The Federal Reserve hiked interest rates a quarter point as expected this week. Fed officials forecast two more rate hikes in 2018 and upped its 2019 forecast from 2 to 3 rate hikes.

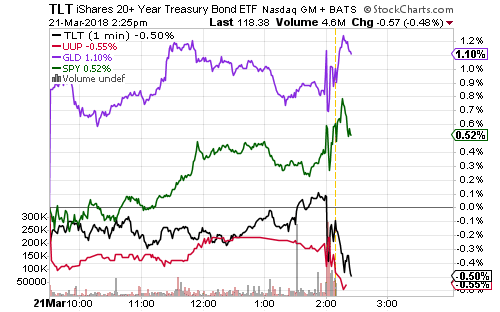

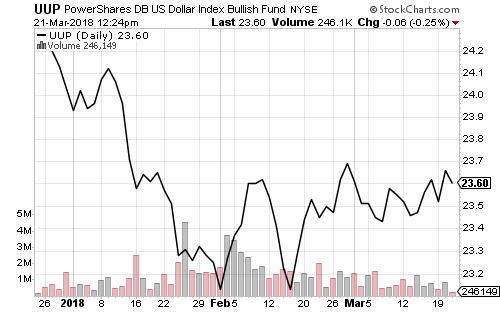

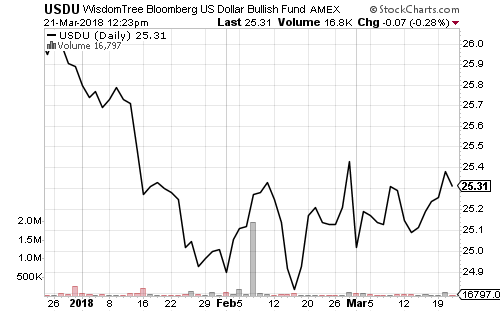

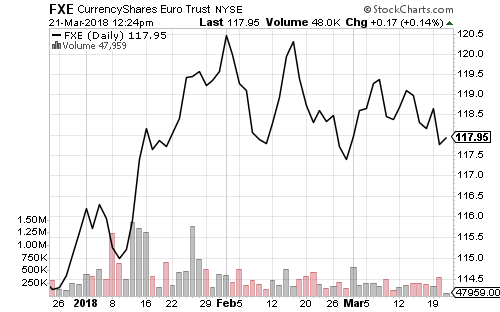

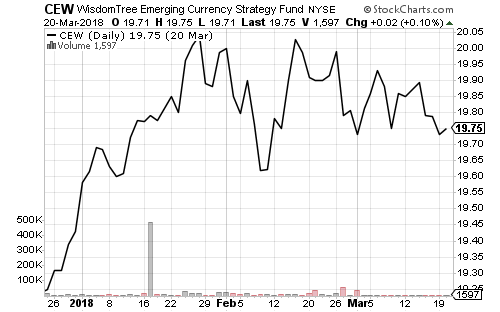

Stocks and gold rallied in the wake of the hike, while bonds and the U.S. dollar declined.

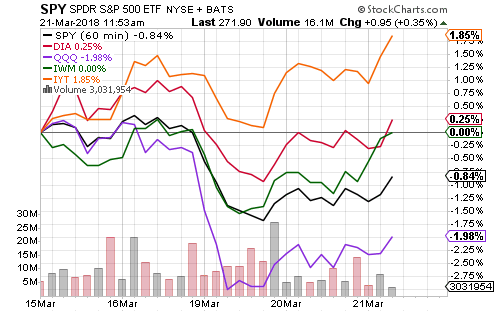

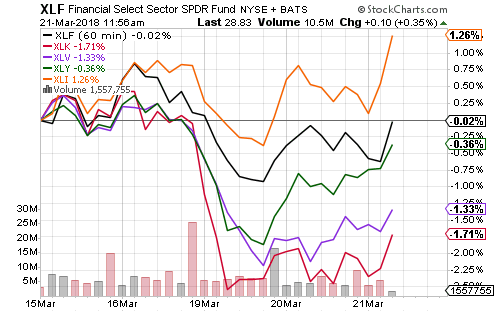

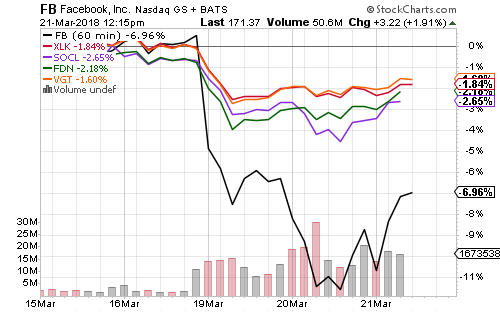

Dow Industrials was the best performing index this week, due largely to its lack of exposure to Facebook (FB). The social media giant was hit by a privacy scandal that sent shares sharply lower and pulled the Nasdaq with it. Many ETFs covering the technology and Internet sectors have 5 to 7 percent of their assets in Facebook.

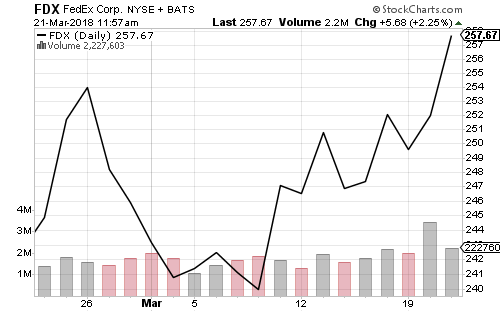

Industrials led among the larger sectors following a rebound in transports. Shares of FedEx (FDX) popped on Wednesday following a strong earnings report. The firm earned $3.72 per share in the prior quarter, beating estimates of $3.11 per share.

Energy was by far the best performing of the smaller S&P 500 sectors after oil prices rallied on a surprisingly large decline in crude inventories.

Facebook (FB) derailed the technology sector this week. The performance gap between technology ETFs largely came down to their Facebook exposure.

Homebuilders rallied on Wednesday following stronger-than-expected existing home sales in February. Sales hit an annualized pace of 5.54 million. Economists forecast 5.40 million. New home sales for February will be out on Friday.

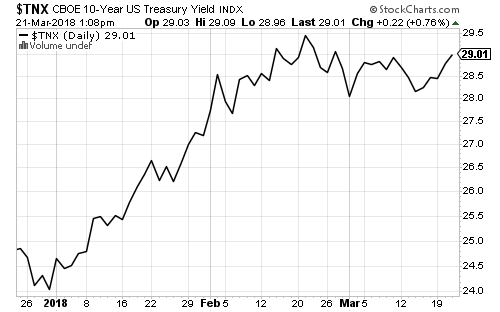

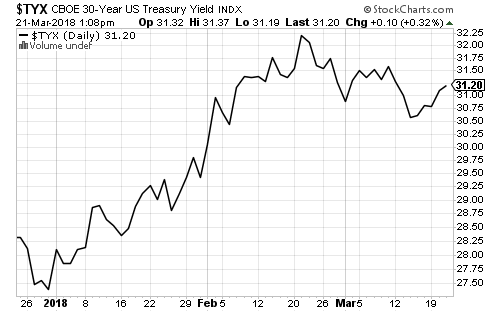

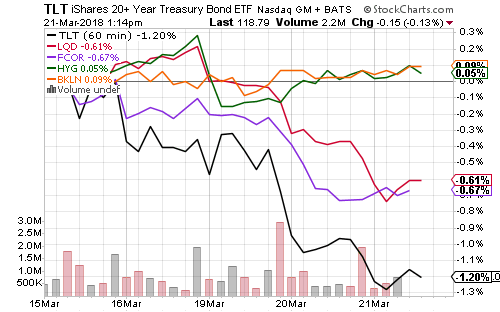

The 10-year and 30-year Treasury yields rose in the past week but remained below 2018 highs.

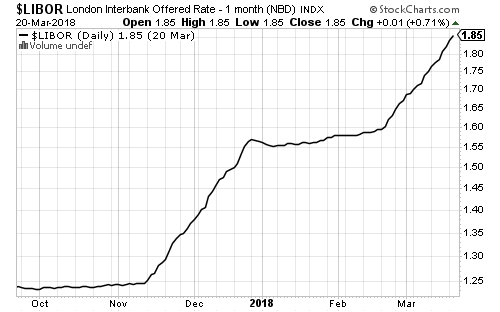

One-month Libor has more than priced in the Fed’s rate hike to a range of 1.50 to 1.75 percent and may be starting to price in a second hike in June. The acceleration in Libor signals a shift in market sentiment.

The rise in interest rates weighed on long-term government bonds, corporate and investment-grade bonds. High-yield bonds and floating-rate funds were higher on the week.

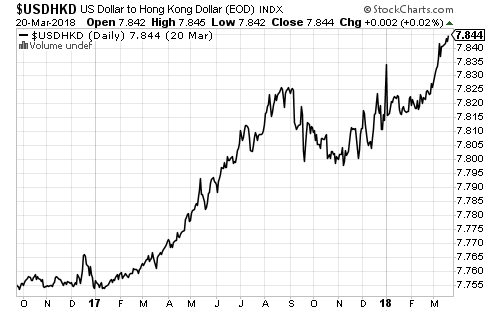

The Hong Kong dollar has weakened steadily against the dollar in recent weeks, with the greenback climbing to 7.8460. Hong Kong pegs its dollar to the U.S. dollar in a range between 7.75 and 7.85.

The U.S. dollar, euro, and emerging-market currencies remained in consolidation patterns this week.

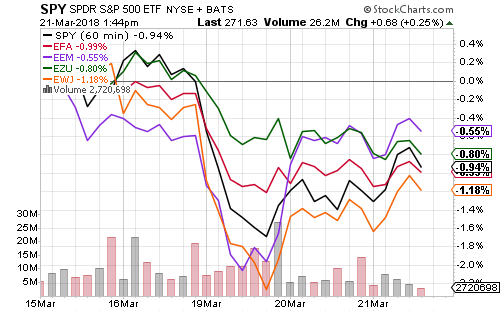

The S&P 500 Index has outperformed the MSCI EAFE for many weeks. Japanese stocks underperformed the MSCI EAFE, while Eurozone and emerging-market stocks outperformed both the EAFE and the S&P 500 Index.

.

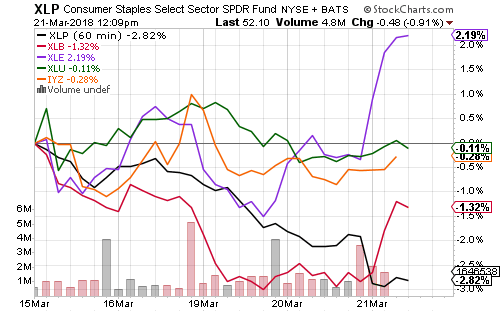

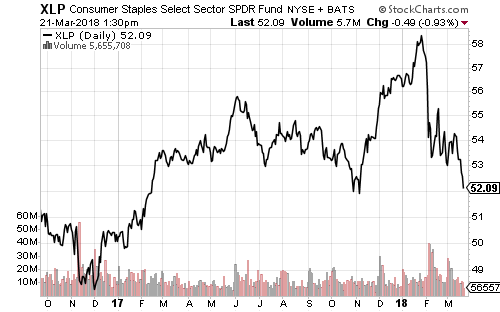

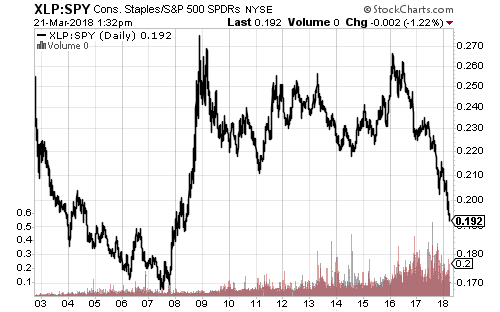

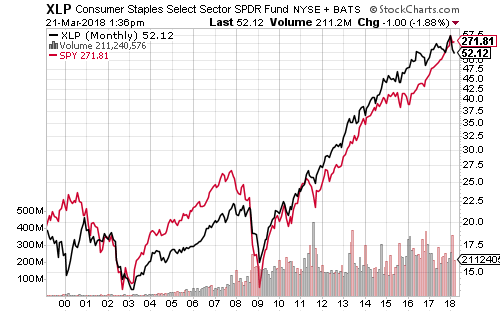

Consumer staples approached their 52-week low over the past week. Rising interest rates have weighed on the sector, as has the market’s overall strength. In relative terms, the consumer staples sector has significantly underperformed since the start of 2016.