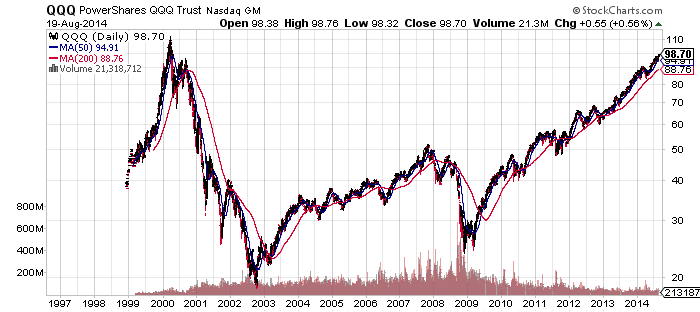

PowerShares QQQ (QQQ)

Below is a long-term chart of QQQ showing the fund trading at its highest levels since the year 2000, similar to the Nasdaq, which is less than 15 percent away from a new record. While the Nasdaq is still far below its old highs when adjusted for inflation, it could be a big psychological boost for the market if it made a new high. Potentially, this could occur sometime in 2015 if the market performs slightly better than it has this year.

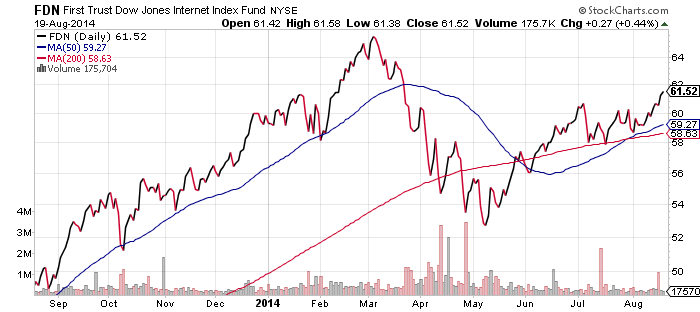

First Trust Dow Jones Internet (FDN)

Last week we were anticipating FDN would break to the upside, which is what happened. The next test for the fund will be whether it can reach its high for the year, an increase of approximately 7 percent.

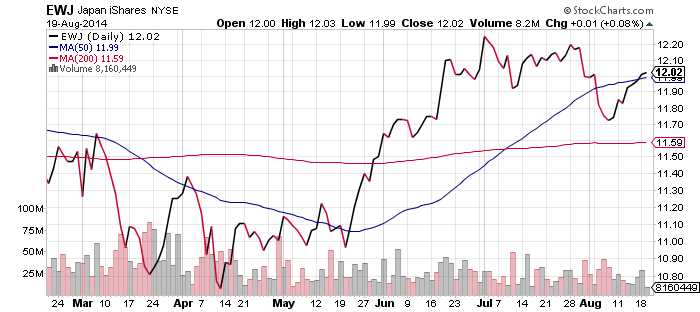

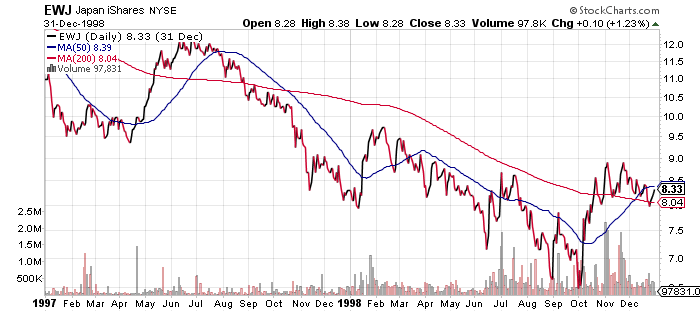

iShares MSCI Japan (EWJ)

While Japan’s GDP contracted in the second quarter at a 6.8 percent annualized rate following a sales tax hike, it hardly impacted the chart of EWJ. This is a reminder that news is often discounted by the markets ahead of time. By the time the news hits, stocks may already be moving in the opposite direction. Nevertheless, EWJ still trades below levels seen in July, when the news of the GDP miss was priced in.

Some investors have pointed to the 1997 sales tax hike as a parallel. Economic activity was similarly distorted over the following year. As the second chart shows, stocks were lower 18 months later. This period includes the Asian Crisis though, which impacted stocks more than the sales tax hike. If there is a parallel to 1997, it will show up in weaker than expected GDP growth in Q3 and beyond. Economists currently forecast GDP will resume a tepid growth pace following last quarters miss.

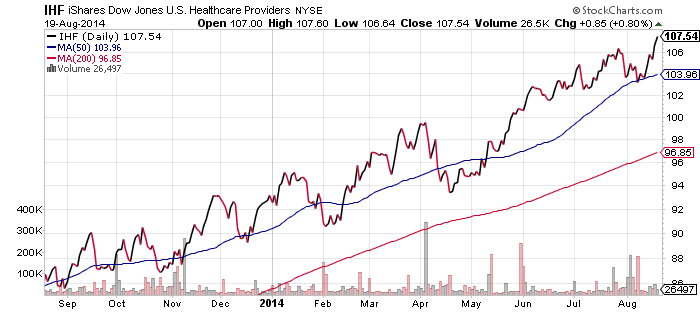

iShares U.S. Healthcare Providers (IHF)

Last week we commented that healthcare is now one of the best performing sectors in the market and providers are outperforming the sector. A dip to the 50-day moving average was expected, followed by a rally. As the chart below shows, IHF bounced on schedule and made a new high for the year.

More broadly, SPDR Healthcare (XLV) also broke out to a new 52-week week high, helped by the rebound in pharmaceutical stocks that had been a drag on returns. Market leadership has now clearly transitioned away from energy and utilities and towards healthcare and technology.

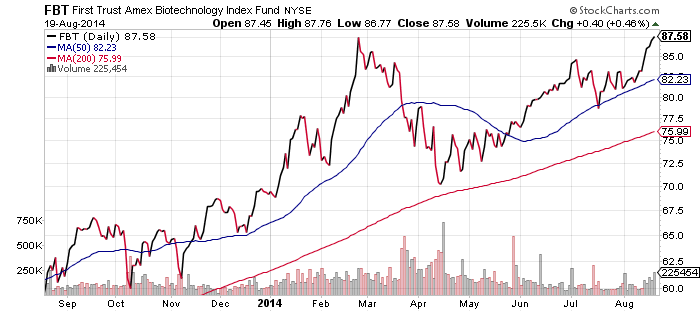

First Trust NYSE Arca Biotechnology (FBT)

This is the strongest biotechnology fund at the moment, as it is the first to climb back to its highs for the year. FBT holds 20 stocks and equally weights them at 5 percent after rebalancing each quarter. A 5 percent position is relatively large in a fund; given the volatile nature of biotech stocks, this can result in substantial ETF moves from a single stock. Intermune (ITMN) was recently the subject of takeover rumors and the share price has bounced on the news. Pharmacyclics (PCYC) has also seen a rapid ascent. FBT has larger positions in these stocks than other biotech ETFs.

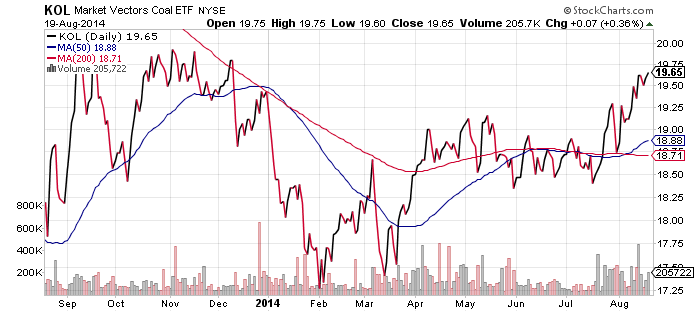

Market Vectors Coal (KOL)

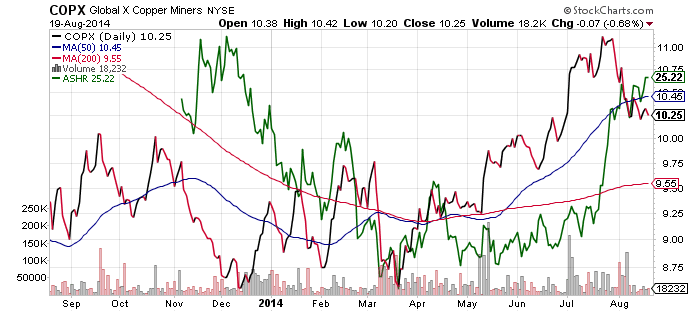

Global X Copper Miners (COPX)

Coal stocks have seen a solid rally since mid-July and shares are approaching their 52-week high. They are being helped from Chinese listed holdings which are up as part of a broad rally in Chinese stocks.

In contrast, Global X Copper Miners (COPX) has declined in August. Copper miners slumped earlier in the year when concern about the Chinese economy peaked. As optimism returned, copper and copper miners led the way higher, and rallied ahead of Chinese stocks (in green below). The recent pullback in COPX comes following weak real estate and power consumption data in China last month.

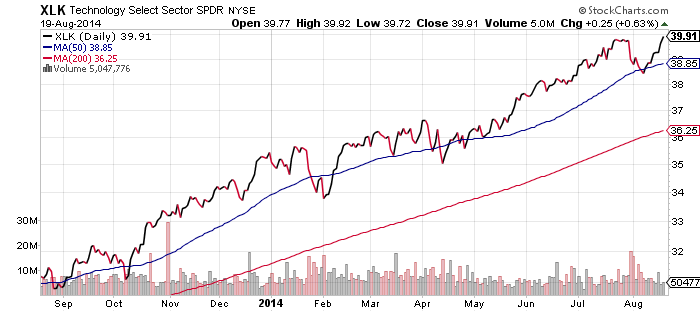

SPDR Technology (XLK)

Large cap technology stocks are doing very well at the moment. Shares of Apple (AAPL) crossed the psychological $100 barrier and shares of Microsoft (MSFT) broke out to a new 52-week high. Shares of Facebook (FB) and Intel (INTC) are also at or very close to new 52-week highs. This sector is now clearly leading the market in 2014 along with healthcare.

SPDR Consumer Discretionary (XLY)

The worst performing sector in 2014 has been consumer discretionary, but it is turning its performance around in the third quarter. Shares of XLY climbed to a new 52-week high in the past week thanks in part to strong earnings from Home Depot (HD), which sent that stock sharply higher. HD earned $1.52 per share versus expectations of $1.45, and the firm increased its guidance for the year. HD accounts for 5.5 percent of XLY’s assets. Top holding Disney (DIS) is also helping to push XLY higher; DIS is trading at a 52-week high.

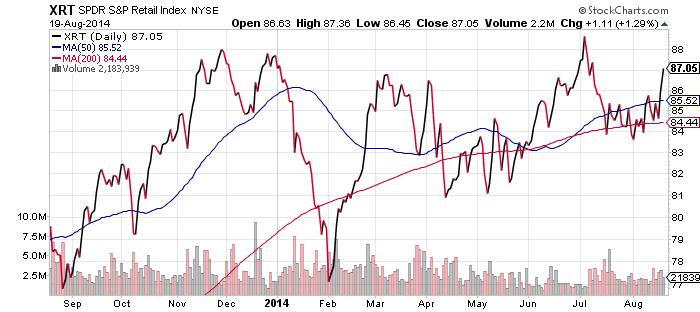

The retail sub-sector of consumer discretionary has also rebounded recently. This week marks the second of a heavy two-week reporting season for retail earnings. SPDR Retail (XRT) could hit a new high for the year this week if it can carry through last week’s gains. It doesn’t hold any Home Depot, but benefited from the positive mood generated by HD’s beat.