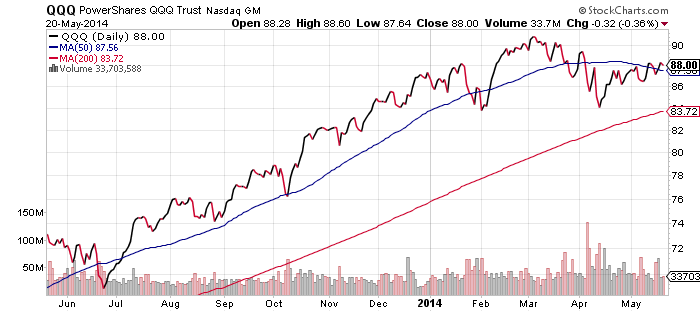

The NASDAQ continues its slow recovery, seen below in the PowerShares QQQ (QQQ). The broader S&P 500 Index and Dow Jones Industrial Index failed in their breakouts to new highs, but the Nasdaq is slowly healing its wounds.

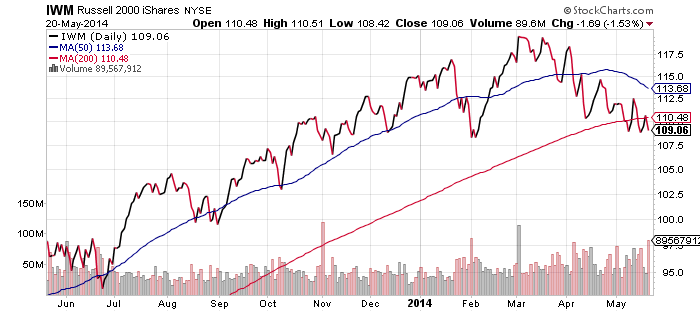

iShares Russell 2000 (IWM)

The Russell 2000 is currently below its 200-day moving average and has failed to break above it in the past week. While the weight of the evidence favors a rebound in stocks over the intermediate and long-term, the short-term picture is much less bullish. Until IWM and the Russell 2000 climb above their 200-day moving averages, active investors need to keep a close eye on the index.

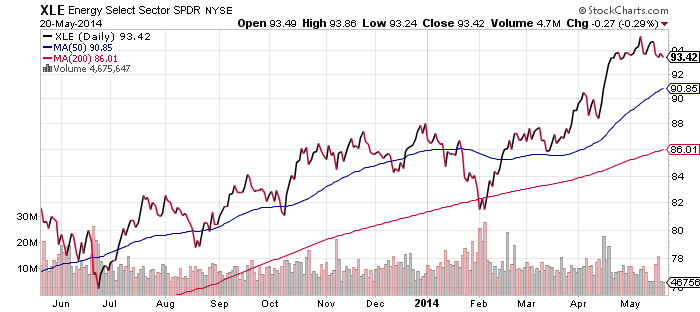

SPDR Energy (XLE)

Energy has flat lined after peaking in mid-April. What is of concern over the very short-term is volume; while volume was high during the April rally, recently it has been weaker except for down days. This is a sign over next week if the trend continues.

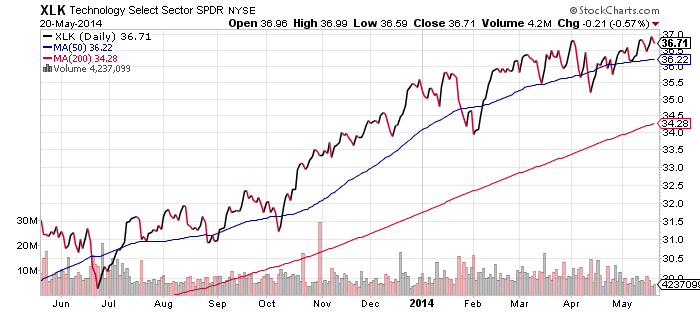

SPDR Technology (XLK)

On the bullish side, XLK has climbed to new highs even though the Nasdaq has not. This signals the strength of the bull market – were XLK as weak as the Nasdaq it would indicate a broader trend was underway. It’s important to keep in mind XLK is 15 percent Apple (AAPL) and the firm’s shares have done very well in the past month.

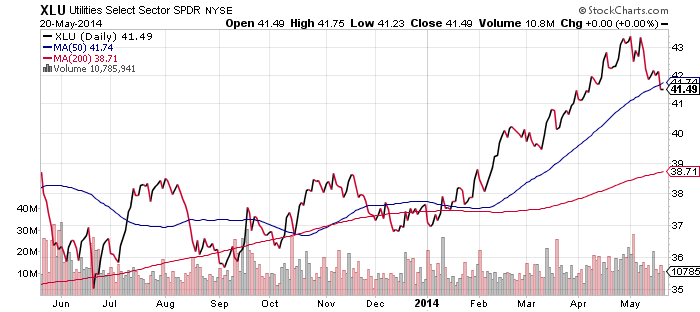

SPDR Utilities (XLU)

Utilities remain weak and the odds of the sector moving from a long-term market underperformer to leader are diminishing along with the price of XLU. Market Vectors Coal (KOL)

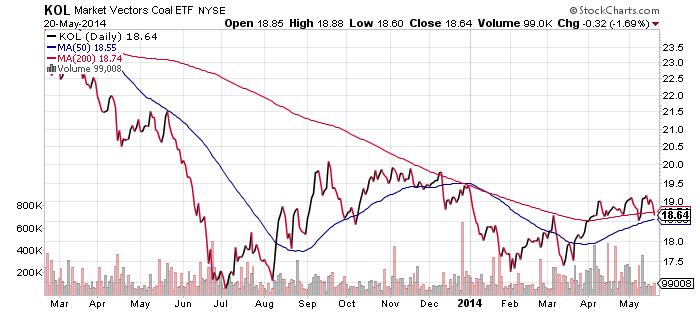

Market Vectors Coal (KOL)

Over the past week KOL has declined in price, but heading into Wednesday trading it is still in a short-term uptrend. As long as KOL can stay above its 50-day moving average, the recent bullish action can be expected to continue. The next step would be for the 50-day moving average to cross above the 200-day moving average. As can be seen, such a breakout failed in late 2013 and into early 2014.

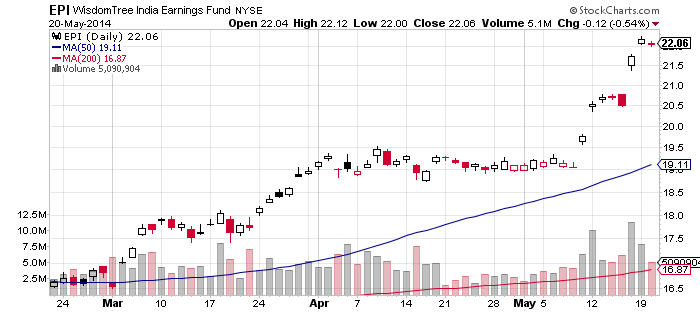

WisdomTree India Earnings (EPI)

WisdomTree India Earnings (EPI)

As can be seen in the chart below, Indian equities have gone on an incredible run in wake of election results that gave the Bharatiya Janata Party (BJP) a landslide victory. Although results show the party won less than a third of votes, it was enough to give them the first absolute majority in parliament since 1984. Along with their allies, the party controls over 60 percent of parliament. The pro-business agenda of the BJP is what has investors excited, but a near-term a pullback is likely give the recent outperformance.

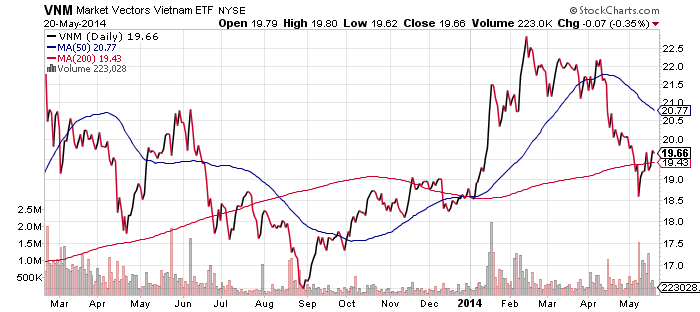

Market Vectors Vietnam (VNM)

A potential military conflict with between Vietnam and China spooked investors. The situation in Southeast Asia has been escalating for several years. China continues to assert sovereignty over islands that are claimed by Vietnam, Malaysia, Indonesia, Japan and the Philippines. Although China’s economy is strong and dominates the region, it also needs to work alongside their neighbors. Even if there is no military conflict, with U.S. support these nations could take steps to hurt China economically.

These are long-term concerns though. In the weeks ahead we’re likely to see a solid bounce in VNM as fears of an imminent military conflict fade.

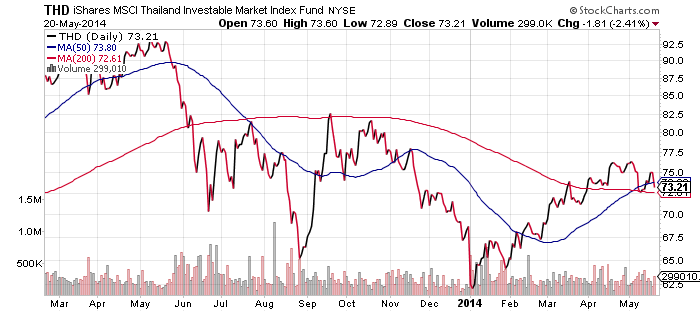

iShares MSCI Thailand (THD)

Thailand has also experienced some non-economic related turmoil in recent weeks. The highest court in the country forced the prime minster to resign and the military has declared martial law. Interestingly, THD shows investors aren’t worried about these events. Thailand has a volatile political history, but the still extant monarchy remains a force for stability. If Thai stocks do sell-off on political concerns, it will likely be a buying opportunity.