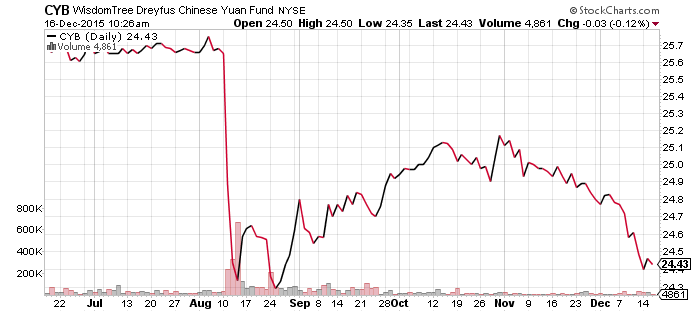

WisdomTree Chinese Yuan (CYB)

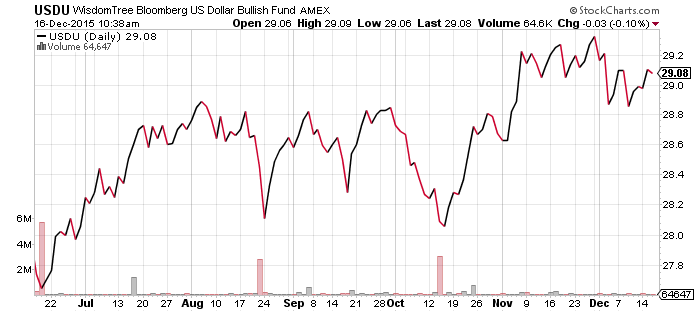

WisdomTree Bloomberg USD Bullish (USDU)

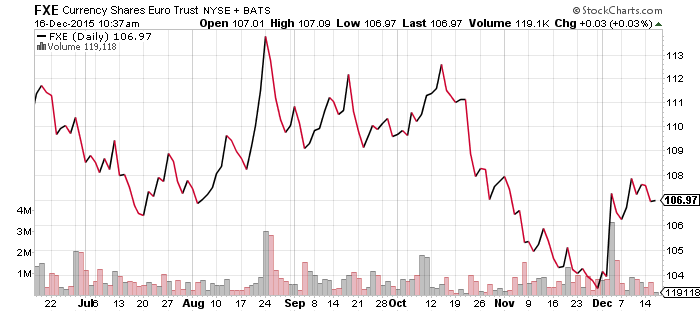

CurrencyShares Euro Trust (FXE)

CurrencyShares Swiss Franc (FXF)

CurrencyShares Swedish Krona (FXS)

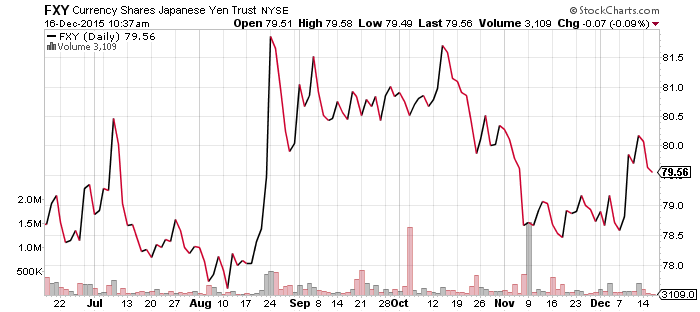

CurrencyShares Japanese Yen (FXY)

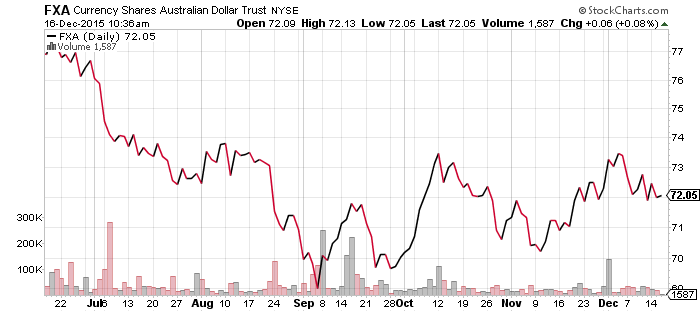

CurrencyShares Australian Dollar (FXA)

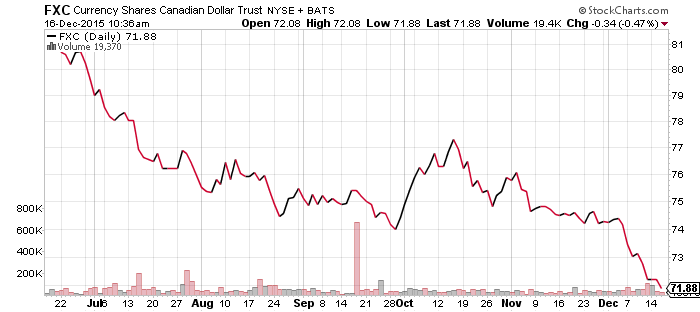

CurrencyShares Canadian Dollar (FXC)

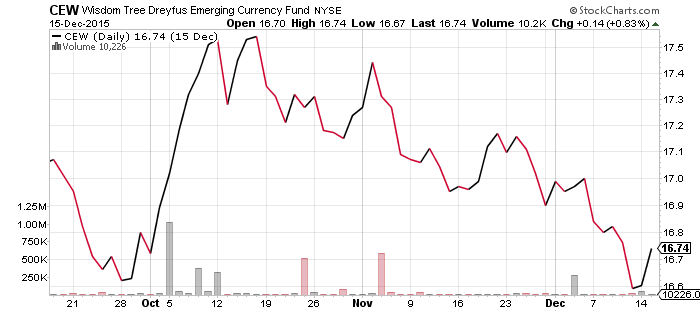

WisdomTree Emerging Market Currency (CEW)

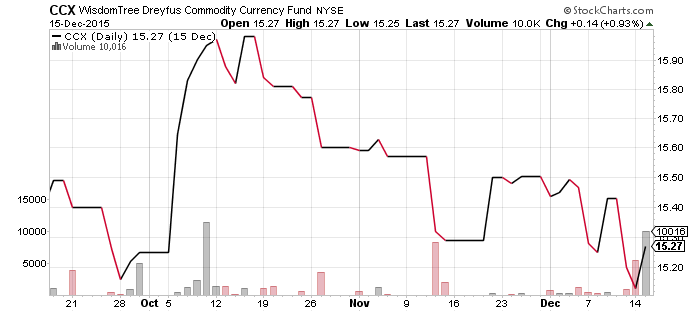

WisdomTree Commodity Currency (CCX)

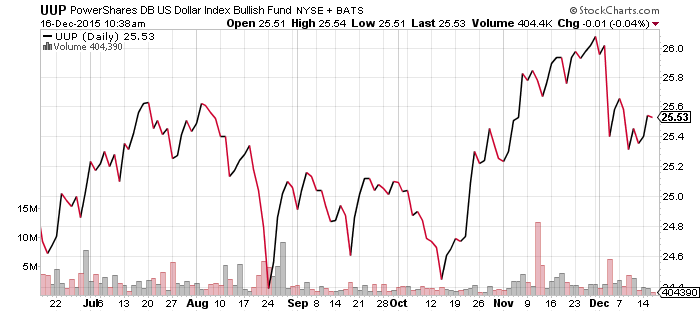

PowerShares DB U.S. Dollar Bullish Index (UUP)

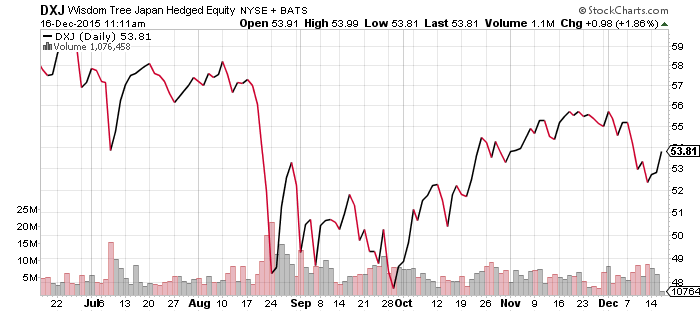

WisdomTree Japan Hedged Equity (DXJ)

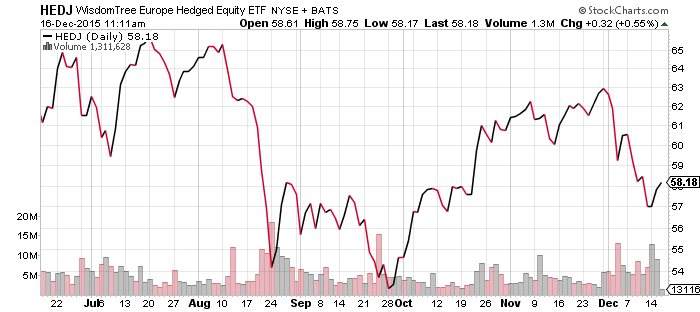

WisdomTree Europe Hedged Equity (HEDJ)

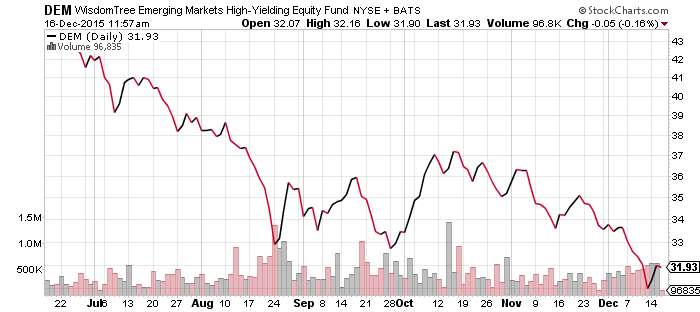

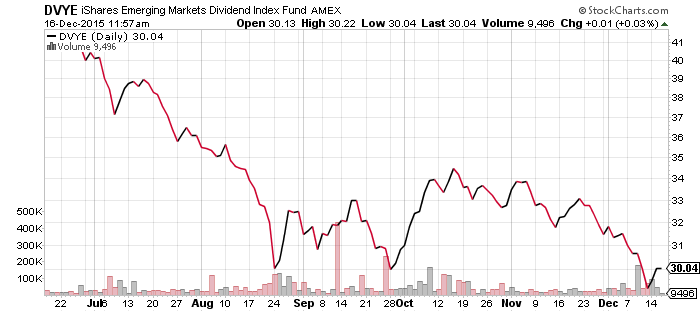

The Chinese yuan broke a 52-week low this week, creating a large headwind that could ultimately pull commodities and emerging-market currencies even lower than the presumed double-bottom of the last few months. The Chinese government announced a new currency index last Friday following the yuan’s introduction to the IMF’s trade-weighted basket of currencies. which will be used to value the yuan. The Chinese government’s use of the new basket to value the yuan, given the relatively low weight of the U.S. dollar, almost guarantees further depreciation should the U.S. dollar move higher versus most foreign currencies, as it has done since summer 2014.

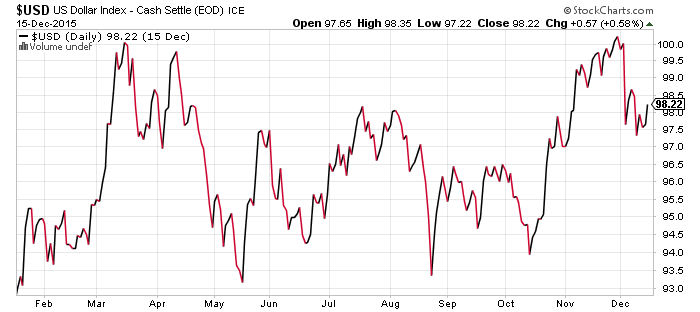

USDU benefits from China’s weakness and emerging-market currency strife on a greater scale than UUP due to its lack of exposure. USDU, however, is unlikely to experience significant gains unless the euro weakens as well. 100 remains the key level for the U.S. Dollar Index. A pullback to the low 90s would still leave the index within its nine-month trading range.

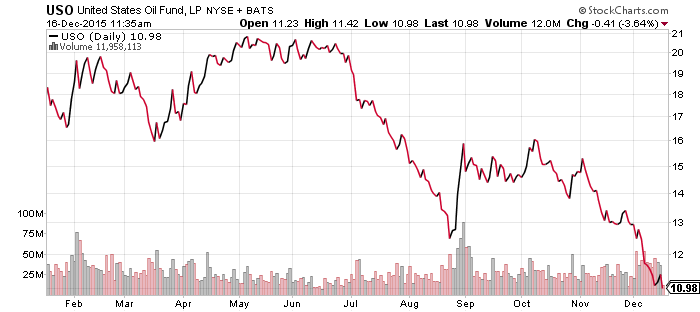

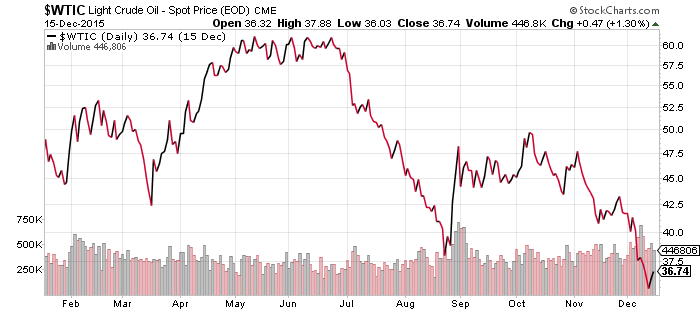

United States Oil (USO)

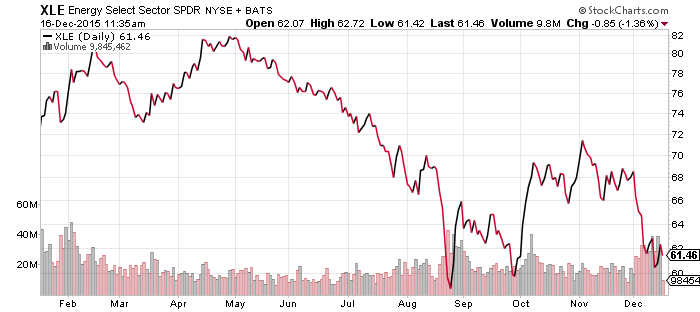

SPDR Energy (XLE)

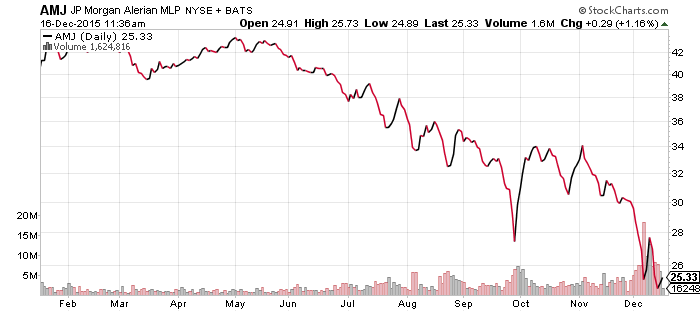

JP Morgan Alerian MLP Index (AMJ)

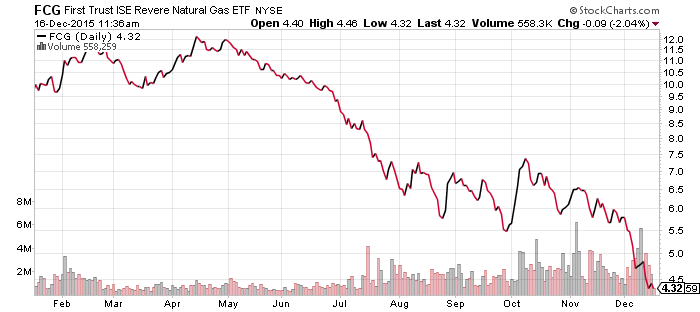

FirstTrust ISE Revere Natural Gas (FCG)

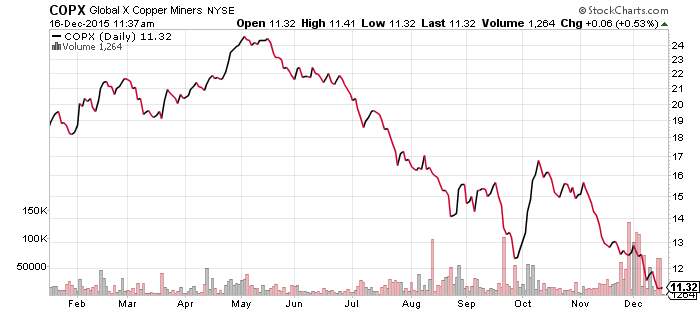

Global X Copper Miners (COPX)

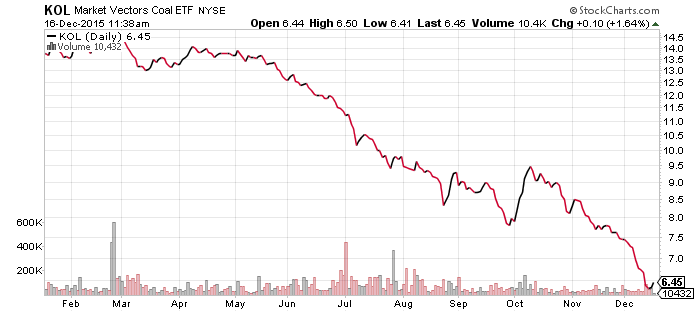

Market Vectors Coal (KOL)

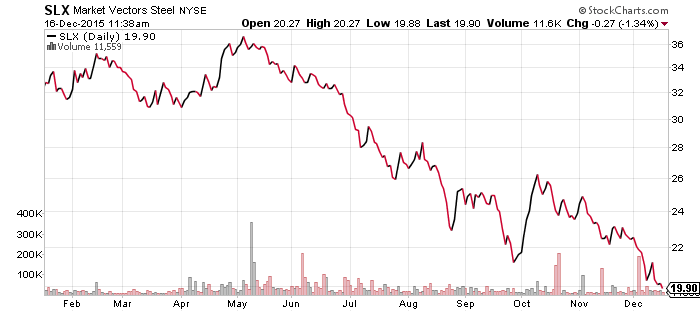

Market Vectors Steel (SLX)

Oil prices broke to another 52-week low in the past week, once again weighing heavily on energy stocks, although shares of oil companies more recently displayed signs of a slight rebound. A huge inventory buildup this month, the largest December inventory increase since 1993, pushed prices back down on Wednesday. XLE is not following oil prices lower today and it remains in an uptrend from the August lows. This signals investors remain bullish on the long-term prospects for energy and are treating the current drop as a short-term move.

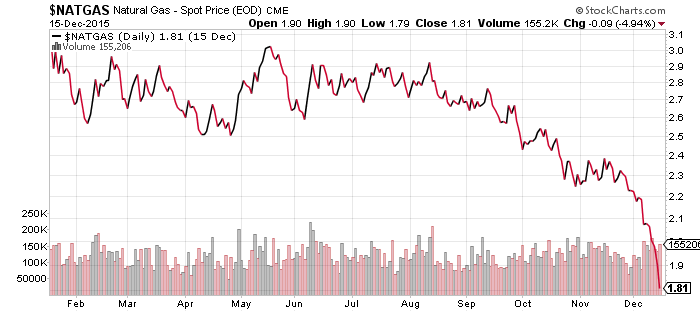

Natural gas prices, meanwhile, have gone into a nosedive and energy companies with heavy exposure and ETFs that concentrate on their stocks such as FCG, have suffered similar losses. The fund is down 28 percent in the past month.

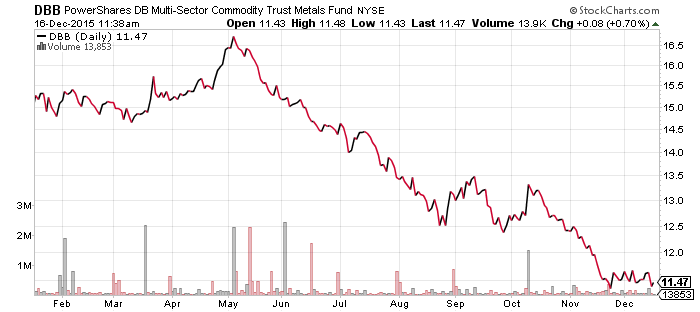

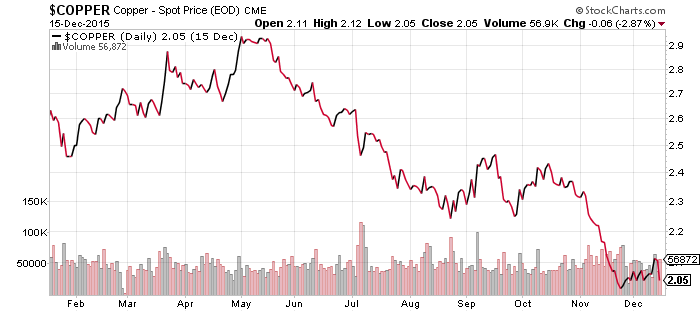

Copper prices rebounded and then retreated in the last week. Steel and coal, two commodities heavily influenced by China, continue to plumb new depths. DBB has held steady thanks to strength in copper and aluminum, while zinc fell, resulting in sideways action in the fund.

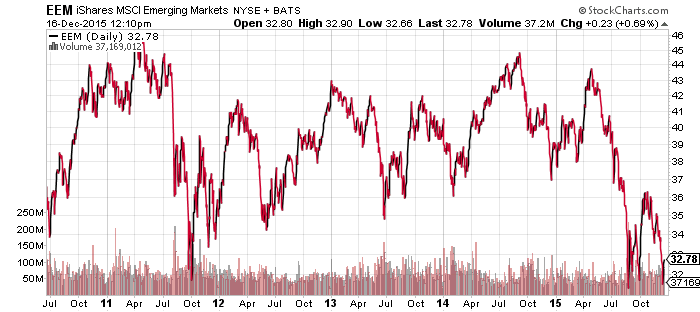

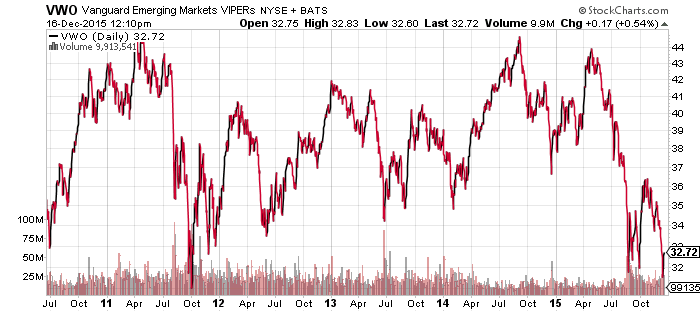

iShares MSCI Emerging Markets (EEM)

EEM and VWO are holding above the 2011 lows, as illustrated in the chart below. Those 2011 lows are a key support line. A rebound move to the top of the trading range in place since 2011 could potentially lead to 40 percent gains in emerging-market funds.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

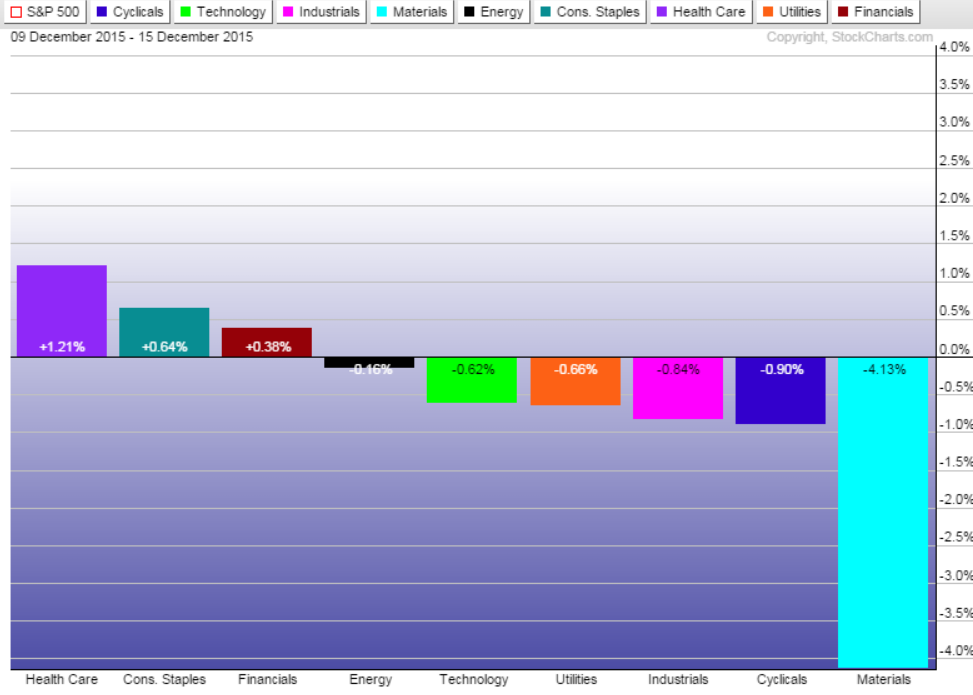

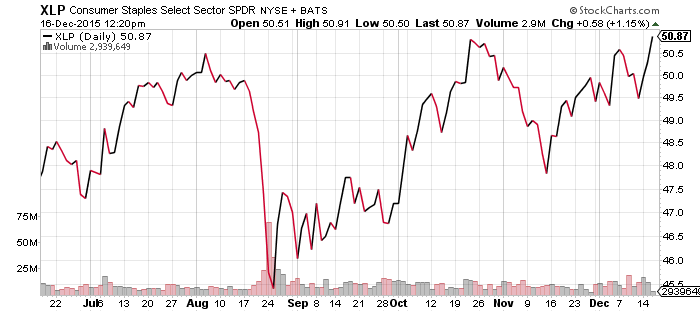

Healthcare weathered the tough market week better than most. The defensive consumer staples sector also rallied, while the financial sector also saw a small gain in anticipation of the rate hike. A pullback in shares of DuPont (DD) and Dow Chemical (DOW) tugged on materials. Both shares peaked last Wednesday following the announcement of the deal, and have since retraced some of those gains. Of the major S&P sectors, consumer staples is the closest to achieving a new 2015 high.

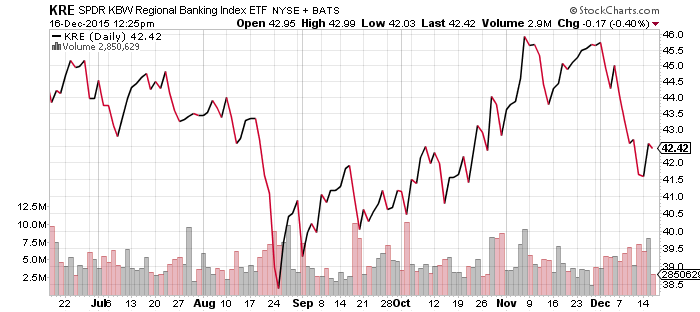

Regional banks predictably pulled back in the past week as investors grew anxious ahead of the Fed meeting. As financials stand to benefit the most from the rate increase, it stands to reason that a preemptory retreat in these funds would be magnified as investors moved to minimize risk.

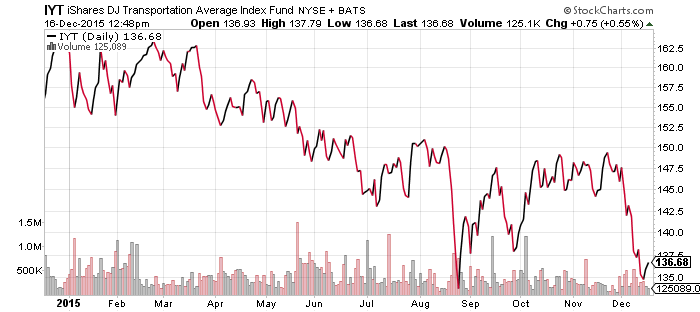

The Dow Transports show a similar pattern to emerging markets and commodities, approaching August lows in the past week. FedEx (FDX) delivered encouraging earnings data after today’s closing bell, reporting a per share increase to $2.58. It is the largest holding in IYT at 11.8 percent of assets.

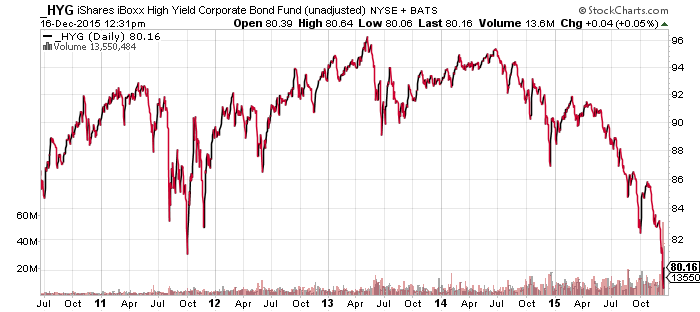

iShares iBoxx High Yield Corporate Bond (HYG)

iShares iBoxx Investment Grade Corporate Bond (LQD)

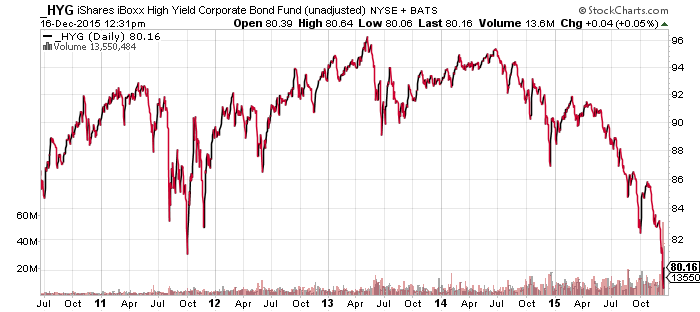

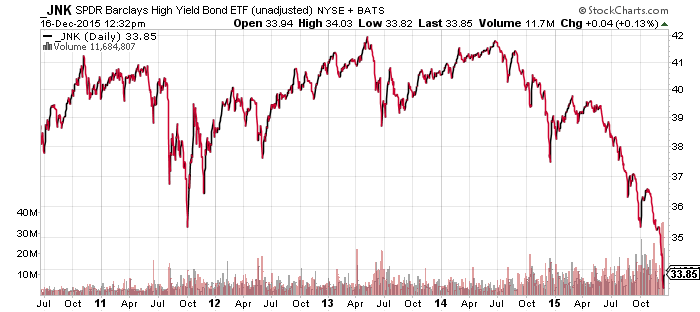

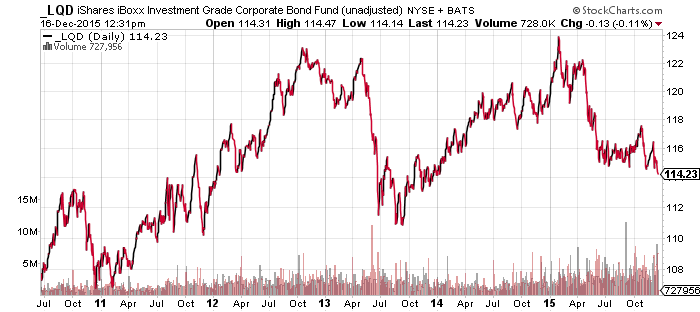

Junk bonds broke their 2011 closing lows on Monday of this week, but HYG did not break its intraday low, setting up a potentially large double-bottom. The SPDR high-yield fund, JNK, also fell, but HYG is the larger and more significant of the two funds. LQD remains in an uptrend in reaction to falling treasury and investment-grade interest rates. All three charts remove dividends in order to show the NAV of the underlying bond portfolios.

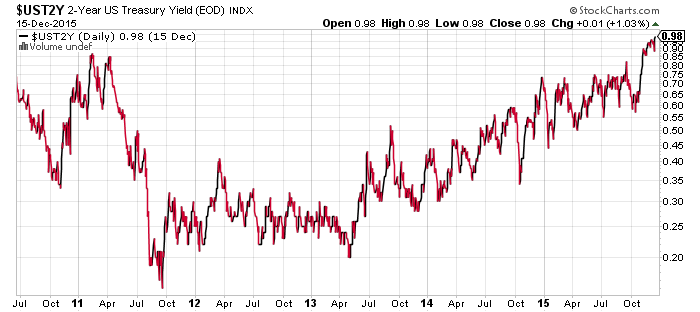

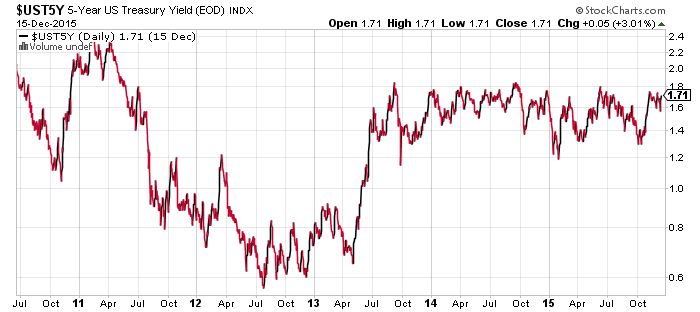

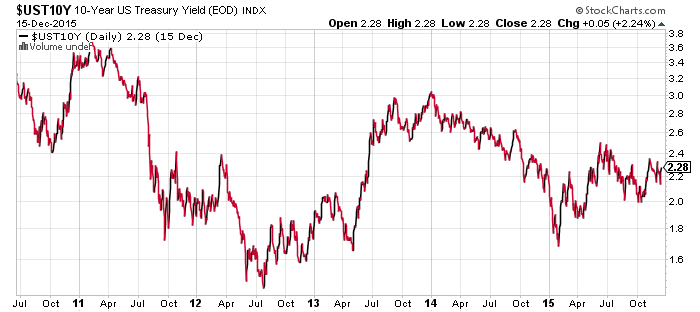

The 2-year treasury is far more sensitive to Federal Reserve rate policy, which is why the yield is at a new multi-year high. The 10-year is well off prior highs, while the 5-year treasury yield is very close to the high of its two-and-a-half year trading range.

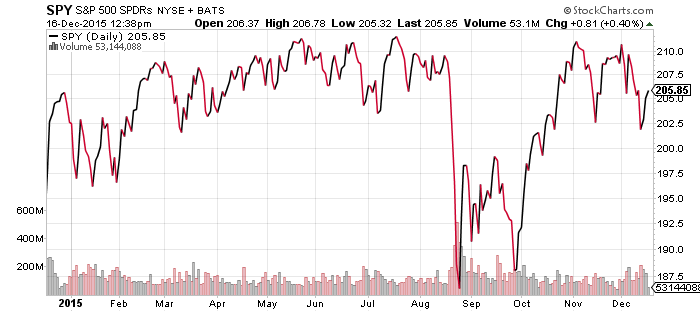

SPDR S&P 500 (SPY)

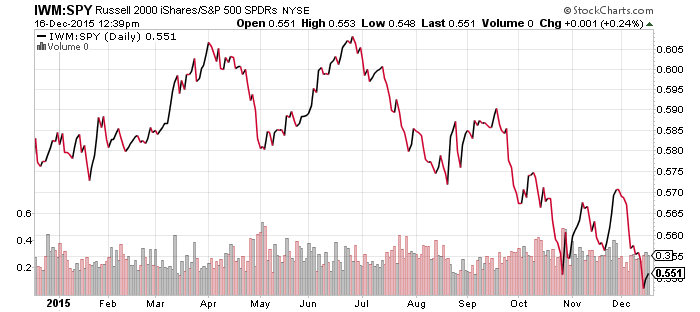

iShares Russell 2000 (IWM)

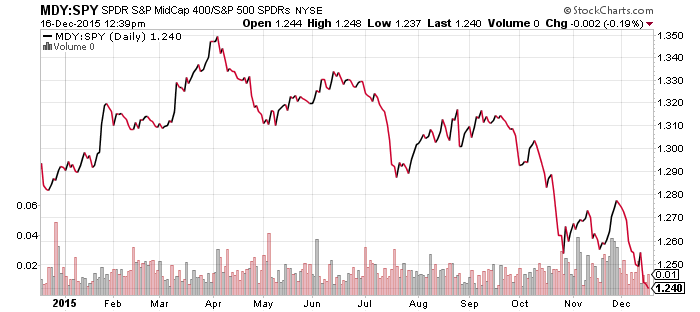

S&P Midcap 400 (MDY)

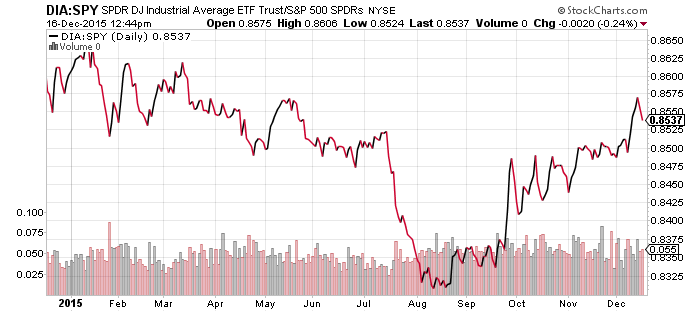

SPDR DJIA (DIA)

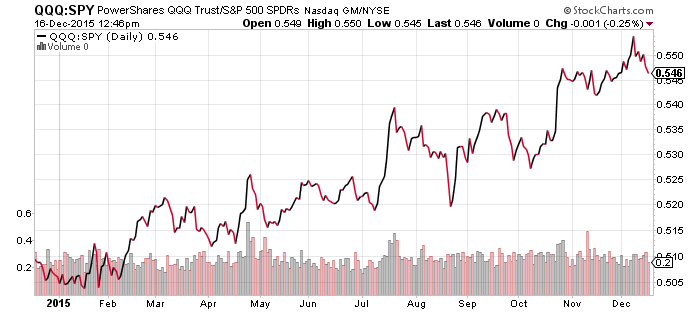

PowerShares QQQ (QQQ)

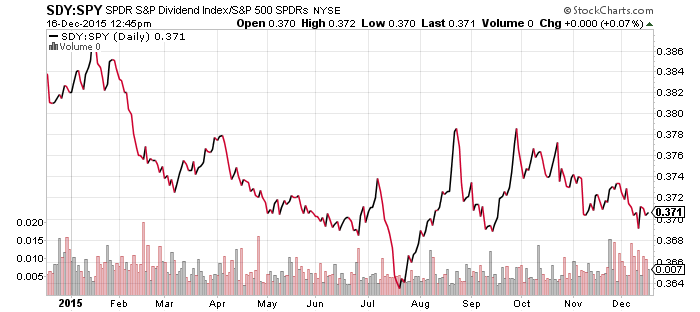

SPDR S&P Dividend (SDY)

The S&P 500’s performance in the next two weeks will determine whether it ends the nearly flat year in the red or black. Small- and mid-cap shares have underperformed large-caps for the second consecutive year and both are currently returning less than zero on the year. An end-of-year rally, however, could carry both indexes back into the black.

The Dow is the most likely candidate for a revival as it benefits from merger activity, improved performance in heavily weighted-sectors such as consumer staples, and relative strength in large caps.

The Nasdaq is sitting on a gain of 5.5 percent, comfortably securing its role as the year’s best performer.