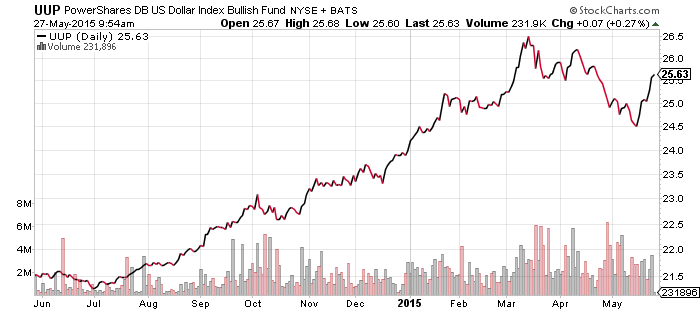

PowerShares U.S. Dollar Index Bullish Fund (UUP)

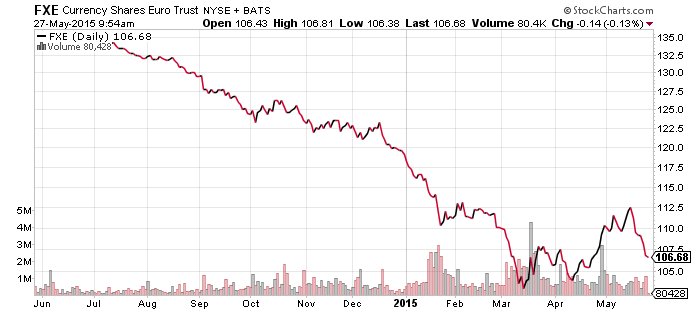

CurrencyShares Euro Trust (FXE)

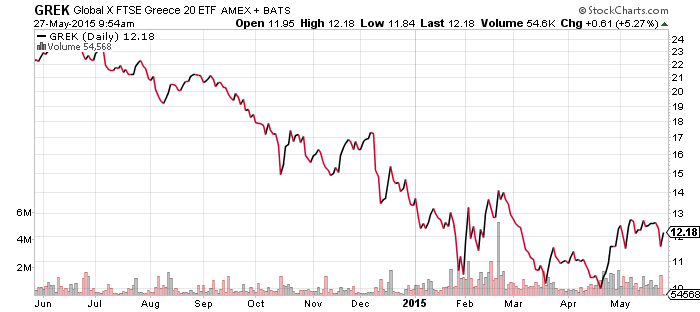

Global X FTSE Greece 20 (GREK)

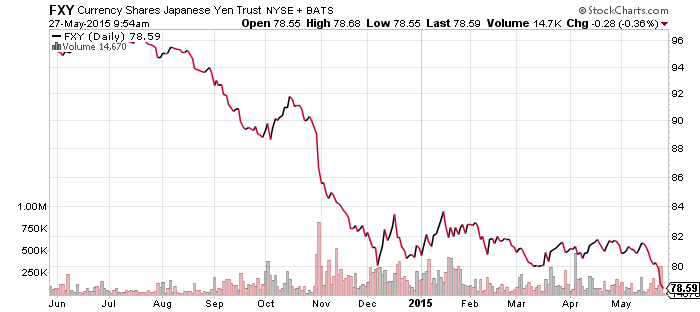

CurrencyShares Japanese Yen (FXY)

Currencies will be the dominant factor in the market over the next week, if not for several weeks depending on how things shake out in Europe. Greece has all but said it will default on its IMF debt payment. It owes 310 million euros to the IMF on June 5. More payments to the IMF follow: on June 12, it owes 348 million euros; June 16 it must repay 581 million euros; and on June 19, must repay 348 million euros. On June 30, the bailout extension expires. If Greece cannot meet next week’s payment, a series of defaults are coming in the absence of a new bailout agreement. In July there is another large debt payment to the IMF, then the big repayment comes in August: 4 billion euros in Greek government bonds mature.

Investors are expressing their concern over Greece in the currency market, where the euro has slumped from $1.14 to $1.08. Both the euro and GREK are above their lows for the year, so “the market” doesn’t think Greece will actually default, or they believe a default to the IMF won’t be a major issue. Rumors of a deal on early Wednesday caused a small spike in the euro, oil, S&P 500 Index and 10-year Treasury yields. Expect the opposite if Greece does head for default.

From the perspective of the euro, it doesn’t yet signal a new leg up in the U.S. dollar bull market, but the view from the yen does. Yesterday, the yen broke below its 52-week low versus the U.S. dollar. Since the yen began weakening in 2012, it has experienced a series of rapid devaluations followed by a period of calm. The yen is a much smaller component of the U.S. Dollar Index, less than one-quarter the weight of the euro.

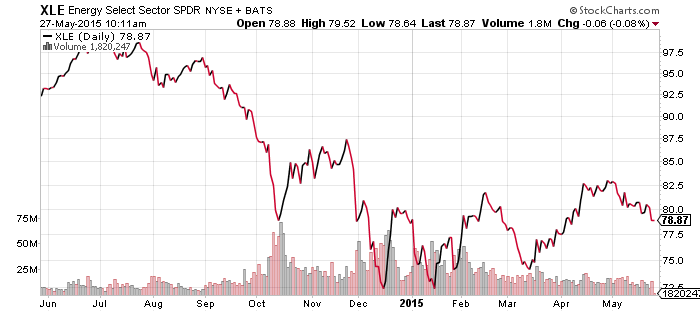

SPDR Energy (XLE)

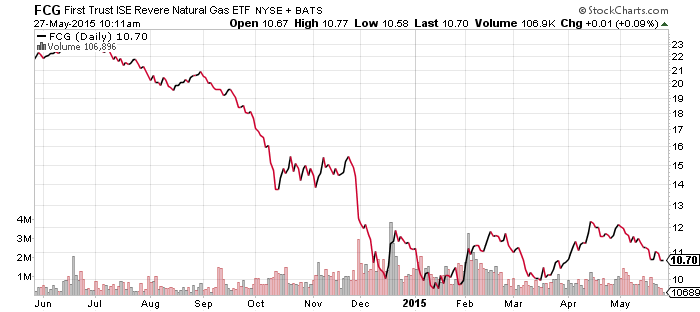

FirstTrust ISE Revere Natural Gas (FCG)

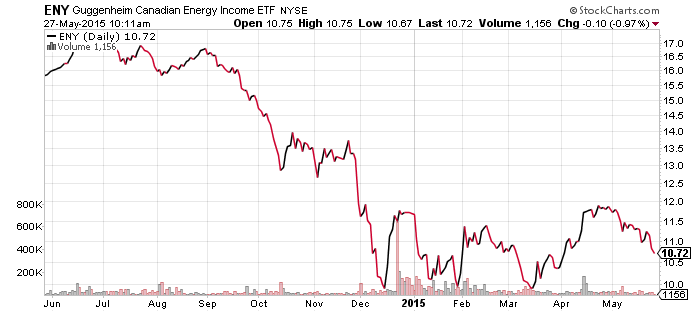

Guggenheim Canadian Energy Income (ENY)

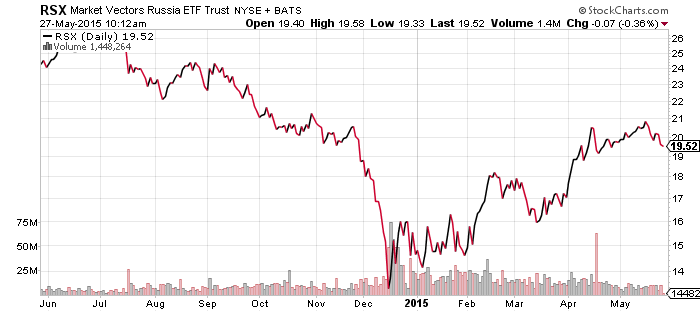

Market Vectors Russia (RSX)

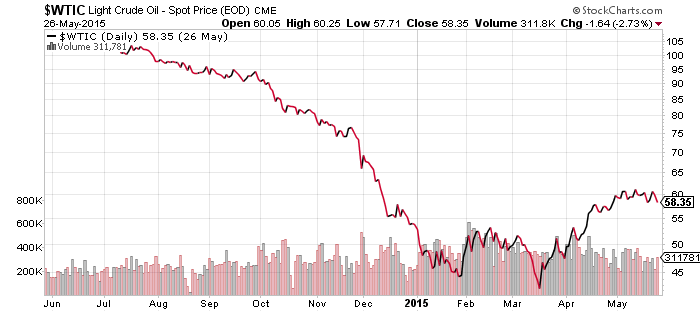

Last week, we said oil prices appeared to be peaking, and that was indeed the case. Crude oil is a few dollars below levels hit in early May following an uptick in the U.S. dollar. Energy has been acting as a brake on the stock market in May and is one main reason why the index hasn’t pushed higher.

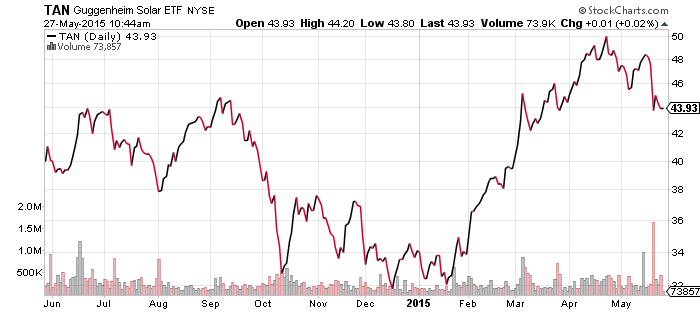

Guggenheim Solar (TAN)

Last week, Hanergy blew a hole in TAN’s valuation. Since then, the index provider has decided to kick the stock out of the index, but with Hanergy shares suspended, that can’t be done. Hanergy isn’t as important to the fund now, falling from 12 percent of assets to a current 6.28 percent, but it is still the fourth largest holding.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

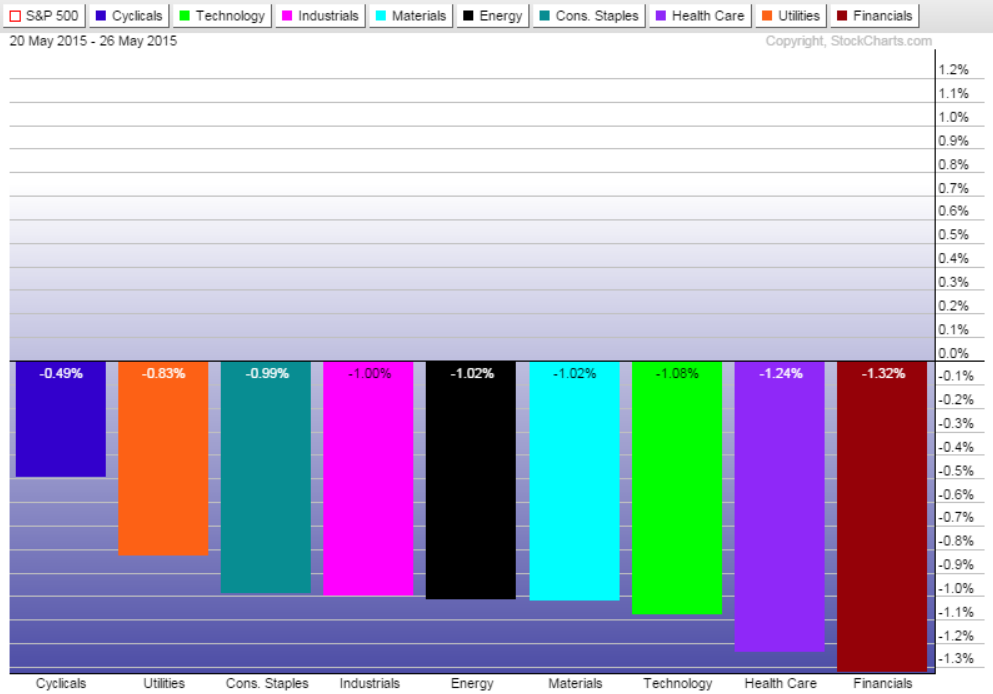

Stocks headed lower over the last week, with almost all of the losses coming on Tuesday. Financials led the way down after long-term interest rates came off their recent highs.

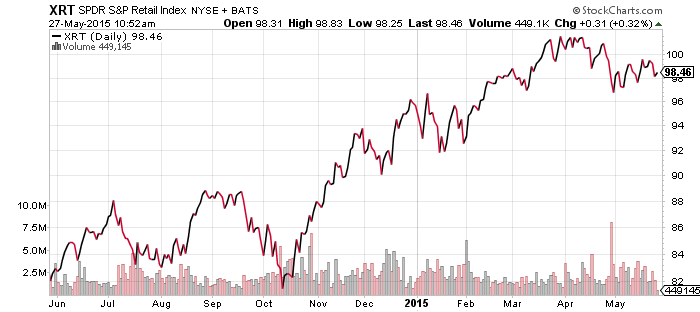

Retail earnings season has been mixed, with Autozone (AZO) down this week and Tiffany’s (TIF) up sharply following their earnings report. Consumer discretionary remains in an uptrend though.

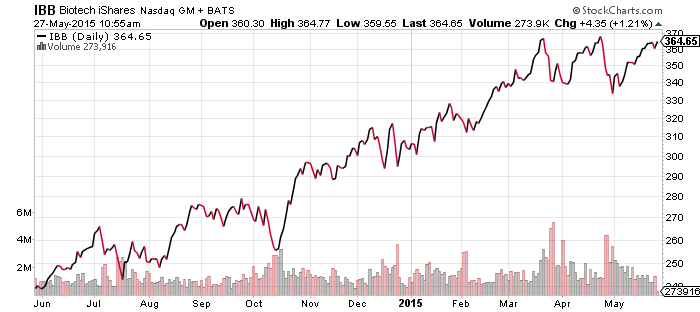

Biotechnology is slowing marching back to its all-time high. The sector may be tracing out a head-and-shoulders pattern, which would have a target price down around $310. For now, the most likely scenario is a push to new highs.

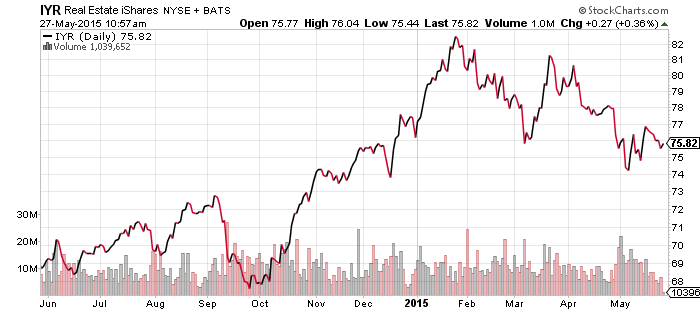

The real estate sector has been hardest hit by rising interest rates and it remains in a clear downtrend.

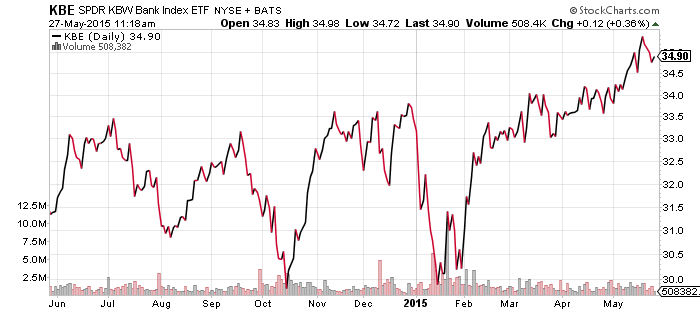

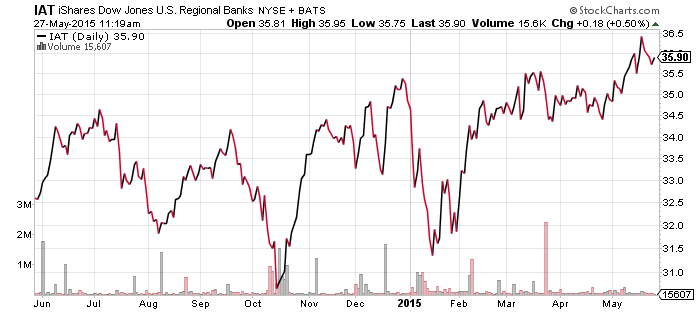

Banks are among the strongest stocks in the market now, thanks to the rally in interest rates and positive economic data that seems to be increasing the odds of a September rate hike.

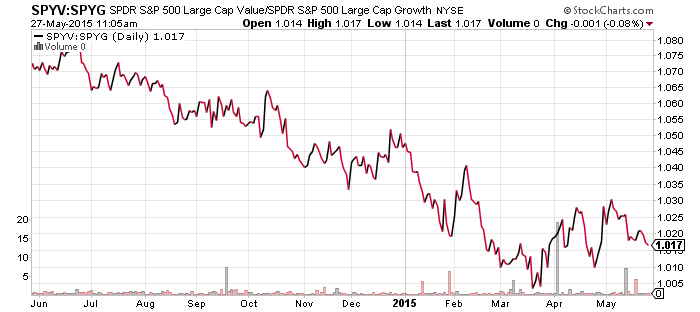

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

Value continue to struggle versus growth. Consumer cyclicals and technology have been among the better performers lately, while the energy sector is pulling value lower.

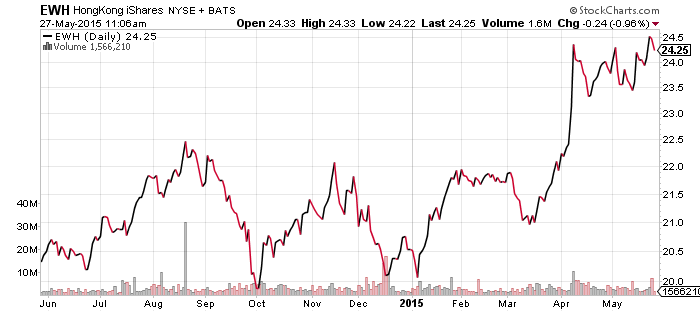

iShares MSCI Hong Kong (EWH)

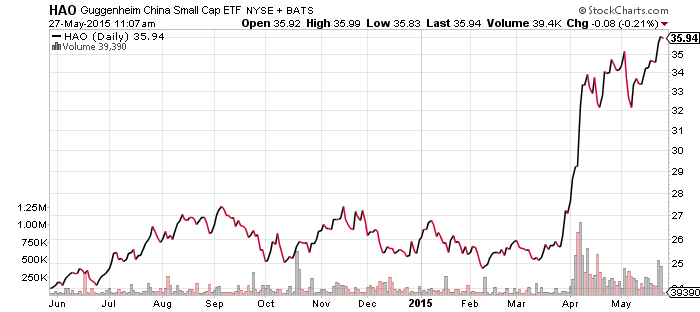

Guggenheim Small Cap China (HAO)

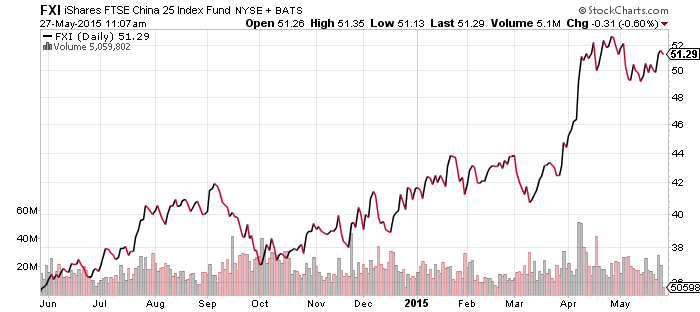

iShares China Large Cap (FXI)

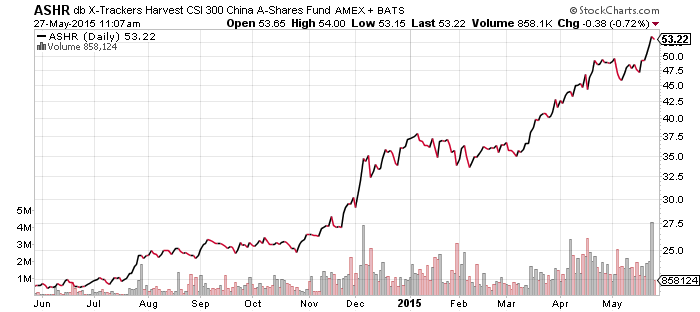

db X-Trackers China A Shares (ASHR)

The Shanghai and Shenzhen markets broke out to new 52-week highs last week, fueled by stimulus policies and ongoing reforms. Starting July 1, Chinese and Hong Kong mutual funds will be open to investors across borders. This could lead to another large inflow of capital, and investors are front-running the opening.

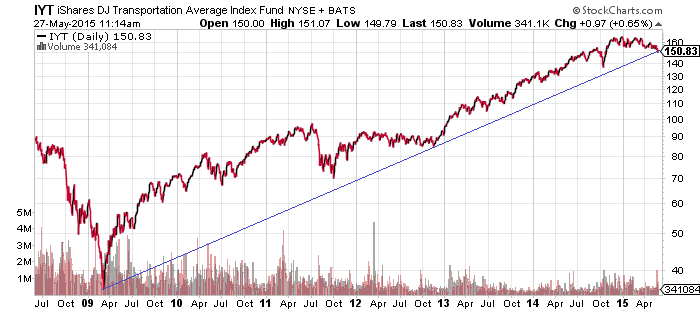

iShares DJ Transportation (IYT)

IYT broke out of its trading range yesterday, to the downside. The drop not only ends a six month trading range, but it broke the trend line that has served as support since the 2009 bottom. For the moment, this is one of the weakest parts of the market.

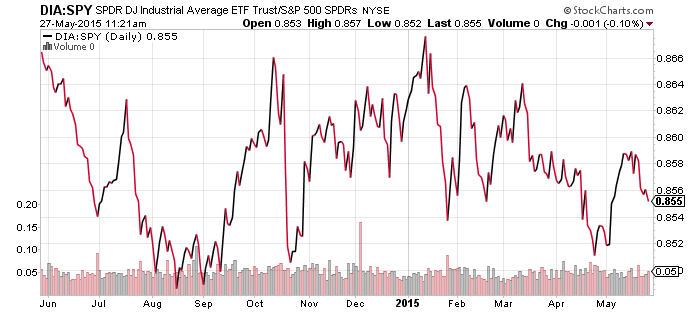

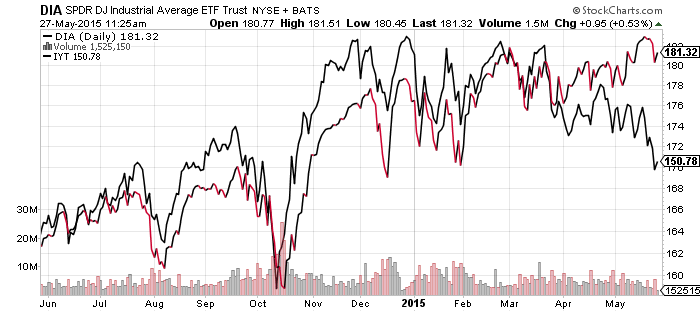

The dip in transports has followers of Dow Theory on the watch for further declines. The Transports and the Industrial Average tend to move in tandem and a divergence always resolves itself. The last significant divergence was in late 2012. Transports declined for the entire year, but when the broader market rebounded in November of that year, transports followed it higher. With stocks in a bull market, odds are transports will rebound, but technical traders are on alert in case divergence resolves with weakness in the Industrial Average.

SPDR S&P 500 (SPY)

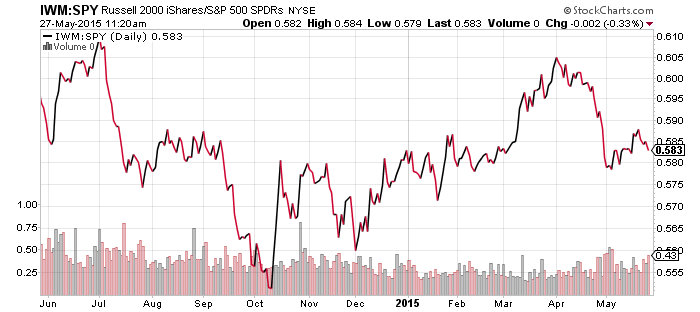

iShares Russell 2000 (IWM)

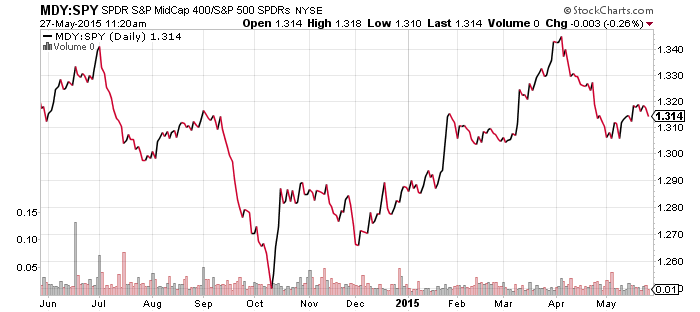

S&P Midcap 400 (MDY)

SPDR DJIA (DIA)

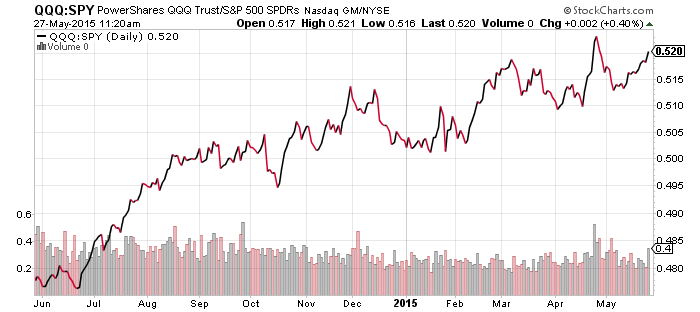

PowerShares QQQ (QQQ)

Mid- and small-cap stocks are still keeping pace with the broader market, while the Dow Jones Industrial Average underperformed and the technology heavy Nasdaq is leading the markets higher. The strength of the financial sector is good news for the Russell 2000, which has 23.4 percent of assets in this sector. Fundamental support for small-cap leadership is building, but it may take a breakout to new highs by the indexes.