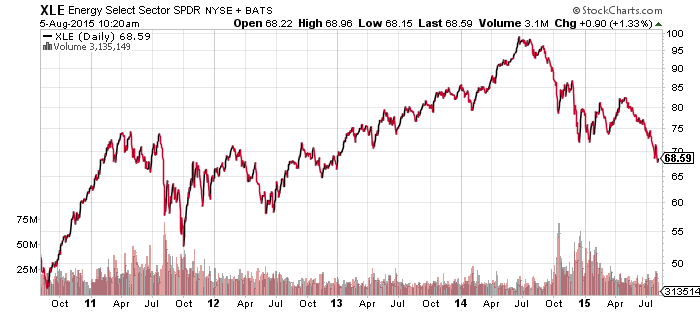

SPDR Energy (XLE)

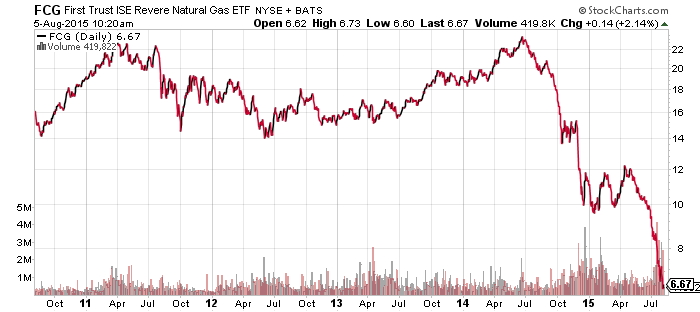

FirstTrust ISE Revere Natural Gas (FCG)

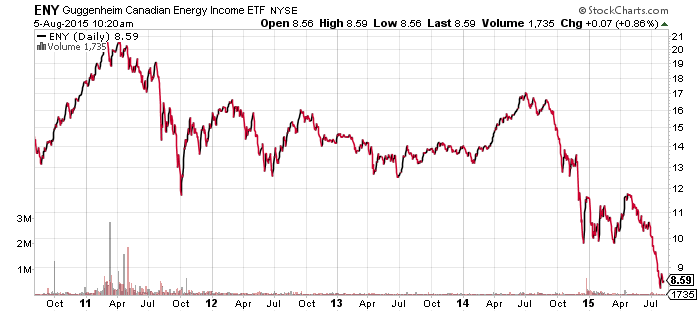

Guggenheim Canadian Energy Income (ENY)

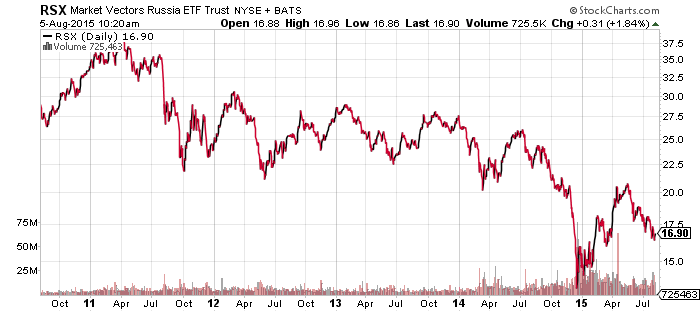

Market Vectors Russia (RSX)

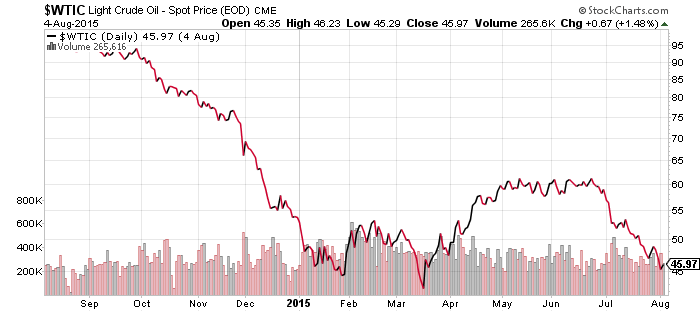

Oil prices slid to the $45 level over the past week and are less than $3 away from 2015 lows. Aside from the drop in oil prices, Exxon (XOM) and Chevron (CVX) both reported weak earnings on Friday of last week, sending many energy funds lower.

Oil inventories declined last week by 4.4 million barrels, despite a projected 1.5 million barrel increase. The big swing in inventory could help to stabilize prices over the coming days. Gasoline inventories continued to rise, which is good news for seasonal travelers. With oil prices down and inventories up, prices should continue sliding even as the peak of summer driving season approaches.

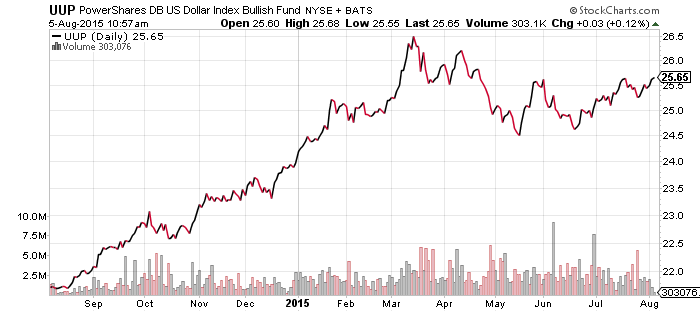

PowerShares U.S. Dollar Index Bullish Fund (UUP)

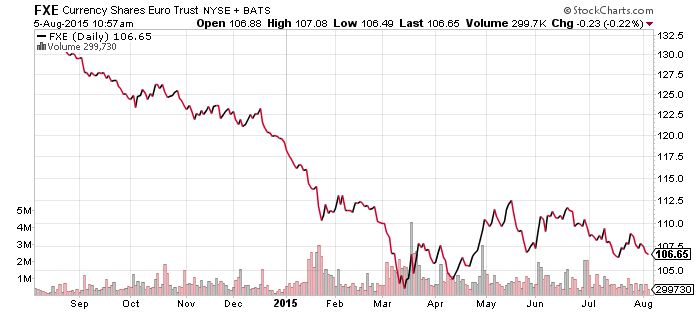

CurrencyShares Euro Trust (FXE)

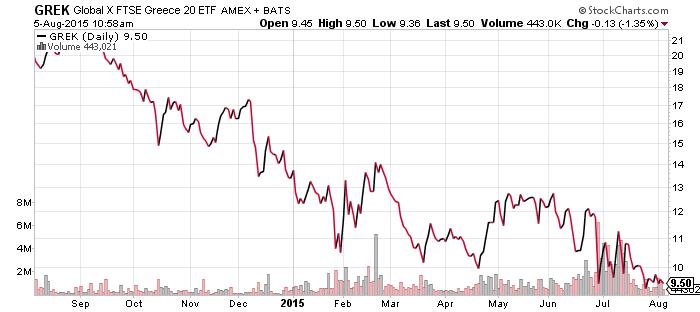

Global X FTSE Greece 20 (GREK)

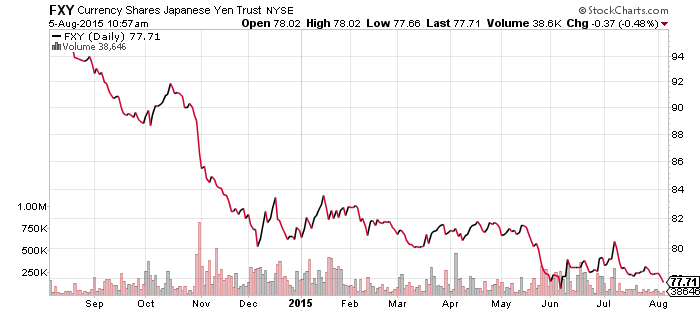

CurrencyShares Japanese Yen (FXY)

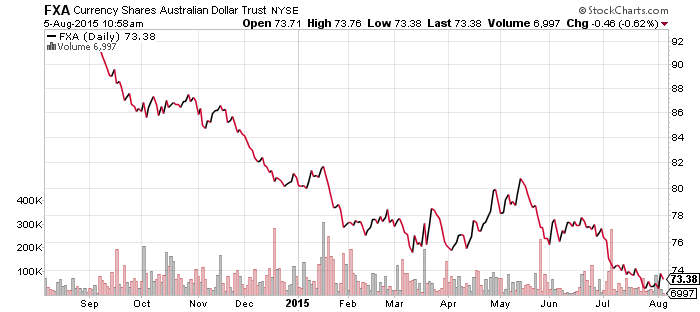

CurrencyShares Australian Dollar (FXA)

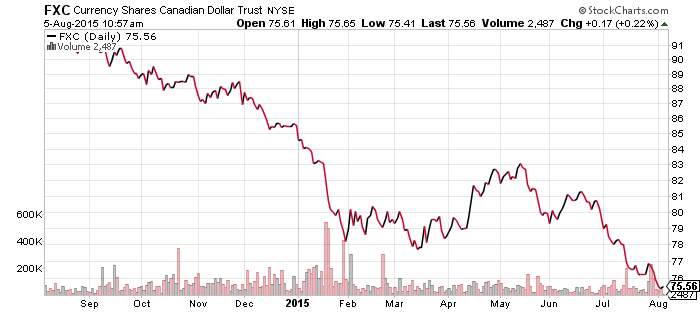

CurrencyShares Canadian Dollar (FXC)

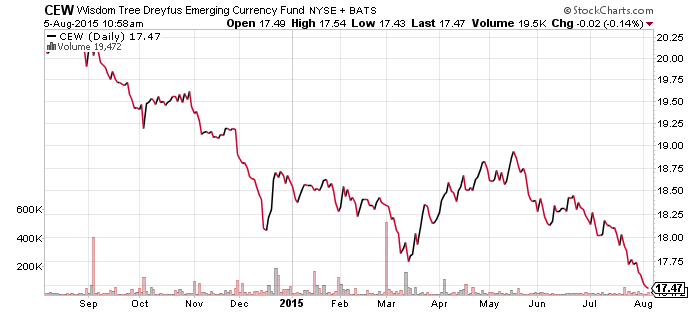

WisdomTree Emerging Market Currency (CEW)

The U.S. dollar spiked on Tuesday following comments by Federal Reserve Bank of Atlanta President Lockhart that indicate economic data would need to significantly deteriorate for him to oppose a September rate hike. He is considered a swing voter in the Federal Open Market Committee and speculators immediately upped their bets on a September rate hike.

The euro bore the brunt of U.S. dollar strength, with the yen remaining stable. Emerging market currencies have broken to new lows over the past week, as did the Canadian dollar. The Australian dollar firmed.

Greek stocks opened for trading for the first time in several weeks. Shares in the National Bank of Greece (NBG) slid when trading resumed, a bearish sign for the financial sector. Greece is expected to have a new deal within the next few weeks, although the IMF recently stated it would not support a deal that lacked major reforms.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

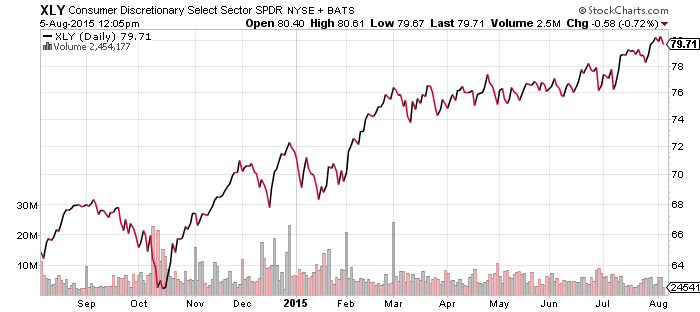

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

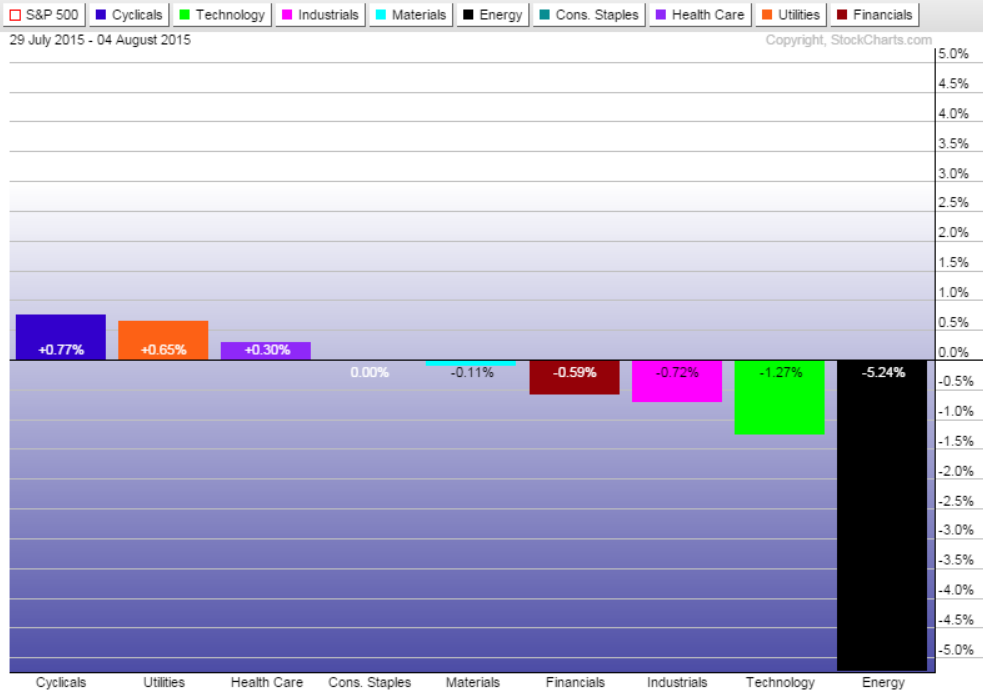

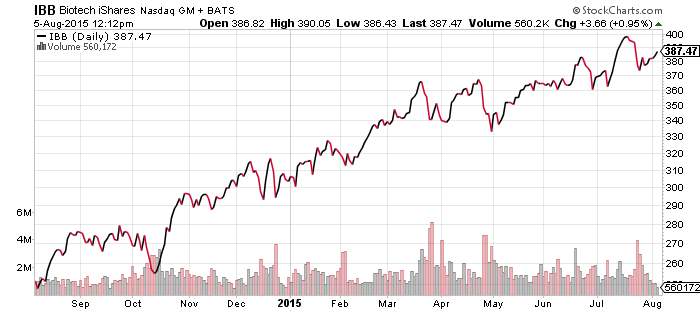

Most stocks fell over the past week, weighed down by the drop in top holding Apple (AAPL) as well as a 5 percent drop in the energy sector. Consumer discretionary (XLY) was the best performing sector, rising 0.77 percent on the week. XLY underperformed today following disappointing results from Disney (DIS). The firm missed revenue estimates, fueling concerns about ESPN going forward. DIS is also a large component in the Dow, which has recently been the poorest performer among the major indexes. Biotechnology continues to march ahead as it recaptures ground lost in mid-July.

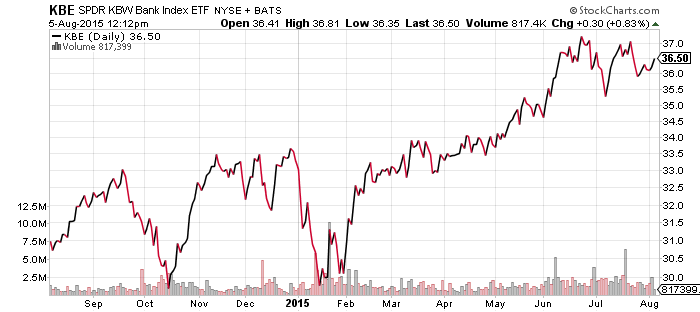

Bank shares are rallying in the wake of Lockhart’s comments about a rate hike.

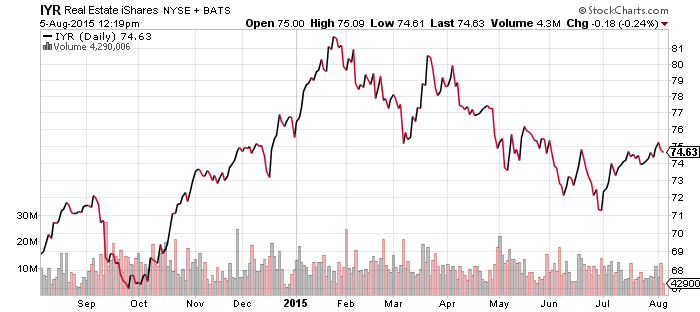

Real estate dipped on the comments by Lockhart, but remains in a short-term uptrend.

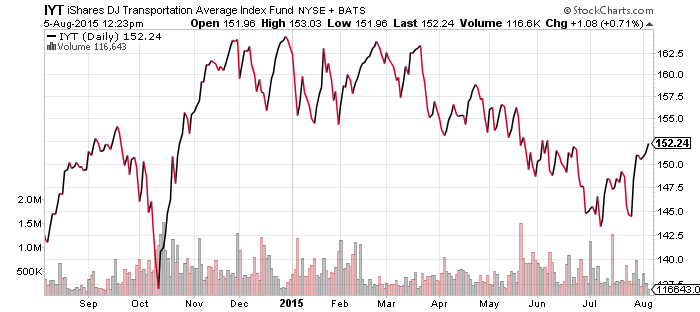

IYT is reaching some short-term technical resistance.

SPDR S&P 500 (SPY)

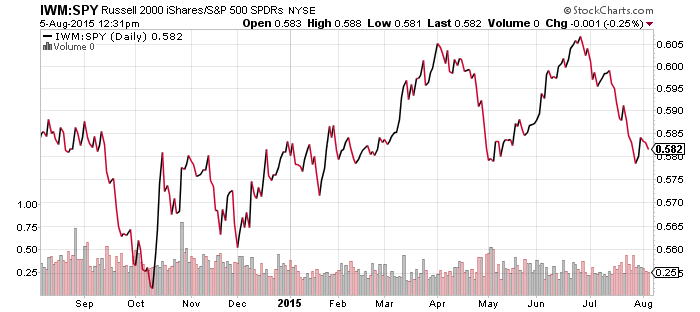

iShares Russell 2000 (IWM)

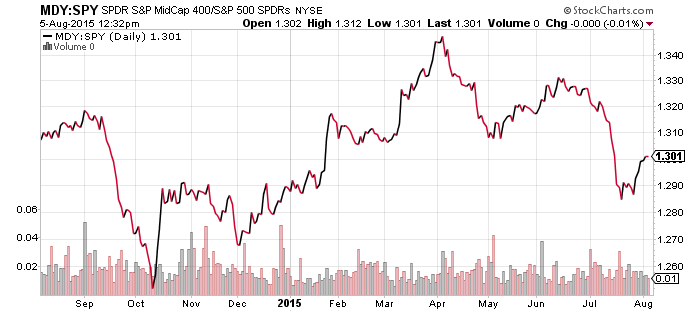

S&P Midcap 400 (MDY)

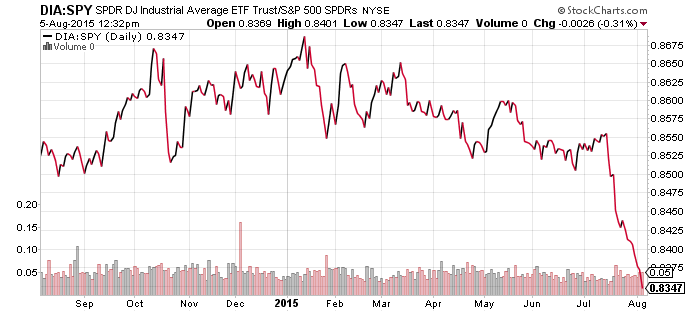

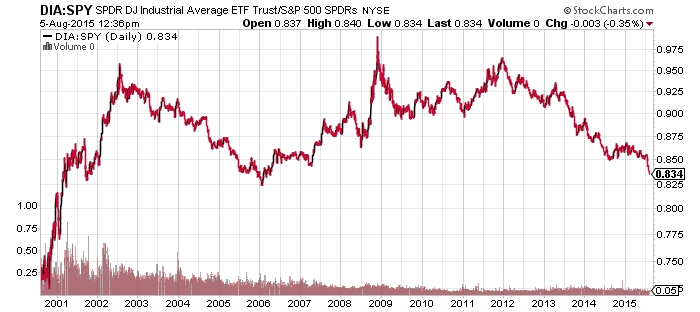

SPDR DJIA (DIA)

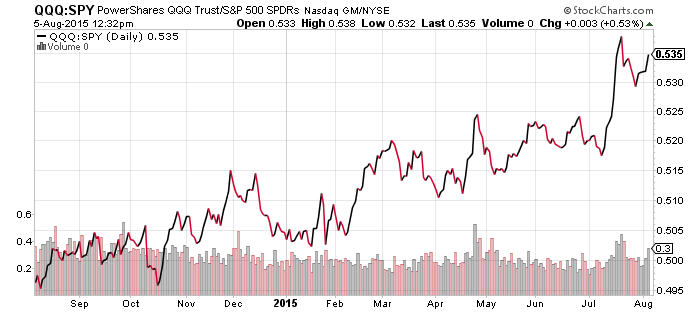

PowerShares QQQ (QQQ)

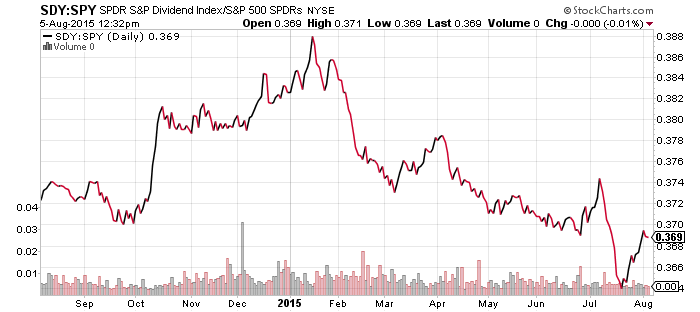

SPDR S&P Dividend (SDY)

Small- and mid-cap stocks remain in a trading range relative to the S&P 500 Index, while the Nasdaq continues to lead. Dividend stocks continue to underperform as rising rates weigh on the decisions of income investors. All of these trends have been in place for most of the year and there is little new to report.

The Dow Jones Industrial Average has taken a relative beating over the past month. The Dow was hit by earnings related stock losses in several holdings, among them Caterpillar (CAT), Disney (DIS), Proctor & Gamble (PG), Exxon (XOM), Chevron (CVX), United Technologies (UTX) and International Business Machines (IBM). Underperformance by Apple (AAPL) and Dupont (DD) further contributed to the index’s decline.

As the long-term chart shows, the Dow is now the cheapest it has been relative to the S&P 500 Index since 2006.