Markets are closed today for the funeral of President George H.W. Bush. Tuesday closed with major indexes falling approximately 3 percent. Numerous financial commentators blamed fund companies for selling due to rules-based models. The more likely and simpler explanation is: it’s simply another correction.

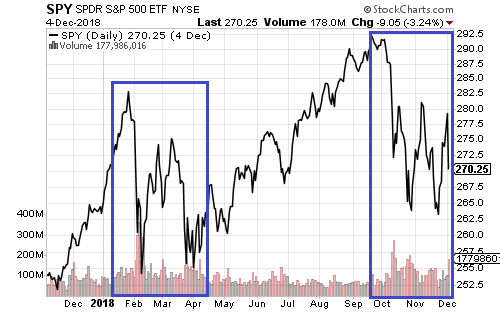

In January the S&P 500 topped, suffered a sharp correction and then rebounded. The index then retested the lows for a few weeks and then ascended to new all-time highs. In October we witnessed a similar pattern involving a correction, a rebound and a new test of the lows. We believe this current correction follows the same pattern, and a rebound is likely.

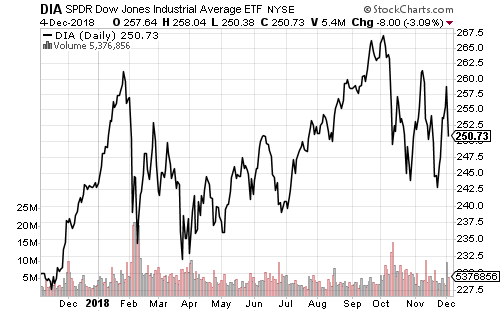

The Dow Jones Industrial Average has followed a similar pattern.

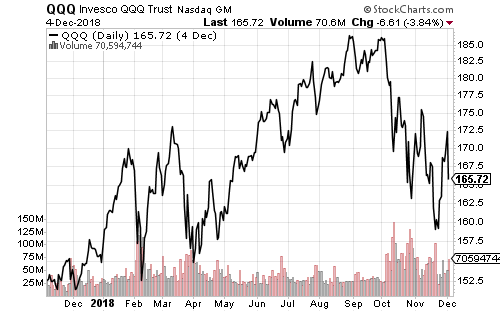

Invesco QQQ (QQQ) is significantly weaker now because technology has led the market lower. The Nasdaq hasn’t rebounded to a new high and didn’t bottom until November 20. Both the Dow and S&P made greater highs after bottoming, but the QQQ has to crack $172.50 to achieve that feat.

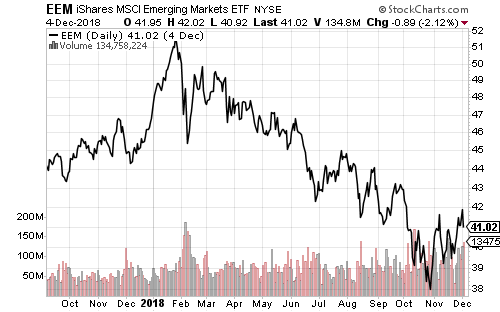

Emerging markets improved over the past week.

Political turmoil in the United Kingdom, Italy and France weighed on the MSCI EAFE Index of developed markets.

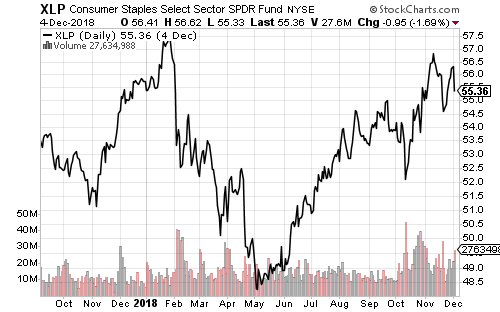

Traditionally defensive sectors have performed very well. Consumer Staples are near their peak for 2018.

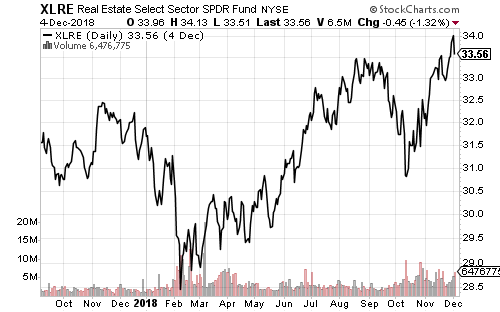

Real estate also made a new high over the past week.

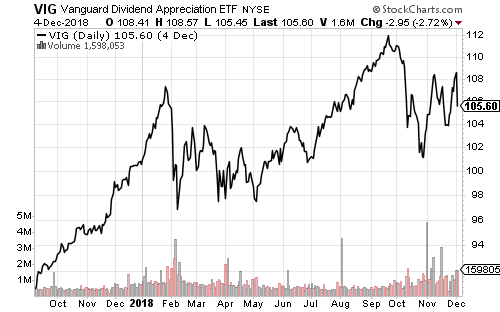

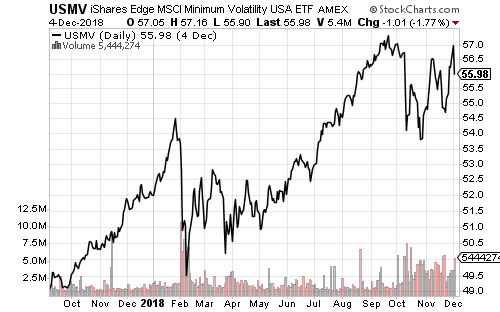

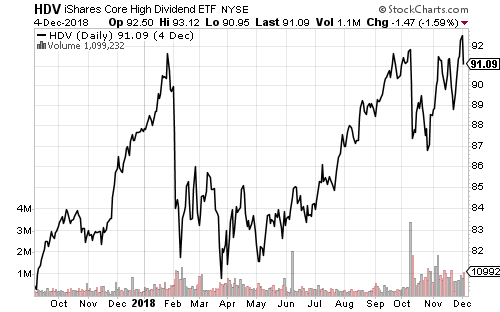

The relative strength of dividend and low volatility funds can be seen in the charts below. Vanguard Dividend Appreciation (VIG) bottomed in October and has outperformed. iShares Edge MSCI Min Vol USA (USMV) is close to its all-time high. iShares Core High Dividend (HDV) also made a new all-time high. These funds are each indicating a bullish signal for stocks.