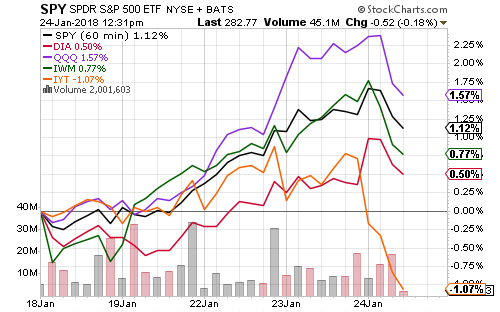

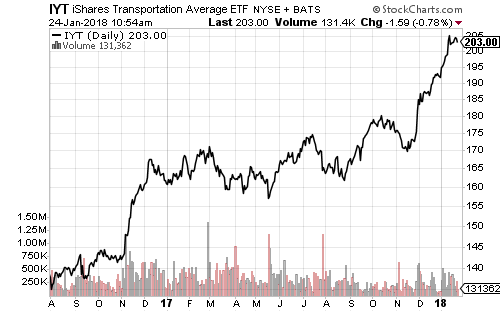

The major indexes have all moved higher in the past week. The Nasdaq climbed more than 2 percent before sliding on Wednesday. The iShares Transportation Average (IYT) chart reflects a 20-percent rally over the prior two months before this week’s Dow Transports consolidation.

The consumer discretionary sector provided the biggest lift for the Nasdaq. Within that sector, Netflix (NFLX) reported stronger than expected subscriber growth. Shares rallied 10 percent the next day.

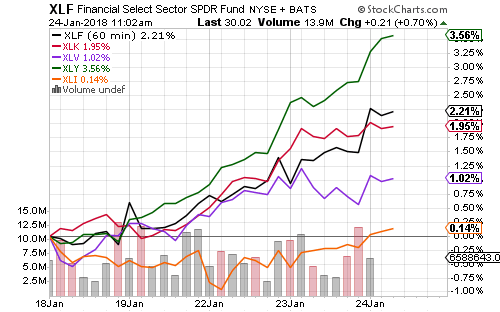

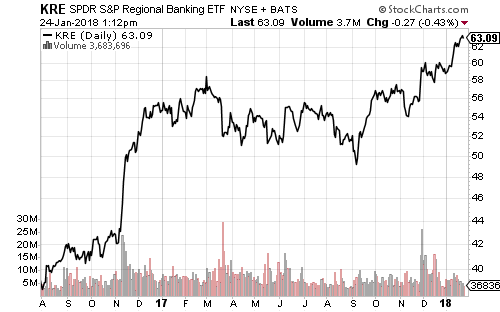

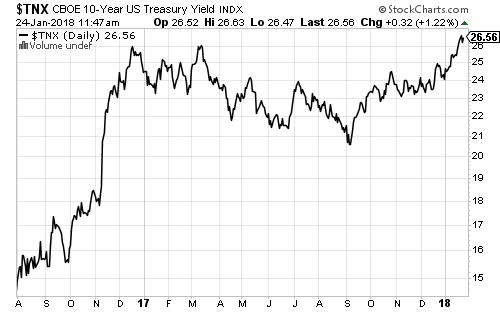

Rising interest rates lifted financial shares. Industrials struggled after General Electric (GE) tumbled to a new 52-week low.

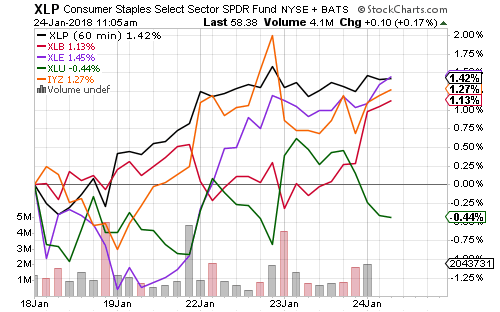

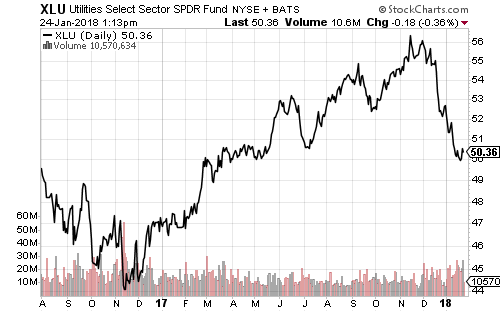

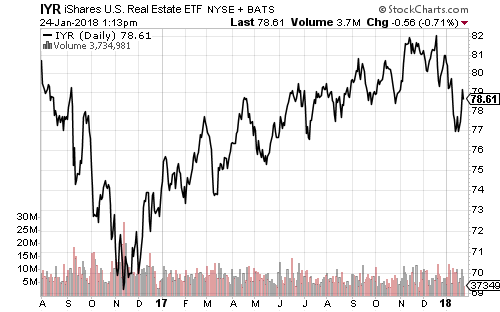

Higher interest rates weighed on utilities, though rising oil prices boosted energy. Utilities and real estate prices have declined as interest rates increased. Banks have broken out to new highs.

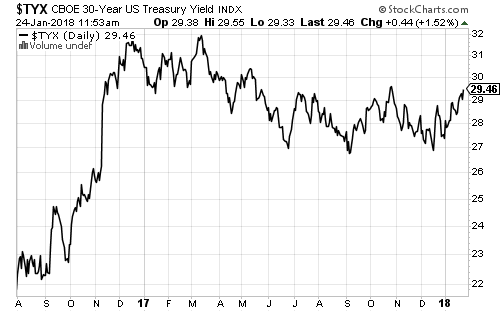

There were several important breakouts this week. The 10-year Treasury yield climbed to a new 3-year high and has now completed a bullish pattern.

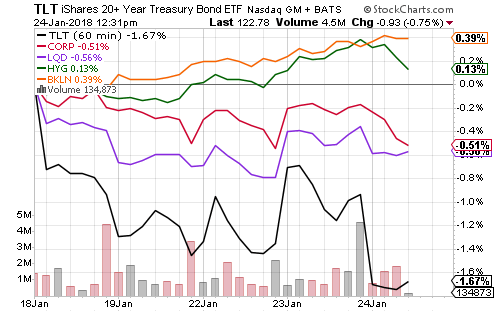

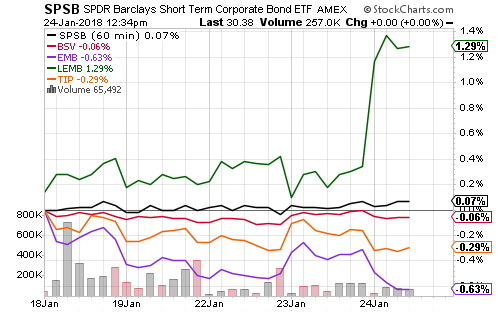

Corporate, investment-grade and government bonds with longer durations are down. High-yield bonds are doing well, but floating-rate funds are doing best.

Inflation-protected bonds are not doing well, indicating the rise in rates is real and not related to rising inflation expectations. Short-term bond funds are holding up well. Emerging market bonds denominated in local currency are rising on the weaker dollar, but emerging market bond funds denominated in U.S. dollars are falling.

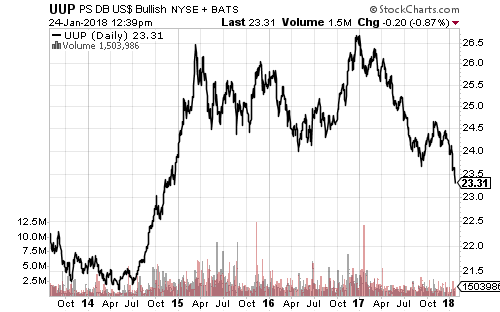

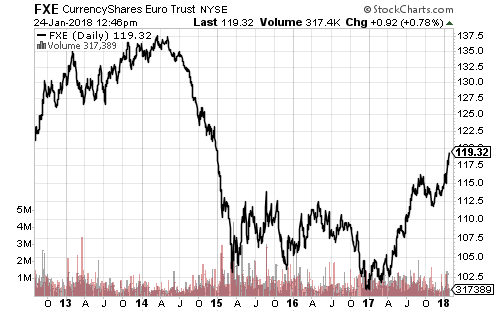

While the dollar remains in a long-term bull market stretching back to July 2014, the current decline has turned the intermediate-term picture bearish. In contrast, the euro has broken out to the upside.

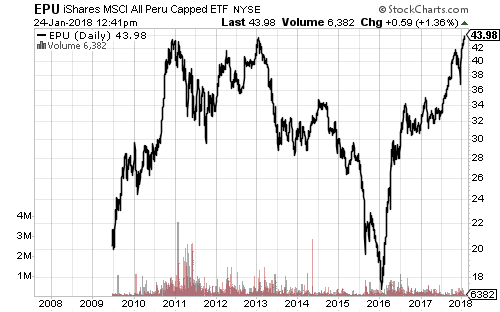

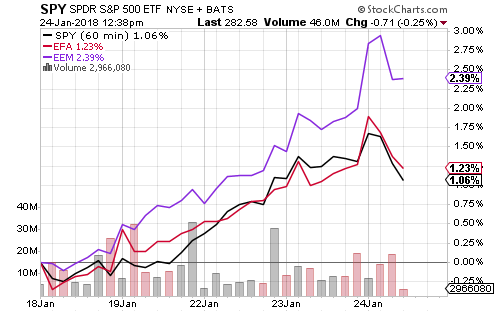

Weakness in the U.S. dollar has boosted emerging markets, but developed markets are struggling to outperform U.S. stocks.

Many ETFs are achieving bullish breakouts. iShares MSCI Peru (EPU) hit a new all-time high on Wednesday.

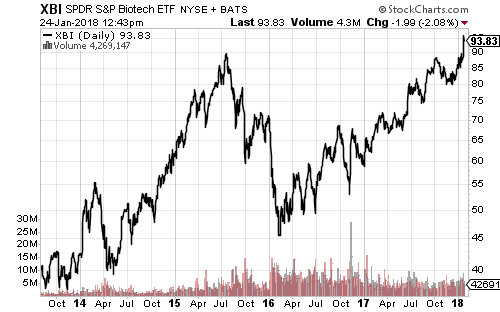

Merger mania in biotechnology pushed SPDR S&P Biotech (XBI) to a new all-time high. Two deals were announced on Monday.

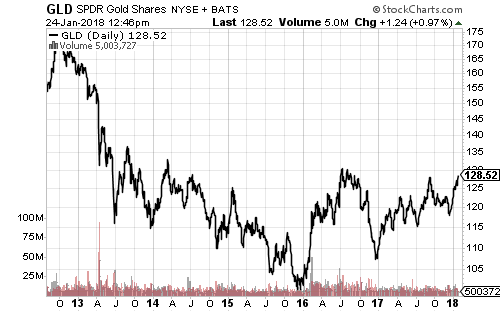

SPDR Gold Shares (GLD) is tracing out a pattern like the 10-year yield, but larger. It would only take a move of about 7 percent to achieve a breakout.

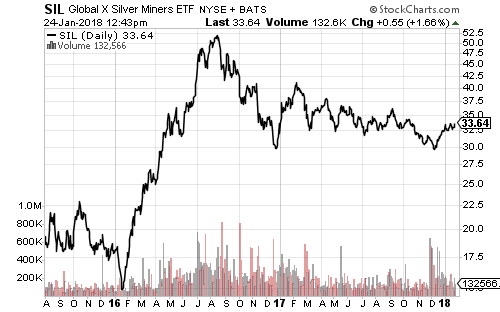

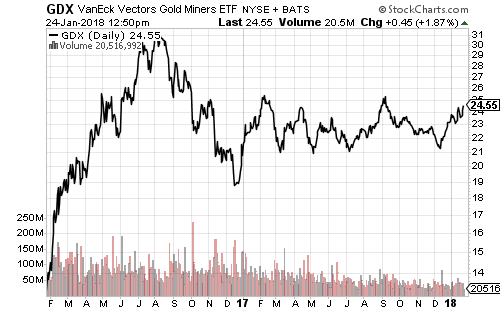

Global X Silver Miners (SIL) has broken out of its downtrend. VanEck Gold Miners (GDX) looks similar to the 30-year treasury yield. GDX is 4 percent away from a new 52-week high.

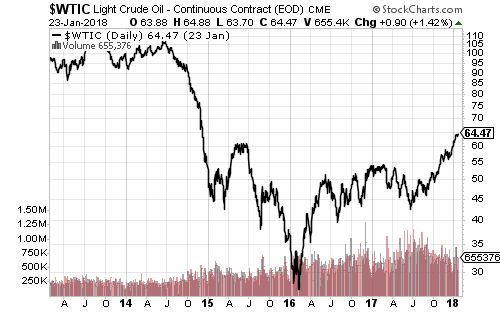

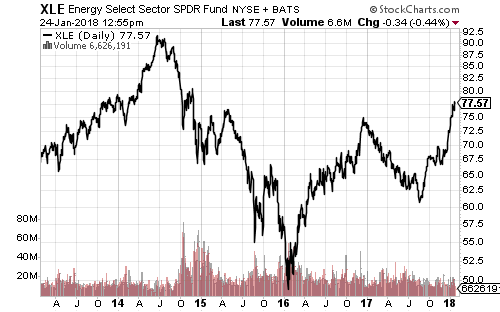

Crude oil has completed a multi-year basing pattern. A move towards $70 is now in play. Fundamentals, such as rising U.S. production could slow or stop the rally, but if the U.S. dollar has peaked, this could be the opening phase of a long-term rally back to $100 oil.

SPDR Energy (XLE) hit a 3-year high this week.

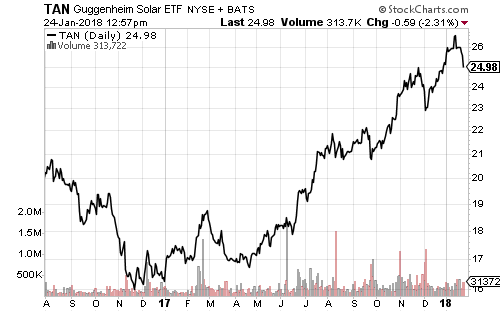

President Trump approved tariffs on solar panels and washing machines this week. Shares of Guggenheim Solar (TAN) jumped on the news, but declined on Wednesday with the broader technology sector.