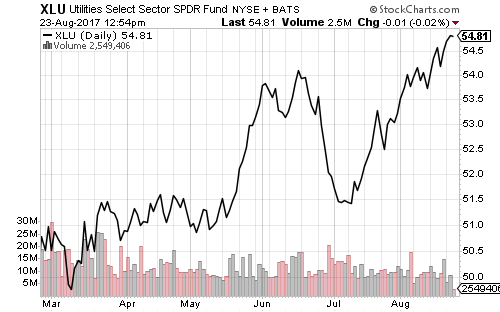

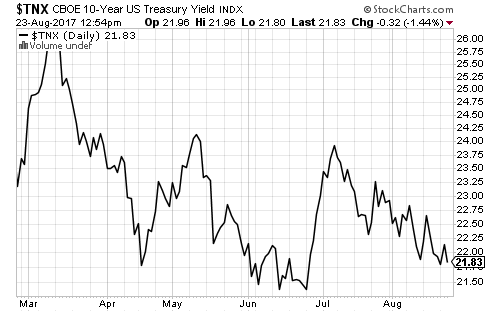

The utility sector is currently the strongest S&P 500 sector. The sector has rallied as long-term interest rates have eased.

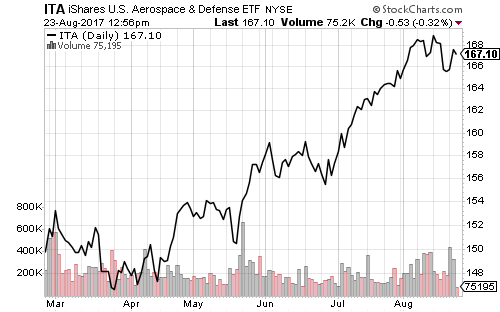

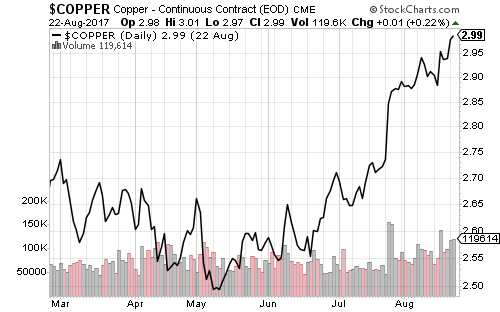

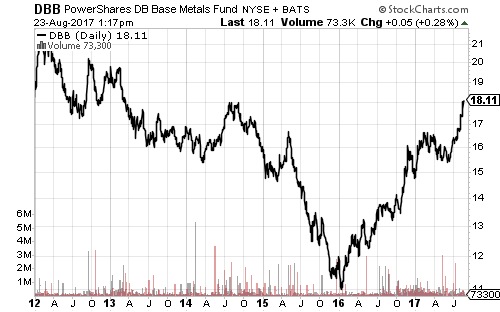

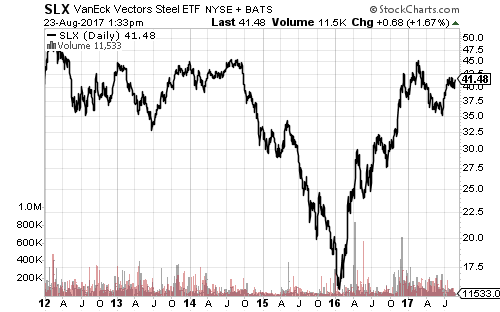

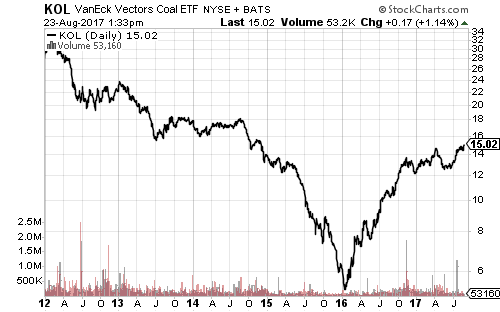

Defense and industrial metals have climbed in the face of increased government spending. A renewed effort in Afghanistan and continued tension with North Korea have significantly boosted demand.

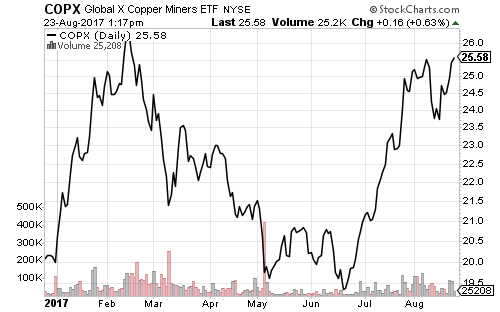

Copper trading at a 2.5 year high and Global X Copper Miners (COPX) is near its 2017 high. Economists, however, have speculated China’s massive credit growth in the past 18 months was responsible for the rise.

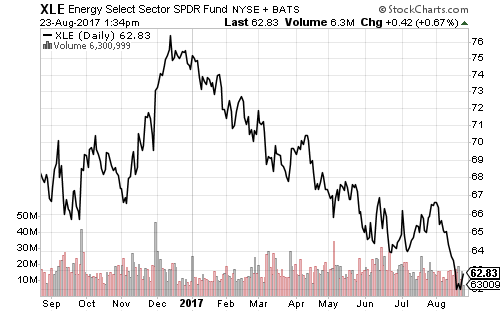

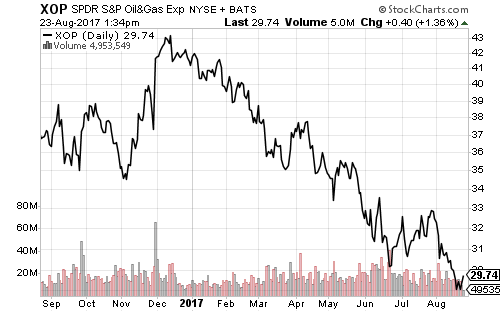

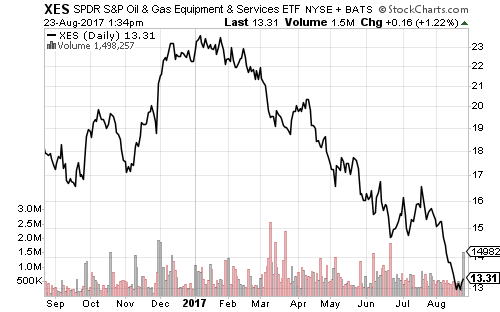

The energy sector and its subsectors made new 52-week lows over the past week. Barring a surprise jump in gasoline consumption, inventories will be at a multi-year high. Crude will likely head back into the lower $40s over the next month.

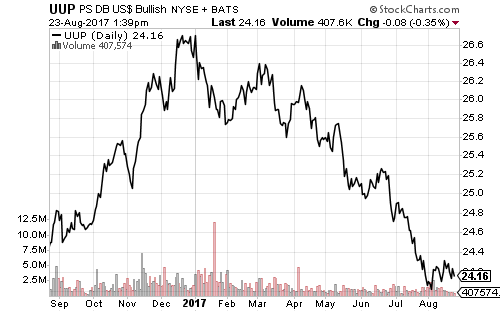

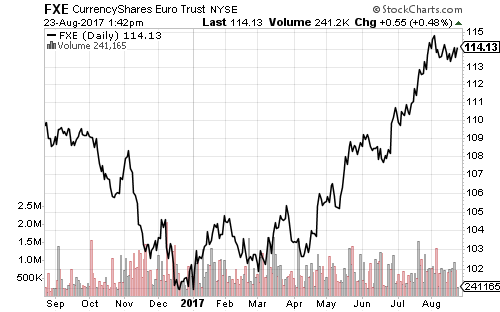

The U.S. Dollar Index rallied in August, but gave back some gains over the past few as bond and currency traders anticipate the Jackson Hole Symposium.