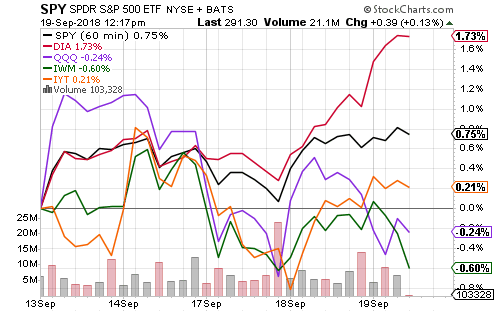

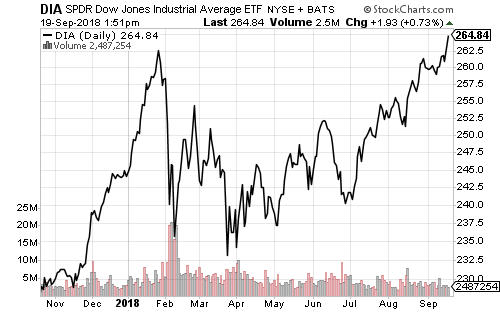

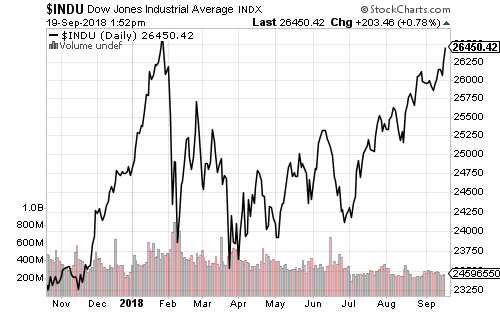

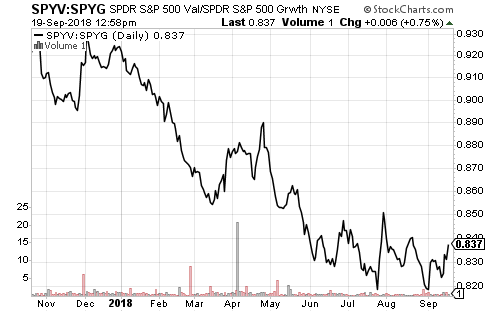

The past week of trading featured a rotation from growth to value as interest rates increased. The Dow Jones Industrial Average outperformed the Nasdaq by nearly 2 percentage points. This week’s rally lifted SPDR DJIA (DIA) to a new all-time high, joining the S&P 500, Nasdaq and Russell 2000 in exceeding the January high.

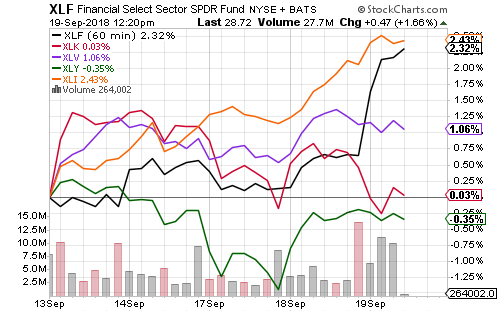

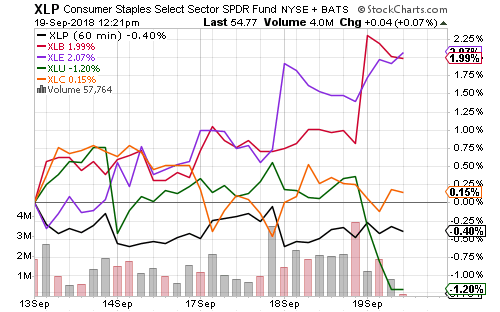

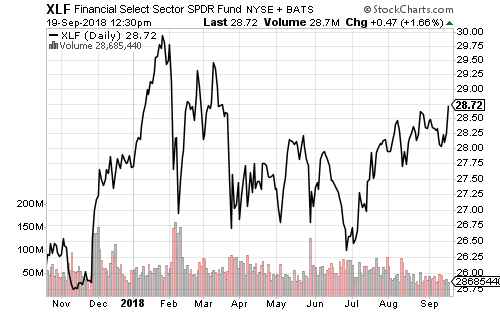

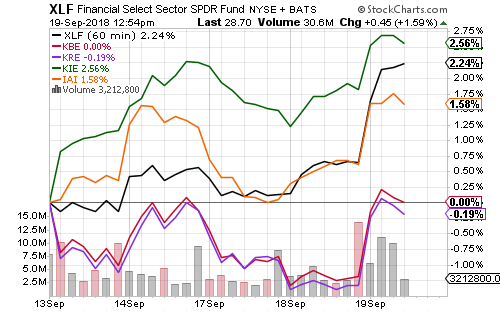

Industrials have been consistently strong over the past week, while financials drove Dow outperformance Tuesday and Wednesday. Rising interest rates weighed on utilities.

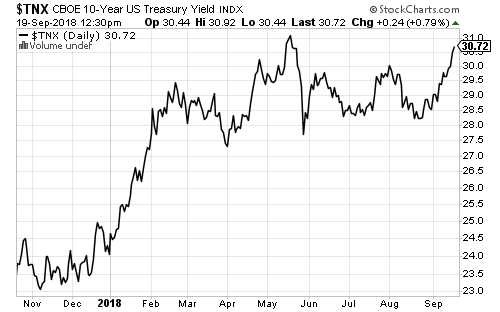

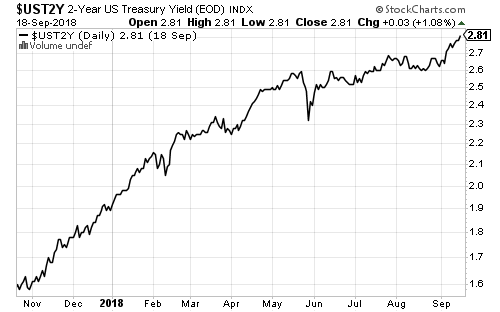

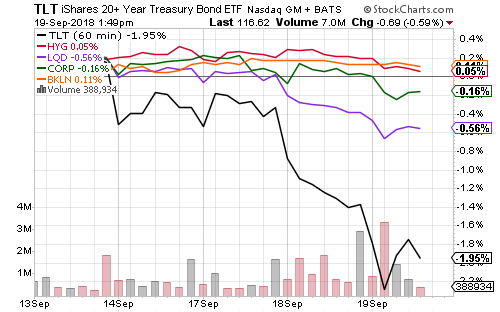

Interest rates are rising due to the likelihood of Federal Reserve rate hikes in September and December. The 10-year yield traded as high as 3.09 percent today. The 2-year yield is 2.78 percent, or roughly 0.30 percent less. The Fed funds rate is 2.0 percent. The Fed will definitely raise interest rates to 2.25 percent next week and the market expects the Fed will hike to 2.50 percent in December.

Rising interest rates lifted the financial sector to a new 6-month high today.

Insurers powered this week’s gains as weaker-than-anticipated winds from Hurricane Florence led to a rebound. Although there was devastating flooding, many homeowners do not have flood insurance. Allstate (ALL) was the most geographically exposed insurer. It has rebounded strongly since the storm weakened.

Strength in industrials and financials triggered value outperformance this week.

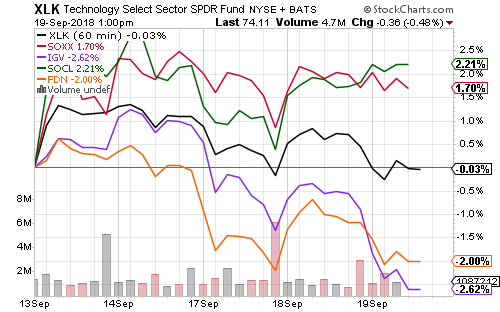

Internet and software stocks pulled technology lower this week.

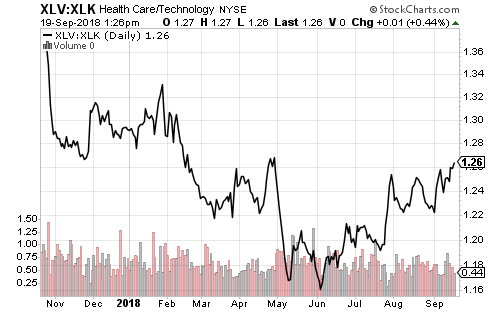

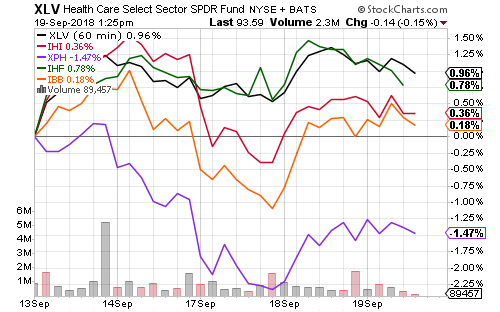

The healthcare sector is best positioned to take over market leadership. SPDR Healthcare (XLV) has been outperforming SPDR Technology (XLK) since June.

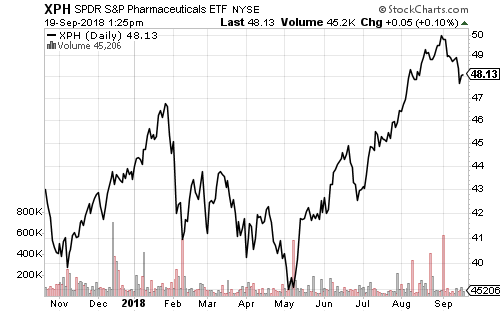

This past week pharmaceutical shares extended their weak September performance, but it’s a small pullback after a strong rally over the prior four months.

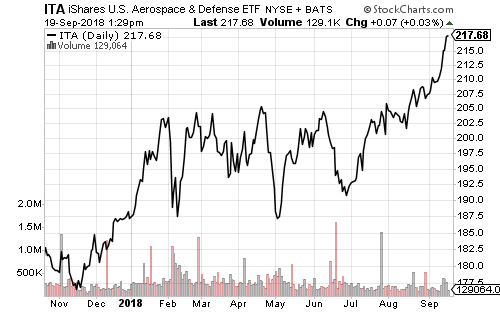

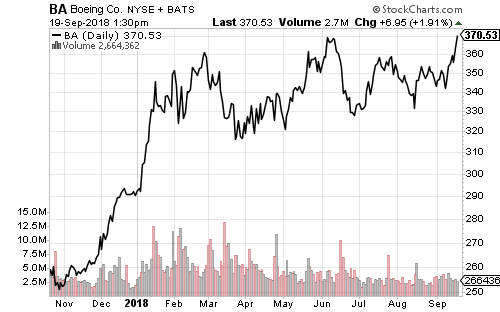

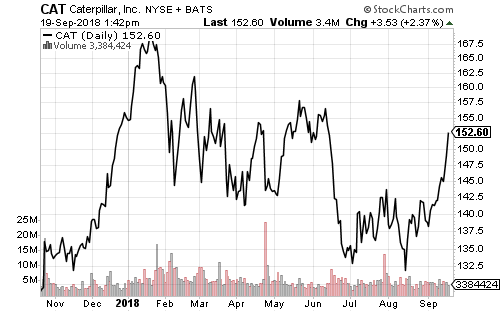

Defense and aerospace funds traded sideways from January through August as investors weighed the risk from tariffs. Boeing (BA) was the locus of concern since it sells many passenger jets to China. This week, it hit a new all-time high following the latest round of tariffs. “Tariff fatigue” is also helping industrials as stocks such as Caterpillar (CAT) rally.

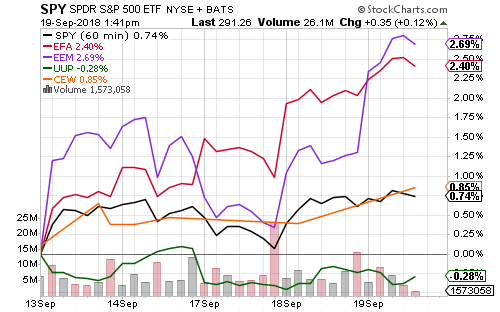

Foreign stocks rallied this week as the U.S. dollar took a breather. Both emerging and developed market funds outperformed. Emerging market currencies are also enjoying some stability after a nightmarish August.

Rising interest rates sank long-term bonds this week, but high-yield and floating-rate funds remained immune.