The trading week ahead will be light as the holiday approaches. The stock market will be open on Friday, though many traders will take the day off, and closed on Monday in observance of Christmas. Although volume will be light, the “Santa Claus rally” is likely to continue.

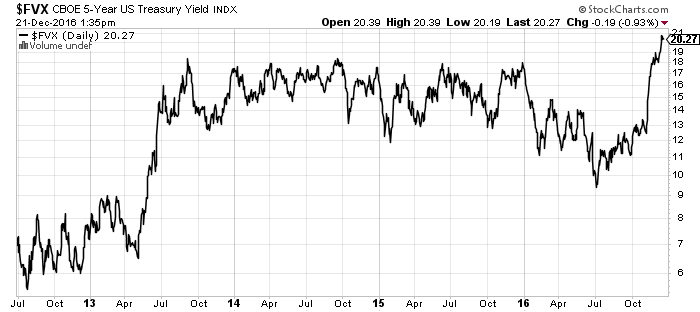

The Federal Reserve hiked interest rates as expected last week and delivered a hawkish forecast. The Fed’s “dot plot” forecast would require three hikes next year.

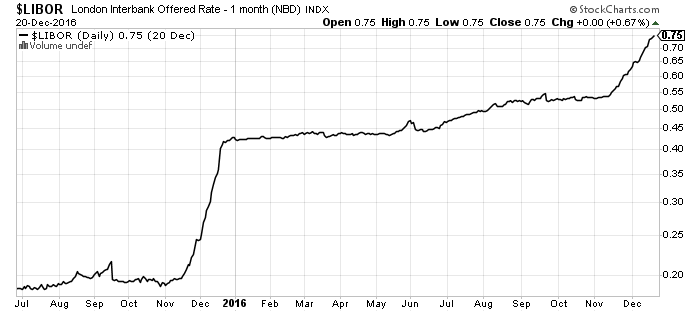

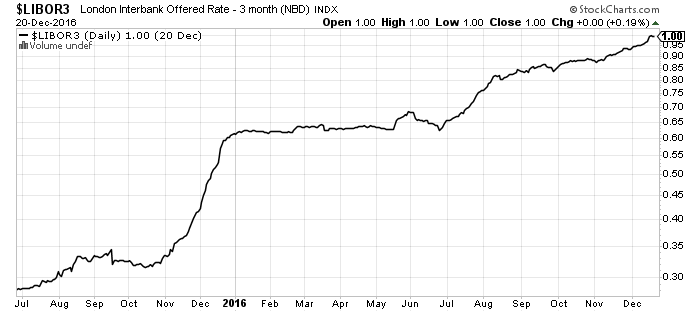

LIBOR reinforces the improved outlook, especially when compared to last year’s rate hike. It took until August 2016 for LIBOR to reach the upper range of the Fed funds rate. This time, LIBOR is at the top end of the range, 0.75 percent, one week after the rate hike. Three-month LIBOR is already at 1 percent.

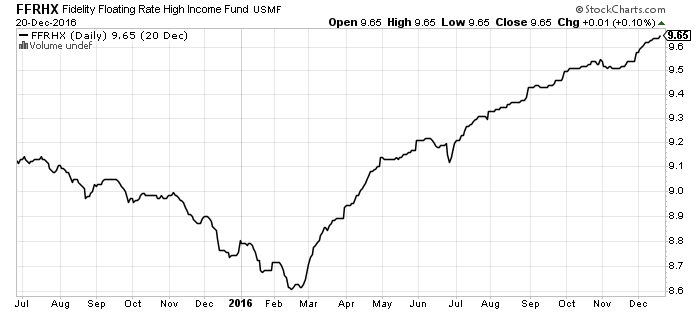

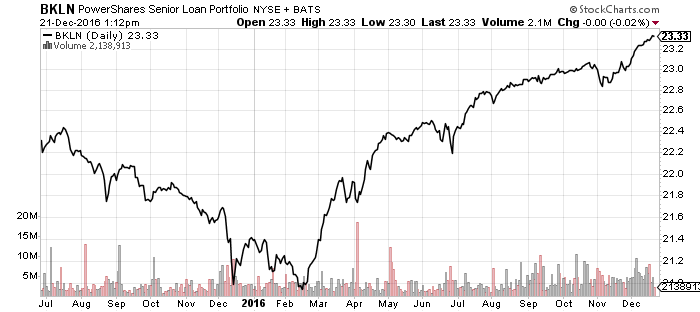

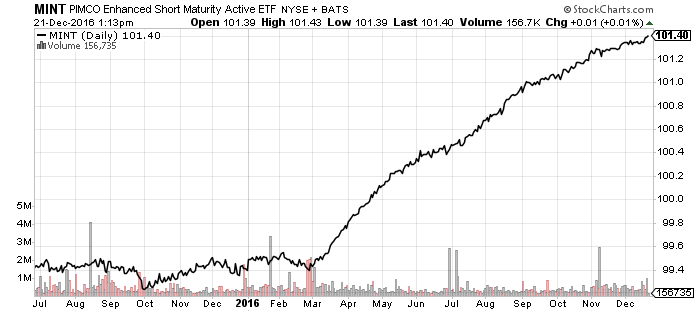

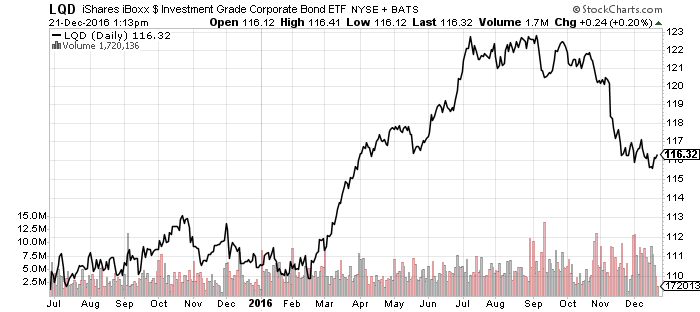

The steady rise in interest rates lifted floating-rate funds such as Fidelity Floating Rate High Income (FFRHX) and PowerShares Senior Loan Portfolio (BKLN). It also lifted funds similar to money markets, such as PIMCO Enhanced Short Maturity (MINT). Investment-grade bonds such as iShares iBoxx Investment Grade Corporate Bond (LQD) stabilized with longer-term interest rates.

The 5-year Treasury yield jumped well above its three-year trading range in the wake of last week’s hike, signaling more gains ahead for intermediate-term interest rates.

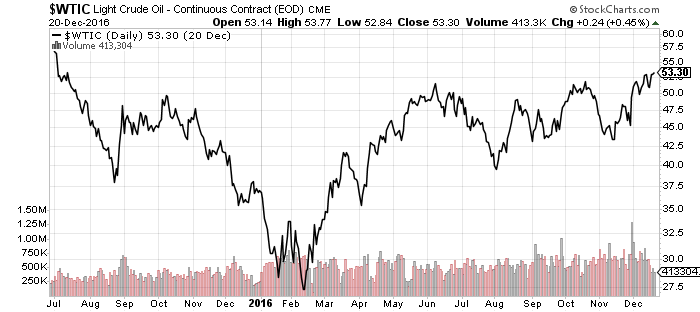

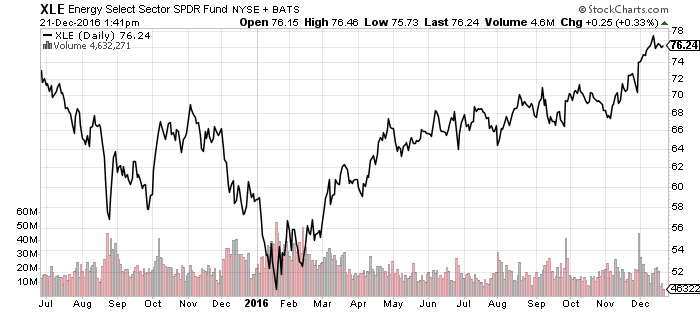

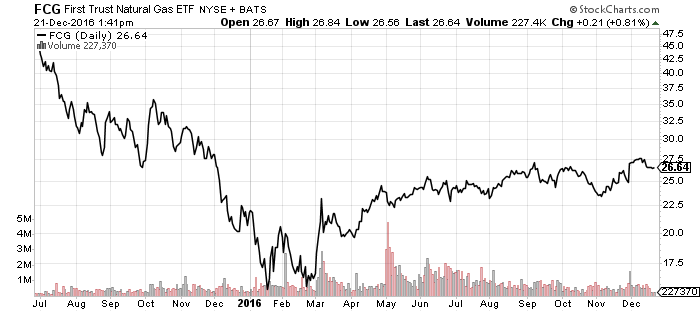

Energy

The outlook for energy remains mixed with prices hovering around 18-month highs. U.S. shale producers stand ready to ramp up production, and prices have barely edged above their 18-month high. Economic optimism is rising, however, and OPEC cut production. A clear bullish breakout would complete an inverted head-and-shoulders pattern with an upside target of $72 a barrel. Equity investors are betting on the bullish side, sending XLE to new 52-week highs.

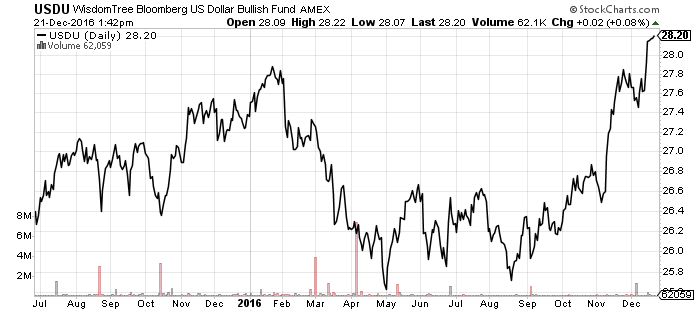

WisdomTree US Dollar Bullish (USDU)

WisdomTree US Dollar Bullish (USDU)

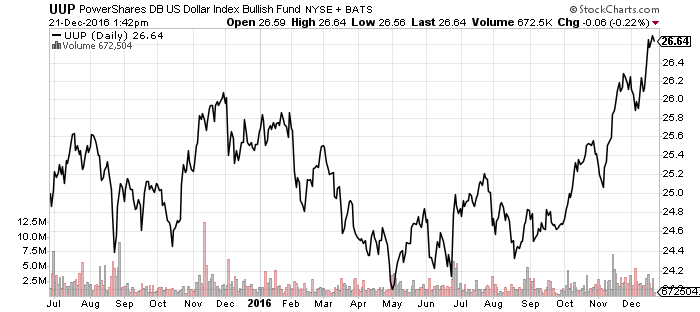

PowerShares DB US Dollar Bullish (UUP)

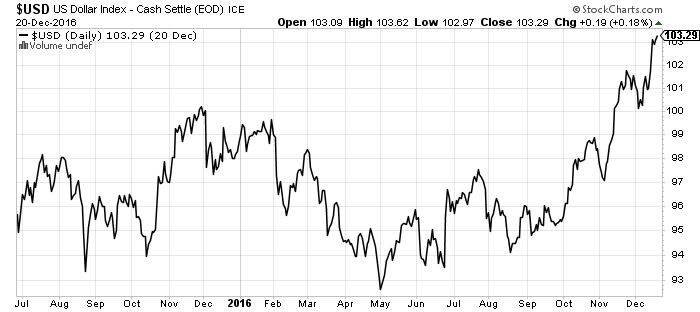

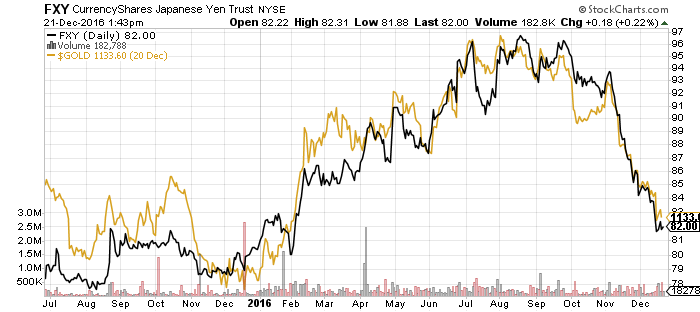

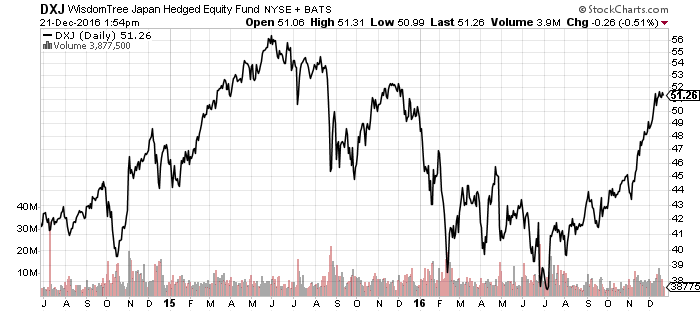

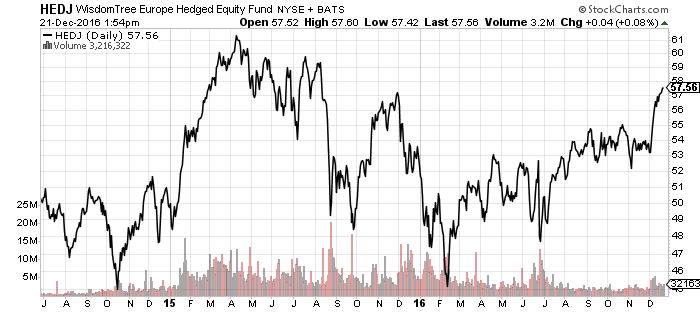

The yen fell drastically with gold following the rate hike as the U.S. dollar rallied. The next target for the U.S. Dollar Index is 105, beyond that the 2002 high above 120. Funds that hedge currency exposure outperformed over the past month and will outperform versus local currency funds if the dollar bull market exists.

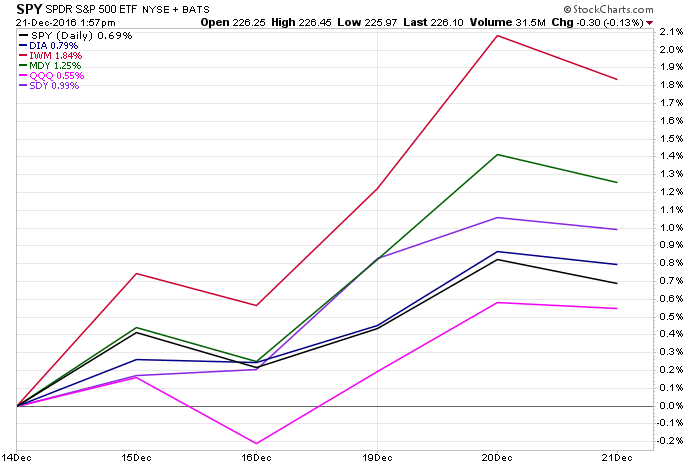

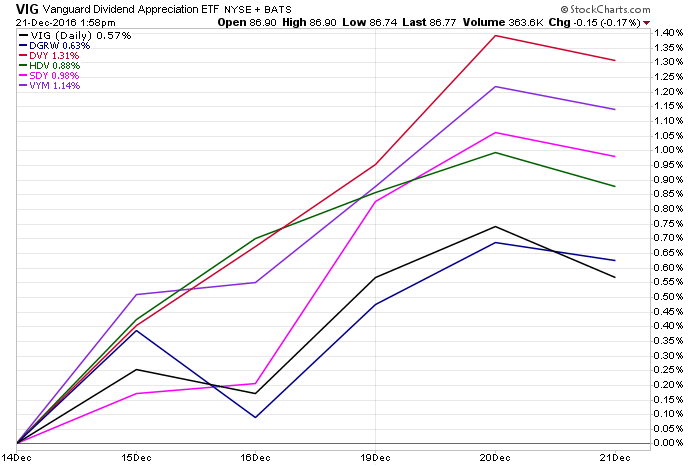

Indexes

Small- and mid-cap shares outperformed the tech-heavy Nasdaq over the past week. Dividend funds also rallied, with most outperforming the S&P 500 Index. The mid-cap heavy iShares Select Dividend (DVY) also performed very well.

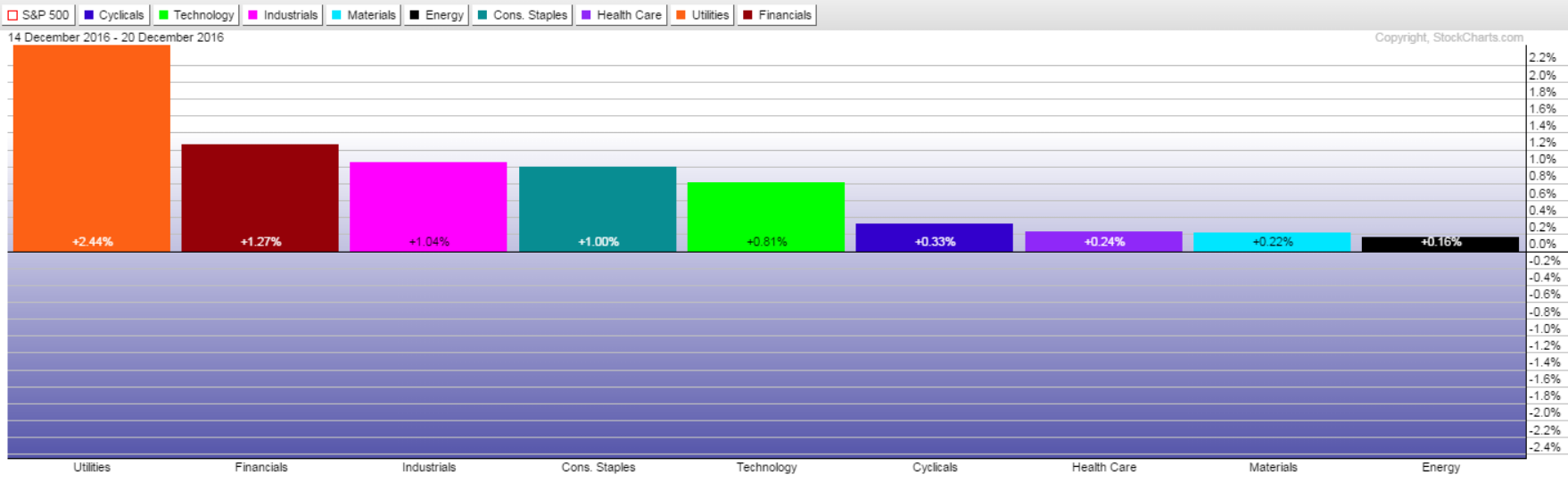

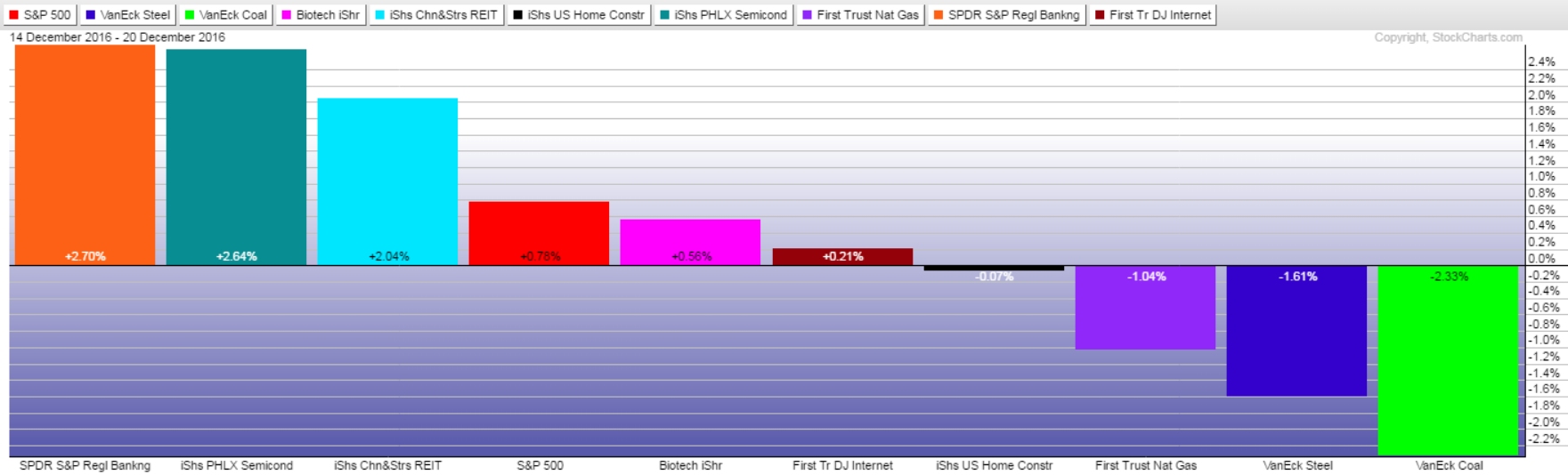

Utilities were the best performer over the past five trading days and consumer staples also held up well. Financials and industrials were the other two top gainers. The worst performers for the week were energy and materials, hurt by a strong dollar and some corrective selling in sectors such as coal and steel.

Value vs Growth

2016’s value vs growth chart, specifically SPDR S&P 500 Value (SPYV) vs Growth (SPYG), has been especially relevant throughout the year.

Value and growth move in long-term cycles that last for several years. It appears the market is shifting back in favor of value, driven by the bounce in the financial sector.