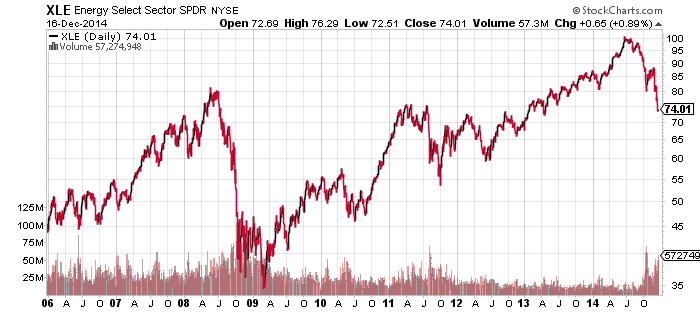

SPDR Energy (XLE)

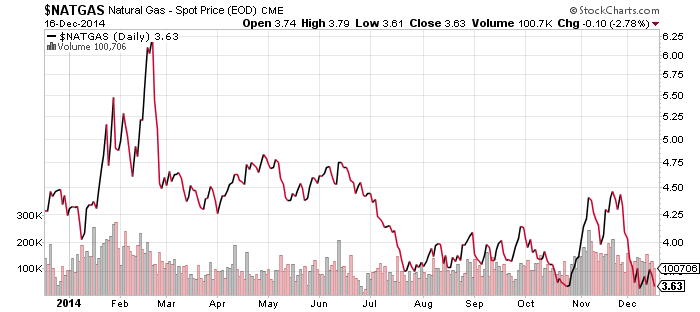

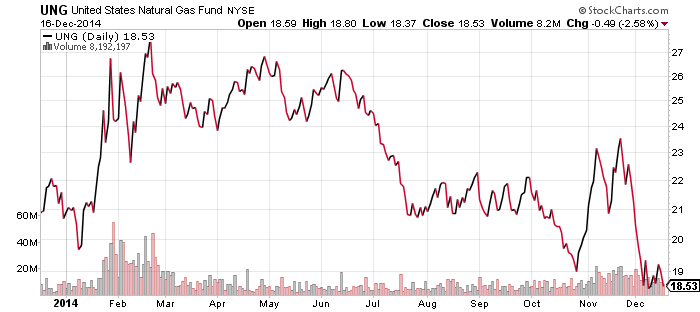

United States Natural Gas (UNG)

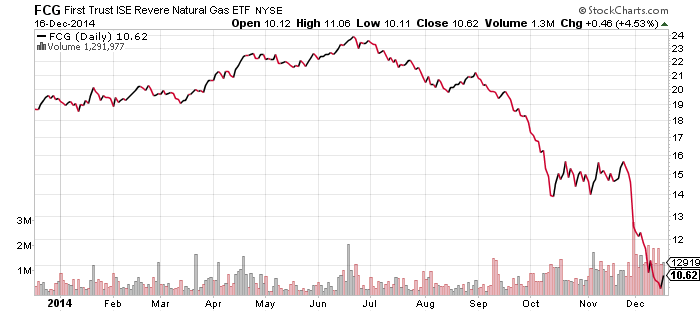

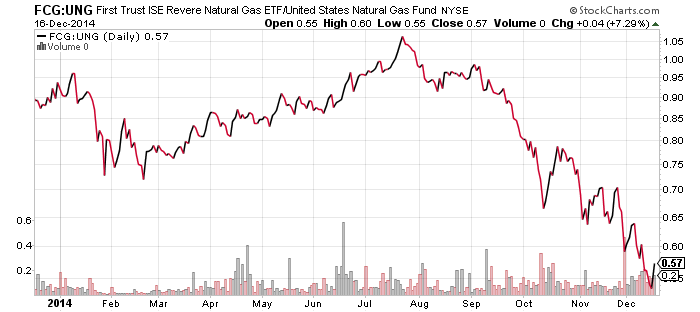

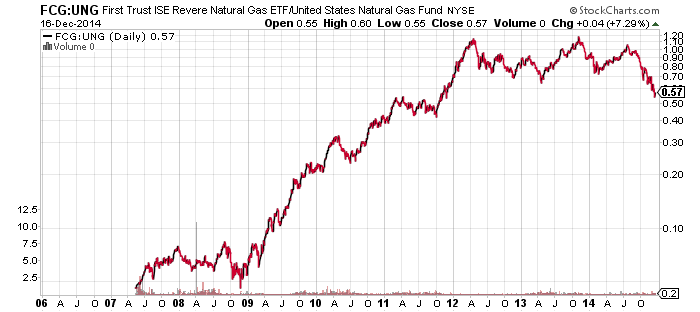

First Trust ISE Revere Natural Gas (FCG)

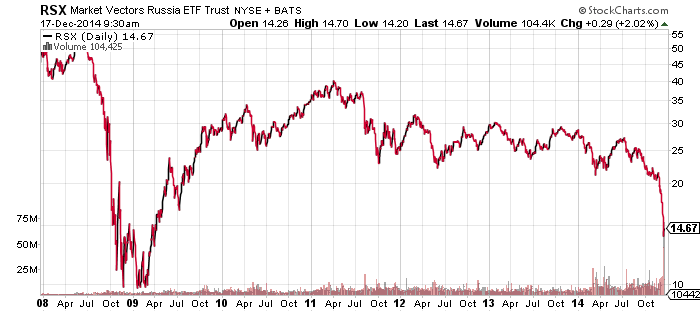

Market Vectors Russia (RSX)

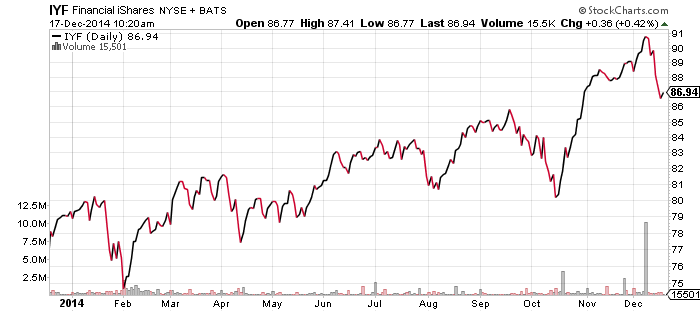

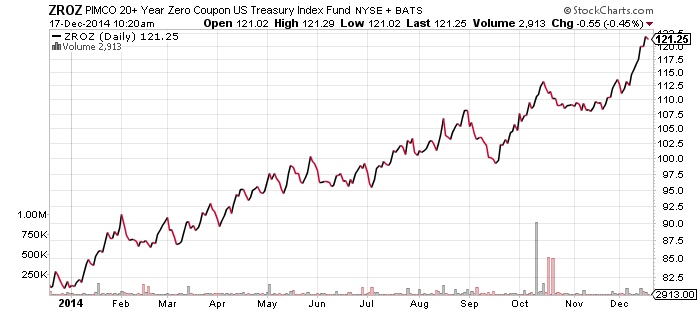

Either stock traders are covering their shorts or investors believe a bottom in oil is at hand. Energy stocks bounced on Tuesday and have been increasingly outperforming oil in December. Investors haven’t been as willing to sell energy stocks as they have crude oil, as the first chart comparing the price ratio of SPDR Energy (XLE) to West Texas Intermediate Crude shows. This has been the case since October because energy firms are still earning profits at lower prices, but the chart has taken on a much steeper curve over the past week as oil prices slumped faster than stock prices.

As the second chart of the ratio shows, this is a replay of the 2008/9 crash in oil prices. The ratio spiked during the decline in both crude oil and energy stocks, and then declined as both energy shares and crude oil recovered (crude recovered faster since it had fallen much further). It appears a bottom in crude oil prices is close, but the market is still highly volatile. Since XLE is also well off its crisis lows, there’s also the chance that it comes down due to energy shares catching up with crude.

Natural gas stocks and natural gas prices are both near their all-time lows.

Finally, Russia was hit with a currency devaluation this week. The ruble spiked to about 80 to $1 in midday trading on Monday, but it has since come down to the low 60s, which counts as a rebound. This may be a sign that the plunge in energy prices is running out of steam because this type of panic V-bottom can mark the end of a bear market.

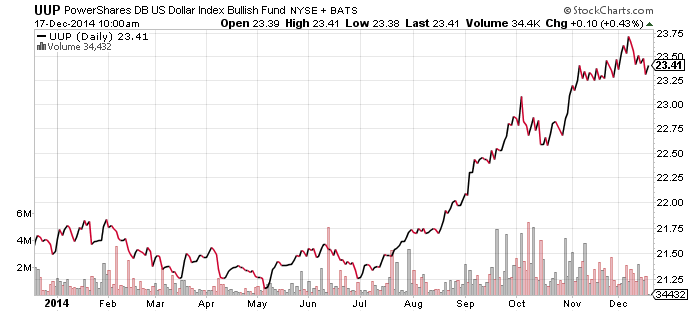

PowerShares U.S. Dollar Index Bullish Fund (UUP)

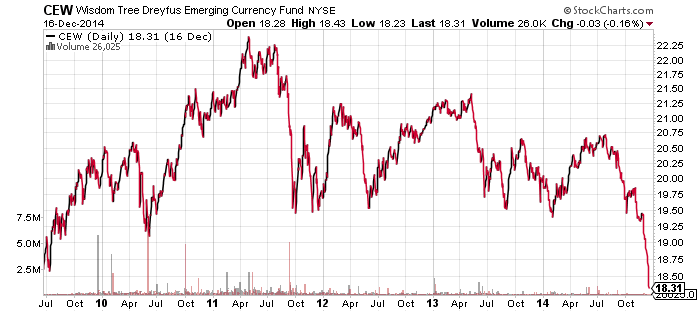

WisdomTree Dreyfus Emerging Currency (CEW)

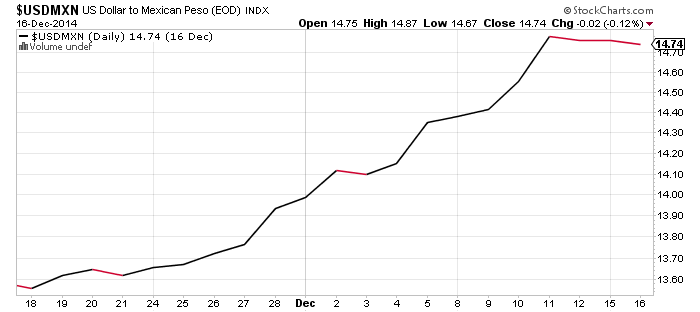

Emerging market currencies were a mixed bag in the past week, with the Russian ruble plunging, while the Mexico peso stabilized. It is too early to say if the market is turning, but a bounce could be underway.

The U.S. Dollar Index retreated over the past week due to a strong rebound in the yen and euro. The yen recently fell to a long-term support line and bounced. The dollar has gone up almost uninterrupted since the summer and a pullback is long overdue.

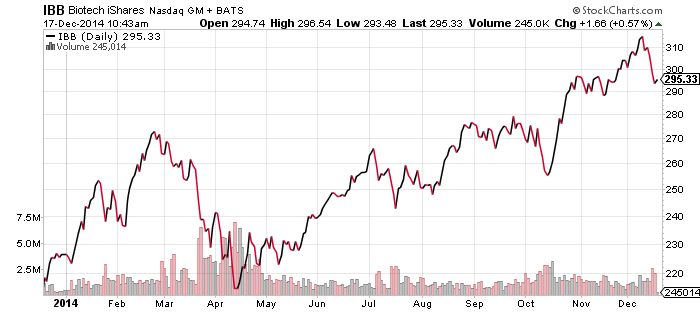

iShares Nasdaq Biotechnology (IBB)

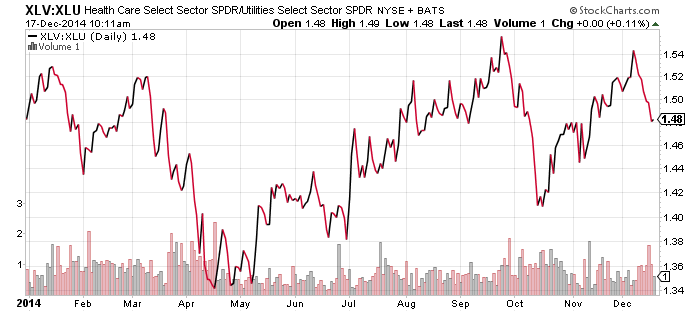

SPDR Healthcare (XLV)

SPDR Utilities (XLU)

Biotechnology shares remain the strongest sector in terms of momentum. Shares recently dipped along with the rest of the healthcare sector, but there’s no sign of any significant weakness yet.

Thanks to lower interest rates, the utilities sector did not decline in the past week. As we head into the last two weeks of trading in 2014, the utilities and healthcare sectors are neck and neck for the best performing S&P 500 sector.

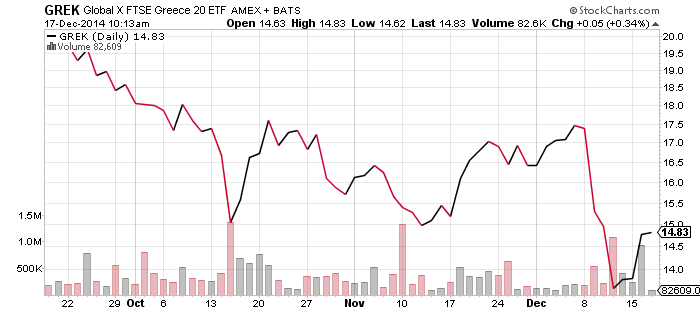

Global X Greece (GREK)

Last week we covered the upcoming Greek presidential election. The first round is later today, but the ruling party is not expected to win until round 3 at the end of December. Failure to secure the election of a new president would result in a general election at the end of January. If a general election is called, the opposition Syriza party, which opposes austerity, is expected to win.

The ruling party is believed to need about 7 votes to win in round 3. This will be the most important number for Greek stocks in the next two week, and what happens in Greece could affect the euro.

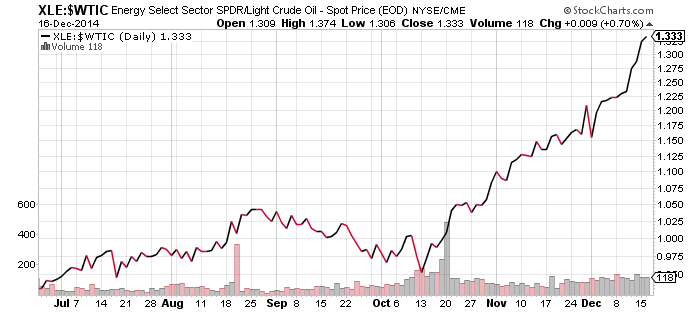

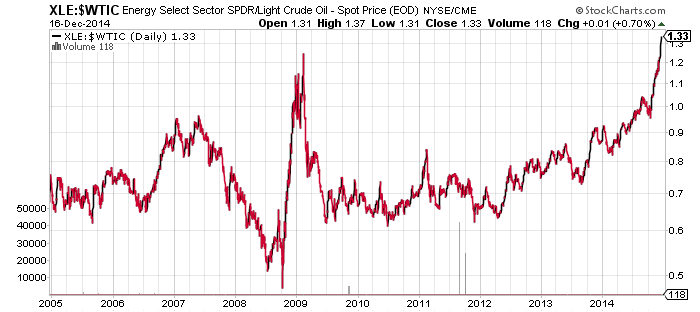

iShares U.S. Financials (IYF)

PIMCO 20+ Year Zero Coupon Treasury (ZROZ)

The past week saw financial shares dip in the face of rising interest rates. The charts of IYF and ZROZ are almost perfect opposites in December.

This afternoon, we will see if the trend continues when the Federal Reserve makes its policy statement. There’s growing expectation the Fed will change its language regarding low interest rates. For several policy statements, they have said rates would stay low “for a considerable time” but many believe it will remove the “considerable time” wording and replace it with something more ambiguous. That wouldn’t signal that rate hikes are coming soon, but would move the Fed a small step closer to rate hikes. Statements by Janet Yellen indicate the Fed is still concerned about the labor market, so a major change is very unlikely today.

Financials stand to benefit from a change in wording, since financial companies can earn higher profits from the steeper yield curve that would result from a normalization of Fed policy.