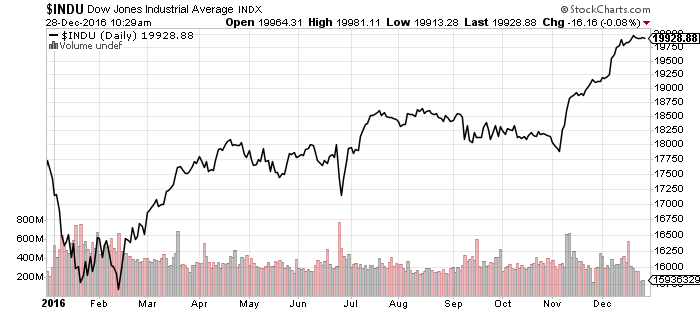

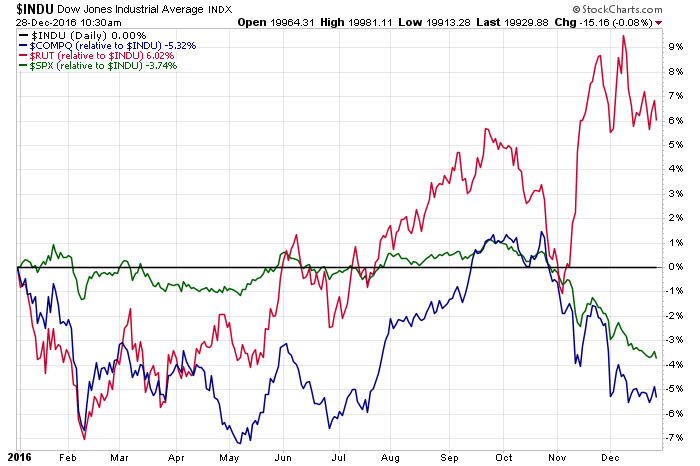

The Santa Claus Rally could carry the Dow Jones Industrial Average past the psychologically vital 20,000 level this week. The Dow has traded within 1 percent of 20,000 for three weeks, but has yet to cross the line even intraday as short-term traders bet on a pullback.

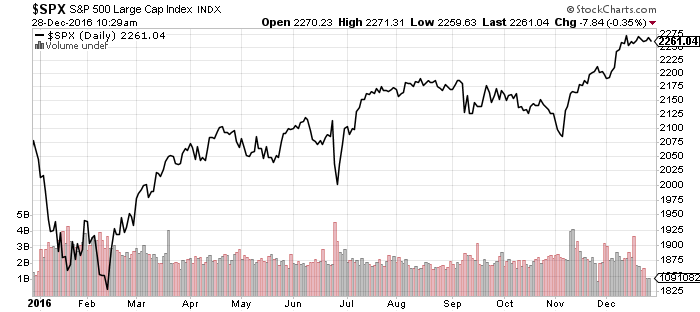

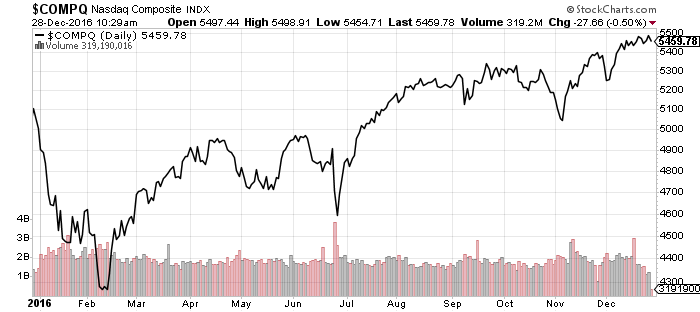

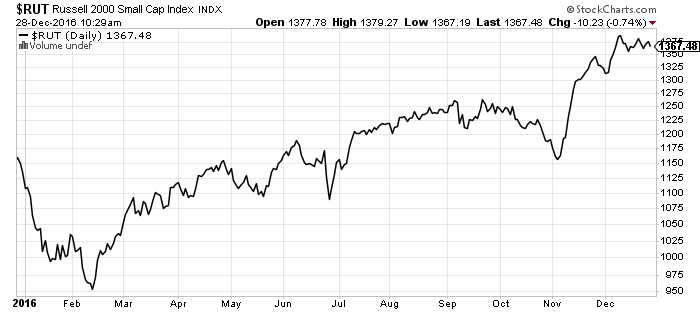

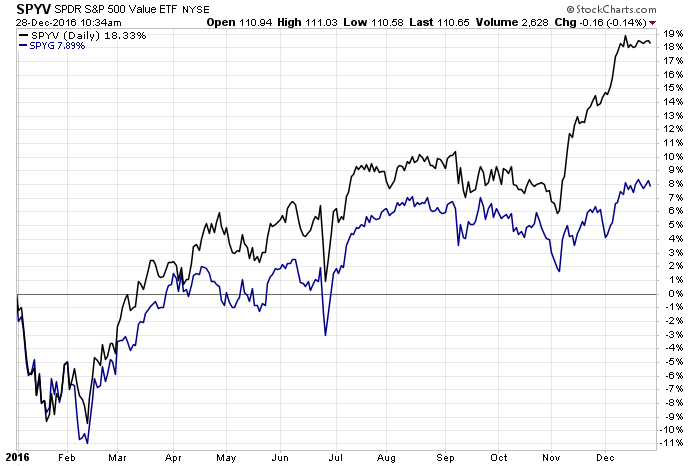

Major domestic indexes performed well in 2016, as reflected in the charts below. Small-caps broke to the upside following the election, while the Dow pulled away as value edged out growth. The next chart reflects value’s breakout, as measured by SPDR S&P 500 Value (SPYV) and Growth (SPYG).

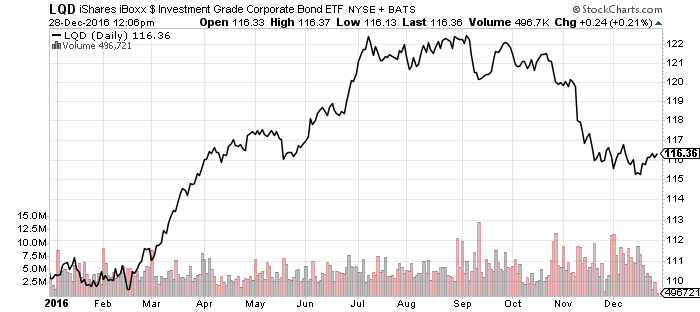

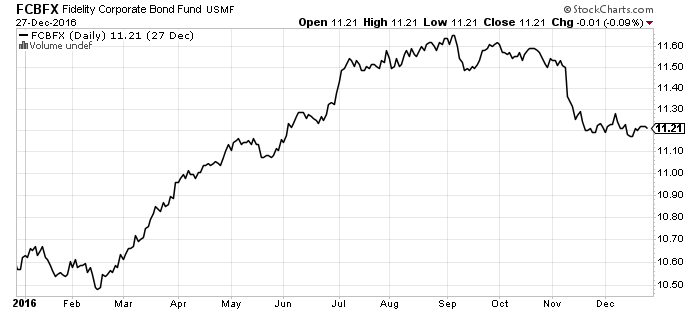

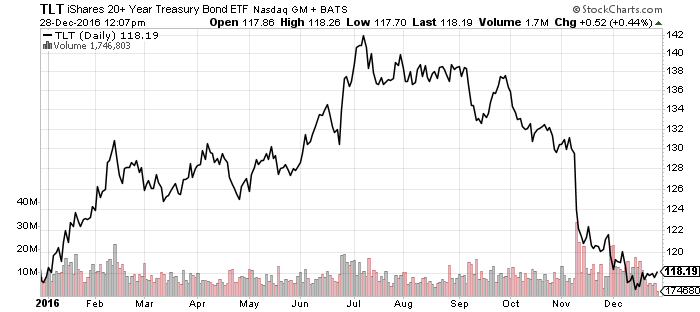

Bonds

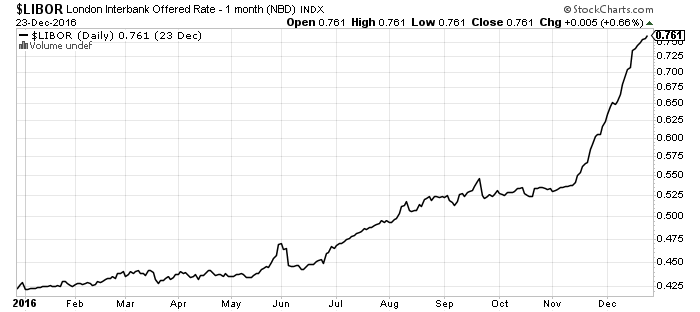

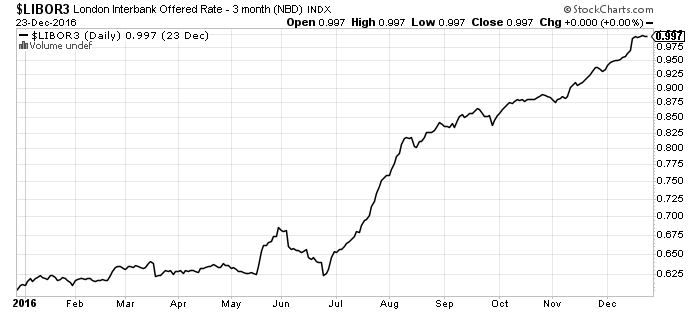

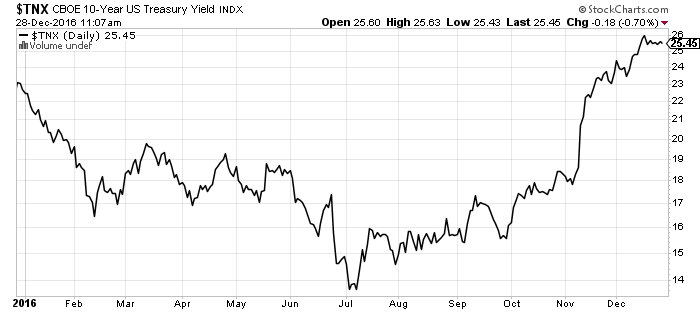

Interest rates heavily impacted bond markets in 2016. Short-term rates climbed steadily in 2017, albeit very slowly until July. This coincided with a drop in long-term bond yields that ended shortly after the Brexit vote. Long-term interest rates bottomed in July and short-term rates began an accelerated rally that remains in effect. Long-term interest rates have since fully reversed and ended the year higher than they began.

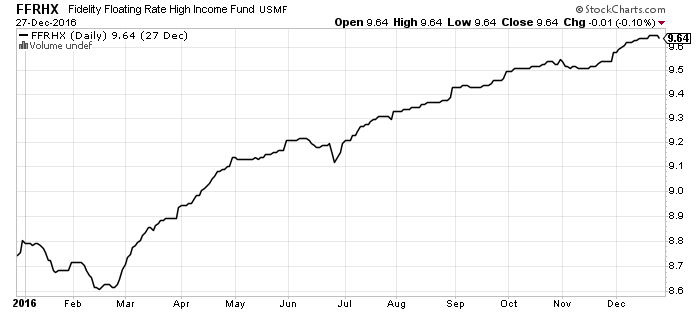

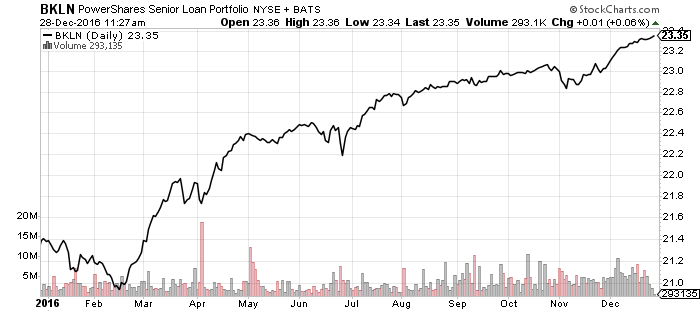

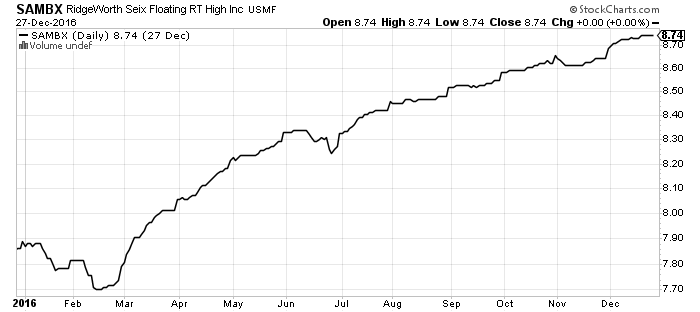

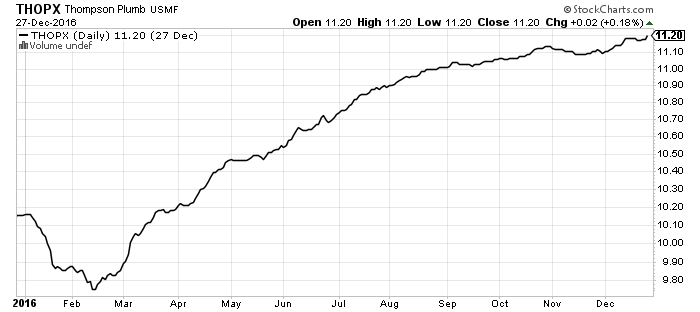

The steady rise in interest rates staged the perfect environment for floating-rate funds such as Fidelity Floating Rate High Income (FFRHX), PowerShares Senior Loan Portfolio (BKLN) and RidgeWorth Seix Floating Rate High Income (SAMBX). Funds with high-yield bond exposure also performed well after oil prices bottomed and credit fears subsided. Thompson Bond (THOPX) was one of the better performers in this space.

Corporate and investment-grade bond funds also finished the year higher, although the rise in rates eventually caught up with corporate bonds. Long-term Treasury bonds fared poorly. iShares 20+ Year Treasury ETF (TLT) was flat on the year, but shares fell nearly 17 percent from their July peak.

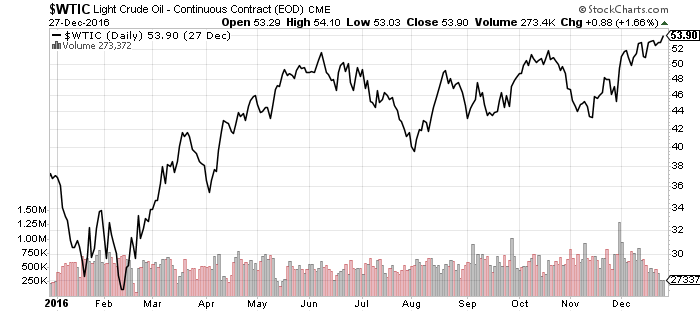

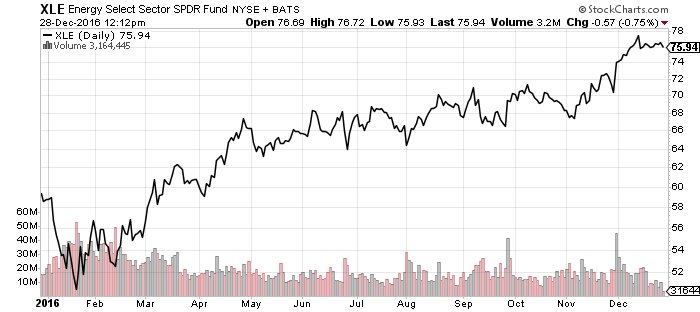

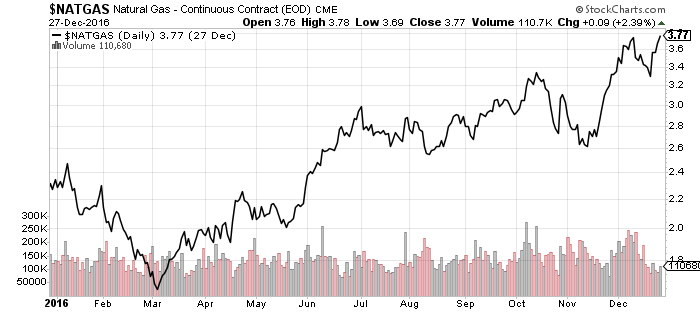

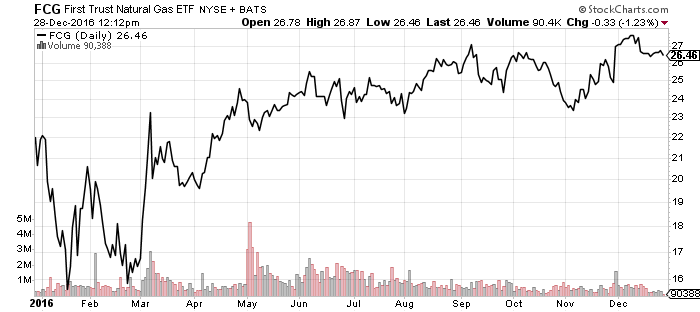

Energy

Oil prices will finish 2016 almost 50 percent higher and natural gas prices are 60 percent above year-ago levels.

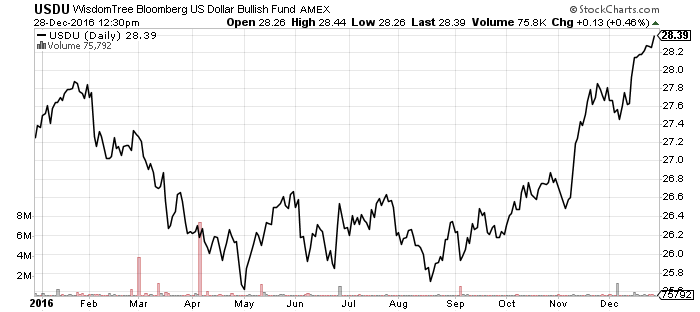

WisdomTree US Dollar Bullish (USDU)

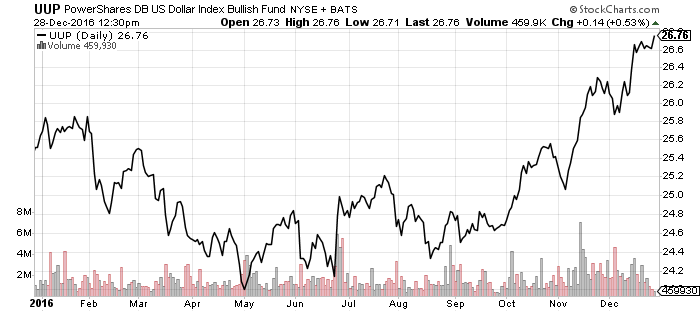

PowerShares DB US Dollar Bullish (UUP)

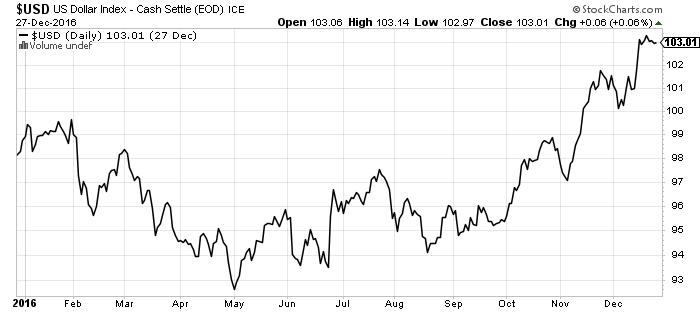

The U.S. Dollar Index rallied 25 percent from July 2014 to March 2015, and consolidated those gains over the next 20 months. This range ended abruptly following the presidential election. The U.S. Dollar Index broke above 100 and will end the year at 14-year highs.

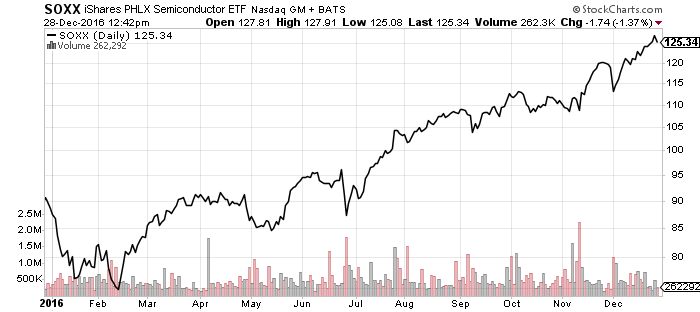

iShares Semiconductors (SOXX)

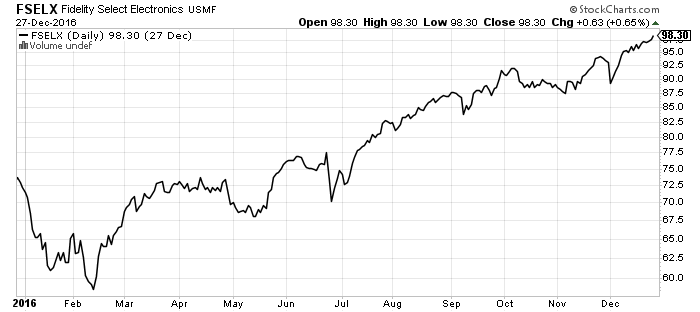

Fidelity Select Semiconductors (FSELX)

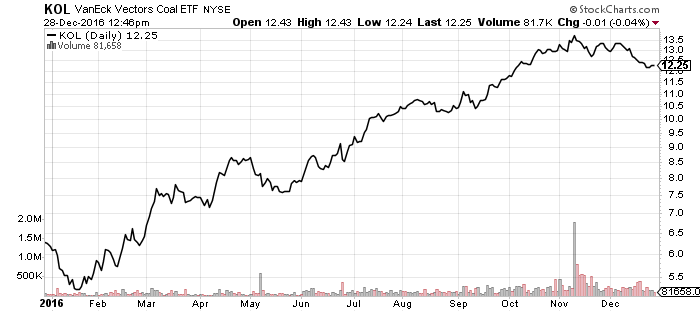

VanEck Coal (KOL)

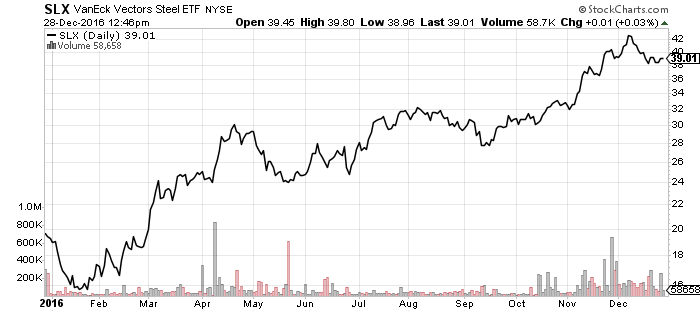

VanEck Steel (SLX)

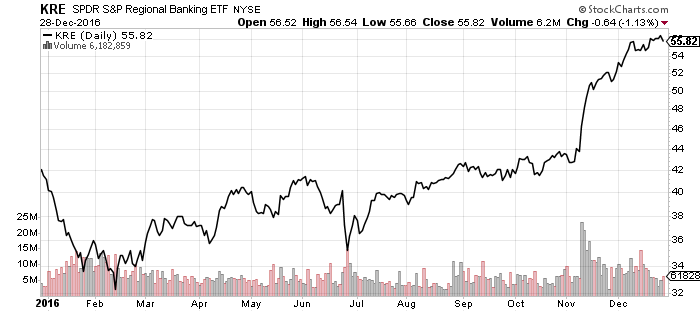

SPDR S&P Regional Banking (KRE)

Semiconductors steadily rose throughout the year, despite technology sector underperformance.

Coal and steel also had superb years. KOL and SLX gained more than 100 percent from their lows in 2016 and finished the year as two of the strongest subsectors in the market. The rally for much of the year was a rebound from a horrible 2015, but after the election, the funds found new life as investors factored in shifting political winds.

Regional banks also enjoyed an impressive post-election rally as shares jumped more than 25 percent. In addition to the prospect of higher economic growth and higher interest rates, the Trump Administration and GOP Congress will likely roll back financial regulations, making it easier for banks to acquire competitors.

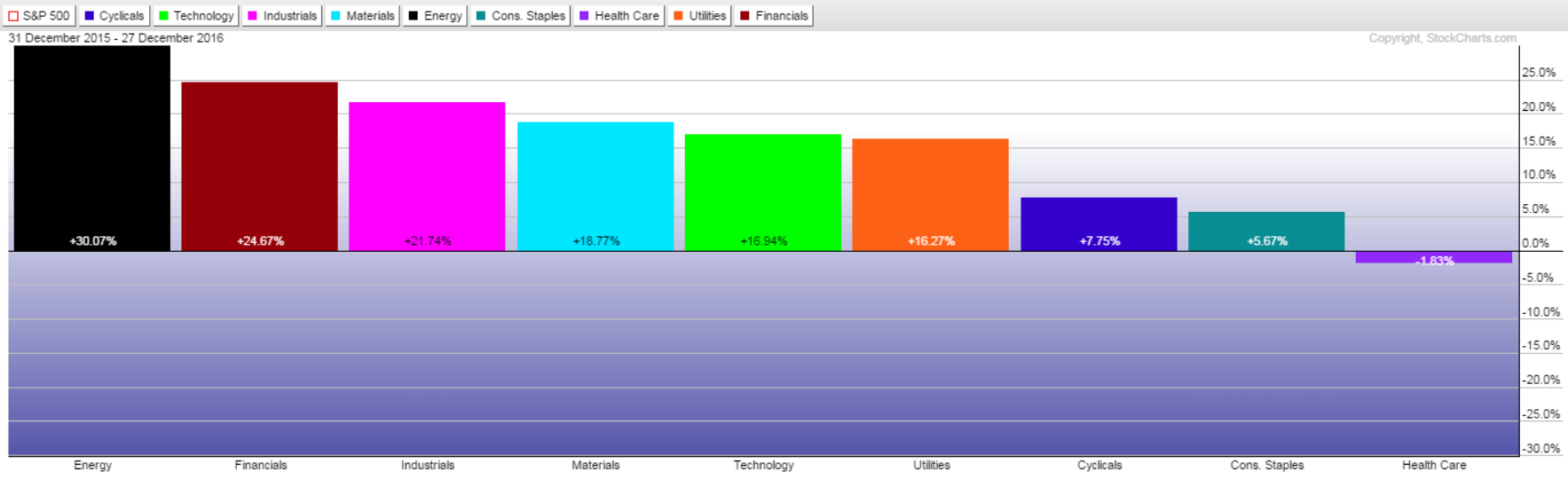

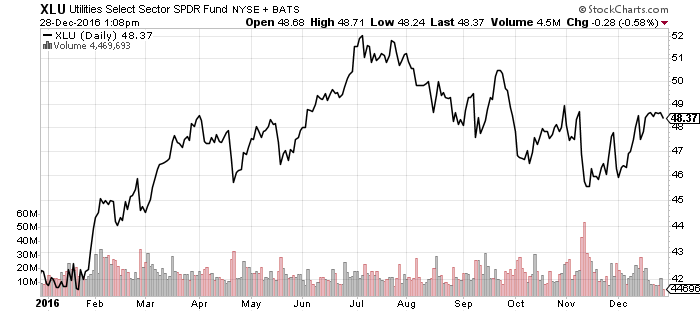

Energy led S&P 500 sector performance in 2016, followed by financials and industrials. SPDR Utilities (XLU) gained almost 25 percent in the first half of the year as the 10-year Treasury yield fell from 2.3 percent to 1.4 percent. XLU only gave back about 7 percent in the second half, despite the 10-year Treasury yield’s rally from 1.4 percent to 2.5 percent.