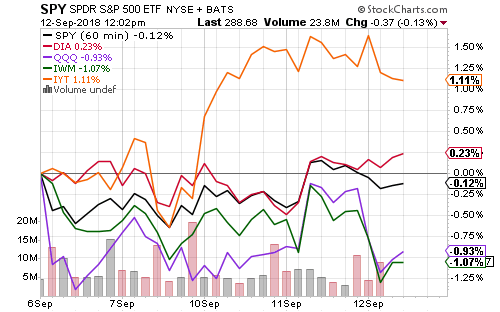

Through Wednesday, the Dow Transportation Index was holding gains of more than 1 percent and the Dow Industrials had a small increase. The Nasdaq and Russell 2000 were lower by 1 percent.

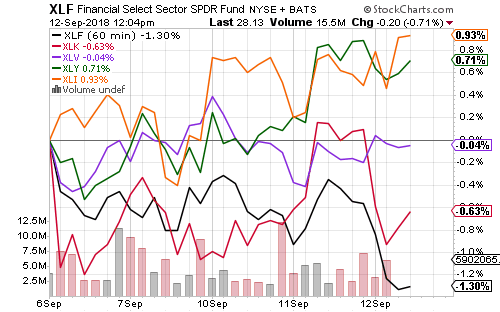

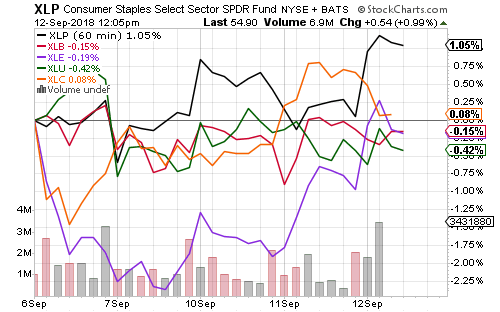

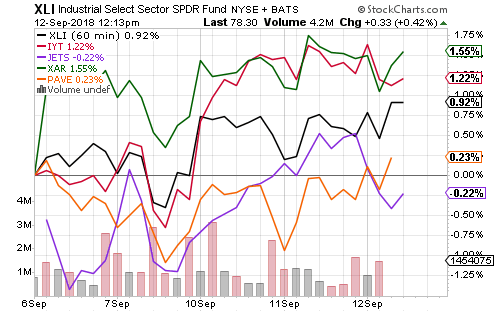

Industrials, consumer staples and consumer discretionary were the week’s best performing sectors.

Defense, transportation and materials subsectors boosted industrials ahead of anticipated hurricane damage.

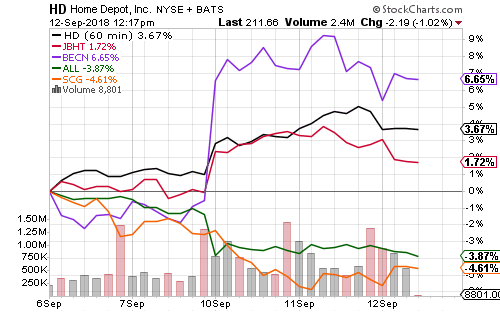

Home Depot (HD), Beacon Roofing Supply (BECN) and trucker J.B. Hunt (JBHT) have all rallied as the storm has strengthened. Insurer Allstate (ALL) and local utility Scana (SCG) slumped.

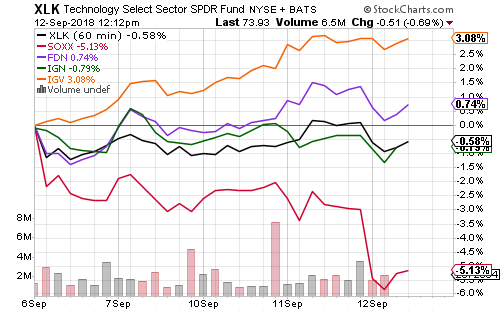

Semiconductors pulled the technology sector lower last week and offset strength in software.

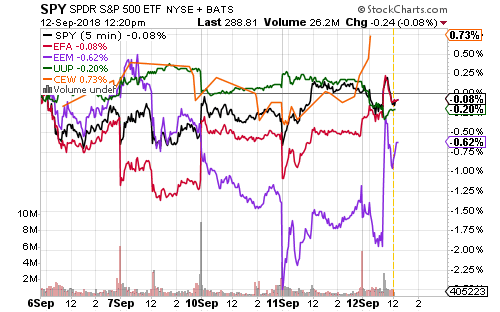

Foreign stocks rebounded sharply on Wednesday morning after reports that the U.S. may reinitiate trade talks with China. The U.S. Dollar Index weakened and the Chinese yuan jumped higher, although previous rumors have not resulted in any substantial outcomes.

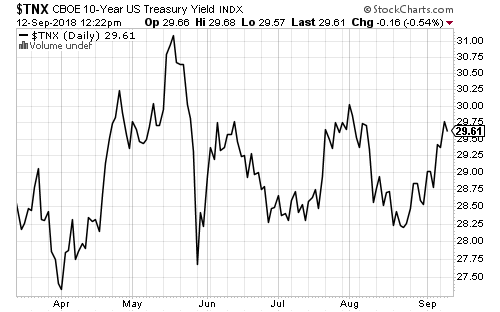

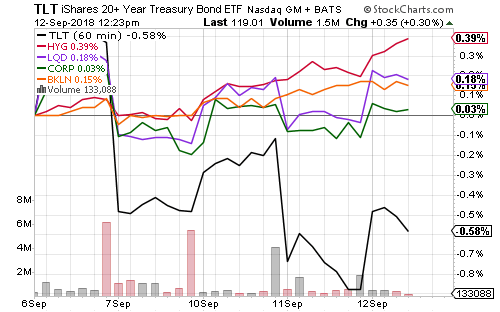

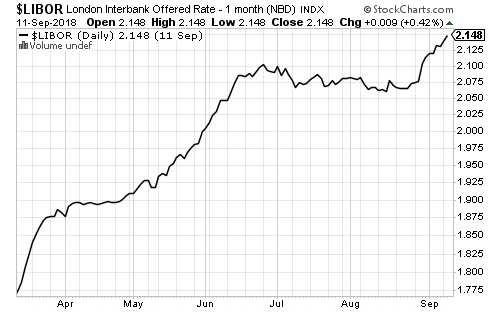

The 10-year yield rallied to near 3 percent this week, topping out at 2.98 percent. Rising yields weighed on long-term Treasury bonds, but corporate, investment grade, high-yield and floating-rate funds all moved higher. With odds of a September rate hike at 100 percent, Libor continued pricing in higher interest rates. The Federal Reserve will lift the Fed funds rate to a range of 2.00 to 2.25 percent at the September 26 meeting.

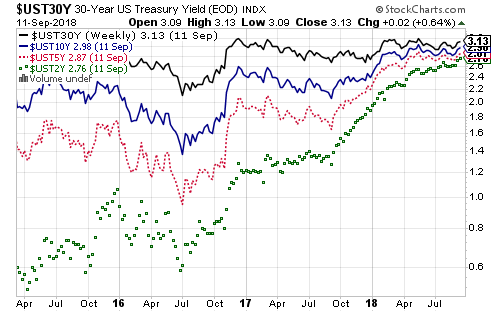

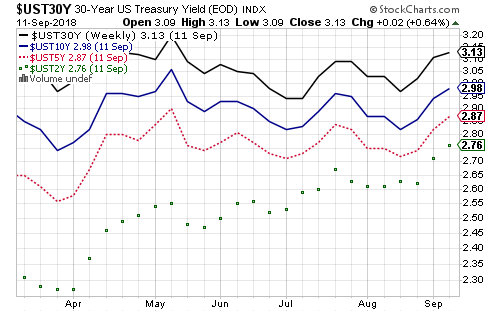

The 2-year Treasury yield was only 0.70 percent three years ago, but now sits at 2.76 percent. The 30-year yield has risen from 3.00 to 3.13 percent. The gap between the two bond yields has fallen from 2.30 percent to 0.37 percent. All of the increase has come at the short-end of the curve, a result of Fed policy.

The market started pricing in another hike in late August. Assuming the Fed also hikes in December as expected, the 2-year yield should rise to near 3 percent, if not above. The 52-week high for the 10-year yield is 3.11 percent. There has been some talk of the yield curve inverting, of 2-year Treasuries yielding more than the 10-year. With the economy on solid footing, however, the 10-year yield is more likely to breakout to the upside. Risk in the bond market remains in the long-end, while opportunity still lies at the short-end and with floating-rate funds.

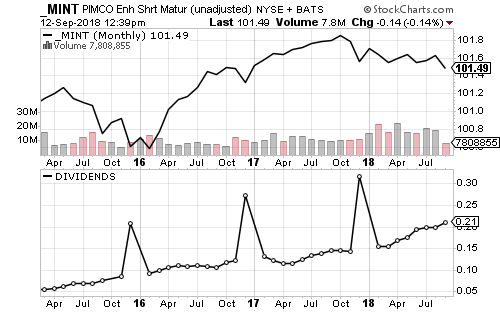

PIMCO Enhanced Short Maturity Active ETF (MINT) has steadily captured rising interest rates. MINT was paying monthly dividends of 5 cents three years ago, and now it is up to 21 cents per month. The unadjusted price of MINT has been very stable at around $100 to $102 per share. MINT’s yield has tracked with the rising yield on the 2-year treasury bond.

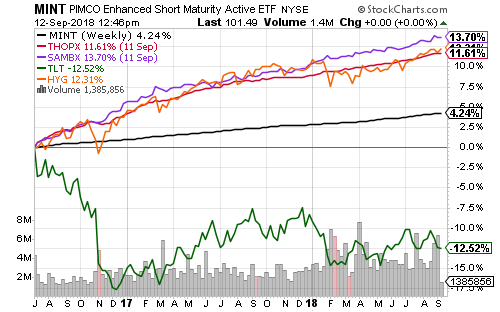

Higher yielding funds such as Thompson Bond (THOPX), iShares High Yield Corporate Bond (HYG) and Virtus Seix Floating Rate High Yield (SAMBX) have outperformed MINT. iShares 20+ Year U.S. Treasury is down since peaking in the wake of the Brexit vote.