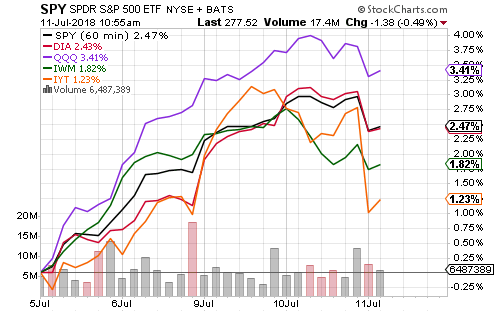

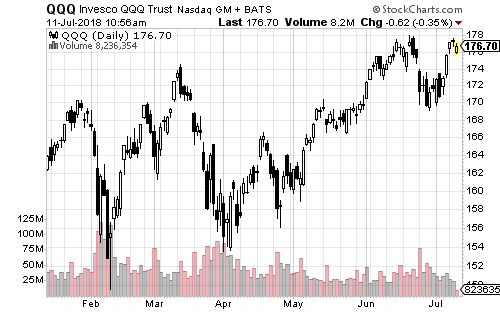

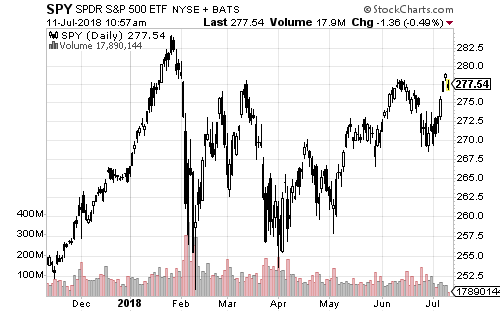

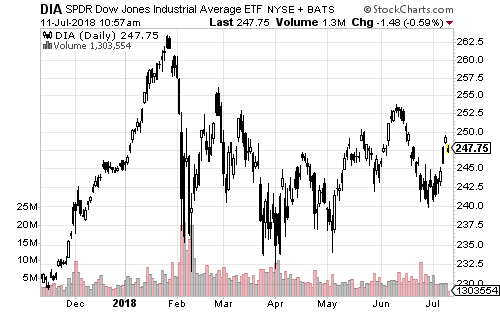

The Nasdaq led last week’s broad rally as all major indexes advanced.

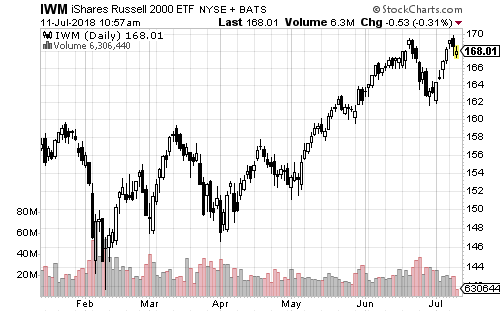

The Russell 2000 Index made a new all-time high over the past week. The Nasdaq is on the verge of a new high.

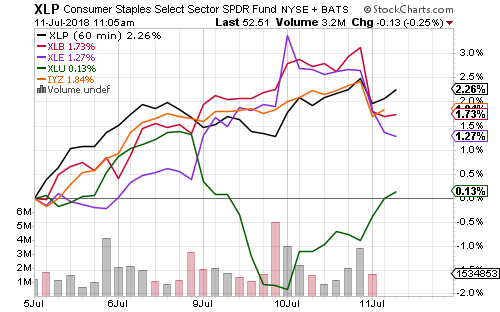

Technology led sector performance last week. The utilities rally ran out of steam, but consumer staples continued to outperform the broader market.

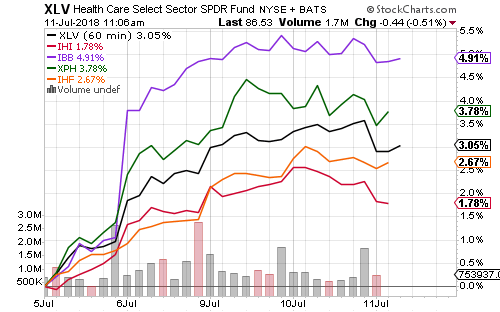

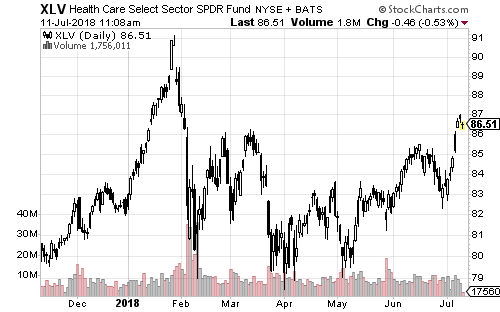

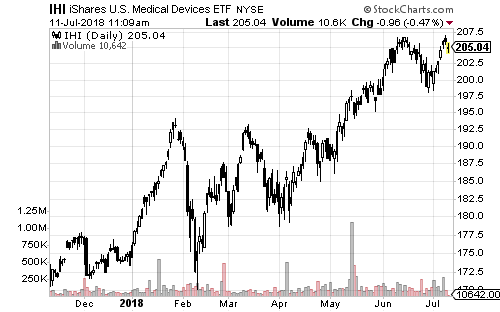

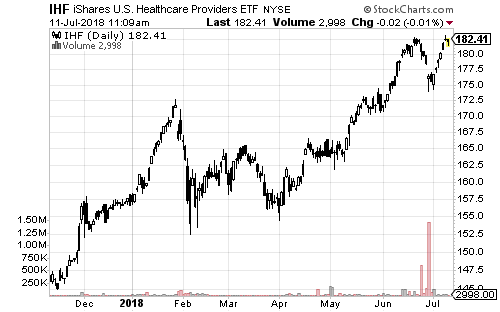

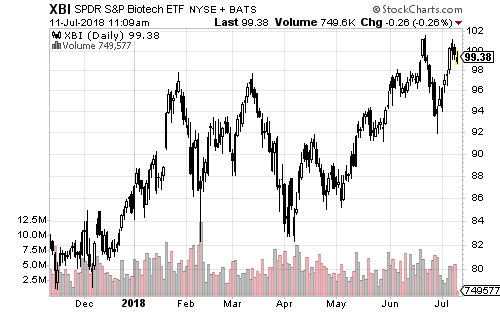

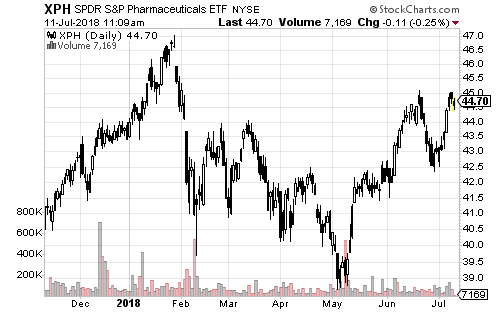

Healthcare performed strongly last week following Biogen(BIIB)’s highly-publicized Alzheimer’s drug trials. SPDR Healthcare (XLV) is off its high due to weakness in pharmaceuticals, but providers, biotech and medical devices are all on the cusp of new all-time highs.

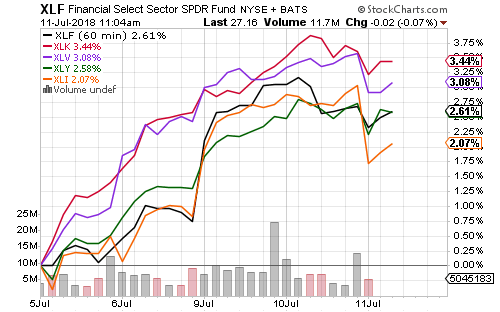

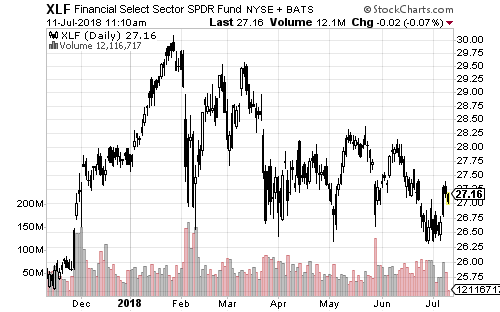

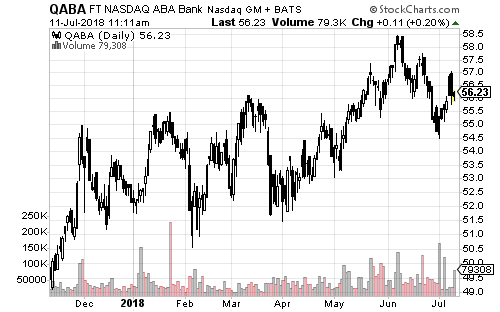

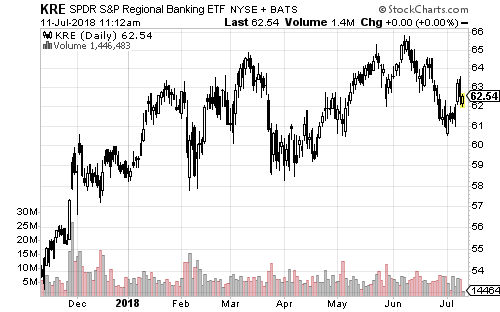

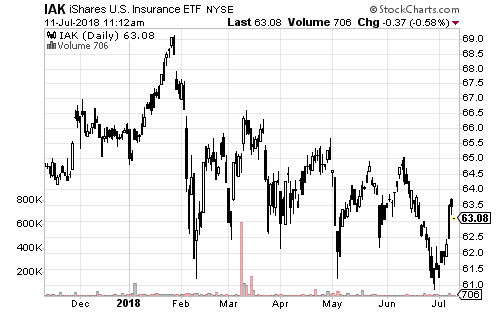

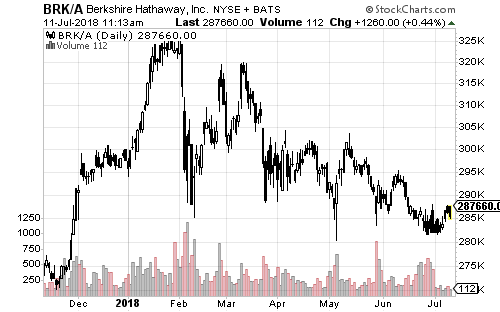

SPDR S&P Regional Bank (KRE) and First Trust Nasdaq ABA Community Bank (QABA) both achieved new highs in June. Weakness has been concentrated in insurance. The largest holding in XLF is Berkshire Hathaway and it has underperformed this year.

J.P. Morgan (JPM), Citigroup (C) and Wells Fargo (WFC) will report earnings on Friday. Their reports could finally break XLF’s downtrend.

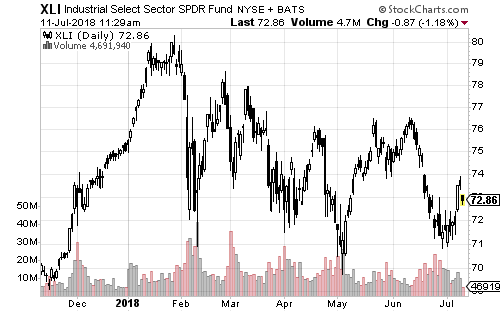

SPDR Industrial (XLI) broke its series of lower highs. Trade concerns have weighed on Boeing (BA) and Caterpillar (CAT).

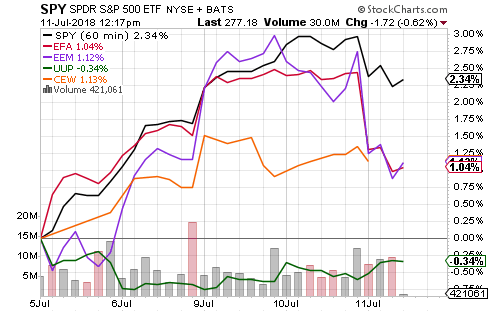

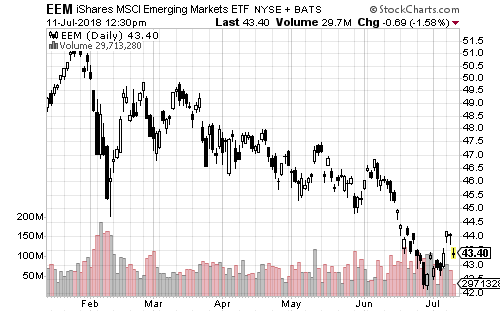

Foreign shares rebounded over the past week and the U.S. dollar weakened, but the S&P 500 Index outperformed nonetheless.

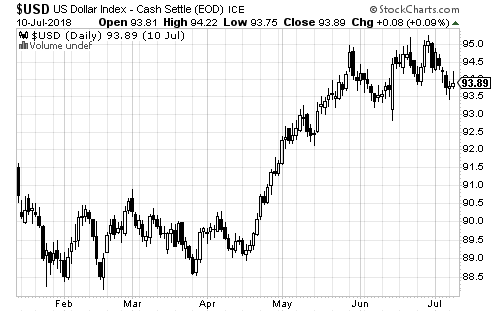

The U.S. Dollar Index traded as low as 93.5 this week, down from a high of 95 in late June. Until the dollar breaches 95, it will remain in consolidation.

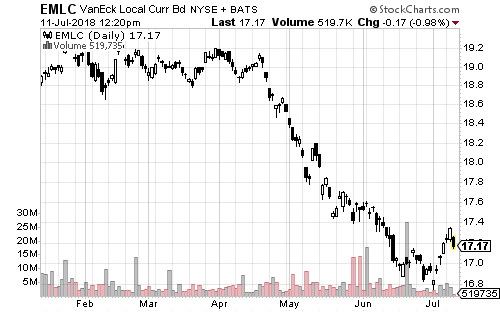

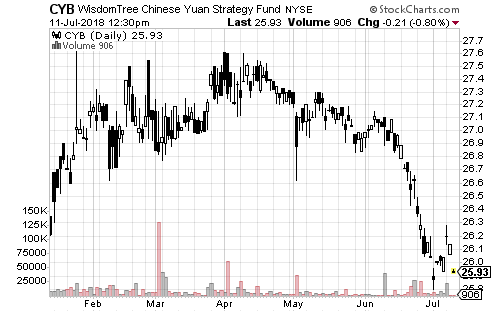

VanEck Local Currency Bond (EMLC) fell again on Wednesday as emerging-market currencies depreciated versus the U.S. dollar, led by a drop in the Chinese yuan.

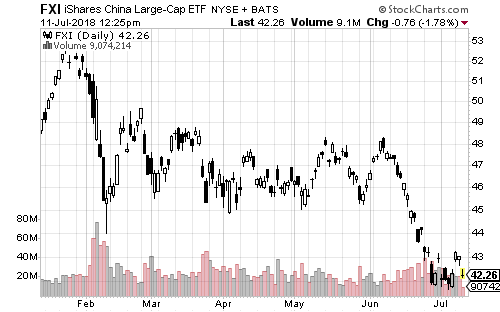

China is a major component in most emerging market funds, but it plays a far greater role in EM economies. Although many financial pundits discuss the cost of a trade war in symmetrical terms, China is at far greater risk than the United States due to its position in the supply chain. All of the lost jobs and factories will come from China.