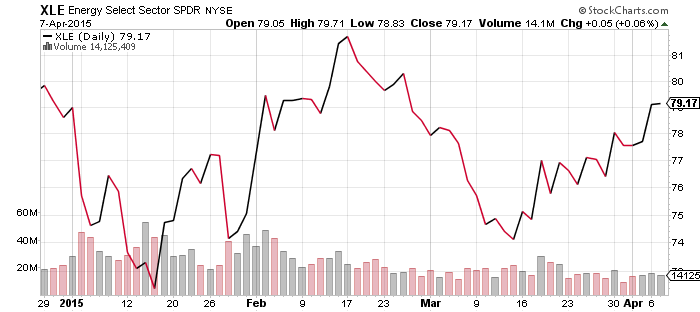

SPDR Energy (XLE)

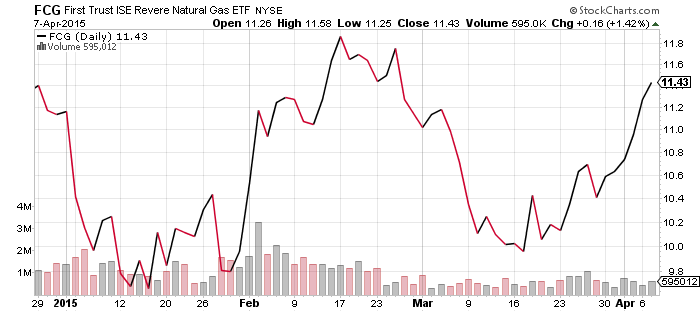

FirstTrust ISE Revere Natural Gas (FCG)

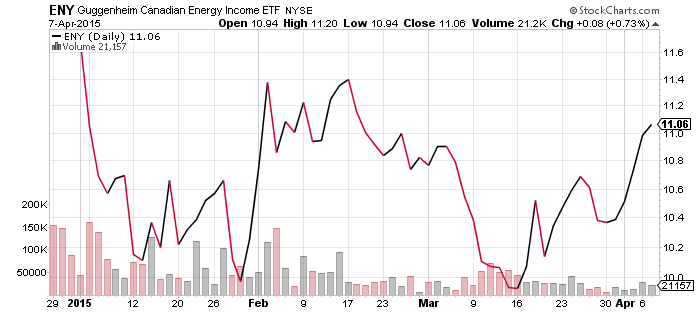

Guggenheim Canadian Energy Income (ENY)

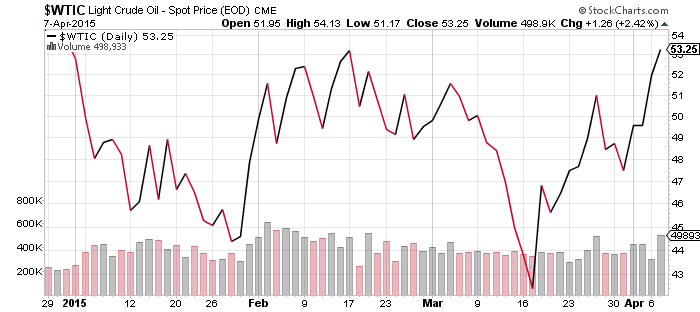

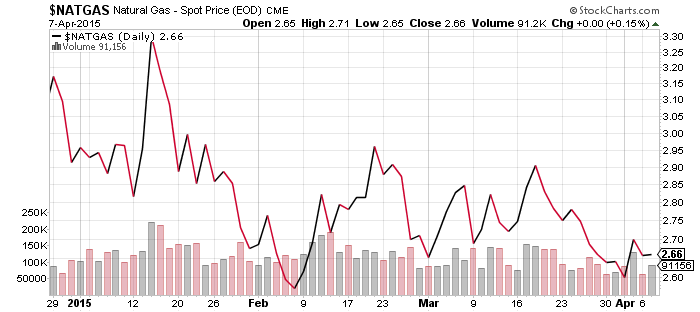

Oil prices pushed above $53 a barrel and helped send the U.S. stock market to solid gain in early Tuesday trading. However, the American Petroleum Institute announced last week’s inventory build, forecasted to be 3.4 million barrels, was actually 12.2 million. This is the largest weekly increase in 30 years. Today, the Department of Energy will release its figures. If they are similar to the API number, we could see oil pull back again. Also working against oil may be any progress on the Iran nuclear deal. Since the initial agreement last week, Iran has been in discussions with China about oil sales.

On the bullish side, West Texas Intermediate Crude is trading at its highest level in 2015 and short-term technical indicators are pointing in a positive direction. If the bulls can overcome negative inventory data, a continued bullish move is likely.

Energy stocks may see a boost today after Shell announced acquisition of BG Group, a $70 billion deal and the 14th largest corporate buyout in history.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

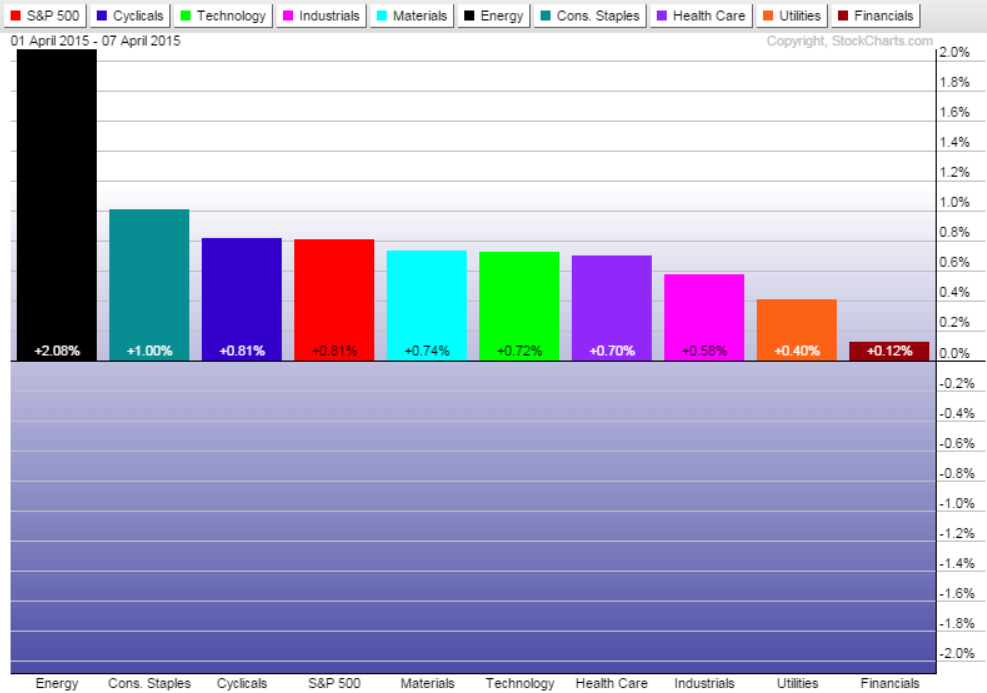

Energy was the best performing sector over the past week thanks to the bounce in oil prices. At the other end, the financial sector was the weakest, although it did gain ground. The weak jobs report on Friday caused investors to push back their rate hike expectations, and since higher rates benefit the financial sector, it naturally lagged.

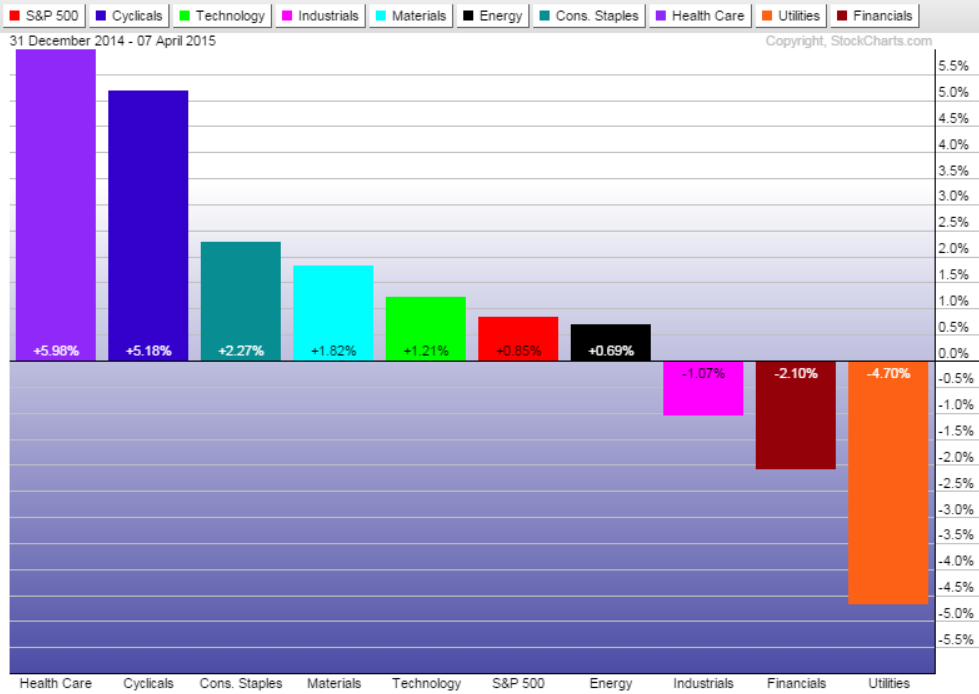

Year to date, there’s no material change to the sector positions. Healthcare remains far in the lead, with consumer cyclicals closely following. Trailing the market is utilities and financials. That pair are an odd couple though, since utilities benefit from low interest rates and financials are the opposite. Some of the drop in utilities may be the result of a pullback following a very strong performance in 2014.

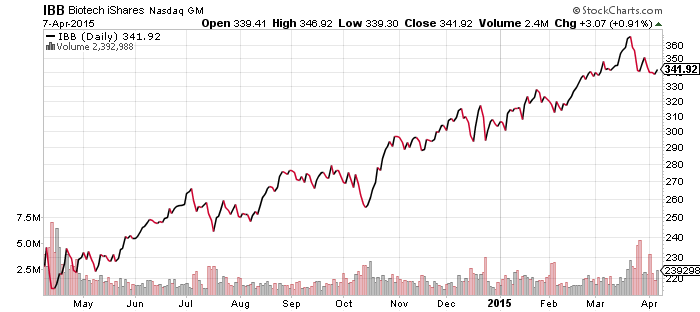

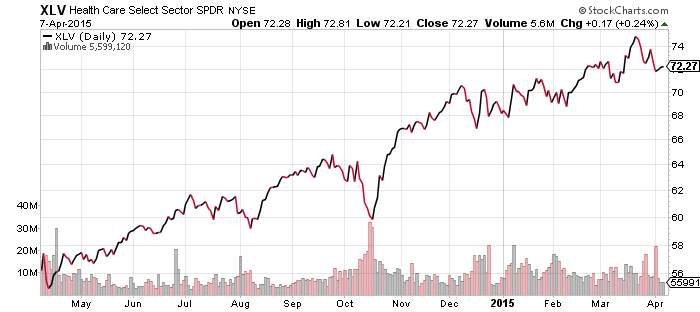

Biotechnology underperformed last week, with shares making a short-term bottom. The chart resembles that of the broader healthcare sector, which itself remains in an uptrend. Healthcare’s only challenger for leadership this year is consumer discretionary, which has been consolidating for five weeks now.

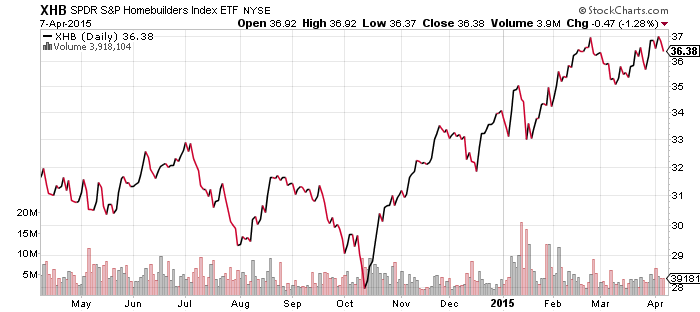

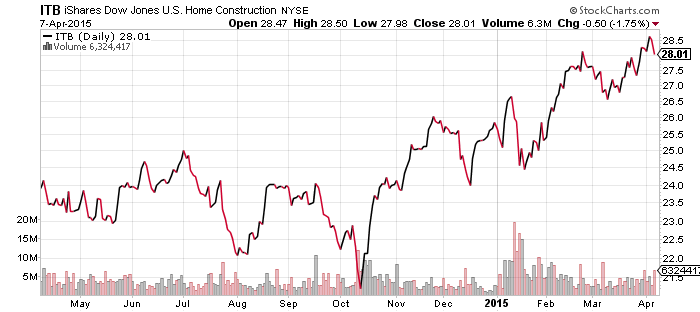

Homebuilders pulled back last week even though housing data was solid. XHB couldn’t break its high from February, but ITB did, signaling the bull market is still intact even in the short-term.

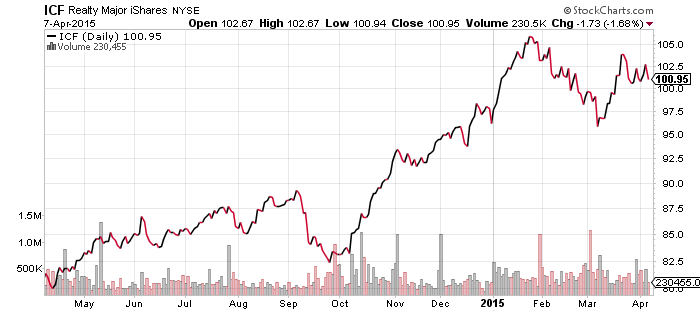

Real estate remains below its January level and Friday’s weak jobs report, which sent interest rates lower, did not help the sector.

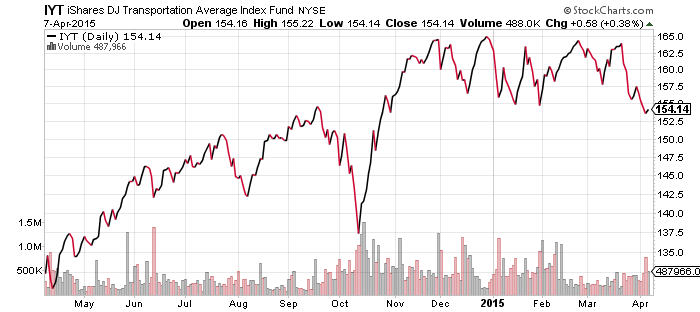

Transportation stocks broke lower last week and a bigger decline could begin this week. The key levels to watch are $155, which could serve as support if IYT pushes above it. On the downside, $150 can provide some support. Below that, a move into the low $140s is possible.

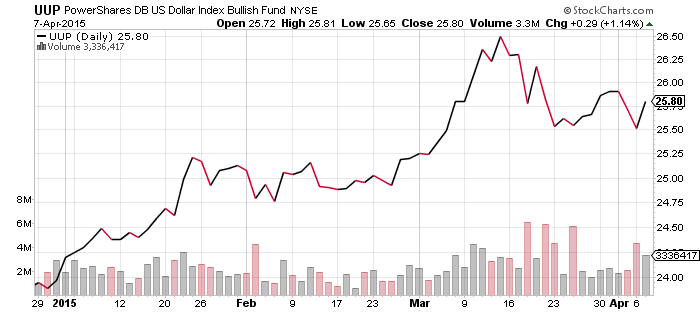

PowerShares U.S. Dollar Index Bullish Fund (UUP)

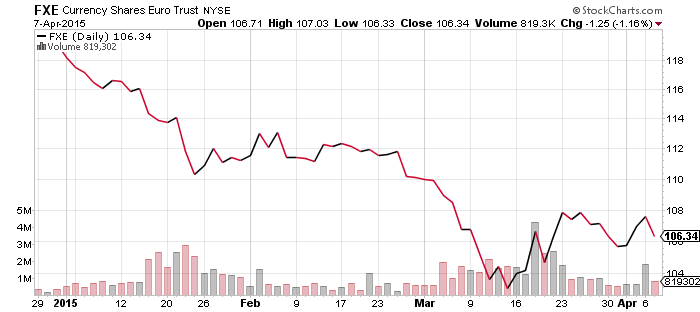

CurrencyShares Euro Trust (FXE)

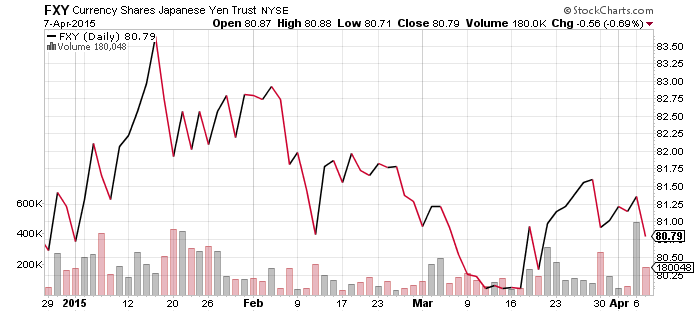

CurrencyShares Japanese Yen (FXY)

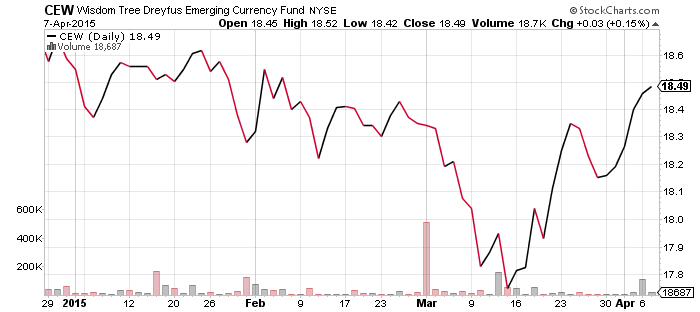

WisdomTree Dreyfus Emerging Currency (CEW)

The U.S. dollar consolidation phase has bottomed at least in the short-term, perhaps aided by Greece popping back into the headlines. The euro similarly stalled in its advance, while the yen has slipped. The $25.50 level is short-term support for UUP.

Emerging market currencies held their bullish trend and along with emerging market stocks, remain one of the brightest spots in the market over the past couple of weeks.

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

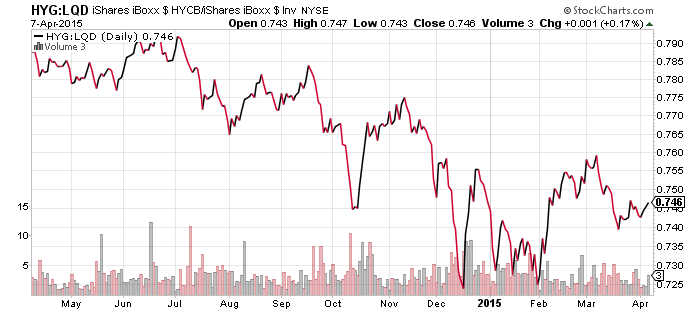

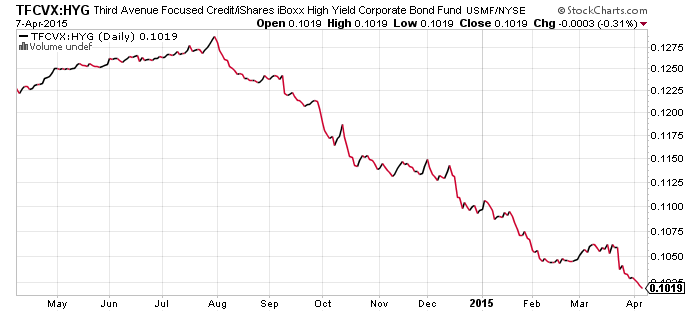

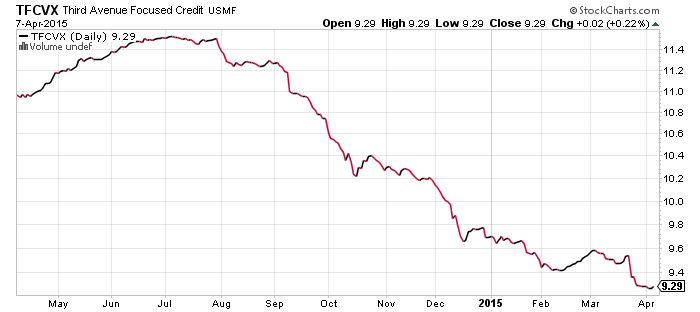

HYG climbed to a new 2015 high last week, while LQD is in striking distance. If bond yields continue to move lower, LQD will hit a new high as well. The higher risk debt in TFCVX continues to underperform though, which raises a cautious flag for the high-yield debt market.

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

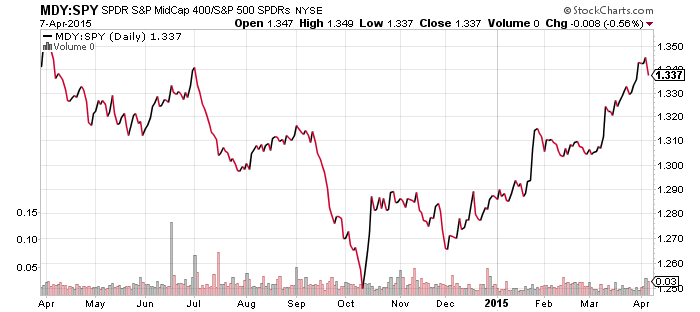

S&P Midcap 400 (MDY)

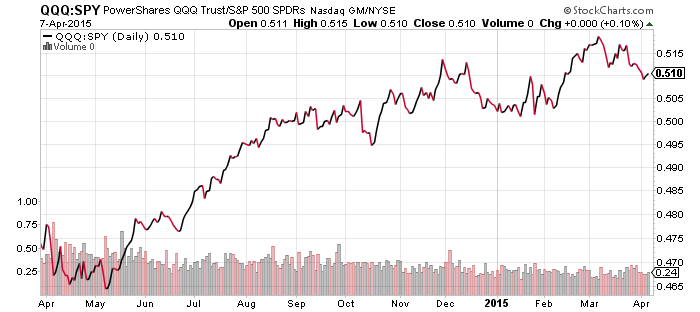

PowerShares QQQ (QQQ)

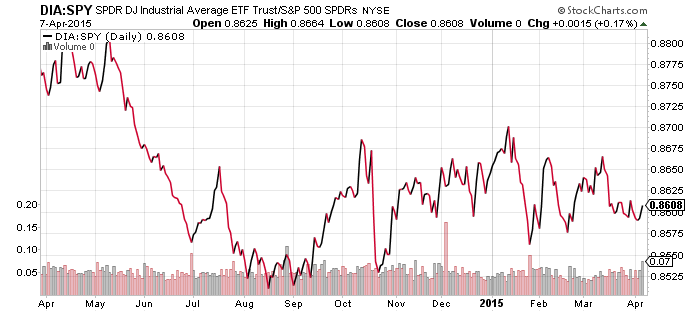

SPDR DJIA (DIA)

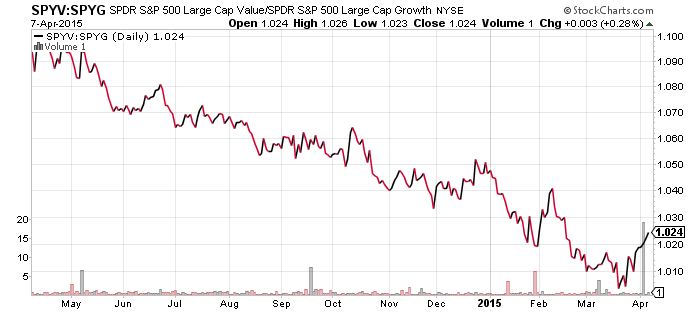

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

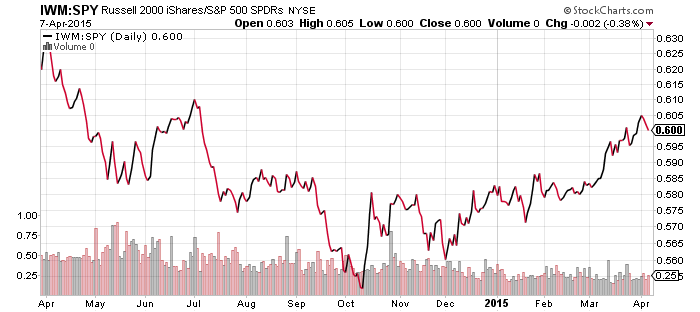

Small- and mid-caps maintained their lead on large-caps over the past week, though they pulled back slightly. The tech heavy Nasdaq was the opposite; it remains in a short-term corrective phase relative to the broader market. The Dow Jones Industrial Average has underperformed in 2015 and that trend remains intact.

A trend change may be underway in value though. Value continued to beat growth last week, though it still hasn’t broken the downtrend that stretches back into 2014. It’ll take a couple more weeks at the current pace to break that longer trend.

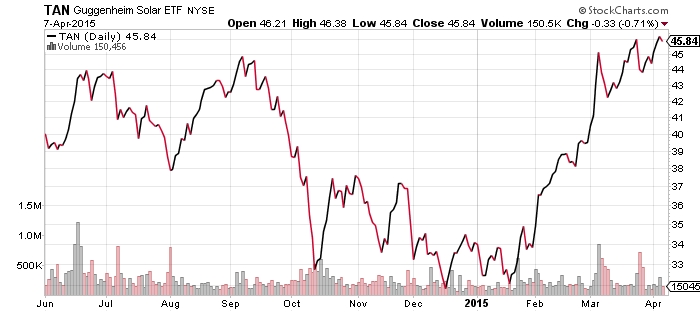

Guggenheim Solar (TAN)

Solar stocks did not correct last week, but remains highly possible given the decline in interest rates. TAN is a highly volatile ETF that is correlated with investor sentiment. Interest rates tend to rise when sentiment is very bullish and fall when investors are less than enthusiastic about the market. TAN fell from March 2014 until early January 2015 as 10-year treasury yields fell from January 2014 until January 2015. Both subsequently rallied, but interest rates turned lower again in March. This divergence is likely to resolve and for the moment, we’d look for a correction in TAN before a rally in interest rates.

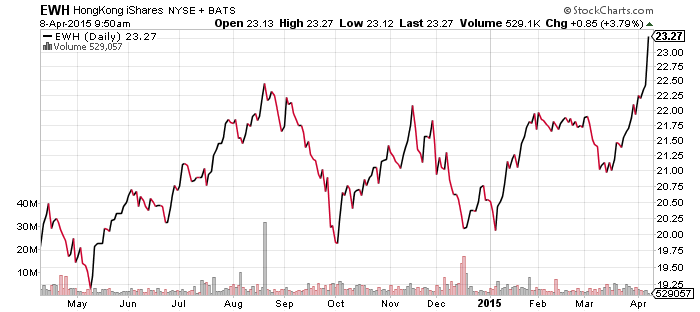

iShares MSCI Hong Kong (EWH)

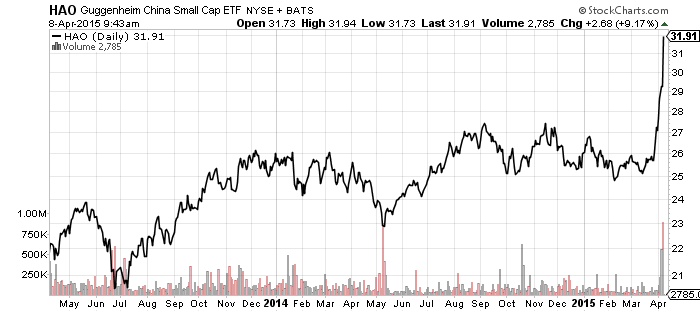

Guggenheim Small Cap China (HAO)

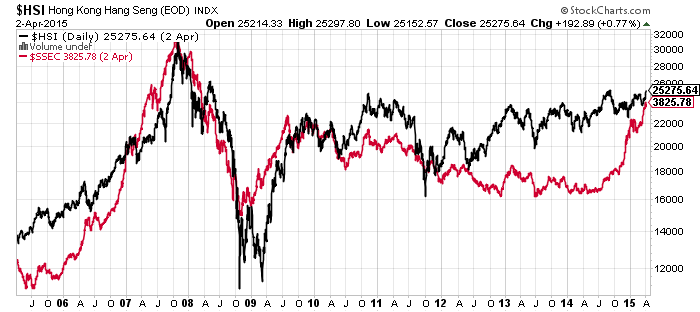

China is in the midst of a massive stock market rally, which is pouring over into Hong Kong and Hong Kong traded stocks of Chinese companies. This is likely due to the anticipated opening of the Hong Kong market to Chinese investors, since most Hong Kong listed stocks trade at a discount to the same shares listed in Shanghai and Shenzhen.