iShares Barclays 20+ Year Treasury (TLT)

PowerShares DB German Bund Futures (BUNL)

PowerShares DB 3X Japanese Govt Bond Futures (JGBT)

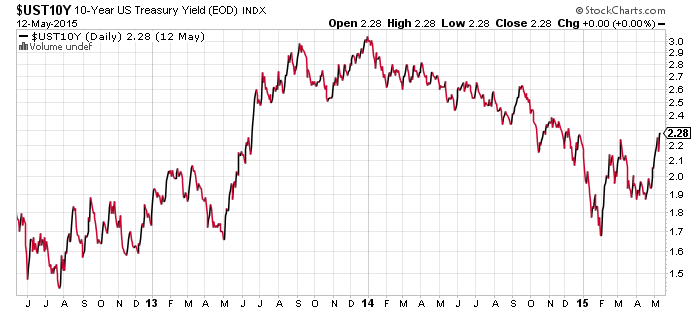

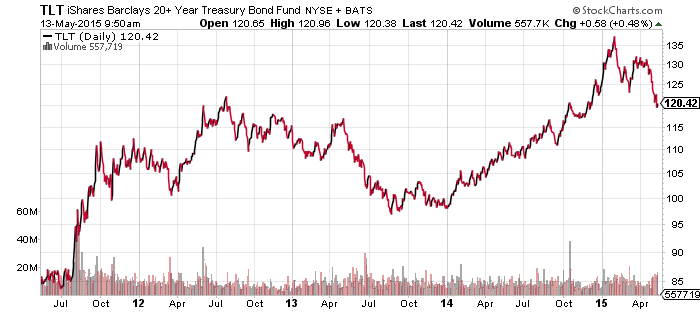

Bonds have moved to the top of the watchlist after a historic sell-off in recent days. The drop in U.S. treasuries has rattled the equity markets and held the S&P 500 Index in a trading range near its all-time highs. As the chart of the 10-year treasury yield shows, the increase to date is very small and the 10-year treasury yield is still in the downtrend begun at the start of 2014.

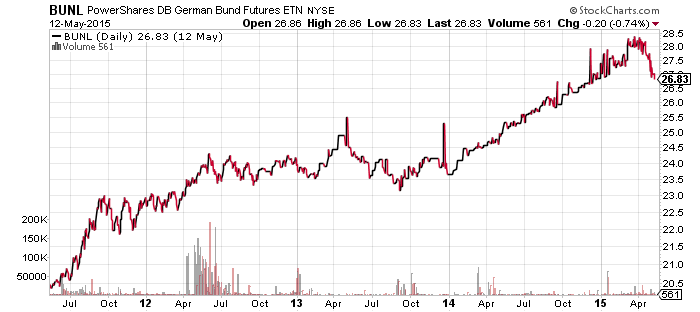

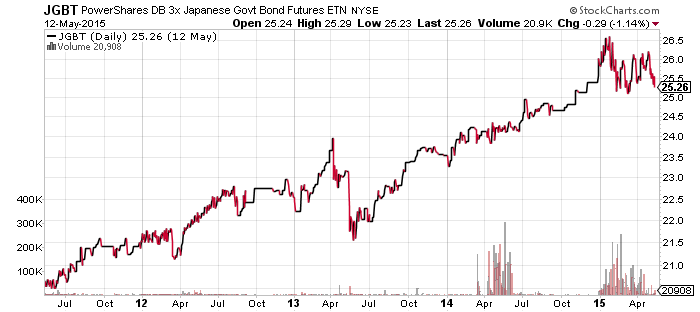

The center of the bond market selling was the German bund. The government bond was negative for shorter durations and near zero for long-term bonds. Bill Gross and Jeff Gundlach, two of the most high profile bond fund managers, both called German bonds a great shorting opportunity. Shortly thereafter, the bonds cracked and a wave of selling carried yields higher.

Looking ahead, the open question is whether this rally in yields is a reversal in the bond market’s trend since early 2014 or simply a short-term corrective move.

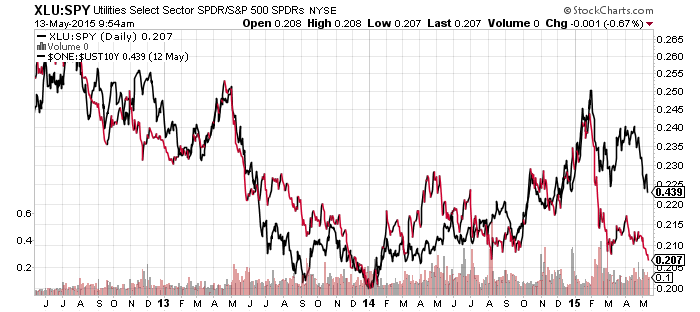

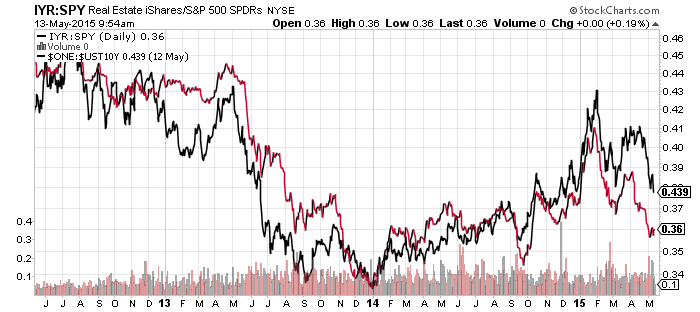

In terms of the main sectors, utilities are hurt by rising yields, financials are helped. Real estate is also hurt by the higher yields. In the charts below, the 10-year yield is compared to these three sectors; in the utilities and real estate chart, the 10-year yield is inverted.

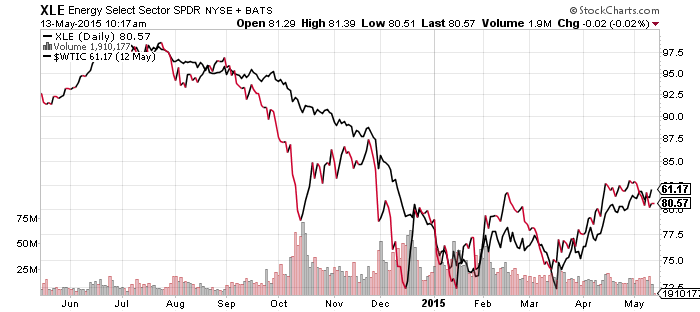

SPDR Energy (XLE)

FirstTrust ISE Revere Natural Gas (FCG)

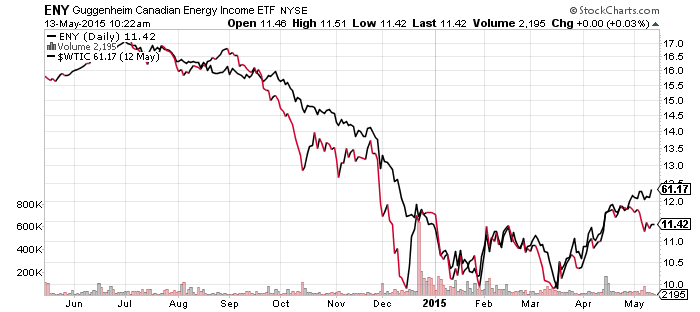

Guggenheim Canadian Energy Income (ENY)

Market Vectors Russia (RSX)

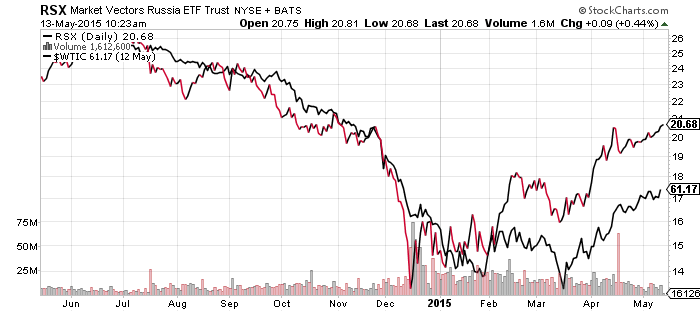

A drawdown in inventory has oil bulls pushing for another upward spike in the price of oil and reports that shale producers have blinked is contributing to the optimism. A new report from the International Energy Agency states the oil glut may persist though, because producers such as Russia, Brazil, Malaysia and China have adjusted to lower prices and their output is now rising.

Investors have been sticking with oil as it rises and falls, but lately the sideways action in the market has weighed on energy. If the stock market rallies this week and oil is flat, it is likely to be an outperformer. ENY has underperformed slightly, while RSX has outperformed thanks to the rally in the ruble. RSX is also on the verge of a breakout to the upside.

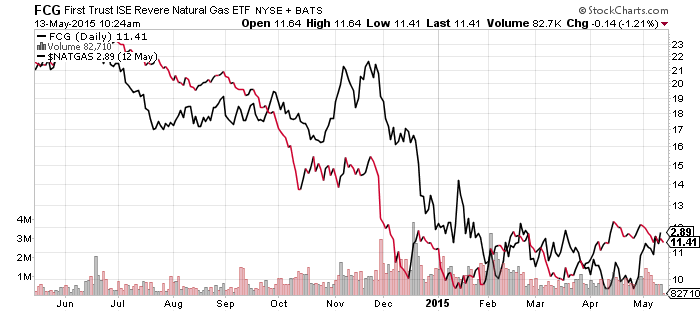

FCG has been weaker with natural gas trending sideways.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

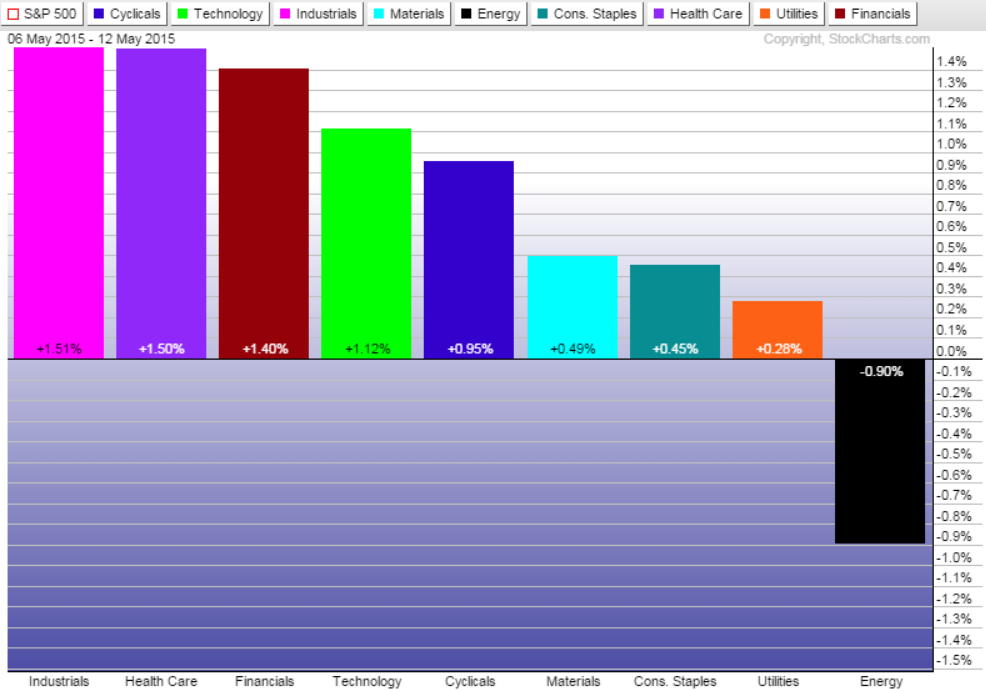

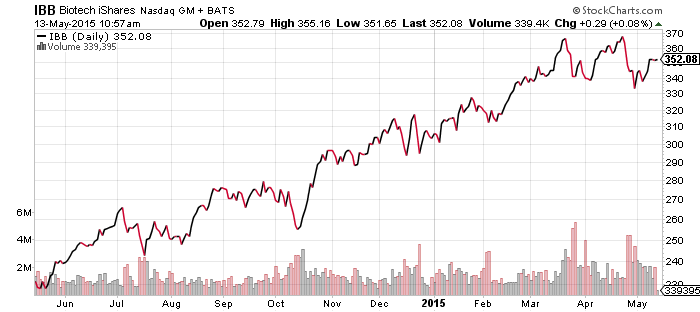

Industrials, healthcare and financials were winners over the past week, while energy was a laggard. Biotechnology rebounded as well, recovering from its mini-correction in late April.

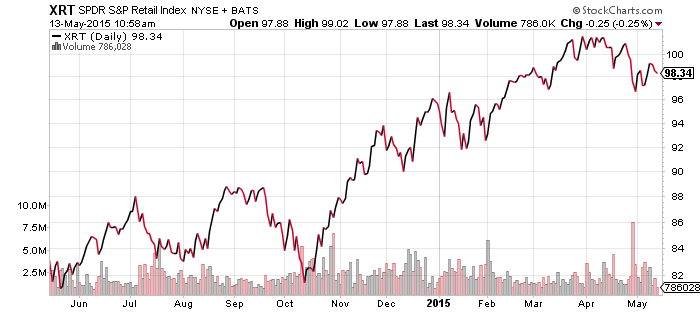

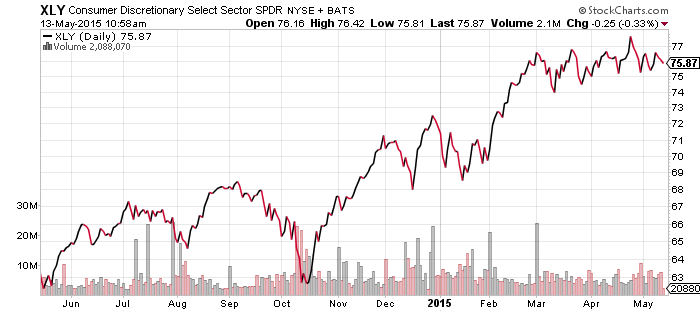

The retail sector is in focus today with retail sales out for April. Sales were flat from March, although March’s sales were revised upward to growth of 1.1 percent. One of the weak spots in the report was a 0.7 percent drop in sales at gas stations, which is a little surprising because sales tend to move in tandem with gas prices. The biggest decline came for department stores, where sales fell 2.2 percent from March. The bright spots were health and personal care, sports, online retail and food. All four were up 0.7 percent to 0.8 percent from March.

This week also kicked off earnings season for retailers. Macy’s (M) reported today and the numbers weren’t bad, but the April data is weighing on the sector. Kohl’s (KSS), J.C. Penney (JCP) and Nordstrom (JWN) report later this week.

PowerShares U.S. Dollar Index Bullish Fund (UUP)

CurrencyShares Euro Trust (FXE)

Global X FTSE Greece 20 (GREK)

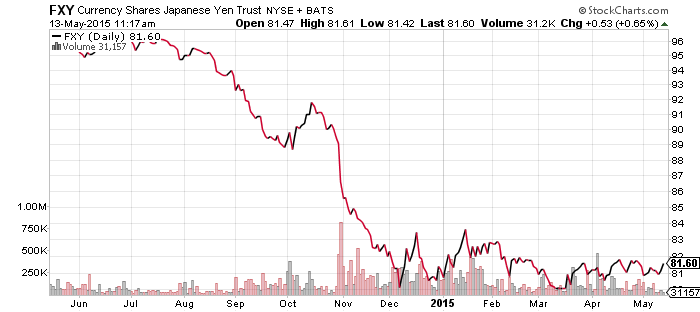

CurrencyShares Japanese Yen (FXY)

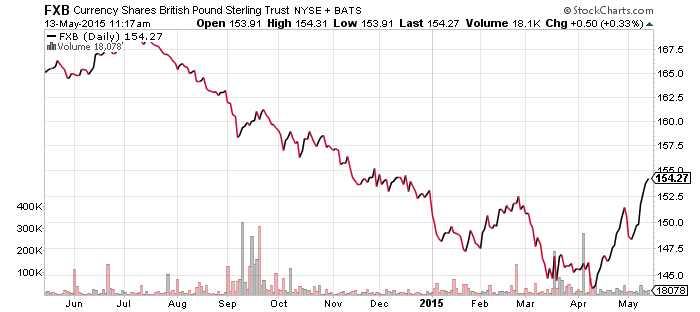

CurrencyShares British Pound (FXB)

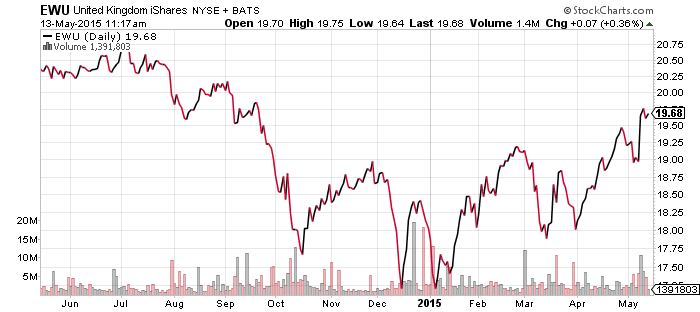

iShares MSCI United Kingdom (EWU)

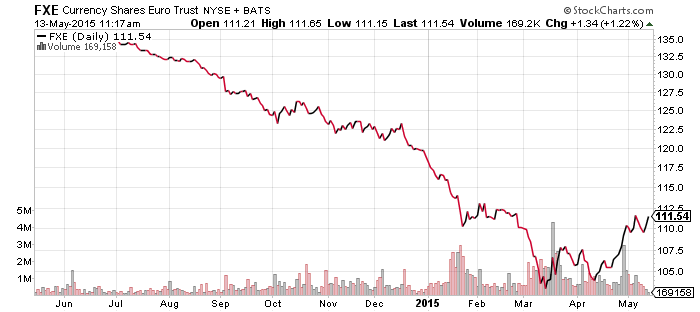

Greece is still making headlines but both the euro and Greek stocks have held up well. Greece had to make a $750 million debt repayment to the IMF this week and they didn’t have the money, so they tapped their special drawing rights (SDR) held at the IMF to pay the bill. These SDRs have to be replenished within a month though, and more debt repayments to other creditors are coming up. Clearly, the market does not expect a default at this time given the trend in the euro.

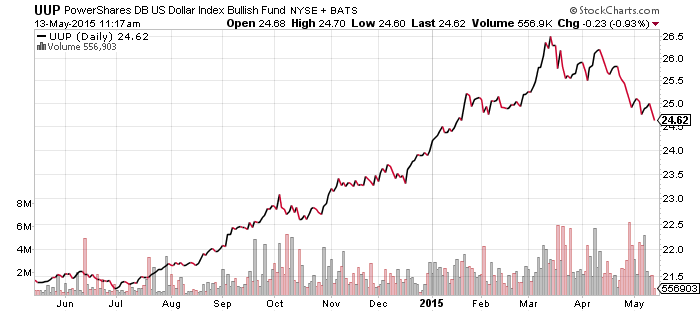

The U.S. dollar has been in a downtrend since topping in May which has continued today with the weak April retail sales report. The data has investors believing rate hikes are not imminent with the economy still under some pressure. A drop in UUP to between $23 and $24 a share would be a normal correction given the steep run up since July.

The British pound and the UK stock market both rallied sharply following Thursday’s surprise win by the Conservatives in the general election. Pollsters had been looking for them to lose, but as we noted last week, voters who were enticed by the UK Independence Party appeared to be moving back to the Conservatives ahead of the vote. In the end, the surprise result was the collapse of the Liberal Democrats and the Labour Party. The rise of the Scottish National Party, which nearly swept all of Scotland, robbed Labour of dozens of seats, while voters who abandoned Labour for UKIP did not return. Investors are pleased with the spending restraint shown by Conservatives and all of the opposition except for UKIP was proposing an increase in spending.

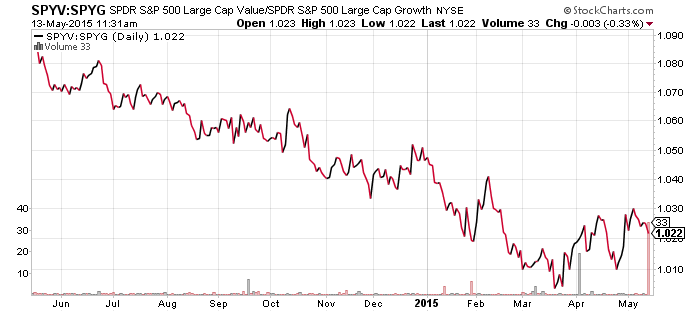

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

Value slipped versus growth in the past week, but for now the uptrend is intact. With rising interest rates and higher oil prices, and value relatively heavy on financials and energy, the outlook for continue outperformance is promising.

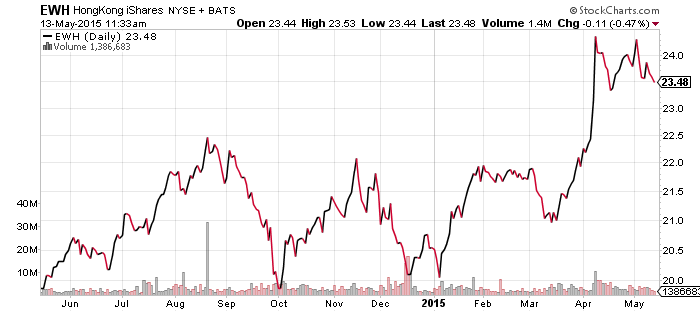

iShares MSCI Hong Kong (EWH)

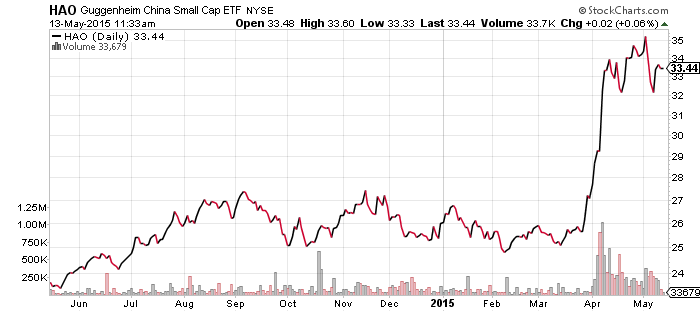

Guggenheim Small Cap China (HAO)

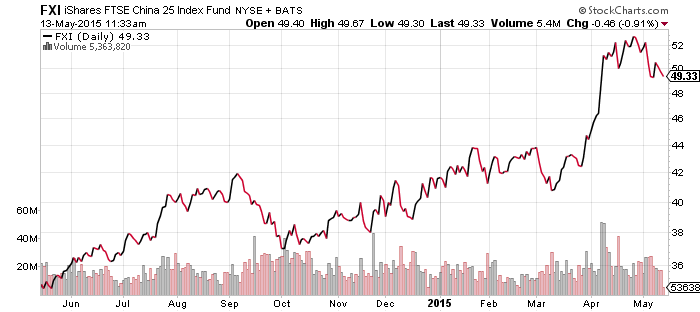

iShares China Large Cap (FXI)

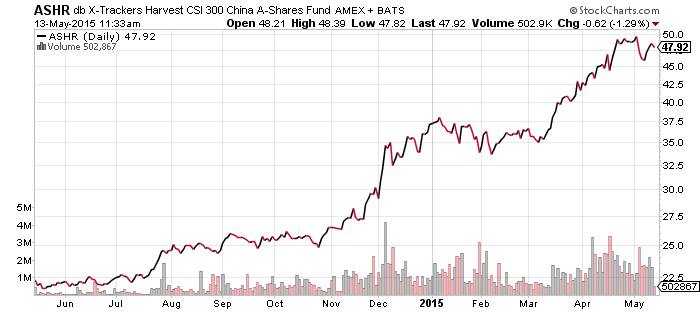

db X-Trackers China A Shares (ASHR)

The Chinese bull market has paused for a breather, with foreign investors becoming a bit more cautious. The PBOC surprised the market with a 0.25 percent interest rate cut on Sunday night as the country deals with a further slowdown in growth. Today, we learned that credit growth was slower than expected in April and real estate investment, a key contributor to growth, collapsed to near zero.

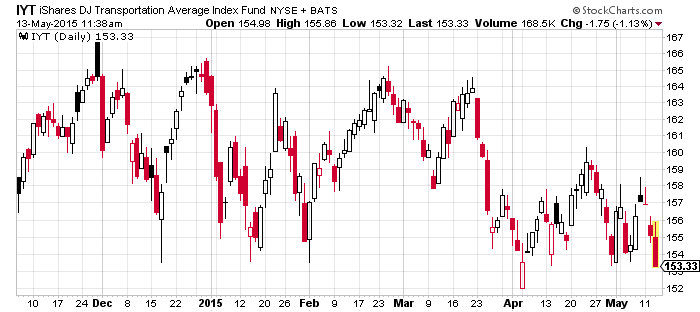

iShares DJ Transportation (IYT)

IYT remains in a tight trading range. In early Wednesday trading, IYT is below its closing low in April, but is still above the intraday low of $152. A move lower could break the fund out of the current range and send it into the mid $140s.

SPDR S&P 500 (SPY)

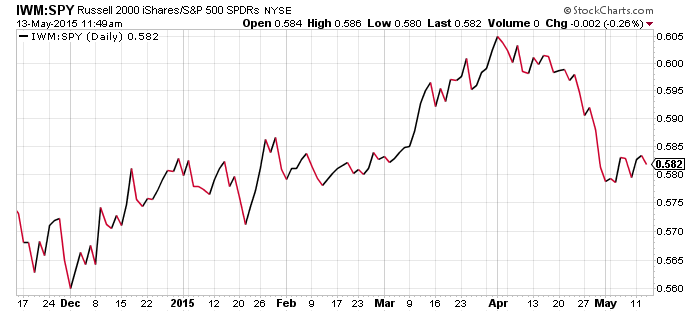

iShares Russell 2000 (IWM)

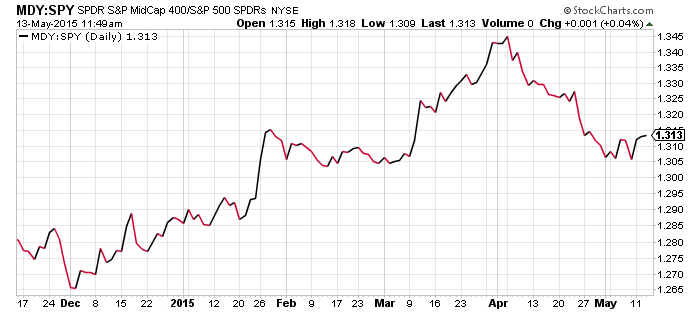

S&P Midcap 400 (MDY)

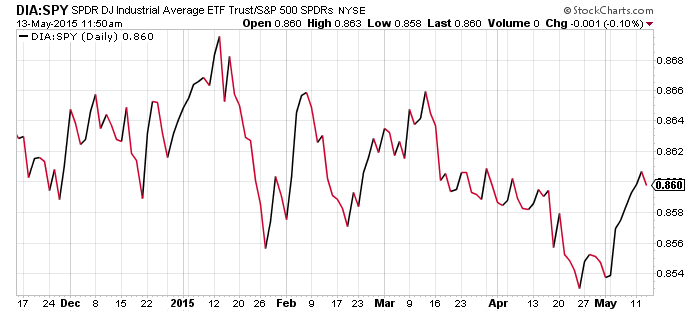

SPDR DJIA (DIA)

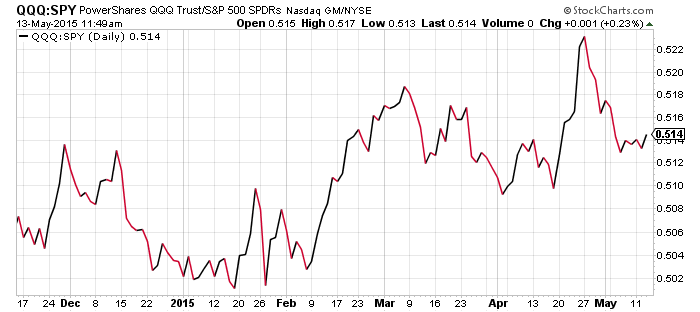

PowerShares QQQ (QQQ)

Mid-cap, small-cap and technology stocks have also stabilized in May following a short pullback relative to the S&P 500 Index last month. The Dow Jones Industrial Average has rallied strongly in May thanks to rising interest rates lifting the financial sector, along with the strong performance from the industrial sector. As the relative price of DIA to SPY shows, the Dow has been a laggard and remains the worst performing index year-to-date.