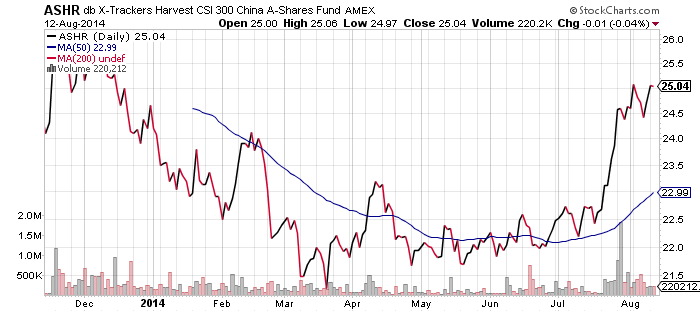

SPDR Retail (XRT)

XRT is a well diversified fund, with the top holding claiming less than 2 percent of the fund’s assets. This makes XRT far less sensitive to a single company than many other ETFs, often an issue during earnings season. For such funds, the underperformance or outperformance of a single company can significantly impact the funds. Earnings still matters for XRT though, because the reports of many retail firms are released in a short period of time. This week, Wal-Mart (WMT), Macy’s (M), J.C. Penney (JCP), Nordstrom (JWN) and Kohl’s (KSS) headline earnings. Next week, PetsMart (PETM), Aeropostale (ARO), Gap (GPS) and a slew of other firms will report. These companies will be interesting to watch as retail sales for July were virtually unchanged from June.

Consumer stocks have not had a strong 2014, but XRT has been in an uptrend since making its lows in February. The broader market has been showing signs of wanting to move higher and a 5 percent rally would push XRT to a new high.

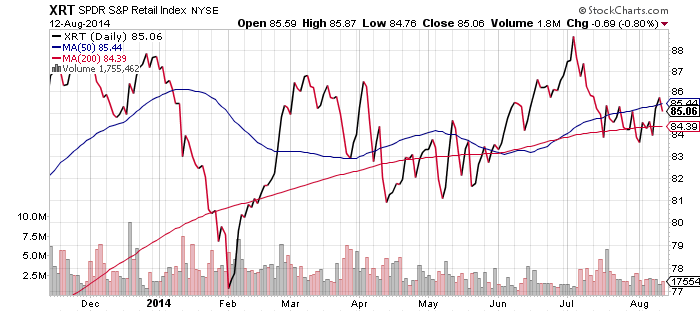

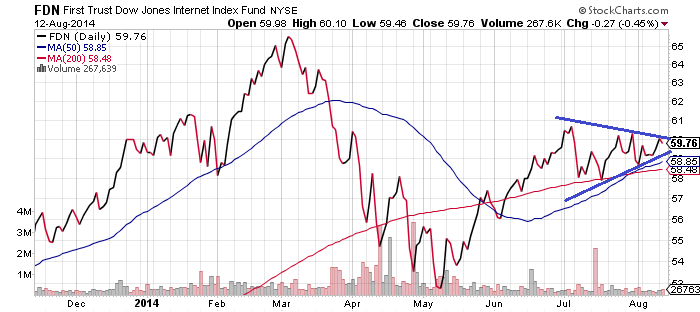

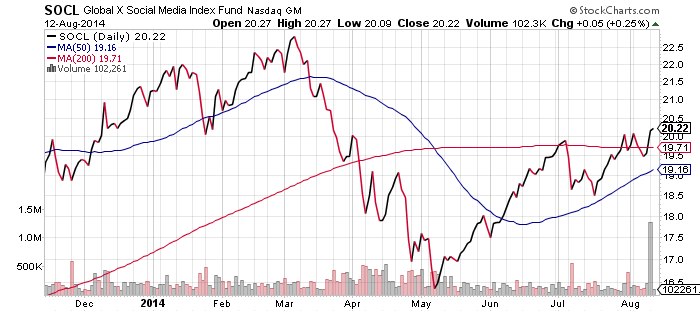

First Trust Dow Jones Internet (FDN)

We highlighted FDN last week, and it has continued on its sideways path. As can be seen in the chart below, the ETF is forming a triangle as it makes lower highs and higher lows. A breakout from this pattern is inevitable and should come within the next ten trading days. This pattern is bullish, and Global X Social Media (SOCL) has already pushed on to 3-month highs, a good omen for FDN.

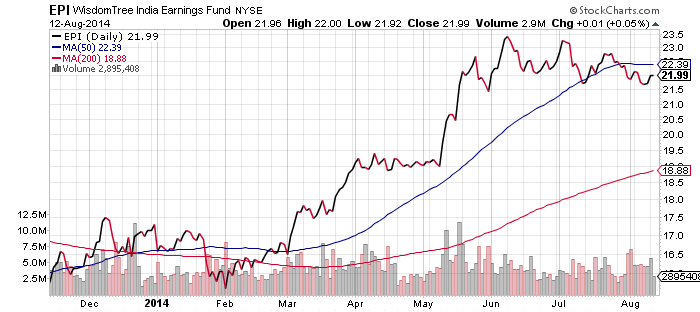

WisdomTree India Earnings (EPI)

Indian ETFs have consolidated following their big rally in the spring. Over the past week there’s been major news for the economy and stock market. First, the nation is moving towards a uniform sales tax which will improve efficiencies across the provinces. Second, India’s securities regulator approved real estate and infrastructure trusts. These REITs will allow firms to tap capital markets and fund India’s development, a major goal of Prime Minister Modi. These are positive catalysts for the economy and stocks should reflect these initiatives in the coming weeks.

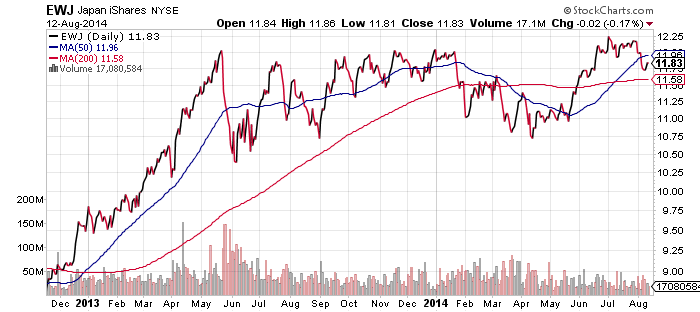

iShares MSCI Japan (EWJ)

Japan was in focus today when it reported GDP in the second quarter contracted at an annualized 6.8 percent rate. That was better than expected and Japanese stocks moved higher. The slump came from a sales tax increase that took effect in April. In turn, consumers made major purchases in the first quarter, before the tax was bumped from 5 to 8 percent. Economists have also been raising their third quarter GDP growth estimates as the impact of the tax wears off. Keep in mind, when a similar tax hike was enacted in 1997, shares finished the year much lower.

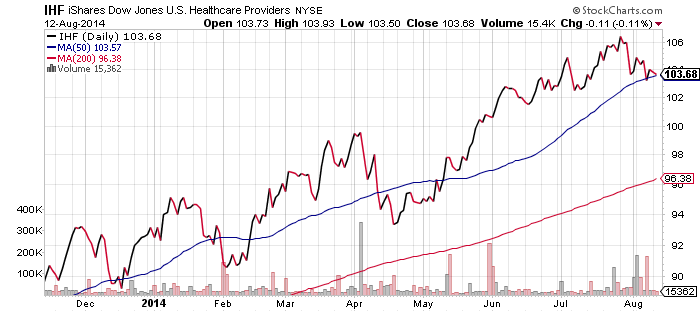

iShares U.S. Healthcare Providers (IHF)

Healthcare stocks beat their second quarter earnings estimates at the highest rate of any S&P 500 sector in the second quarter. Tenet Healthcare (THC, 2.15 percent of IHF) was perhaps the brightest spot in the sector, beating estimates handily. Healthcare providers were a question mark earlier in the year when confusion over the Affordable Care Act weighed on healthcare spending. Healthcare is now one of the best performing sectors in the market and providers are outperforming. Look for the dip to the 50-day moving average to spark a bounce.

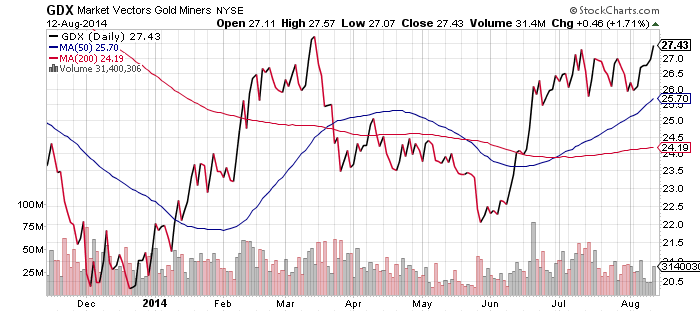

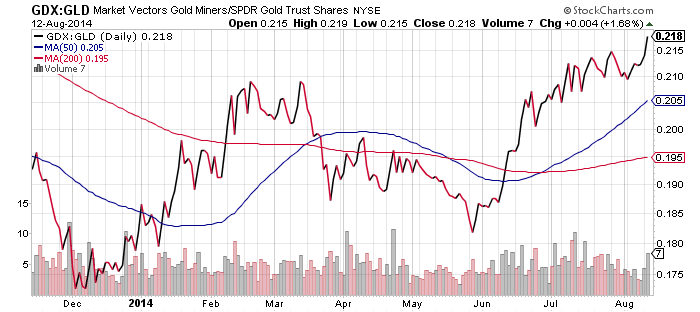

Market Vectors Gold Miners (GDX)

Gold miners are showing signs of life again after consolidating gains since late June. Rather than the catalyst being higher gold prices, investors are turning bullish on the mining sector once again. The chart below, a ratio of the price of GDX to GLD, shows that the mining shares have been persistently outperforming the metal. Gold had been outperforming mining shares from 2007 through the end of 2013. If this trend is reversing, it could signal a major shift in the market. Look for GDX to break its high for the year in the coming days and if it can accomplish this, another rally could begin. The next resistance level is around $30.

db X-Trackers Harvest CSI 300 China A-Shares (ASHR)

China plans to partially open the mainland stock market to foreigner investors in October, while simultaneously providing some access to the Hong Kong market for mainland investors. A list of stocks will be available for trading and there will be limits on trading volume. Many Chinese companies are listed in Hong Kong (H-shares) as well as in Shanghai or Shenzhen (A-shares). Many also trade at steep premiums and discounts. The major reason for the spike in shares is because investors are front-running the opening, betting on a closing of the valuation gap.

The spike in share prices isn’t limited to those traded in both markets. Stocks that can only be purchased in China have seen large gains, while mainland financial firms traded in Hong Kong are up several hundred in some cases.

There’s reason for the rally to continue, the most important being low valuations in China. Still, it is too soon to expect the economy to cooperate. Data out today showed credit collapsed in July. The central bank was quick to indicate this was a one-off event, which helped to push the market to a small gain for the day.