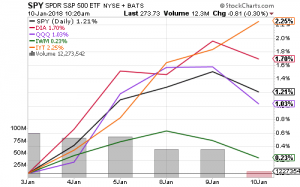

Transportation stocks led the market over the past week as traders rotated out of interest rate-sensitive utilities. The Dow Jones Industrial Average also advanced.

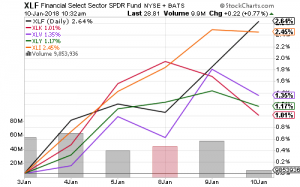

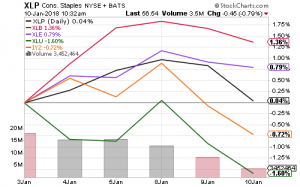

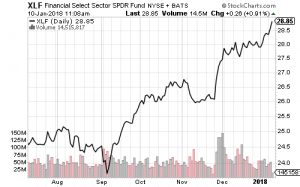

The financial sector was the best large-sector performer after interest rates spiked. Telecommunications and consumer staples trailed as investors shied away from high-yield stocks.

SPDR S&P Regional Banks (KRE) and SPDR Financial (XLF) outperformed this week and hit new 52-week highs.

Long-term interest rates jumped on Wednesday following a report that China might slow or stop purchasing U.S. treasuries. China hasn’t increased treasury holdings since 2014.

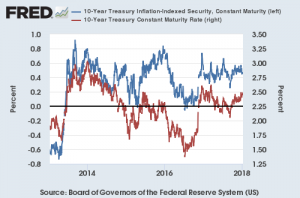

The 10-year yield is approaching its 52-week highs and a bullish breakout (bearish for bonds) could follow. The important near-term level is 2.6 percent, the high over the past 52-weeks. After that, the next key level will be 3.0 percent.

There’s no sign of a bond bear market in treasury inflation protected securities. The yield on the 10-year TIPS is near 0.50 percent. In 2013, it topped out close to 1 percent.

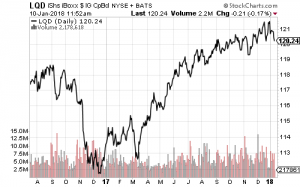

Rising long-term bond yields haven’t stung the investment-grade or corporate bond market. Federal Reserve rate hikes are pushing short-term yields higher. Floating-rate funds, such as PowerShares Senior Loan Portfolio (BKLN) and Virtus Seix Floating Rate High Income (SAMBX), are at new 52-week highs.

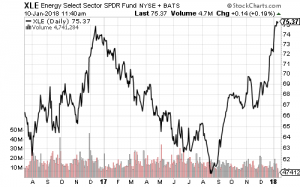

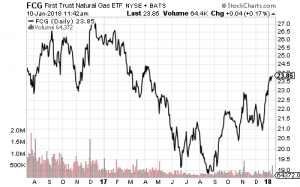

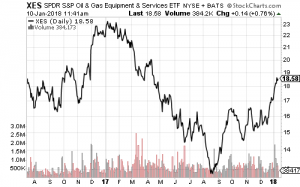

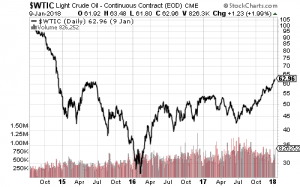

SPDR Energy (XLE) exceeded its 2017 high this week. Energy subsectors such as services and natural gas producers are performing better than XLE, but also have much further to go before achieving even 52-week highs. WTI climbed past $63 on Wednesday, the highest level since late 2014. This clears an important technical hurdle for oil as bullish traders up their targets to $70 or higher.

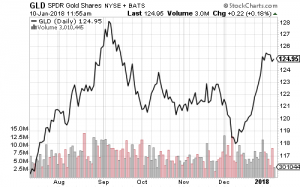

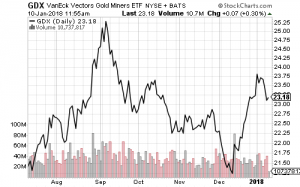

Gold enjoyed a strong rally in December, but rising real interest rates have halted the advance for now. The December import price index increased only 0.1 percent. Producer and consumer inflation for December will be out later this week.

Raw material producers in the steel, coal and copper sectors have built strong momentum at the start of 2018. A short-term pullback appears likely in the short-term given the speed of the advance. SLX is trading at a new multi-year high.

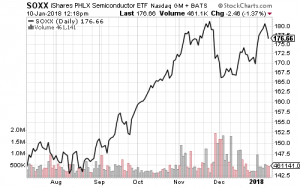

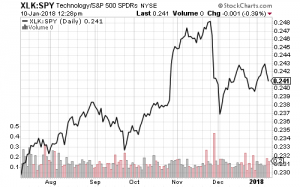

Intel (INTC) pulled semiconductor funds lower this week. The technology sector underperformed the S&P 500 Index last week due to weakness in semiconductors.