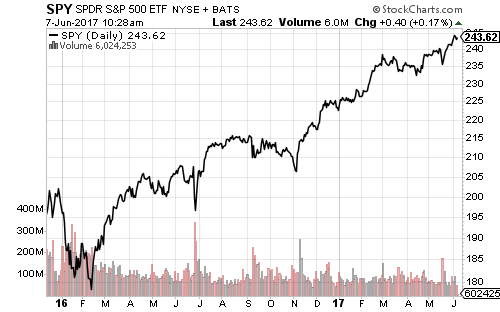

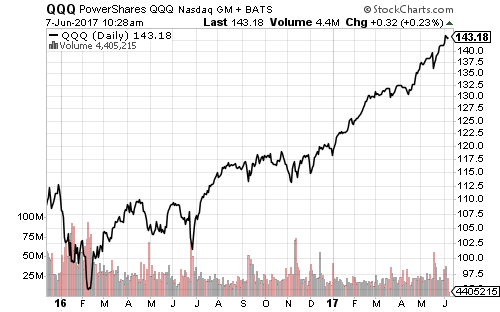

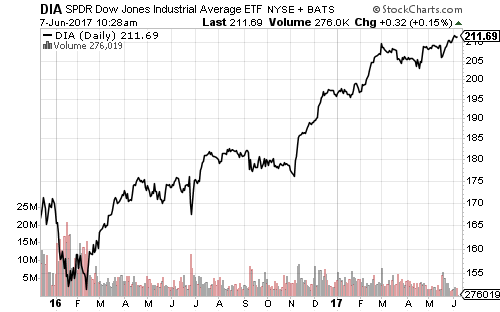

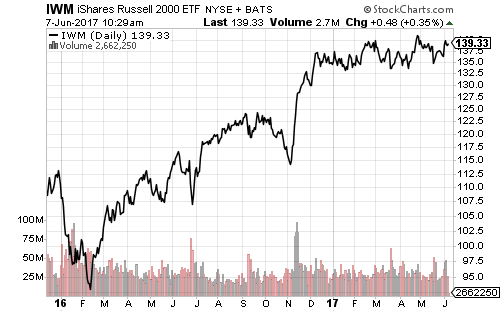

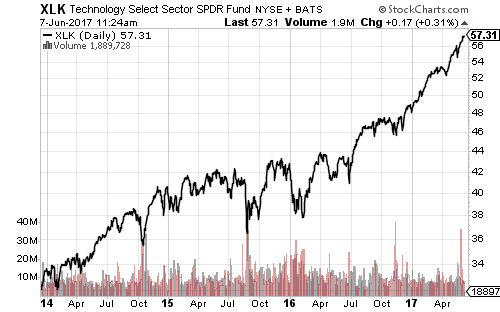

The S&P 500 Index, Nasdaq and Dow Jones Industrial Average are all trading at new all-time highs.

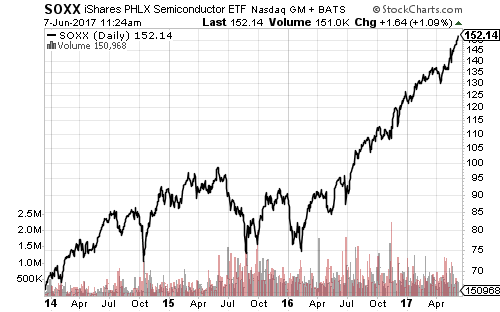

Technology continues to pull the market higher, but subsectors such as semiconductors (SOXX) are likely to slow. SOXX has gained 17 percent since mid-April, an annualized pace of around 150 percent.

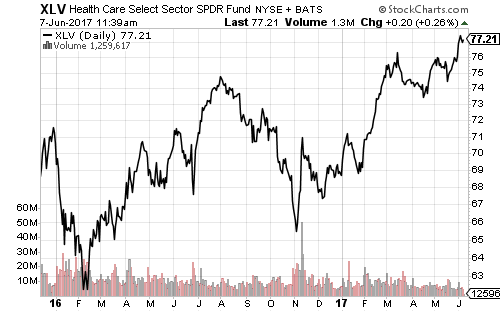

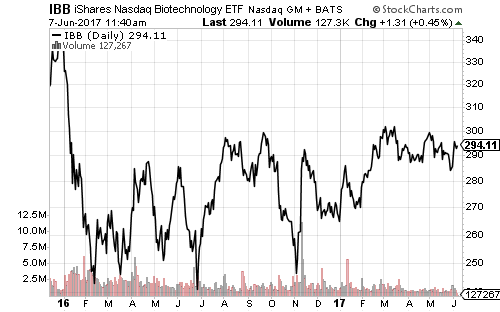

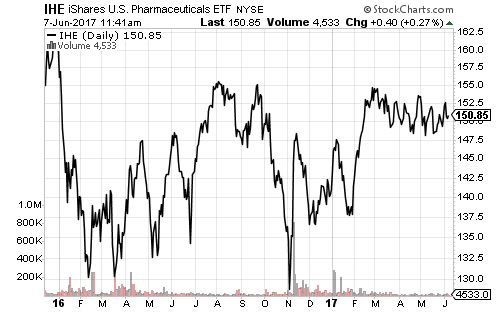

The healthcare sector hit a new all-time high over the past week. Biotechnology pushed the overall sector higher. Healthcare would look much stronger if IBB pushes above $300 per share to a new 52-week high. The medical device sector is at a new all-time high, and healthcare providers are on the verge of breaking their all-time high.

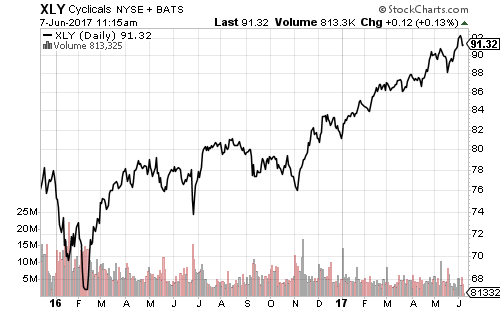

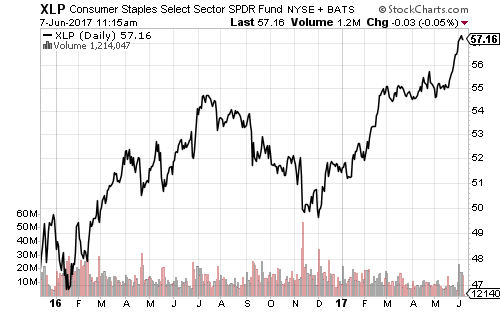

Consumer sectors have also been performing well. Both consumer staples and consumer discretionary are in record territory.

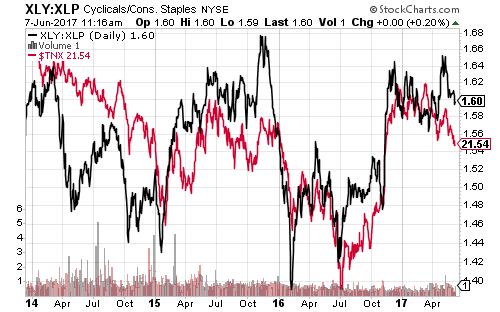

The bottom chart shows the price ratio of XLY to XLP in black and the 10-year Treasury yield in red. XLP has outperformed (falling black line) when the 10-year Treasury yield falls, and XLY when rates are rising.

XLY has been in a relative uptrend versus staples since March.

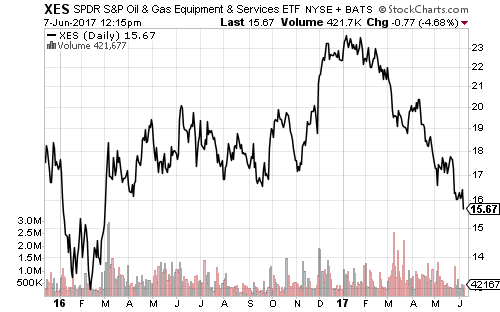

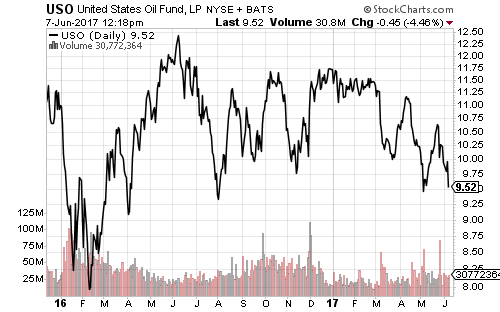

While technology, healthcare and consumer shares remain strong, energy remains weak. Oil prices tumbled $2 a barrel following a large increase in gasoline inventories. Oil services and exploration firms traded at new 52-week lows on Wednesday. If West Texas Intermediate crude oil closes below $45 a barrel, a test of the 52-week low set in August 2016 could follow.

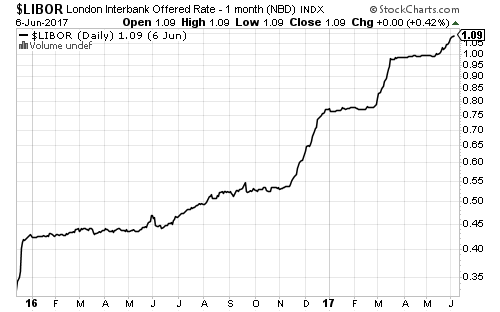

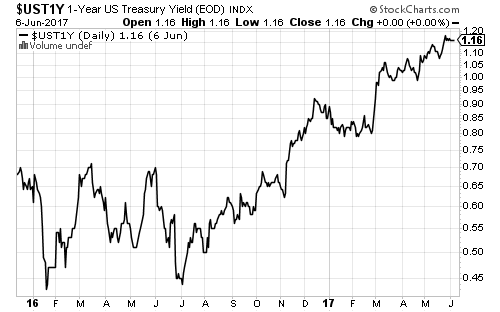

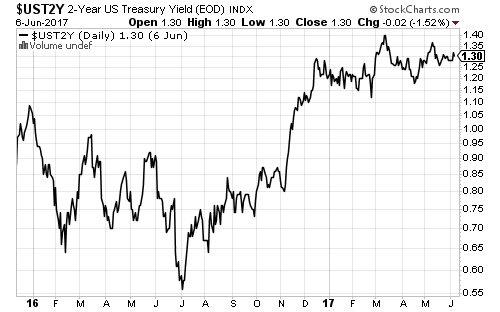

The odds of a June Federal Reserve rate hike stood at 98 percent on Wednesday. Short-term interest rates are still in an uptrend.

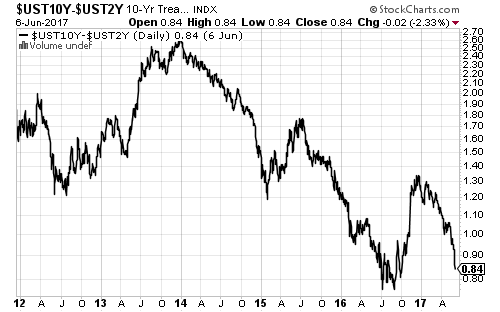

The spread between the 10-year and 2-year Treasury yield fell to 0.84 percentage points, and is approaching the 2016 low.

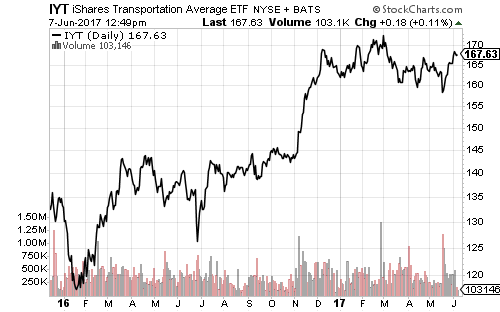

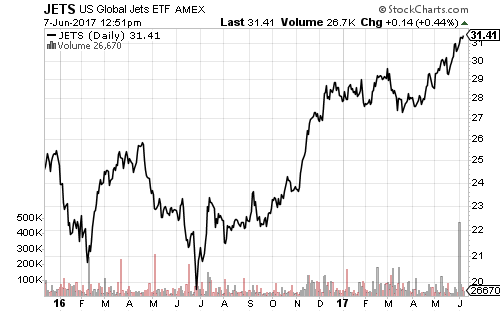

The transportation sector remains in a trading range. iShares Transports (IYT) is rallying back towards its 52-week high, however. US Global Jets (JETS) also remains in a strong uptrend.

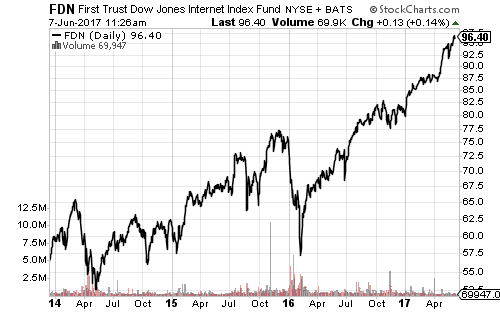

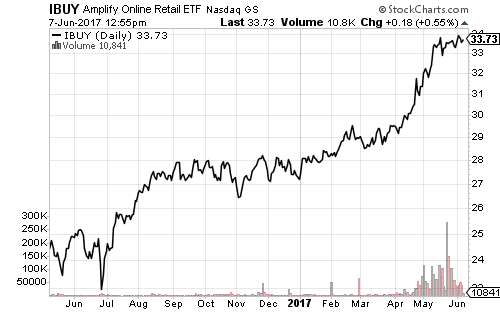

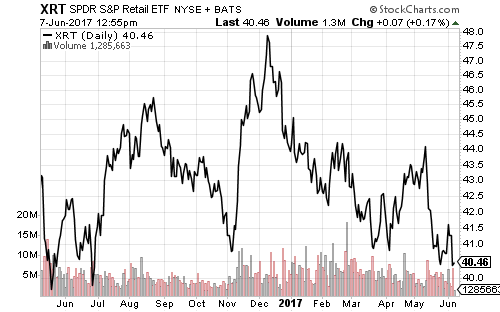

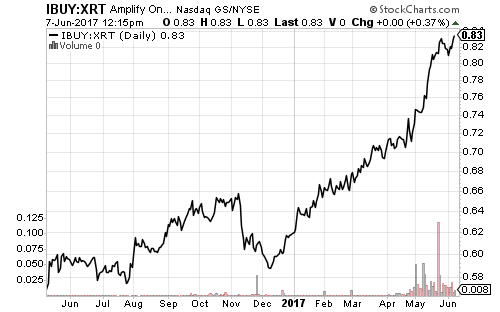

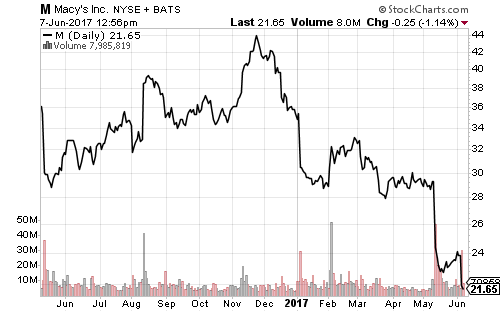

The relative performance of online retailers versus brick-and-mortar stores hit a new high on Wednesday. Macy’s (M) pulled retail lower on Tuesday after reporting gross margins could fall below forecasts.

Homebuilder shares continued rising in the past week.