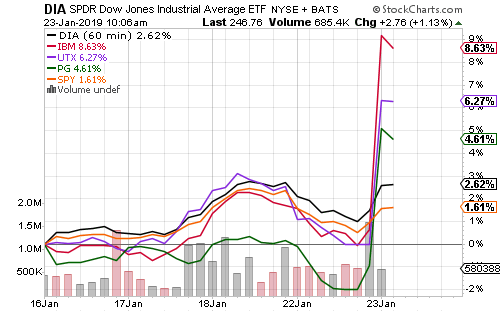

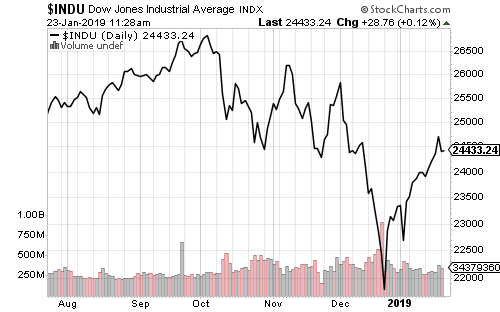

Solid earnings growth pushed the market higher in the past week. The Dow Jones Industrial Average increased during early Wednesday trading after International Business Machines (IBM), United Technologies (UTX) and Proctor & Gamble (PG) delivered earnings reports.

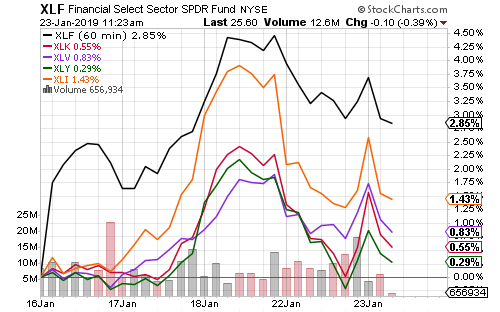

Financials have outperformed thanks to strong earnings from Citigroup (C), Bank of America (BAC) and Goldman Sachs (GS).

United Technologies (UTX) beat estimates by a wide margin. Analysts were looking for a 6 percent drop in earnings and a 7 percent increase in sales. Instead, earnings rose 21 percent and revenue climbed 15 percent. Aside from UTX’s rally, the industrial sector has rallied as several railroad and trucking companies reported positive earnings.

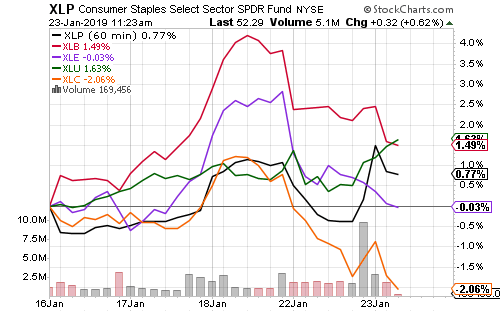

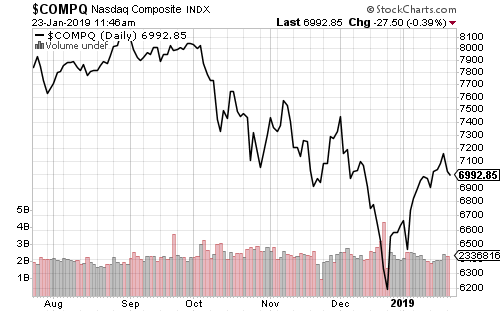

Consumer staples entered positive territory due to P&G’s earnings report. Netflix (NFLX) and Facebook (FB) weighed on communication services. NFLX offered lower than expected guidance, while there is a possibility FB could receive a record fine from the FTC for privacy violations.

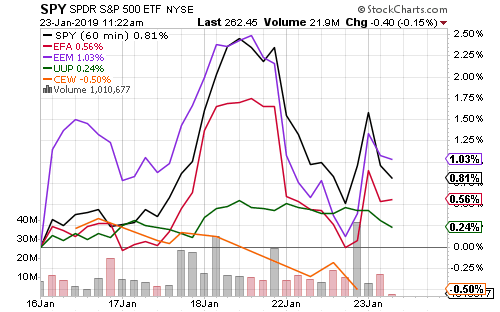

The U.S. Dollar Index has increased over the past week and emerging market currencies slumped. Nevertheless, iShares MSCI Emerging Markets (EEM) was still able to outpace the S&P 500.

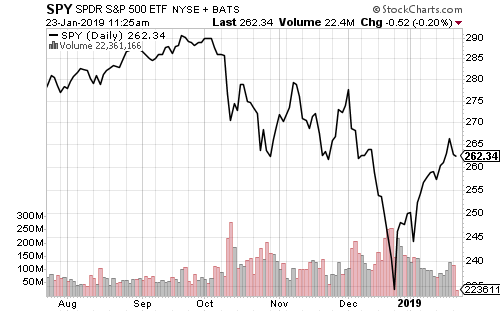

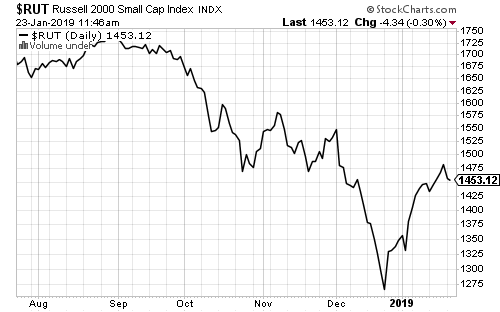

SPDR S&P 500 (SPY) rallied since December 24 and the major indexes have recovered more than 50 percent of their losses since October. The Dow, Russell 2000 and Nasdaq have each shown a similar pattern.

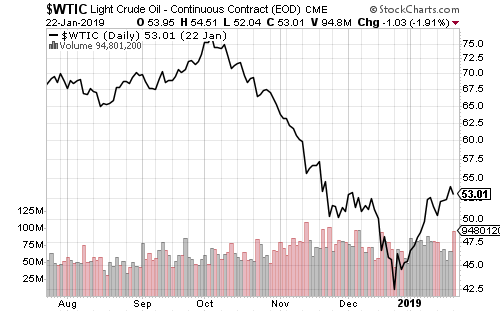

Crude oil has surpassed its fourth-quarter trading range. If bullish trading continues, oil may soon exceed $60 per barrel.