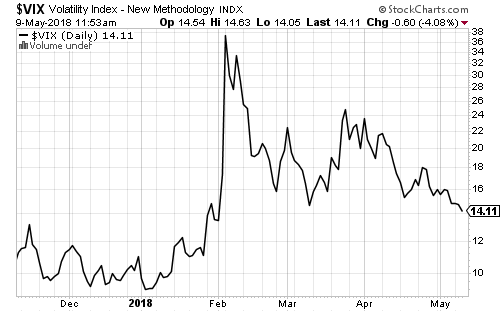

Volatility has been steadily declining since the February high. A break below 14 on the VIX would be bullish for stocks.

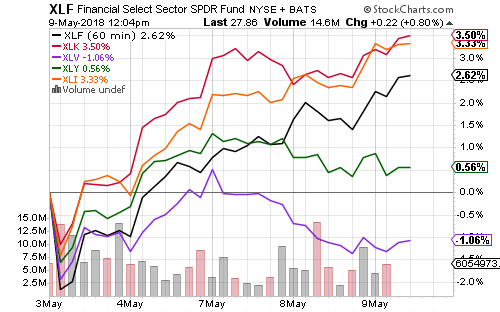

Technology and industrials have led large sector performance this week, followed by financials.

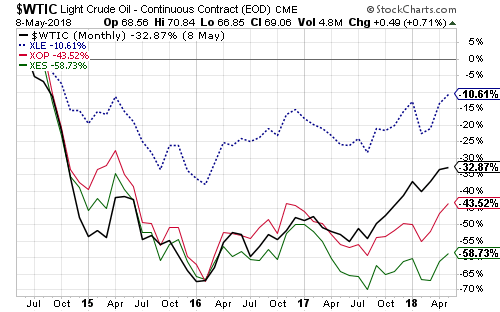

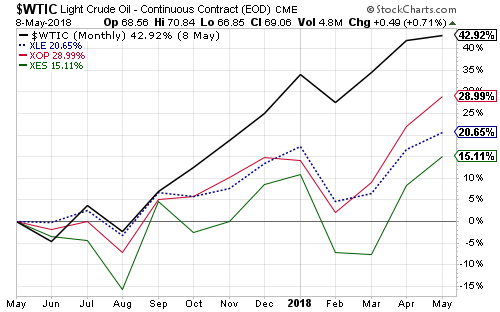

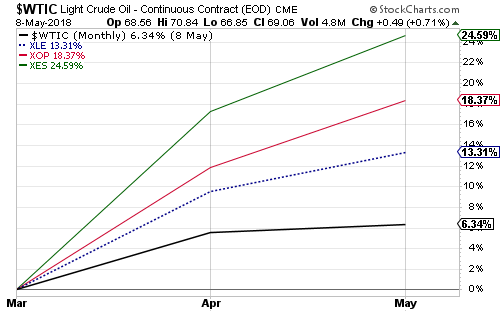

Energy also outperformed following President Trump’s decision to scrap the Iran nuclear deal. Crude oil prices spiked above $70 ahead of the news, and remained high with an unexpected decline in crude oil inventory. We would not be surprised to see a modest pullback in crude prices over the coming weeks.

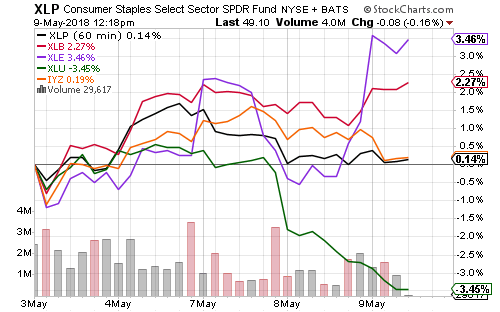

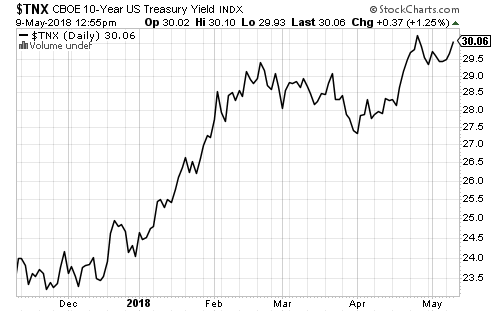

The utility sector was by far the week’s worst performing sector as the 10-year interest rate hit 3 percent again on Wednesday.

Energy exploration and service subsectors (XOP and XES in the chart below) have underperformed the overall sector since 2014.

As oil steadily rises and clears $70 a barrel, the fear of a decline back into the $50s or $40s fades and could lead to a reversal of fortune for energy-related equities.

The 10-year Treasury rallied above 3 percent, but remains below the 3.05 percent level that technical traders are waiting for. A bullish breakout above this level would benefit financial markets.

While long-term U.S. Treasury yields are rising, German bond yields are still very low due to continued quantitative easing in Europe.

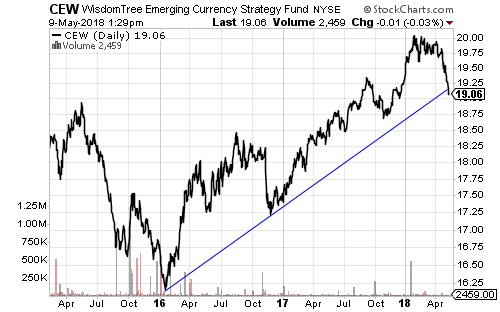

Argentina raised interest rates to 40 percent and it accepted an IMF bailout this week after its currency tumbled.

WisdomTree Emerging Currency (CEW) broke the uptrend in place since 2016.

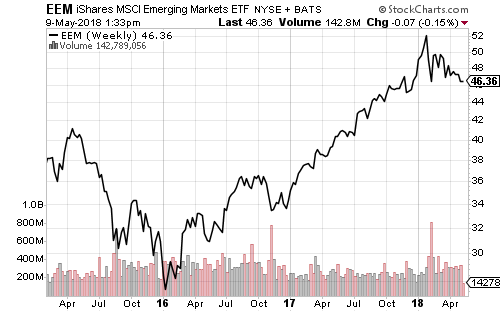

Emerging-market stocks are also threatening a break of their uptrend since 2016.

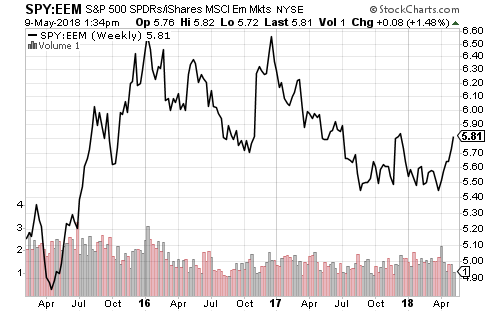

SPDR S&P 500 Index (SPY) has strongly outperformed iShares MSCI Emerging Markets (EEM) since the end of March. It has also performed well versus iShares MSCI EAFE (EFA) since the dollar rally began in April.