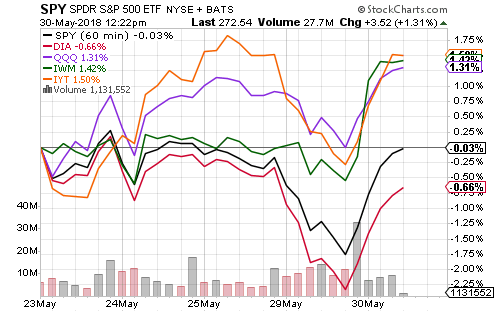

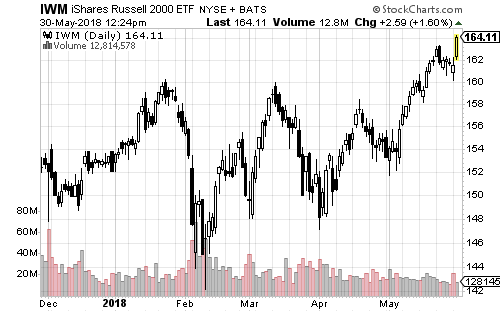

Small-caps and technology marched higher over the past week, while large-caps dipped. The Russell 2000 pushed into record territory on Wednesday.

Consumer discretionary and technology shares led on the week. Amazon (AMZN) accounted for roughly half of the consumer discretionary gains.

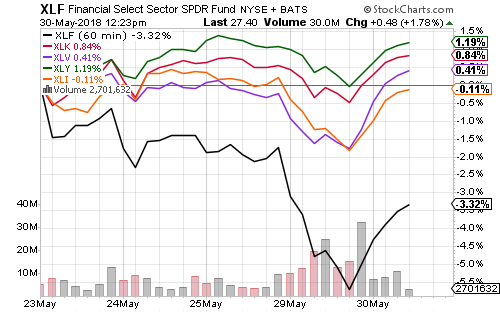

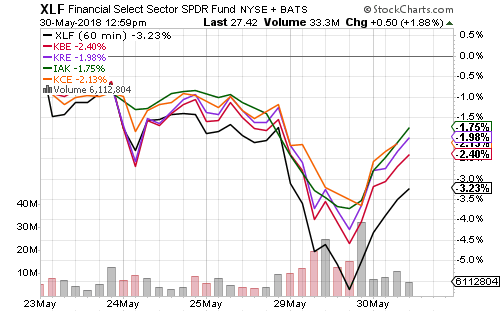

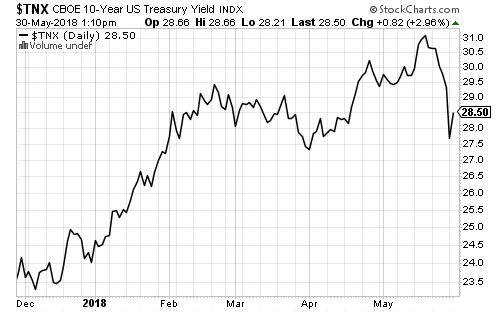

Financials came under pressure as long-term interest rates fell on Tuesday before rebounding. J.P. Morgan (JPM) and Morgan Stanley (MS) also warned on revenue. XLF underperformed, followed by KBE, while insurance and regional banks outperformed.

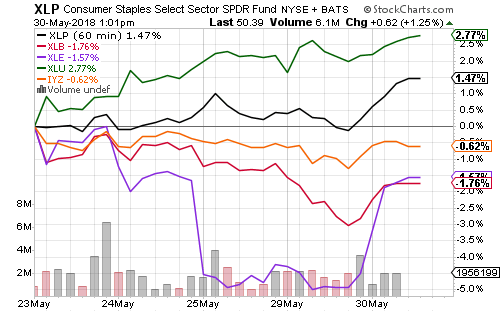

Falling interest rates benefited utilities. Consumer staples caught a strong bid on Wednesday.

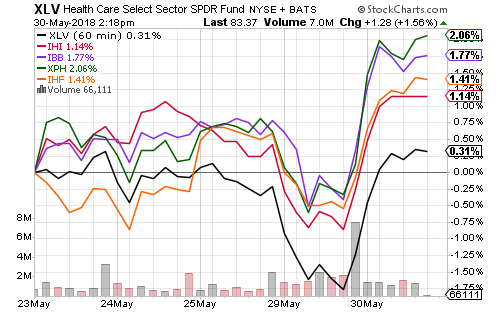

The healthcare sector was very strong this week, despite underperformance in SPDR Healthcare (XLV). Johnson & Johnson (JNJ) shares weighed on XLV, but subsector funds were up between 1 and 2 percent as of Wednesday.

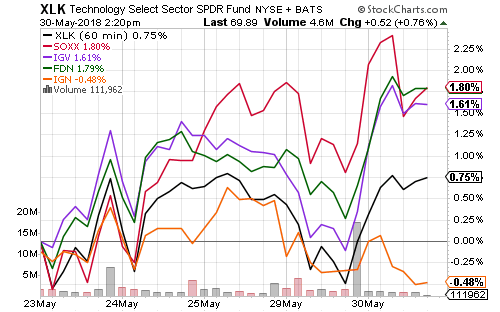

Technology subsectors were also far stronger than the overall sector. Semiconductors, software and Internet shares all saw gains of more than 1 percent.

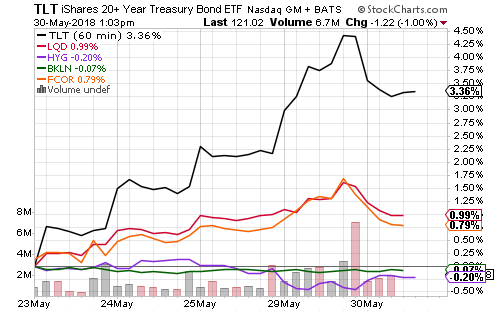

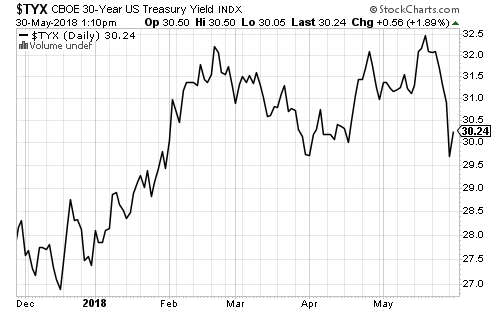

Bonds rallied sharply as interest came down over the past week. High-yield debt was flat as rising credit risk offset falling interest rates on Tuesday. Corporate and investment grade bonds saw the best returns.

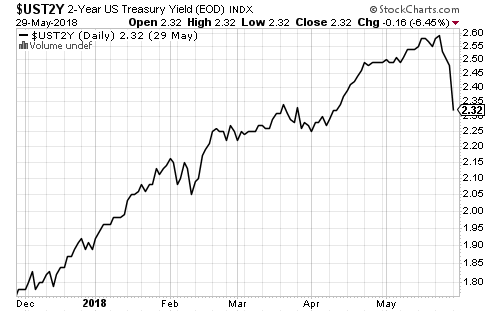

Bond yields tumbled across the yield curve over the past week. This week’s bond rally looks like a healthy correction within the larger down move.

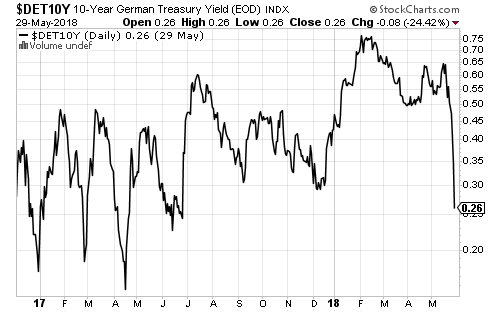

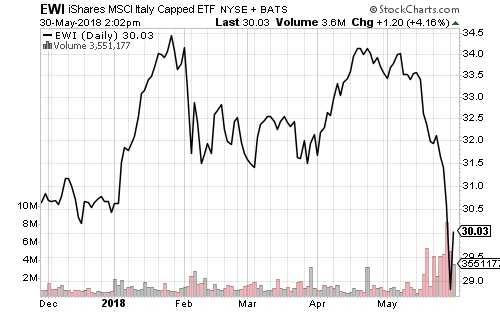

German bond yields erased nearly a year of gains as investors fled Italian debt amid political turmoil. Italian shares fell sharply this week, though rebounded on Wednesday.

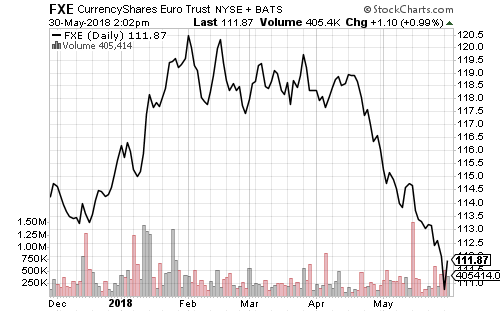

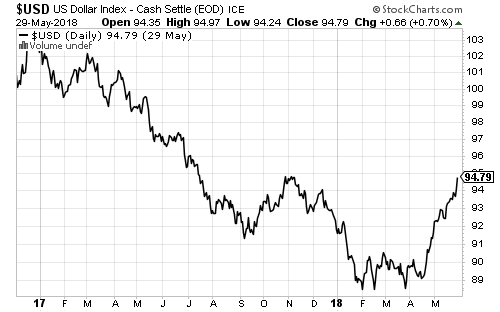

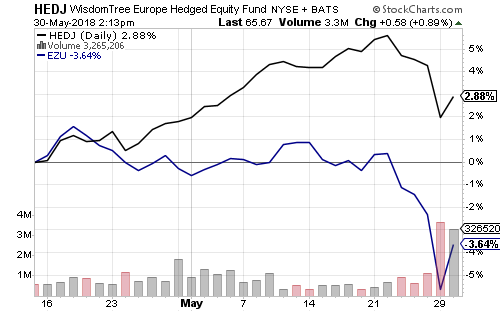

European politics powered the U.S. Dollar Index to new 2018 highs. The index failed to breakout above 95, the next key level for the rally. Investors who’ve hedged euro exposure have done far better amid Italy’s political turmoil, outperforming by as much as 7 percentage points over the past month.

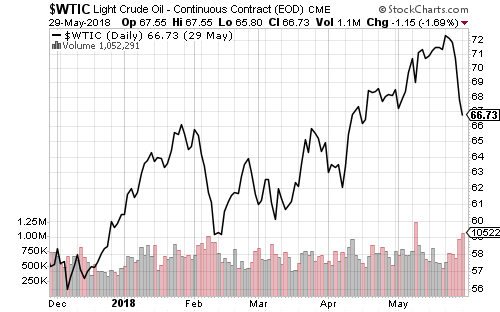

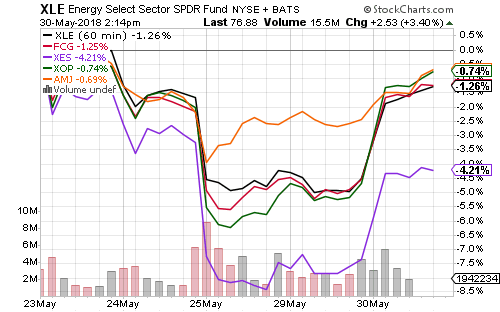

A swift drop in oil prices heavily impacted energy shares.