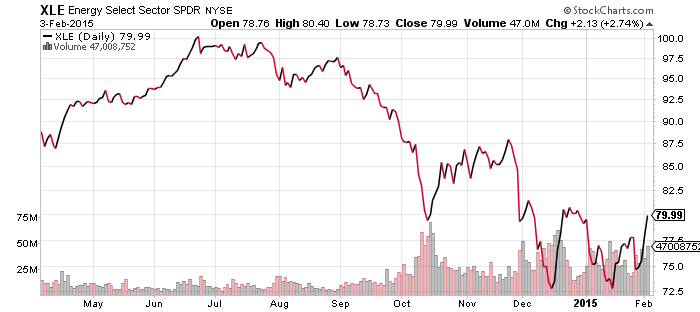

SPDR Energy (XLE)

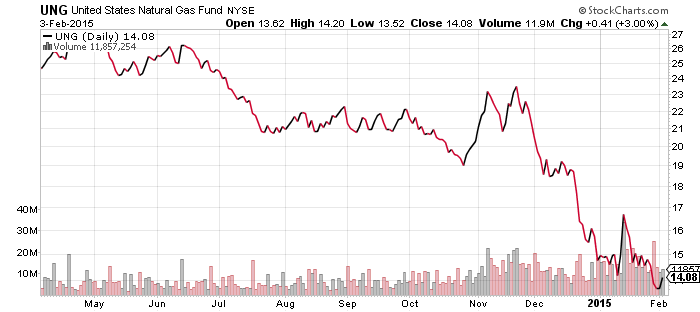

United States Natural Gas (UNG)

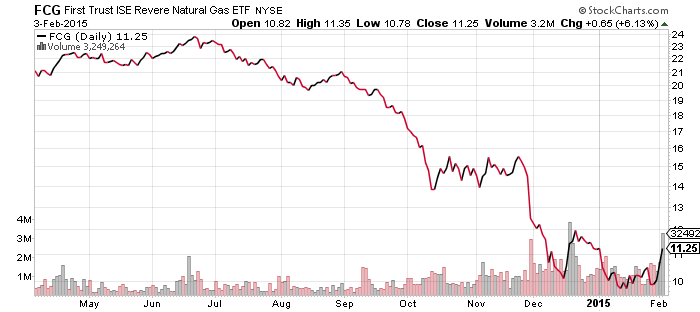

First Trust ISE Revere Natural Gas (FCG)

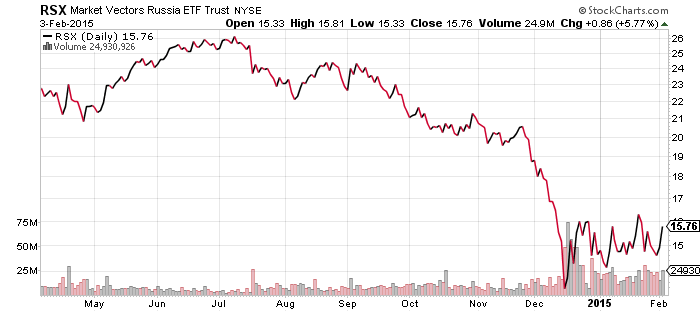

Market Vectors Russia (RSX)View Post

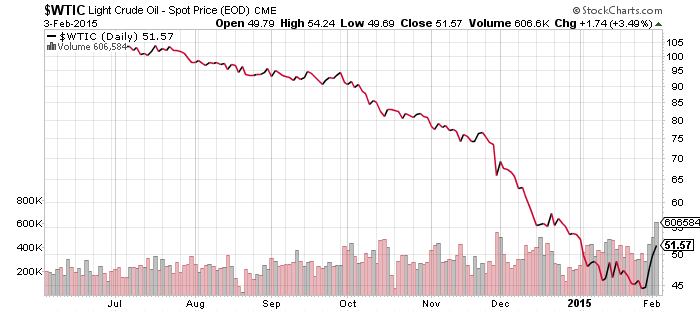

Oil prices rallied sharply over the past week, highlighting the incredible drop in West Texas Intermediate Crude (WTIC). On the chart of WTIC below, there hasn’t been a significant rebound in oil for seven straight months. The latest move is the largest rebound in dollar terms and in percentage terms since oil started to fall in July.

While this bounce is a very good sign, it is probably not the start of a long-term rally just yet. Unless a big growth surge in the global economy is coming soon, a V-shaped bounce in oil is unlikely. Instead, this is the first test of the down move in oil, and the shorts will probably take oil back down into the $40s to test the lows.

Equities have proven to be the better forecaster of oil thus far and investors should remain cautiously optimistic. XLE bottomed in December and then successfully tested that bottom in January. Exxon (XOM) helped this week when the firm delivered earnings and guidance that was better than expected. XLE remains in a downtrend, but $72.50 is now a solid support line and a move to about $82 would break the trend. The next level to watch after that is $87.50.

Although oil prices have bounced, natural gas fell to new lows. A cold winter in the northeast has done nothing to budge prices and with the coldest part of winter gone, a weather related boost is increasingly unlikely. Luckily for the energy producers in FCG, equity investors are bidding up the entire sector.

RSX looks better, with an uptrend that started in December. This bounce is mainly due to the recovery in the ruble and bottom fishing by investors attracted to Russia’s low valuations, and not the recent bounce in oil prices. A rise in oil prices would be good news for RSX, but a move back to the lows for crude oil probably wouldn’t derail this nascent recovery.

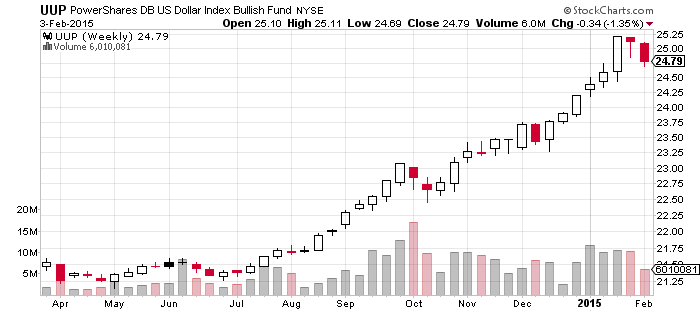

PowerShares U.S. Dollar Index Bullish Fund (UUP)

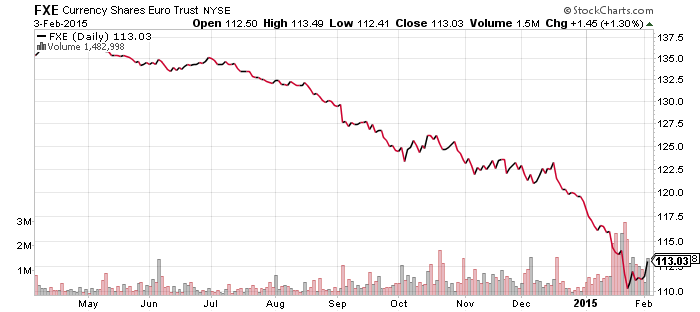

CurrencyShares Euro Trust (FXE)

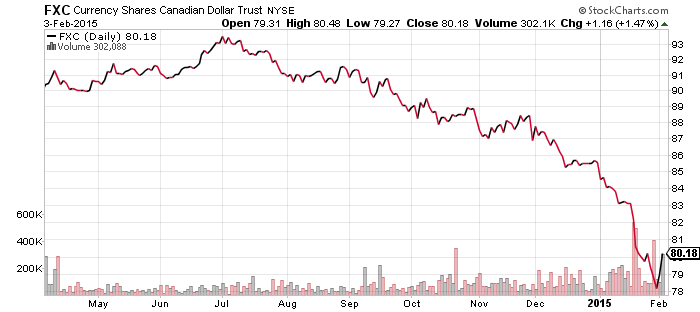

CurrencyShares Canadian Dollar (FXC)

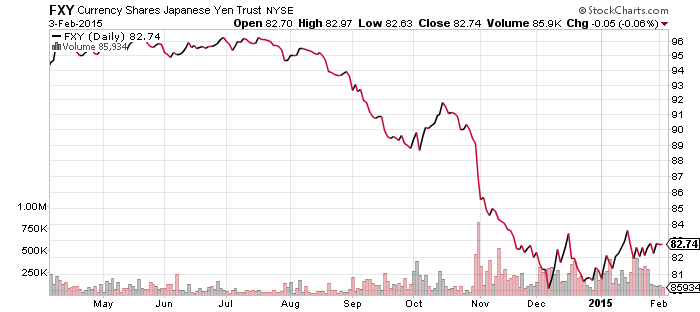

The oil rebound coincided with a drop in the U.S. dollar, a reversal of its multi-week rally. As the weekly candlestick chart shows, the U.S. dollar rallied for six consecutive weeks and is now down for the second consecutive week, something that has happened only once since July. The U.S. Dollar Index has also rallied for seven consecutive months, its longest win streak in history. As with oil, a reversal is long overdue. Due to the length of the prior move, the dollar could experience a multi-week or even multi-month correction that could eventually give way to new highs.

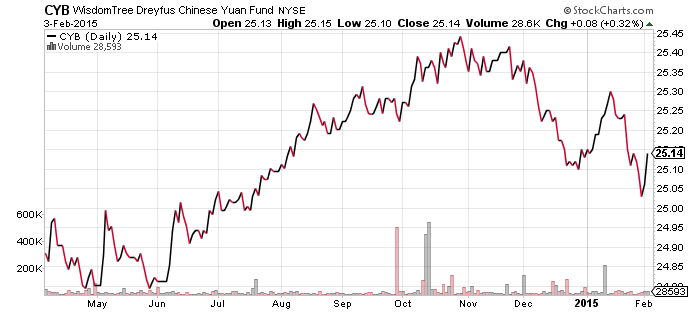

One currency that recently weakened versus the dollar is the Chinese yuan. CYB is in a downtrend since November and while the move is small, news of capital flowing out of China hints that further declines may be in store.

Major currencies such as the yen and euro moved higher, as did the natural resource influenced Canadian dollar.

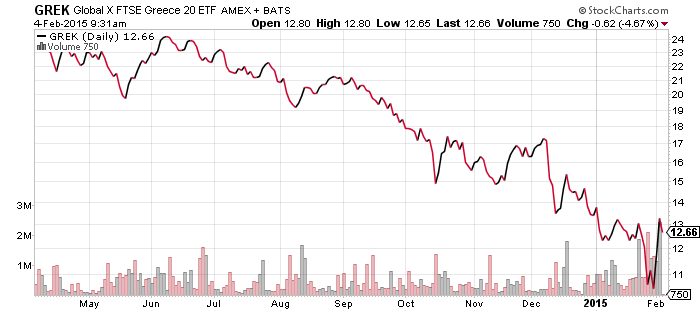

Global X FTSE Greece 20 (GREK)

Almost everything that had been dropping has rallied this week, including Greece. GREK bottomed around $10.50 and is up more than 20 percent from its lows. The new Greek government is playing hard ball with its European creditors. The Europeans may be in the stronger position here because it seems the Germans are more willing to let Greece leave the euro than the Greeks are willing to walk away. At this point, the price of GREK is merely a reflection of expectations. This week, it sounded as if the Greeks toned down their position on renegotiating debt, and stocks rallied strongly. One comment from either side could change everything though, for good or bad.

SPDR Utilities (XLU)

SPDR Consumer Staples (XLP)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

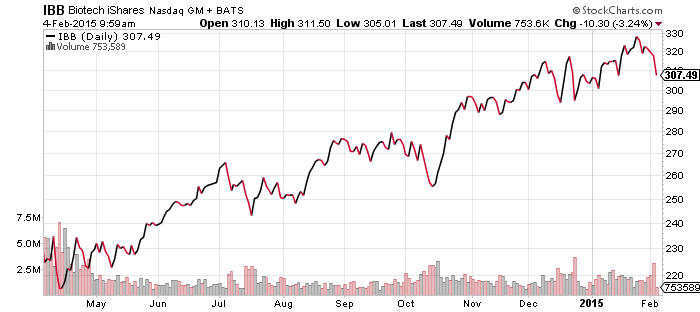

iShares Nasdaq Biotechnology (IBB)

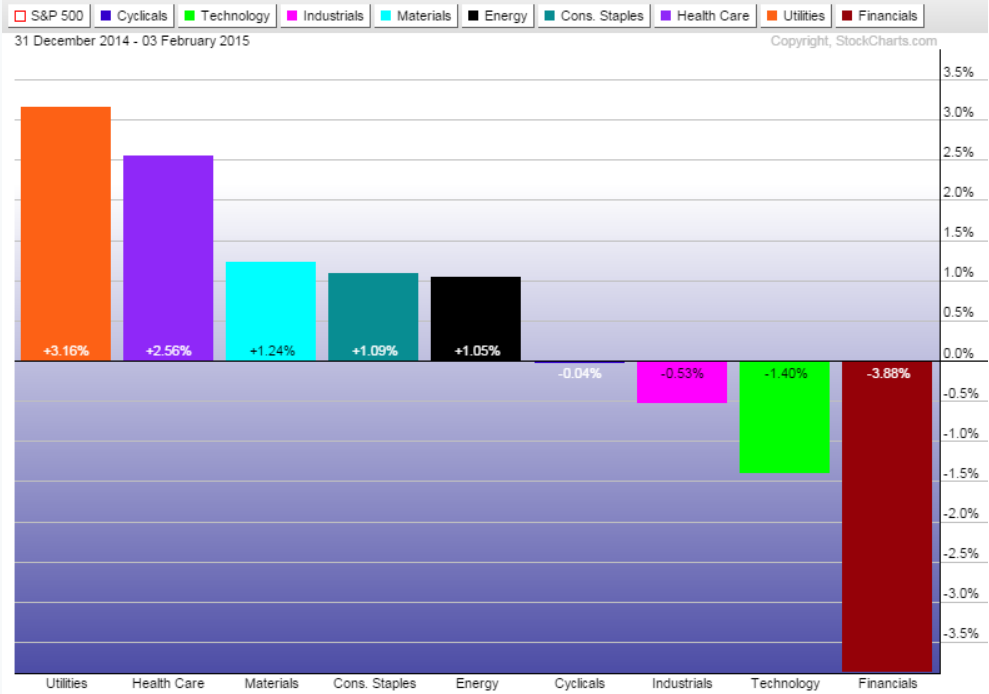

In sector funds, the last week was a reversal of the prior month. Utilities, healthcare and consumer staples fell as the rest of the market rebounded, led by energy and materials. Of all the sectors, financials was one of the weaker ones in January, yet it saw the smallest rebound. Year to date, energy is now up 1.05 percent and in the middle of the pack, while financials is down 3.88 percent.

These reversals are carrying into Wednesday trading. The market leading biotechnology sector, represented by IBB, is sliding more than 3 percent and helping to pull XLV down roughly 1.5 percent.

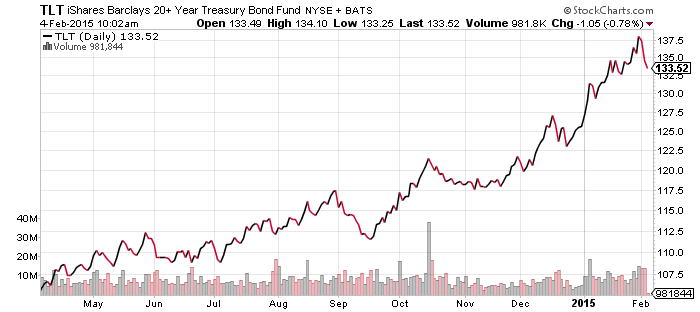

iShares Barclays 20+ Year Treasury (TLT)

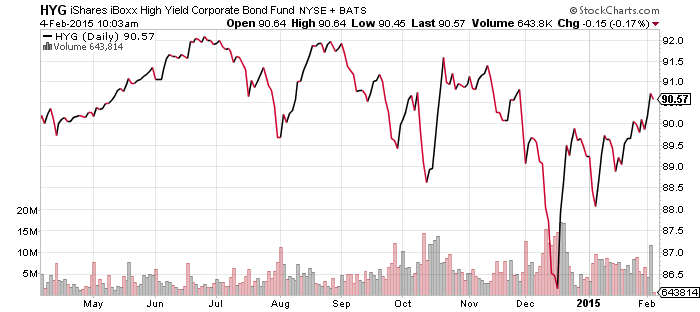

iShares iBoxx $ High Yield Corporate Bond (HYG)

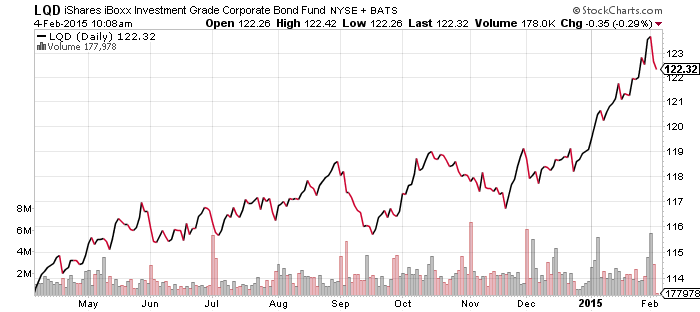

iShares iBoxx $ Investment Grade Corporate Bond (LQD)

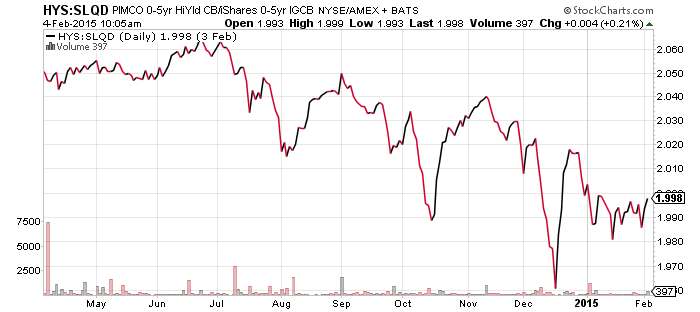

PIMCO 0-5 Year High Yield Corporate Bond (HYS)

iShares 0-5 Year Investment Grade Corporate Bond (SLQD)

TLT experienced a sharp reversal over the last week, but not before hitting a new all-time high.

LQD, which holds high quality corporate bonds, experienced a similar rally as investors bid up these higher yielding bonds. Based on the latest 30-day SEC yield, TLT yields 2.18 percent and LQD yields 2.98 percent.

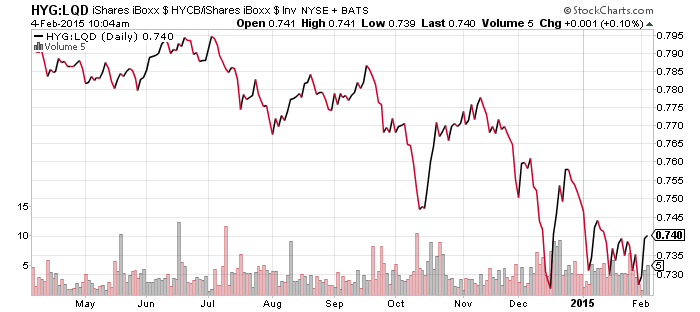

Although high-yield bonds are recovering nicely from their losses in prior months, they remain relatively out of favor. HYG yields 5.52 percent, but investors still leaned towards the lower yielding, higher quality bonds in the past month. This relationship held up for short-term high yield and investment grade debt as well. HYS yields 4.76 percent versus the 1.27 percent offered by SLQD.

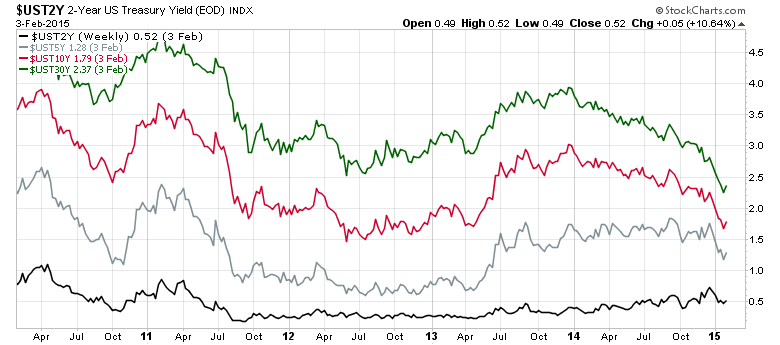

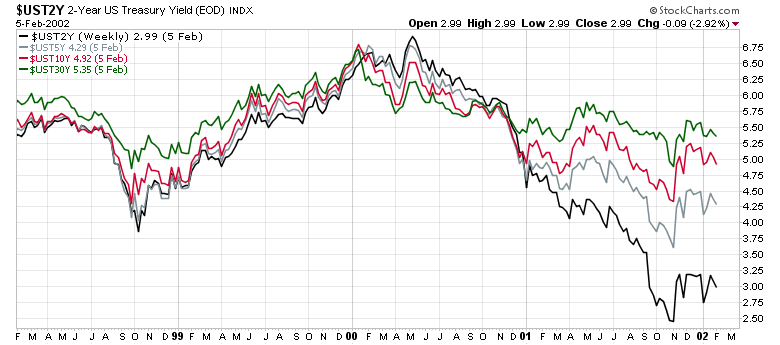

The best explanation for why high-yield hasn’t recovered as quickly is the flattening of the yield curve. As the chart below shows, the yields on 2-,5-,10- and 30-year Treasuries. When the spread between these rates narrows, it is taken as a warning of possible economic stress. This signal strengthens the more the spreads narrow, but generally speaking, investors don’t get worried about the economy until these lines converge or even reverse. An example is shown at the bottom. In the year 2000, yields were completely reversed, with the 2-year Treasury yielding the most and the 30-year yielding the least.

In conclusion, if these spreads continue to narrow, high-yield debt may continue to lag investment grade debt, but if these spreads widen, high-yield debt will likely outperform. High-yield will also benefit if oil prices rebound, since some of the stress in the sector was due fears over highly indebted shale oil producers.