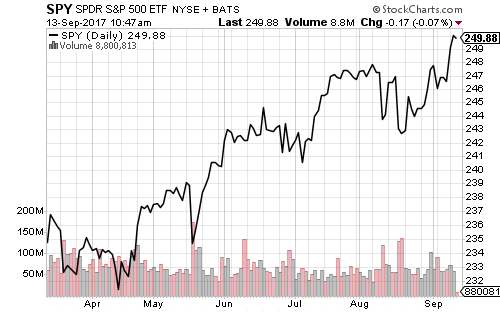

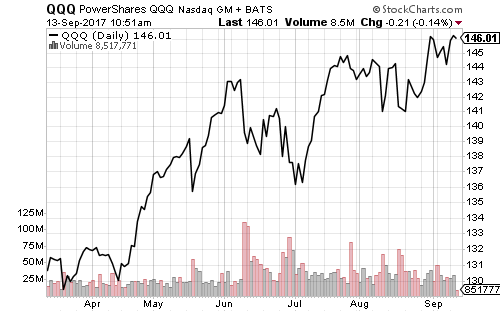

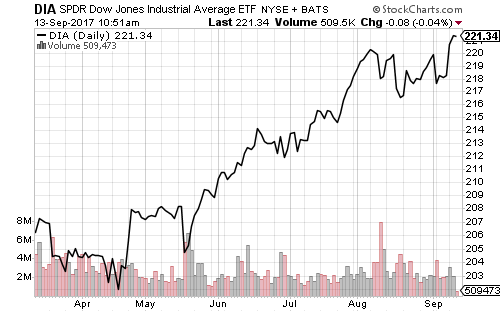

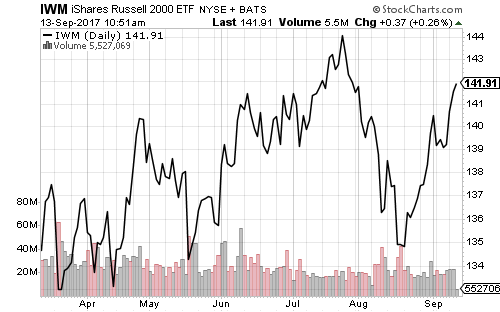

Stocks quickly moved into record territory this week as hurricane risks subsided and recovery began.

Only the Russell 2000 Index has yet to make a new all-time high in September.

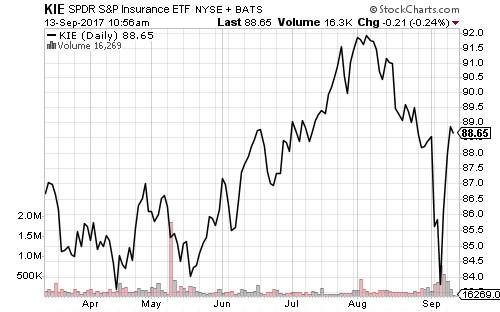

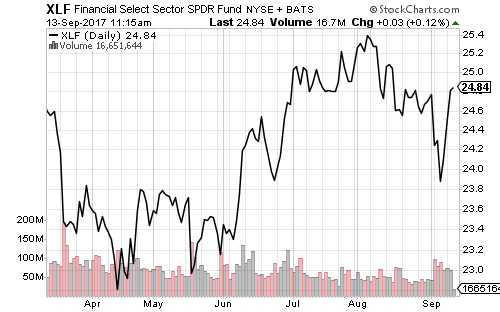

Financials have rebounded strongly in the past week as SPDR S&P Insurance (KIE) regained half of August’s 9-percent losses.

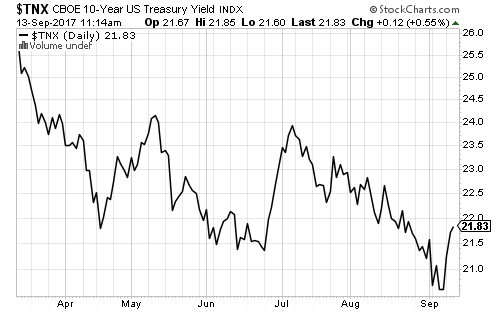

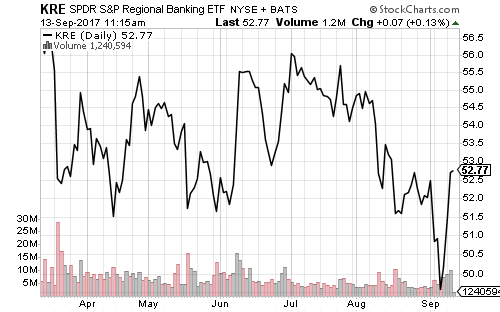

The 10-year Treasury yield also rallied sharply over the past week after hitting a new 2017 low. Regional banks benefited the most from rising rates.

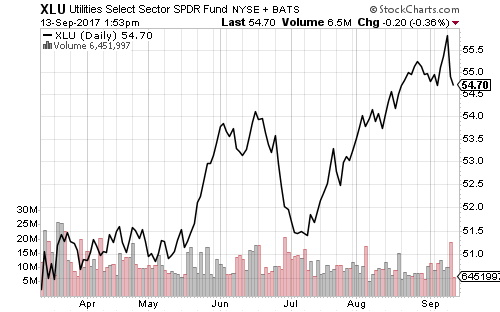

The utilities sector suddenly reversed on Tuesday from last week’s 52-week high in response to rising rates.

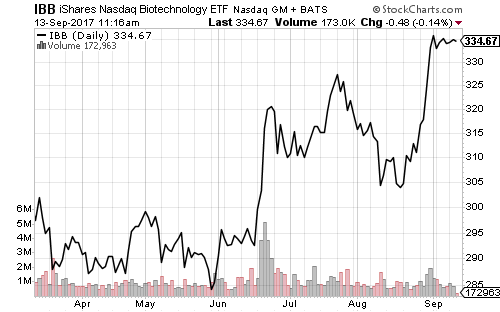

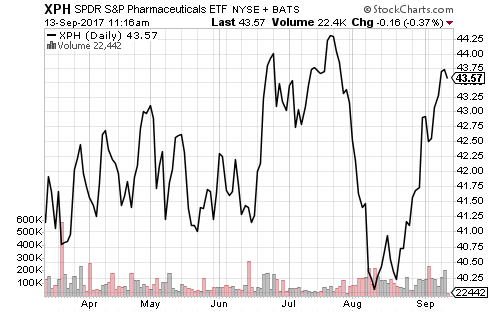

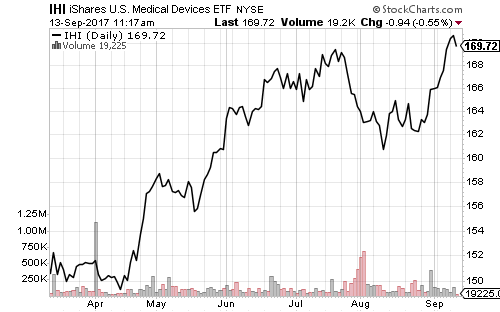

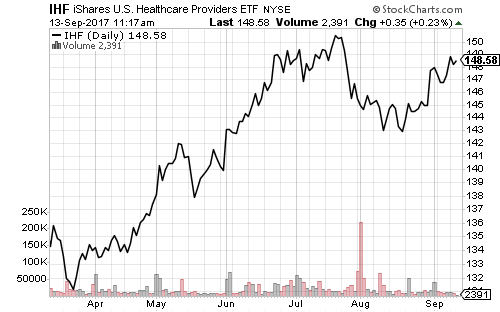

All major healthcare subsectors (biotech, pharma, medical devices and healthcare providers) have advanced since mid-August following merger activity, successful drug trials and government approvals.

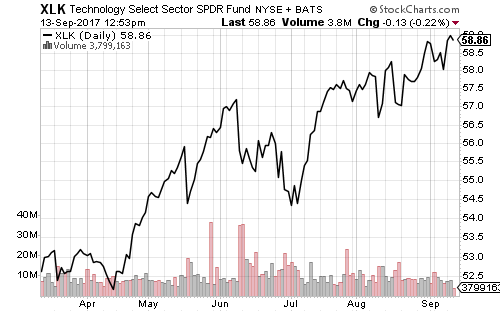

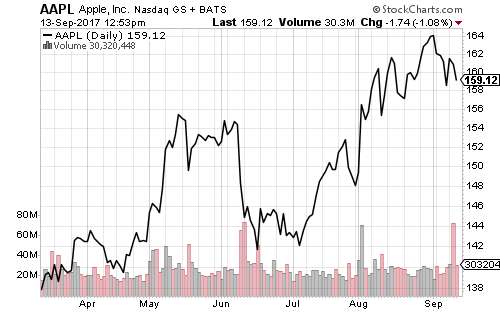

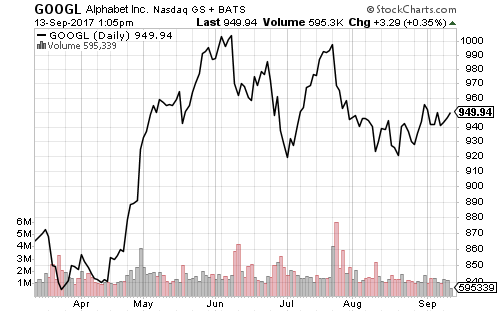

SPDR Technology (XLK) hit a new all-time high on Tuesday, but tech followed Apple (AAPL) lower on Wednesday as speculators exited ahead of the iPhone X launch.

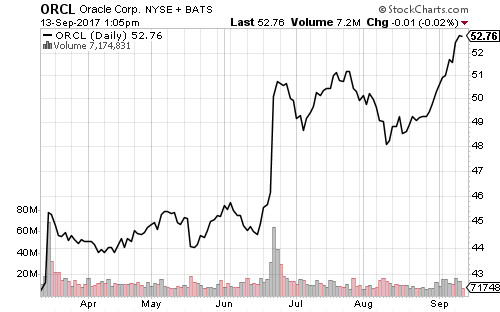

Oracle (ORCL) will report earnings on Thursday. The consensus forecast calls for earnings of 60 cents per share.

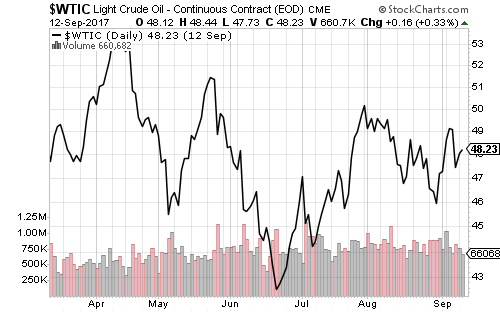

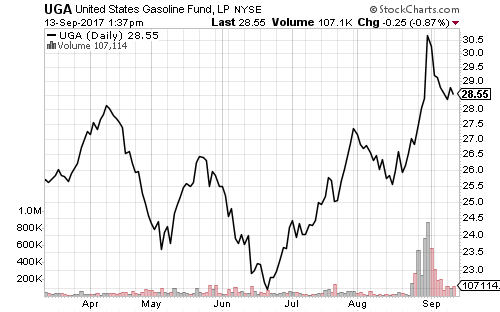

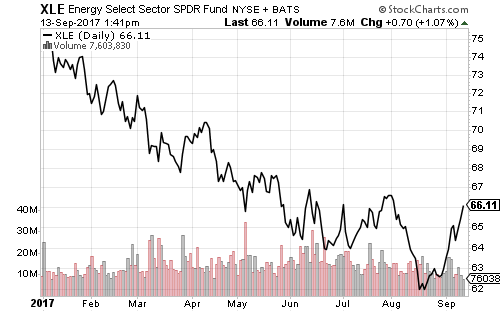

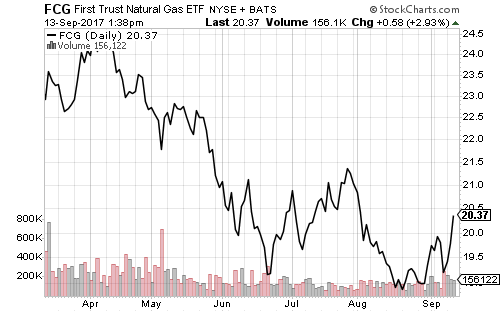

Oil prices fell on hurricane volatility, but rallied as the storm weakened.

Energy-related equities have rallied sharply. SPDR Energy (XLE) is approaching a record high for the first time since early August.

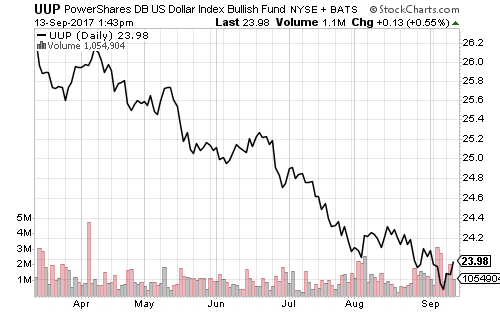

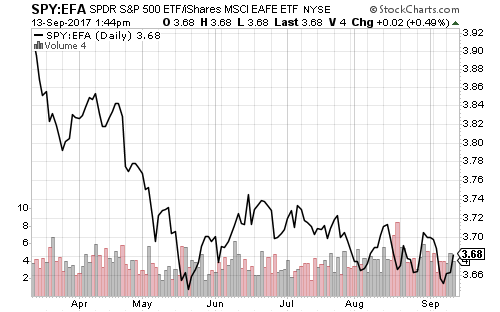

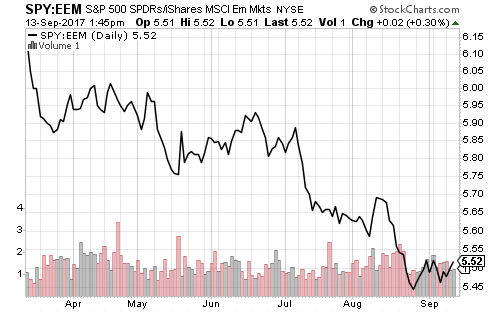

The U.S. dollar fell to a new 52-week low in September, but rebounded in the past week. SPDR S&P 500 (SPY) has kept pace with iShares MSCI EAFE (EFA) since early August. SPY has also outperformed iShares MSCI Emerging Markets (EEM) since late August.

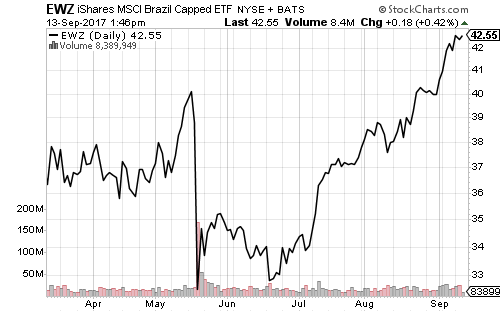

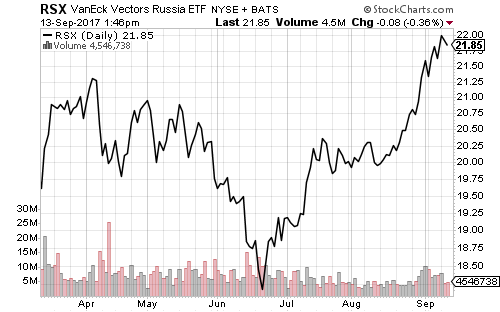

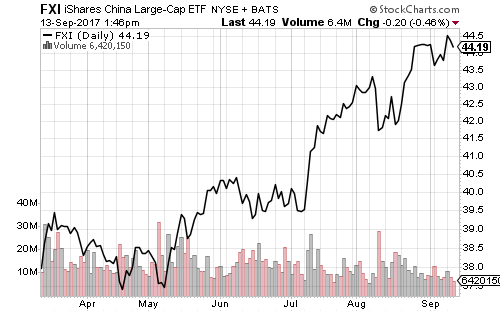

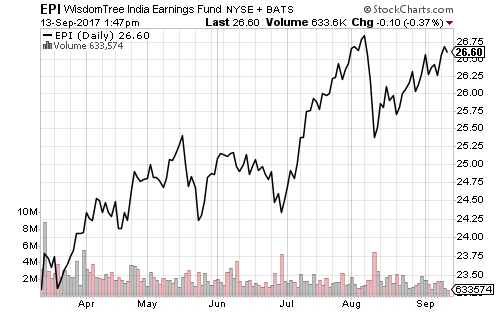

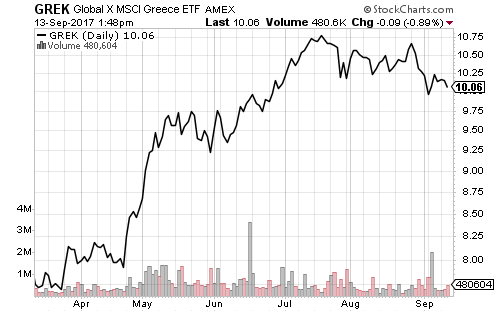

The BRICs are pulling emerging markets higher, while smaller markets such as Greece consolidate gains.

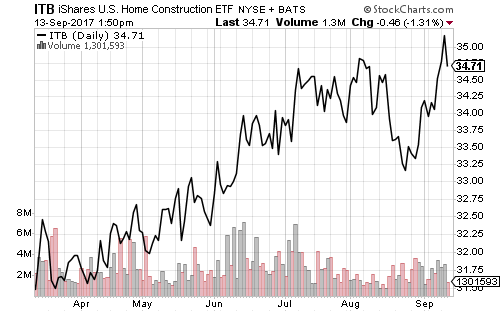

Homebuilder stocks hit a new 52-week high in September. Falling long-term interest rates have boosted the sector in the last week.