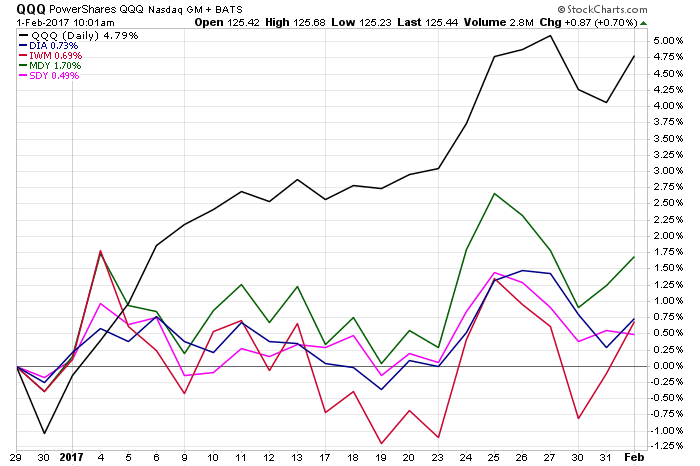

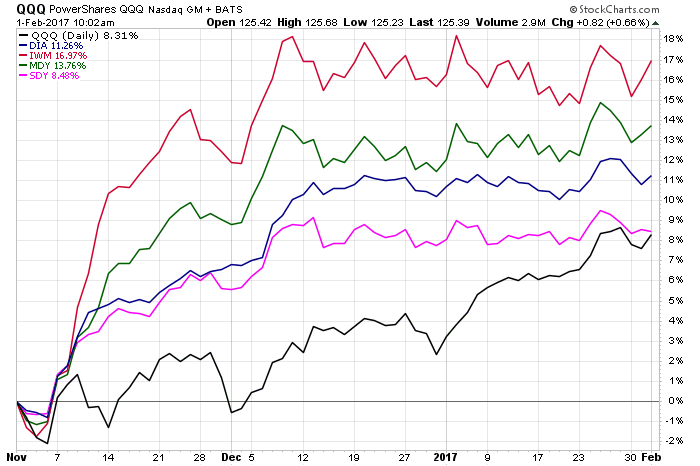

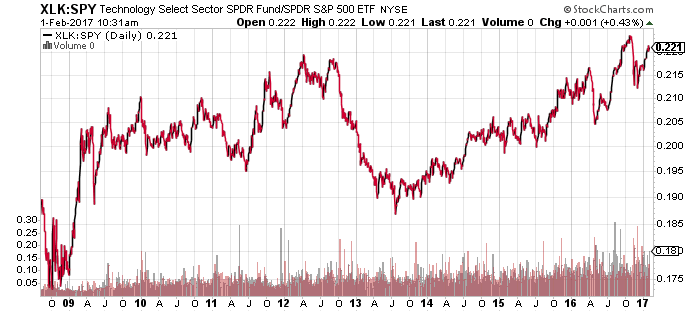

January was a great month for technology. The Nasdaq 100, tracked by PowerShares QQQ (QQQ), soundly outperformed other major index ETFs.

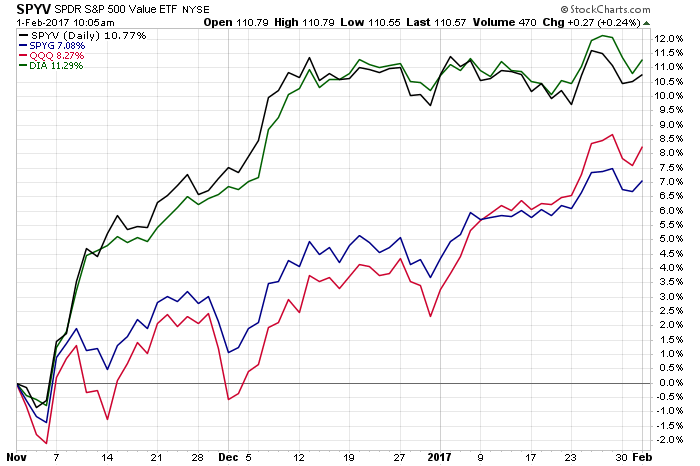

SPDR S&P 500 Value (SPYV) has trended with the Dow over the past three months, as illustrated in the third chart below. PowerShares QQQ tracks with SPDR S&P 500 Growth (SPYG). The January Nasdaq rally was part of a broader rally in growth sectors.

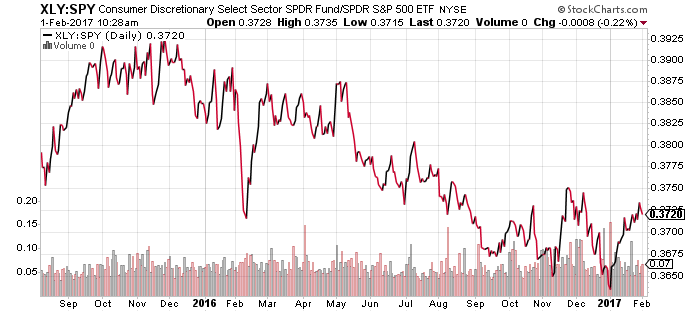

Consumer discretionary also led the Nasdaq higher in January. SPDR Consumer Discretionary (XLY) gained 4.2 percent last month.

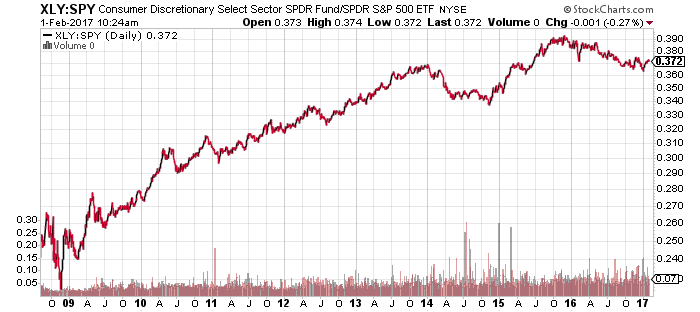

The chart below compares the price ratio of XLY against SPDR S&P 500 (SPY).

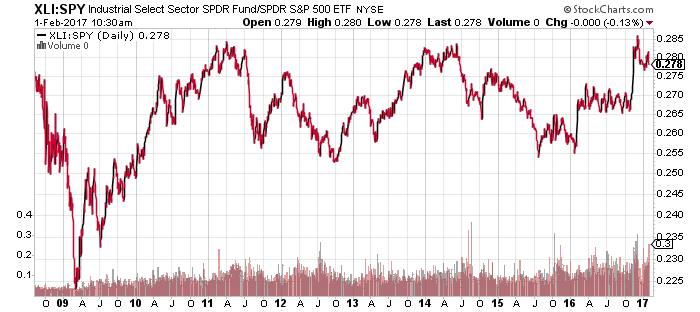

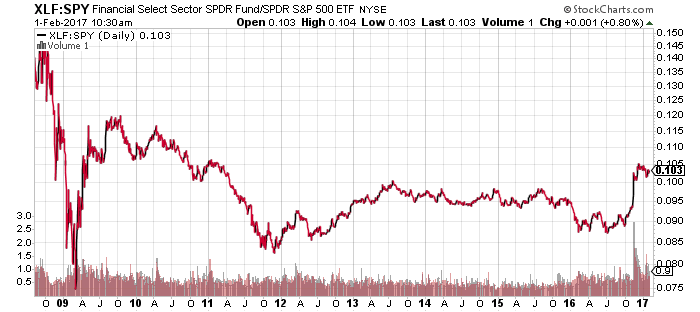

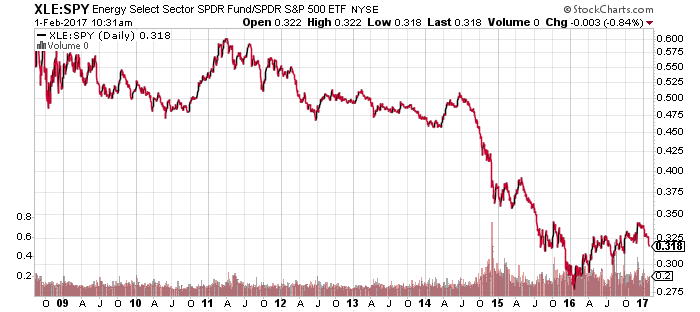

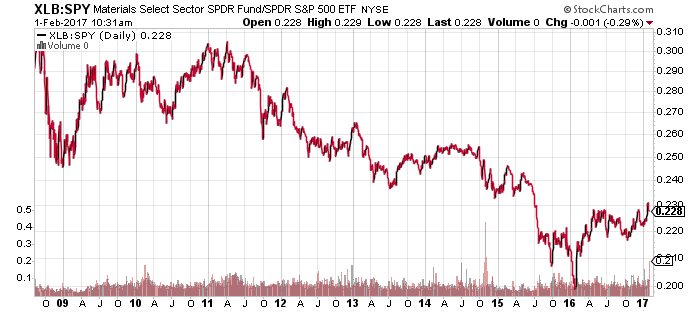

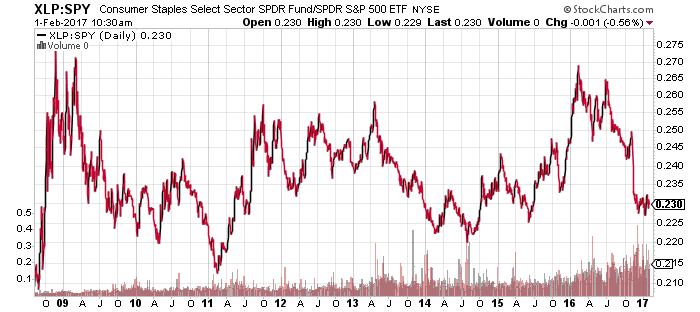

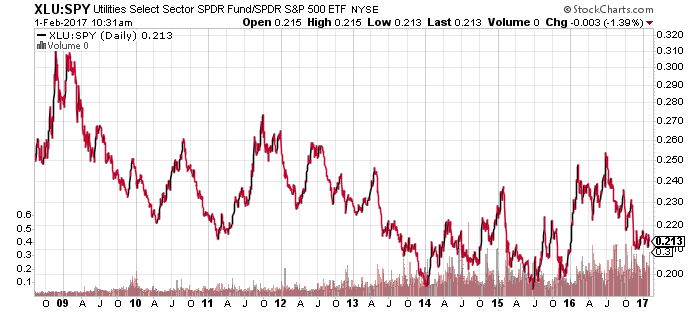

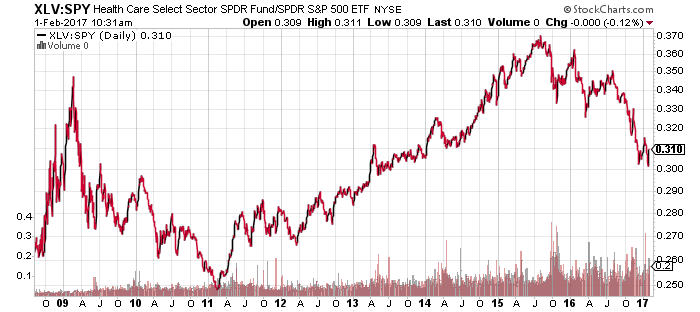

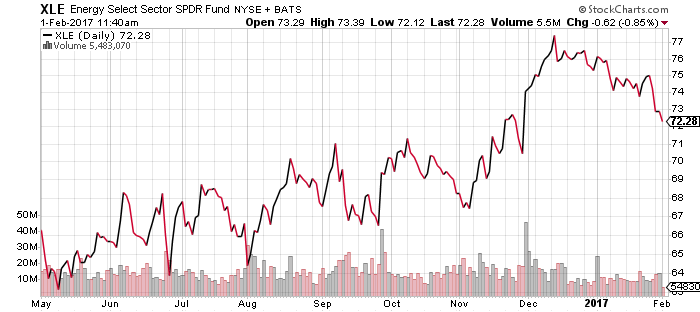

Most S&P 500 sectors have all performed in line with the broader market. Below are the price ratios of SPDR Industrials (XLI), Financials (XLF), Energy (XLE), Materials (XLB), Consumer Staples (XLP), Utilities (XLU), Healthcare (XLV) and Technology (XLK). Energy and materials look the most overdue for outperformance, but financials, industrials, healthcare, and consumer staples are also poised to rebound.

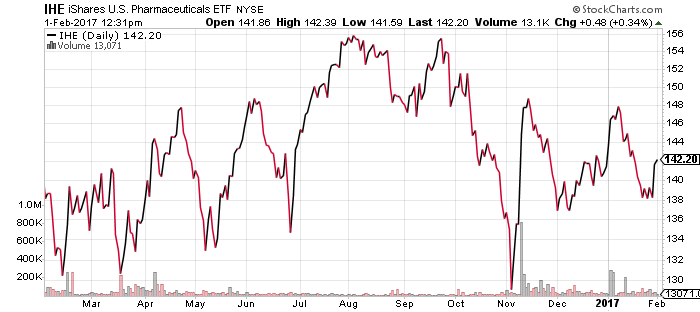

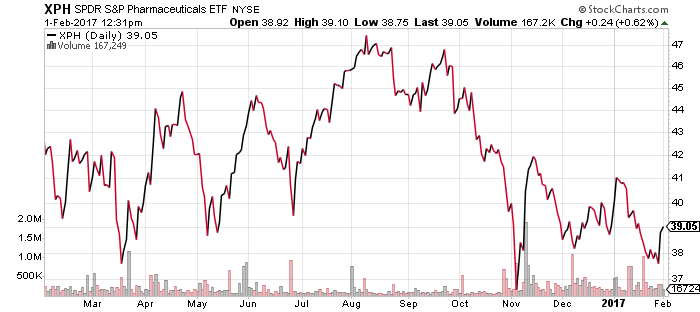

The pharmaceutical subsector will be especially active this week. Pfizer (PFE), Eli Lilly (LLY), Merck (MRK), Novo Nordisk (NVO), and AstraZeneca (AZN) are among the companies announcing earnings. PFE and LLY missed analyst earnings estimates on Tuesday, but shares of both companies rallied with the sector.

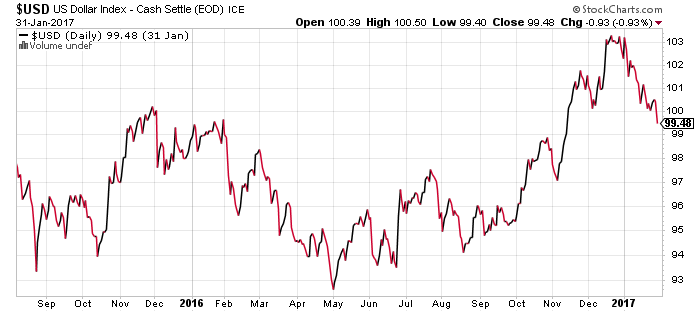

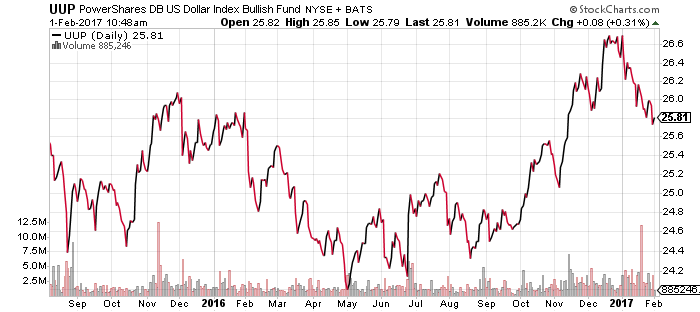

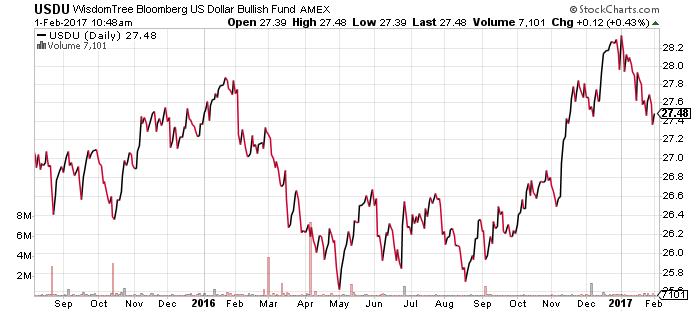

Last week we discussed the pullback in the dollar and an eventual bottom in the area around 97 for the U.S. Dollar Index. This week the correction continued. Below are the charts for WisdomTree US Dollar Bullish (USDU) and PowerShares DB US Dollar Bullish (UUP).

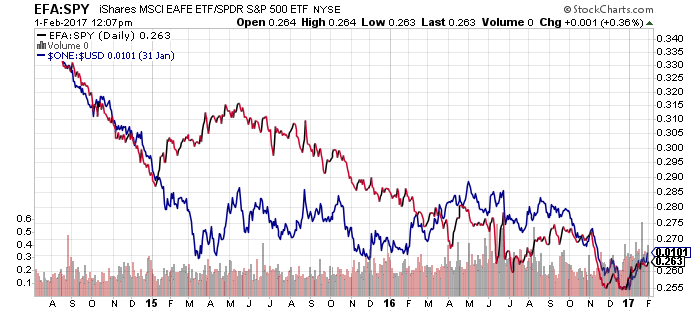

While the dollar is weak, international shares will likely outperform. The chart below shows the price ratio of iShares MSCI EAFE (EFA) versus SPY, accompanied by the inverse of the U.S. Dollar Index in blue.

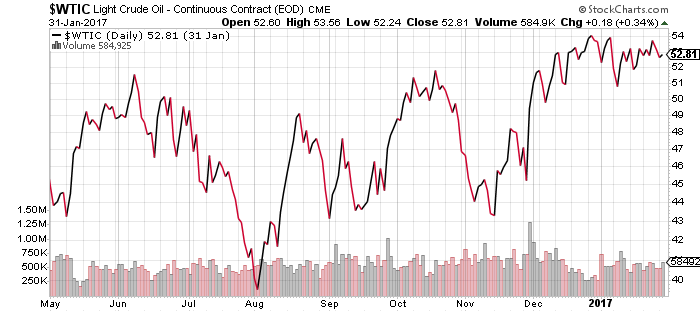

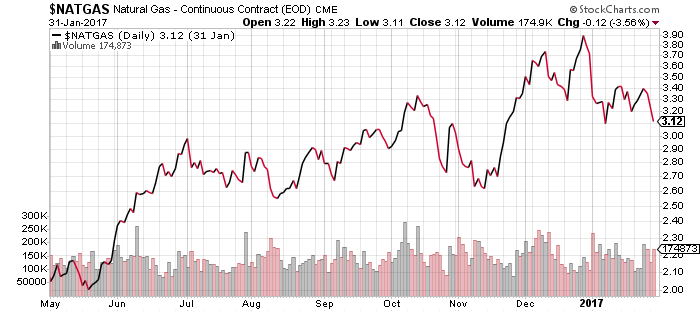

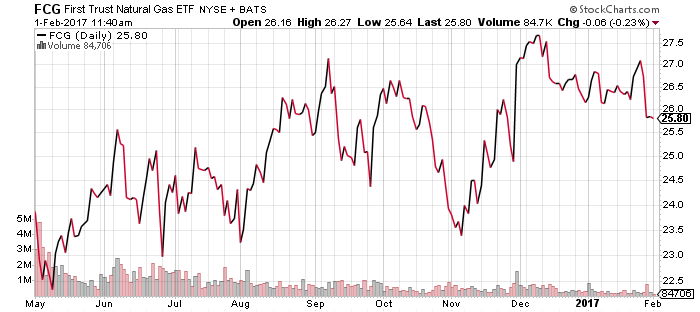

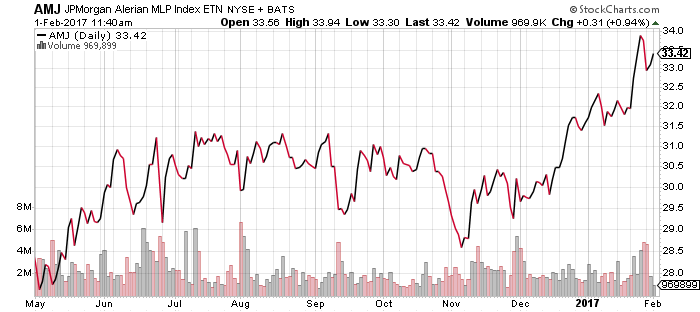

Although oil prices are holding steady, energy sector equities are following natural gas prices lower. Energy infrastructure, however, covered by funds such as AMJ, pulled back with the broader stock market on Monday, but bounced on Tuesday and Wednesday.

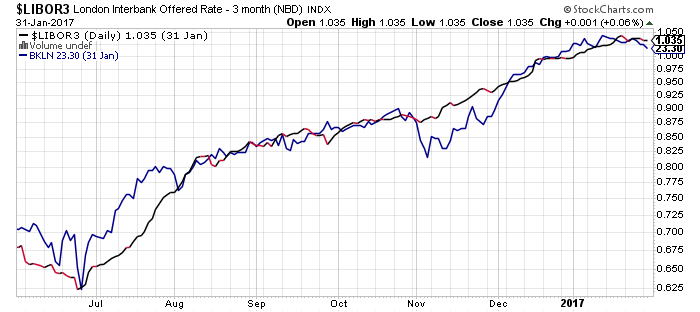

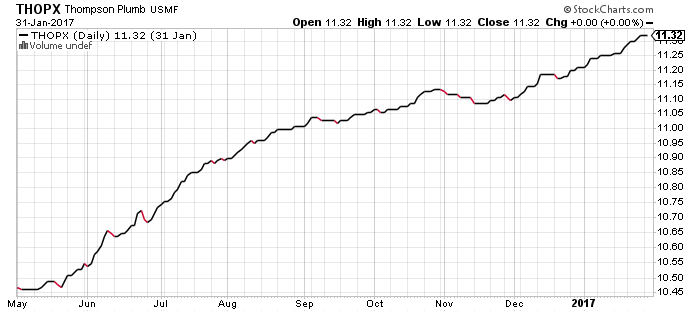

3-month LIBOR pulled back slightly over the past week, dipping alongside floating-rate funds like PowerShares Senior Loan (BKLN). Thompson Bond (THOPX) remains well-positioned and continued moving higher.

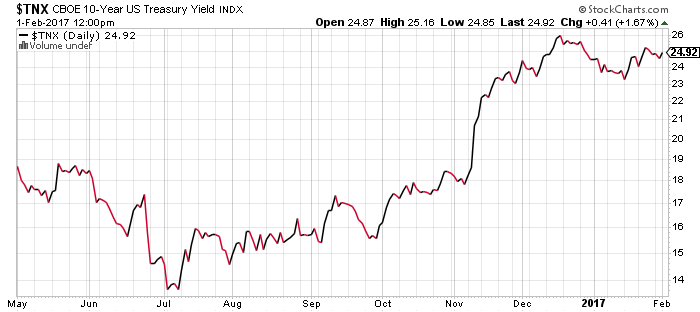

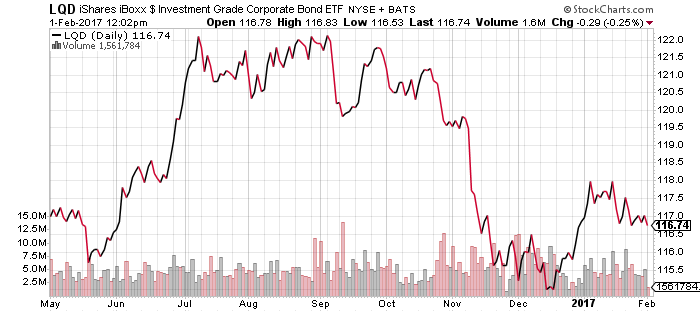

The 10-year Treasury yield extended its basing pattern. Although the yield fell on the week, it has not made a new low since bottoming on January 17. iShares iBoxx Investment Grade Corporate Bond (LQD) has an inverse pattern, peaking on January 17.

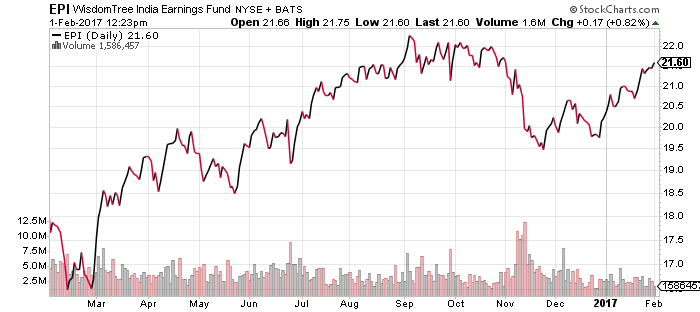

India’s government launched a crackdown on the black-market economy in November, including disruptive restrictions on high-denomination cash. The move sent Indian stocks down more than 10 percent. Since then, they have been slowly recovering, with the old highs now in sight.