Speculators have raised the odds of rate hike in the futures market to 87 percent as of Wednesday morning. November’s CPI numbers will be announced next week. Unless there is a major surprise in this data, or a Fed official breaks the normal pre-meeting silence, the market should head into next Wednesday expecting an increase in interest rates.

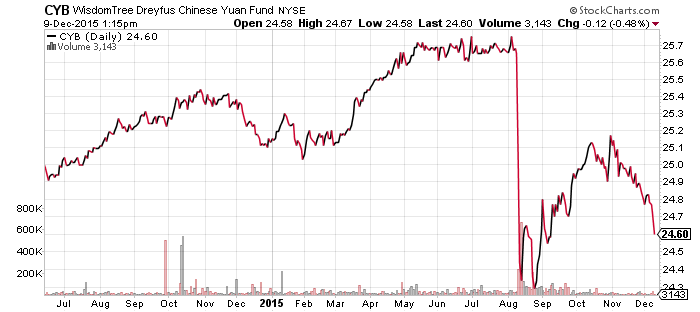

WisdomTree Chinese Yuan (CYB)

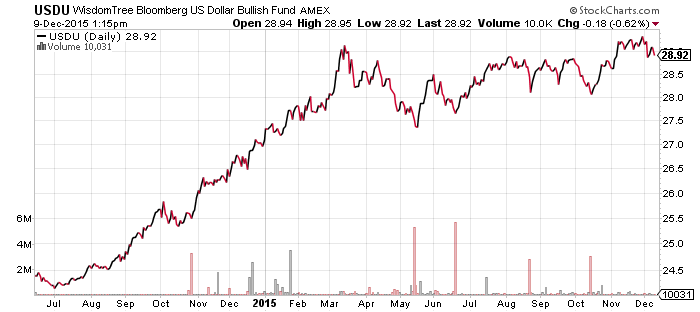

WisdomTree Bloomberg USD Bullish (USDU)

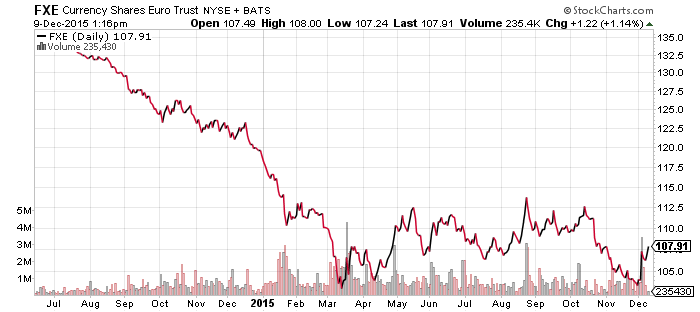

CurrencyShares Euro Trust (FXE)

CurrencyShares Swiss Franc (FXF)

CurrencyShares Swedish Krona (FXS)

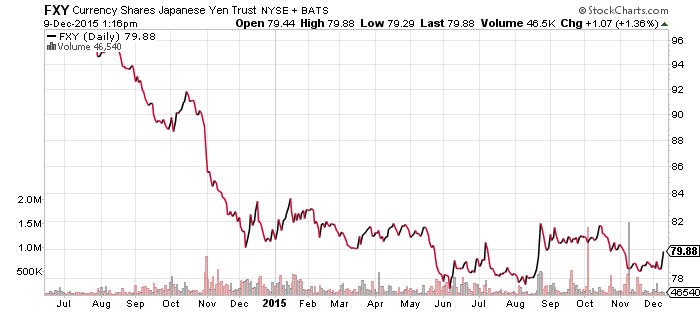

CurrencyShares Japanese Yen (FXY)

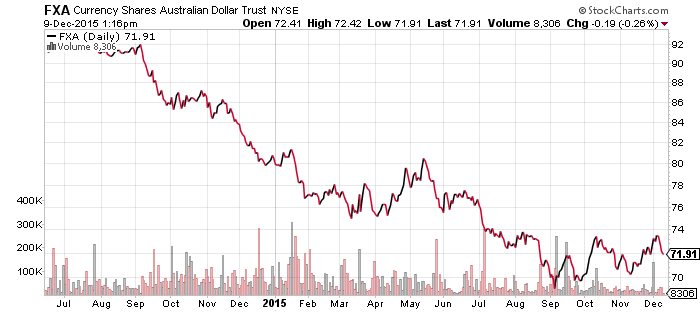

CurrencyShares Australian Dollar (FXA)

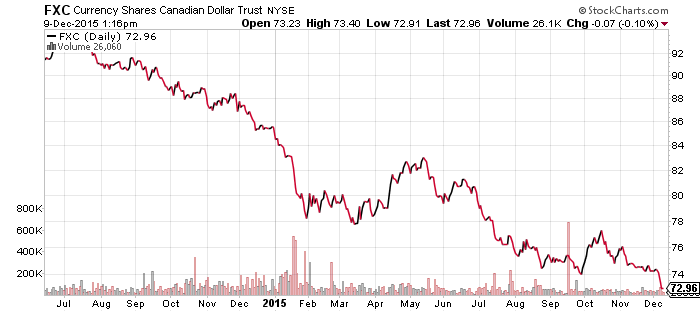

CurrencyShares Canadian Dollar (FXC)

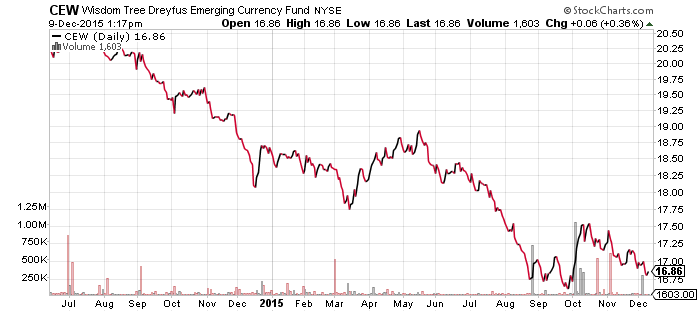

WisdomTree Emerging Market Currency (CEW)

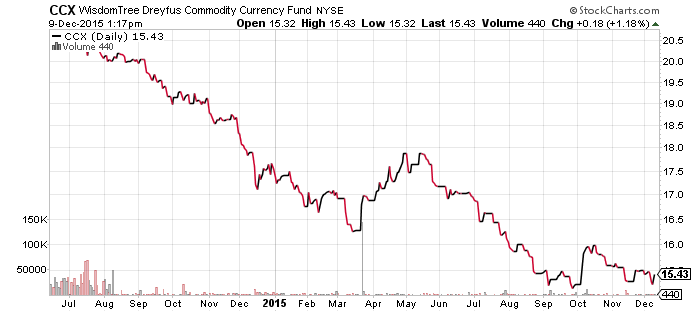

WisdomTree Commodity Currency (CCX)

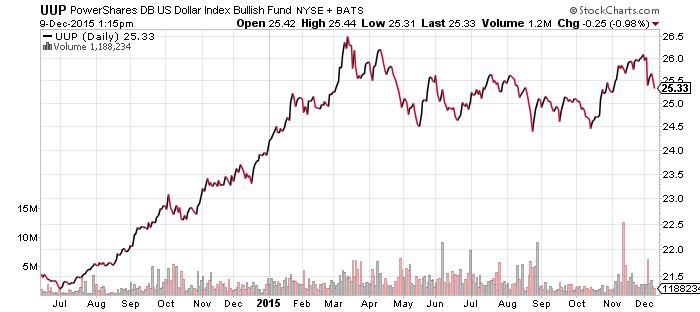

PowerShares DB U.S. Dollar Bullish Index (UUP)

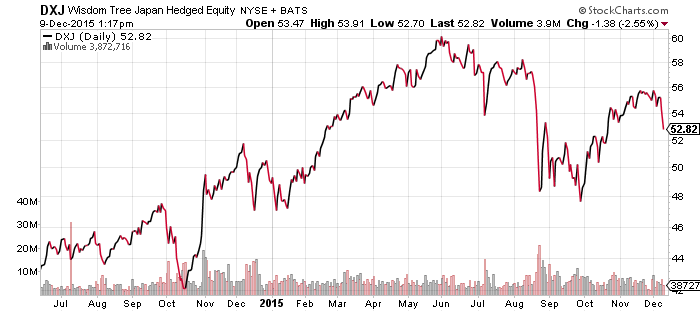

WisdomTree Japan Hedged Equity (DXJ)

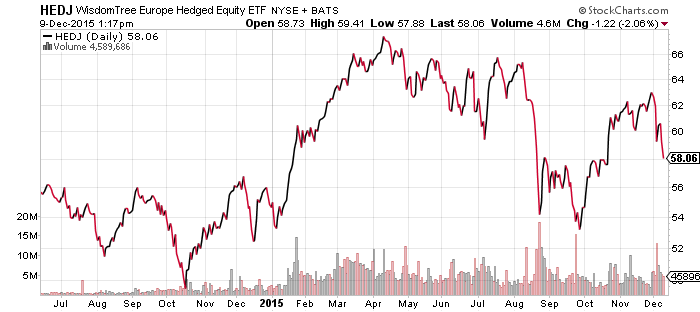

WisdomTree Europe Hedged Equity (HEDJ)

The Chinese yuan is at its lowest 2015 levels after continued producer price deflation in November compounded with weak trade numbers. The yuan anticipates further depreciation in 2016 and sentiment has shifted considerably; many were hopeful the addition to the SDR would stabilize the currency. The yuan was additionally hit by an acceleration in currency outflows in November, to the fastest pace since August’s surprise devaluation.

The yuan has dragged the Asian Dollar Index to near multi-year lows, burdening emerging market currencies. USDU outperformed UUP today due to its exposure to emerging market and smaller developed market currencies.

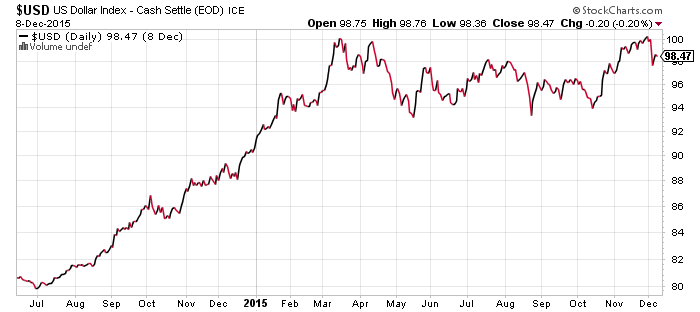

The U.S. Dollar Index battled strength in the euro and other developed currencies, with the exception of the Canadian dollar, which broke to a new 52-week low versus the U.S. dollar. The head of the Canadian central bank stated a lower bound for the current policy range hovers around negative 0.50 percent. The European Central Bank (ECB) expanded its monetary policy, but not to a large enough extent to satisfy the market, prompting ECB President Draghi to announce the bank’s commitment to further interventions. The Swedish krona also bounced and may have triple bottomed.

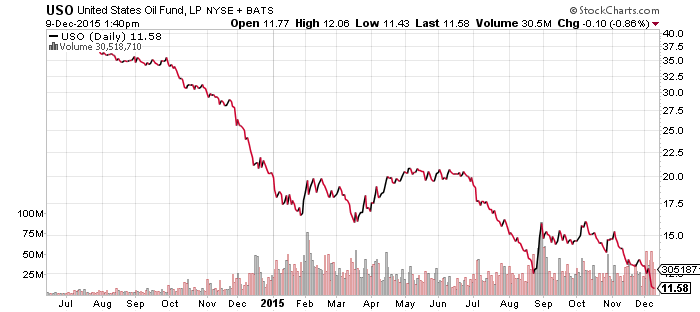

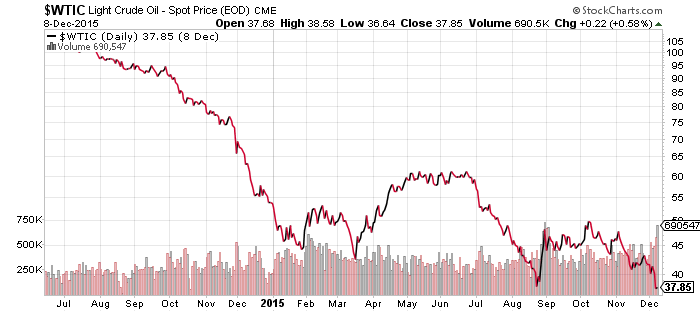

United States Oil (USO)

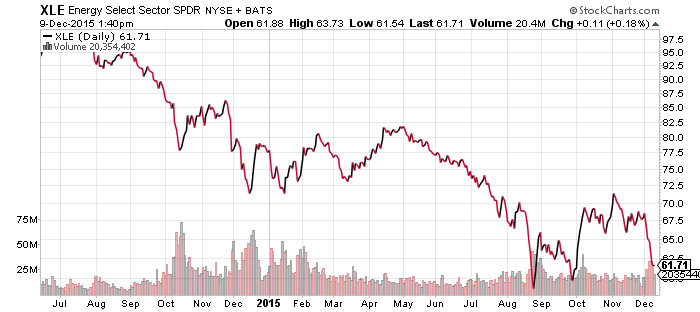

SPDR Energy (XLE)

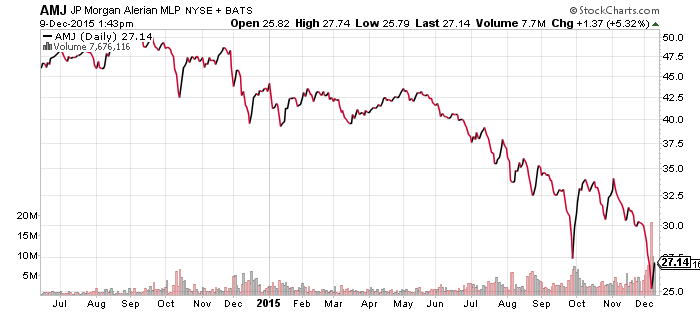

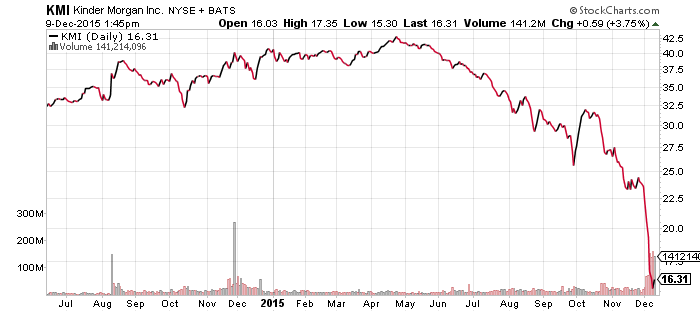

JP Morgan Alerian MLP Index (AMJ)

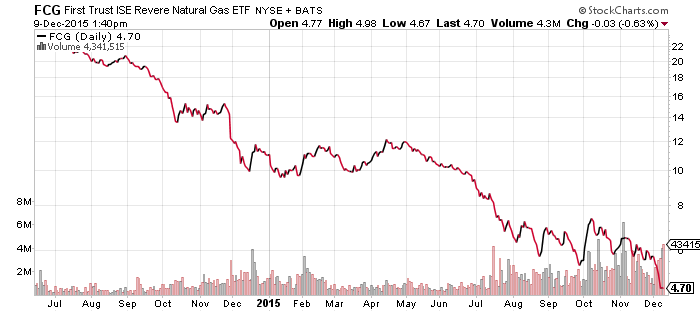

FirstTrust ISE Revere Natural Gas (FCG)

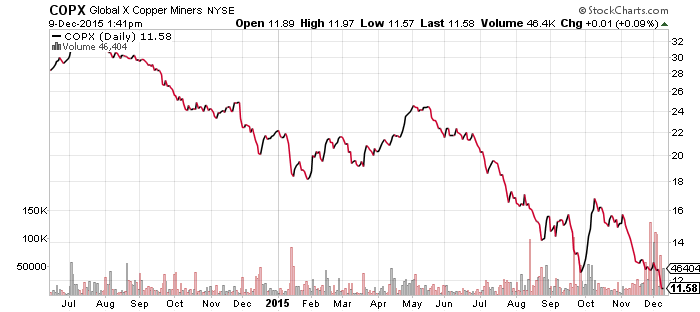

Global X Copper Miners (COPX)

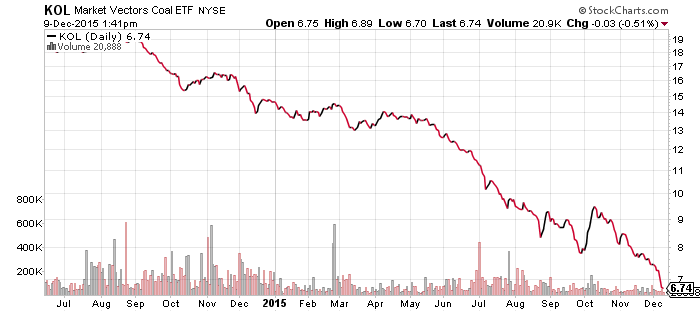

Market Vectors Coal (KOL)

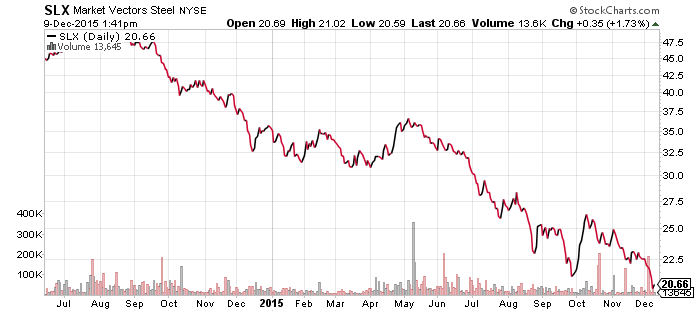

Market Vectors Steel (SLX)

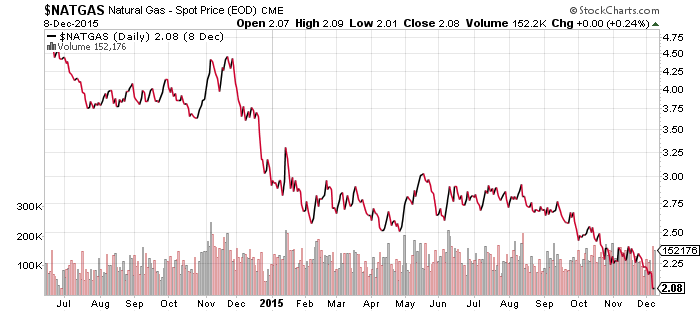

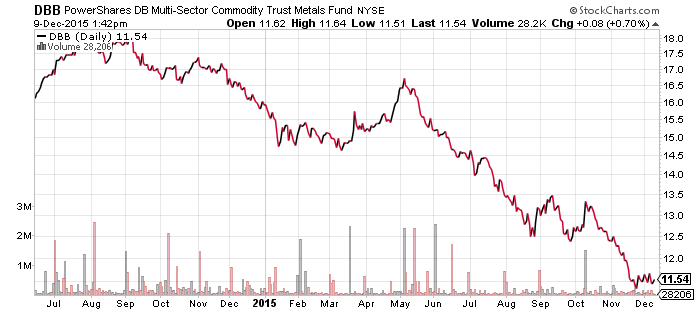

Oil prices broke to a new 52-week low in the wake of OPEC’s failure to modify production. Equity investors have not “bought” the decline yet, as energy stocks remain in an uptrend from the August lows. Master Limited Partnerships (MLPs), a favorite of income investors, made news today as Kinder Morgan (KMI) shares achieved a double-digit rally following yesterday’s 75 percent slash in dividends, though those gains have eroded. Income investors never welcome dividend cuts, but such moves have the potential to revive the company’s fortunes.

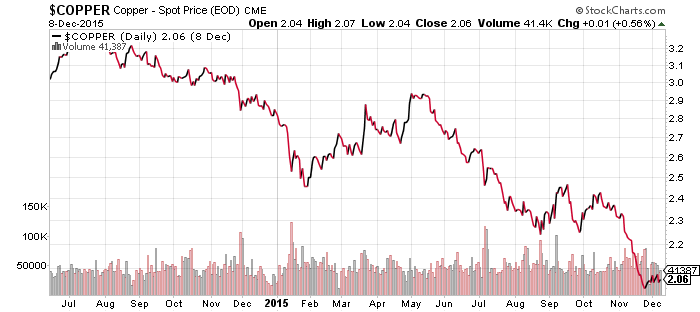

Freeport McMoRan’s (FCX) decision to eliminate its dividend also dominated headlines due to the company’s size relative to the industry, stabilizing copper prices while coal and steel stocks fell to new lows over the past week. Steel was impacted by news of Chinese mills dumping iron ore at losses in order to repay bondholders, suggesting the next step will be dumping of steel inventory.

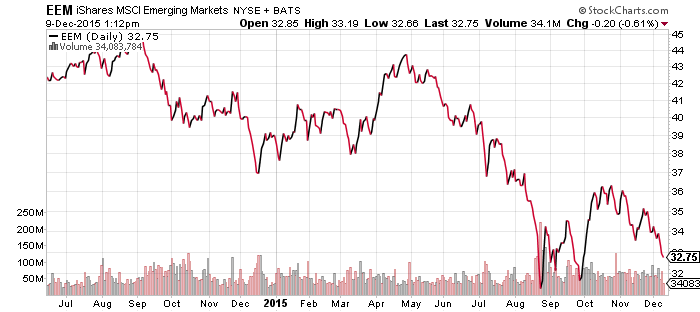

iShares MSCI Emerging Markets (EEM)

Emerging markets are still a key asset class to watch. A test of the low at $32 appears likely, perhaps as soon as this next week with the Fed rate decision looming.

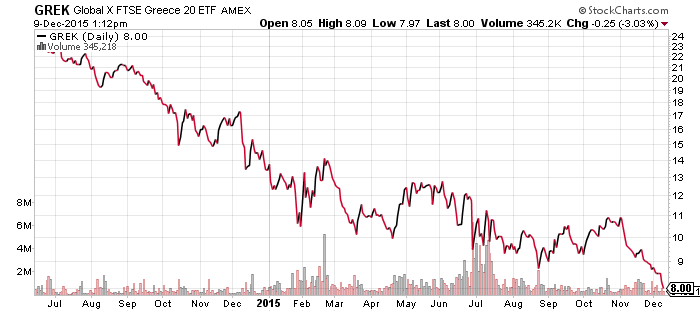

Global X Greece (GREK)

The Greek stock market had been under restriction since the summer, allowing investors to buy, but unable to draw from their accounts. Those restrictions were lifted this week and Greek stocks promptly fell to a new 52-week low due to the release of pent-up selling pressure. Greece and Europe’s failure to address the debt problems will likely lead to further losses. Unfortunately, the political landscape in Greece currently warrants little optimism.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

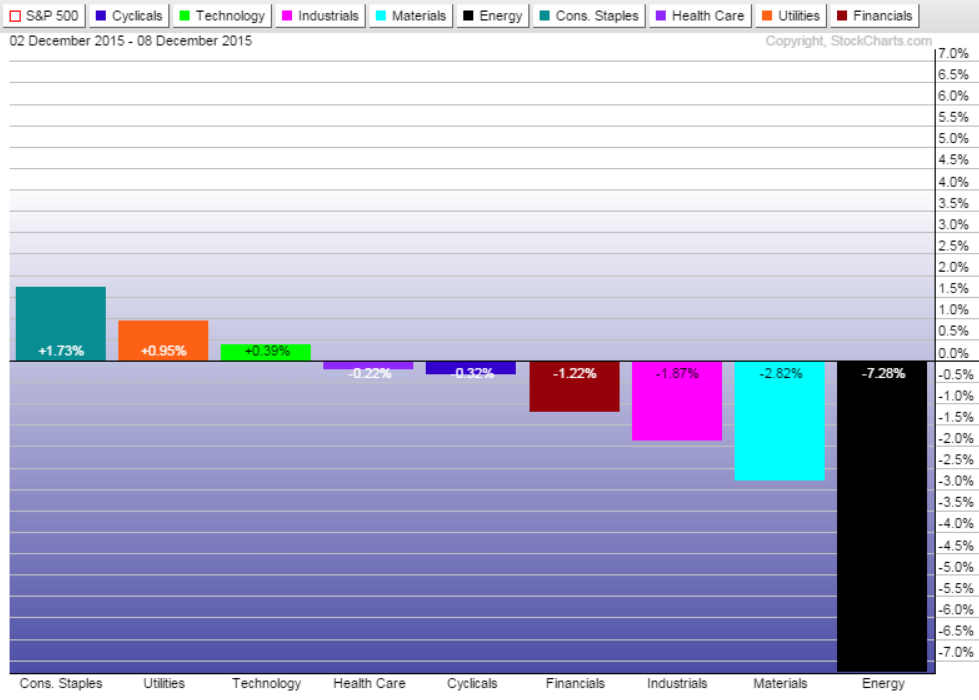

Energy was by far the worst- performing sector over the past week, pulling the broader market lower. There was also some pullback in internet names and financials, perhaps indicating investor apprehension ahead of the Fed’s decision next week. Defensive consumer staples and utilities displayed the strongest performance.

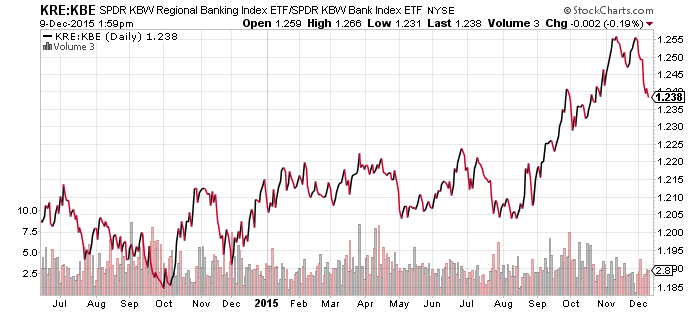

The relative performance of regional banks versus large banks ebbed nicely, reflecting investor wariness. Regional banks should outperform following a rate hike, though some traders may shy away from their inherent volatility over the immediate short-term in order to minimize risk.

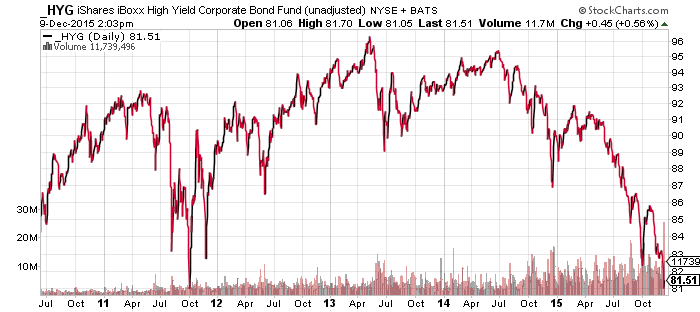

iShares iBoxx High Yield Corporate Bond (HYG)

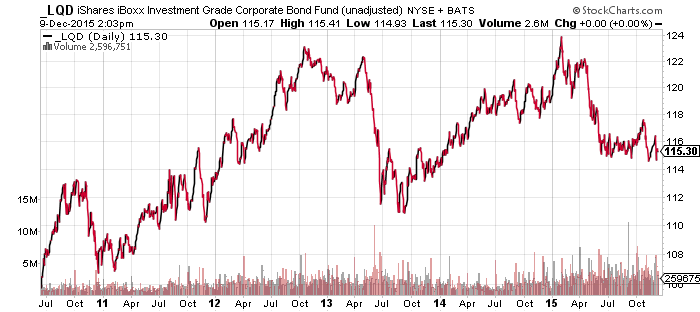

iShares iBoxx Investment Grade Corporate Bond (LQD)

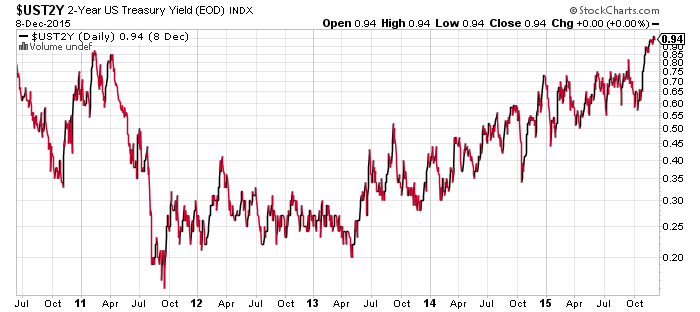

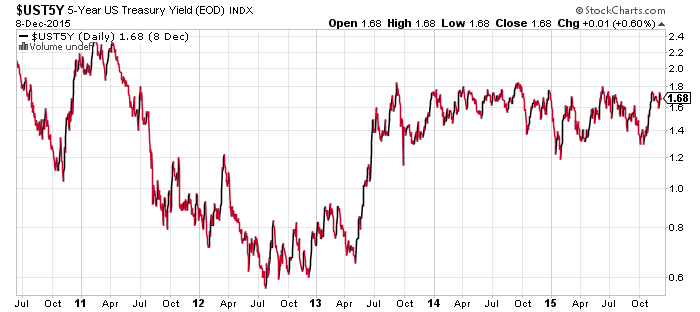

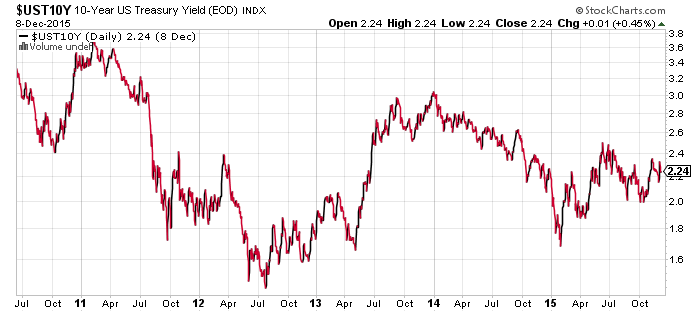

The below charts reflect HYG and LQD dividend adjustments. LQD has been in an uptrend since 2011, but high-yielding HYG is near its 2011 lows. Bankruptcy concerns for shale oil producers continue to weigh on the market. Bond yields were steady in the past week with the 2-year treasury yield holding near its highs for the year. The Fed’s interest rate policy impacts shorter-term bonds far more significantly than long-term bonds.

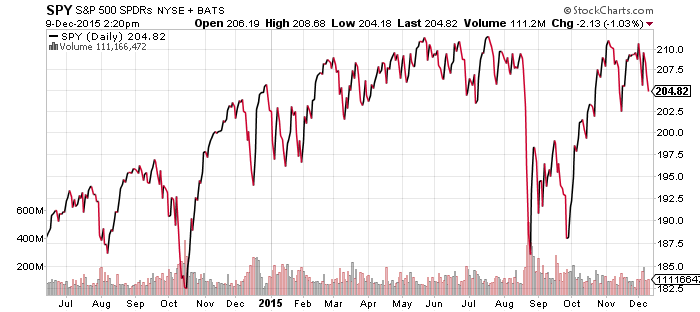

SPDR S&P 500 (SPY)

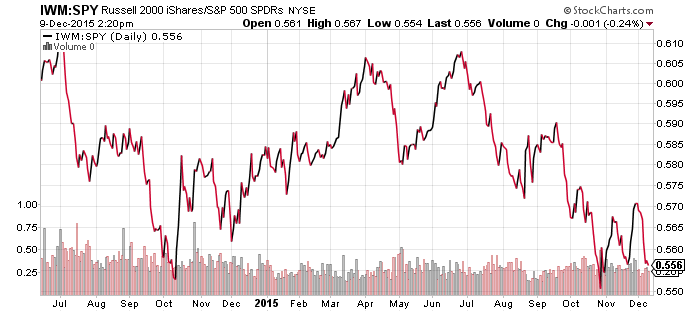

iShares Russell 2000 (IWM)

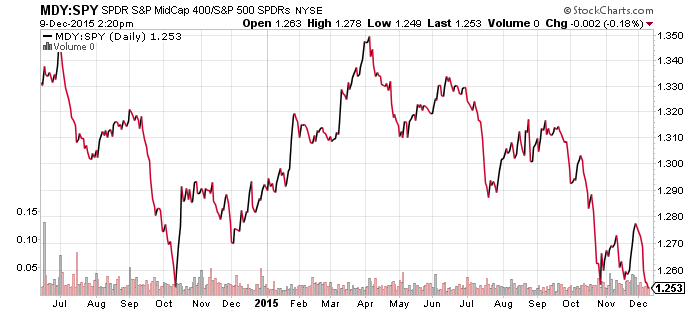

S&P Midcap 400 (MDY)

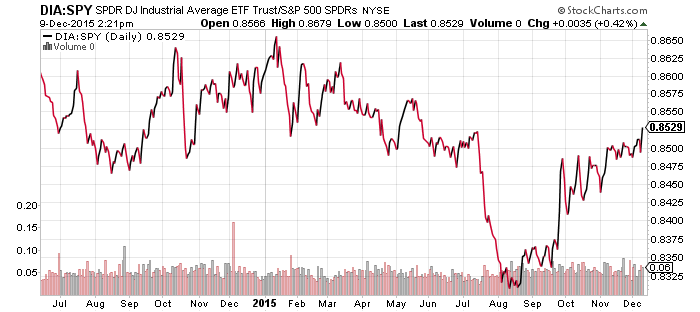

SPDR DJIA (DIA)

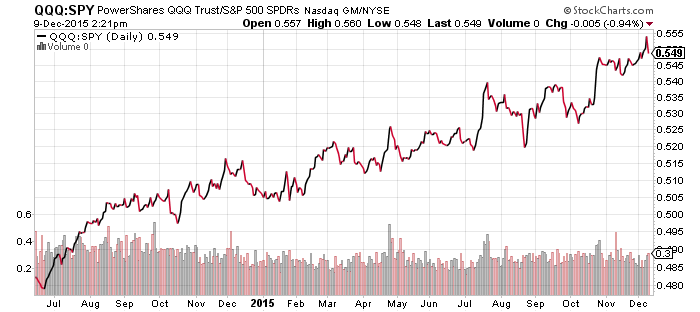

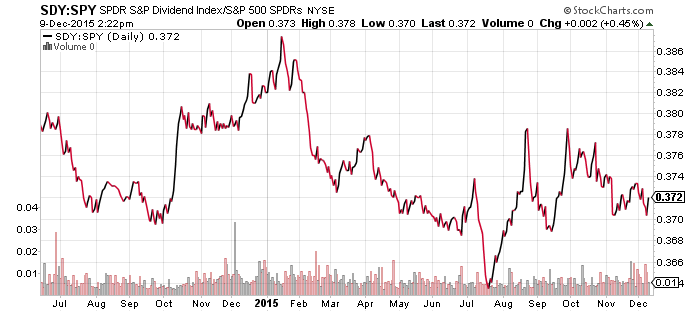

PowerShares QQQ (QQQ)

SPDR S&P Dividend (SDY)

Traders are offloading some risk ahead of the Fed’s decision, which has weighed on mid- and small-cap shares. The relative performance in the Dow Jones Industrial Average has been the week’s notable emerging story. Industrial and consumer giants such as General Electric (GE), Coca-Cola (KO), Procter & Gamble (PG) and Home Depot (HD) have led the Dow to outperform the S&P 500 in recent weeks. Dow Chemical (DOW) and Dow component DuPont (DD) announced merger talks today, delivering another boost to the index.