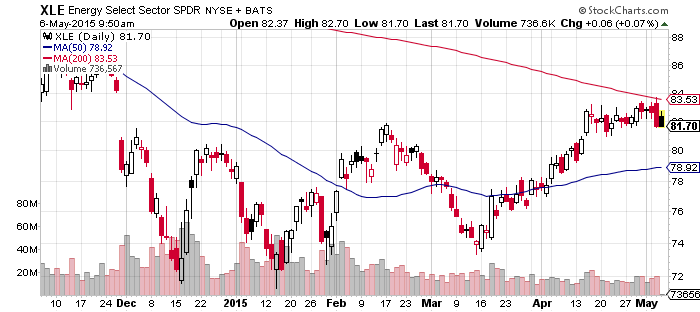

SPDR Energy (XLE)

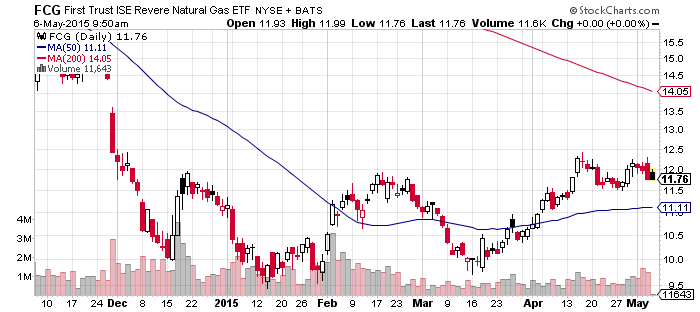

FirstTrust ISE Revere Natural Gas (FCG)

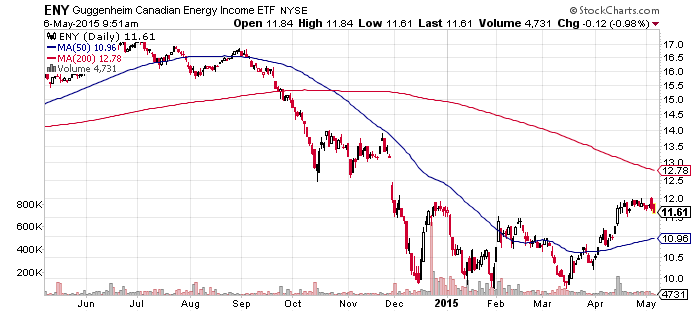

Guggenheim Canadian Energy Income (ENY)

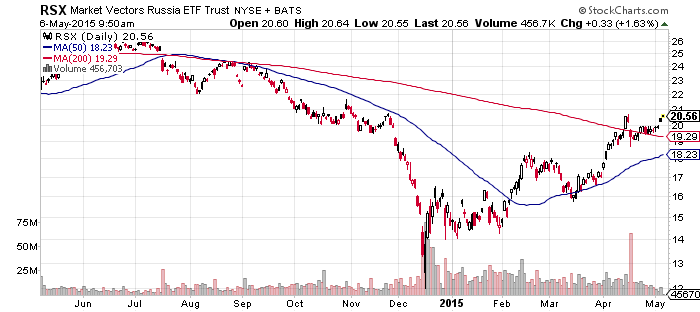

Market Vectors Russia (RSX)

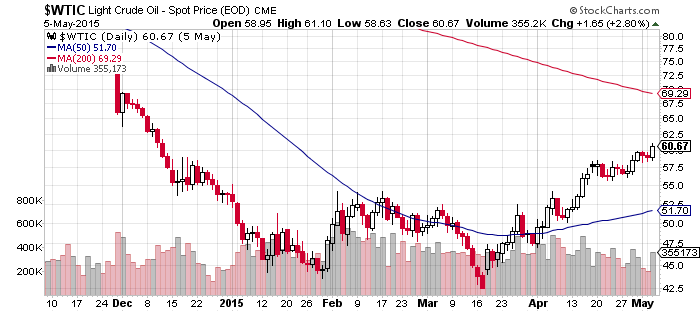

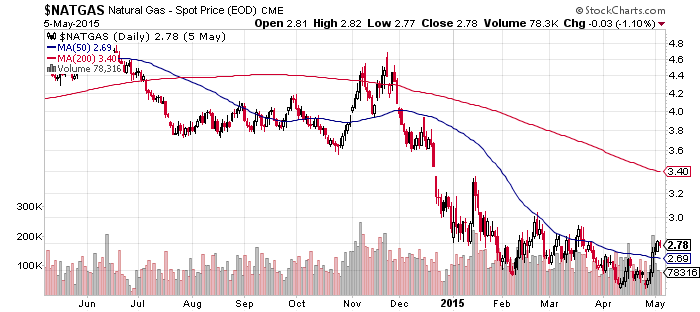

West Texas Intermediate Crude broke the $60 level on Tuesday as news of a decline in inventory sparked buying. Inventory had been rising almost non-stop in 2015, but recently there have been a drawdown, signaling the build may be peaking with the summer driving season just around the corner. Looking at short-term momentum, oil appears to be topping out. However, the break of $60 is important because there is minimal resistance above this level. While a rapid advance is unlikely, the outlook for oil is now bullish.

Equity funds are similarly positioned for extended bullish moves. RSX is in a resistance zone now and a push higher will signal another bullish breakout. Some funds such as FCG and ENY have large gaps in the chart made back in December. Those could also prove to be areas of resistance.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

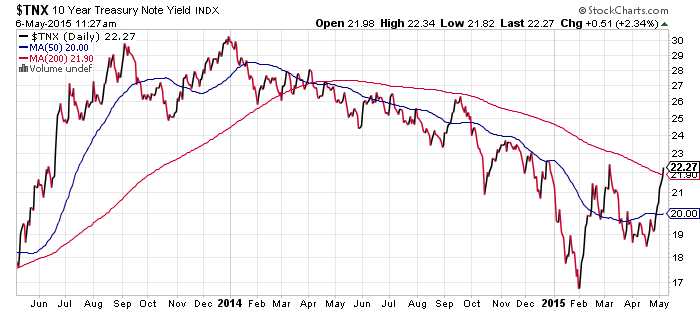

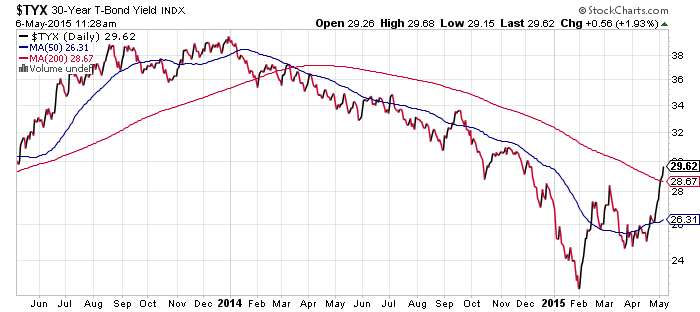

The pop in interest rates last week lifted the financial sector; it was the only S&P 500 sector to advance. Interest rates were lifted by strong jobs data as well as rising yields in German government bonds. Yields are on the cusp of a serious breakout that could be good news for financials, but possibly bad news for the broader market as rapidly rising yields make investors jittery.

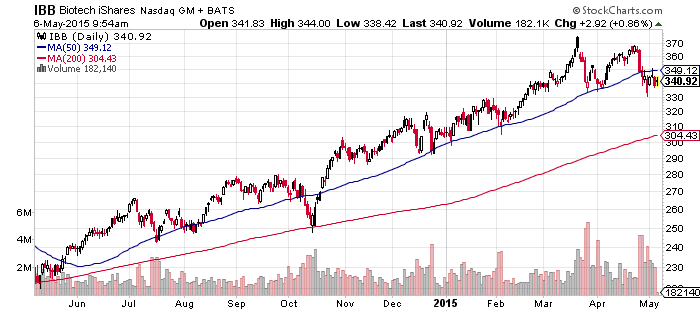

Biotechnology is hugging its 50-day moving average after settling over the past week. This line has served as support and we’d look for a recovery here. The next level of support is the 200-day moving average, should the selling pick up again.

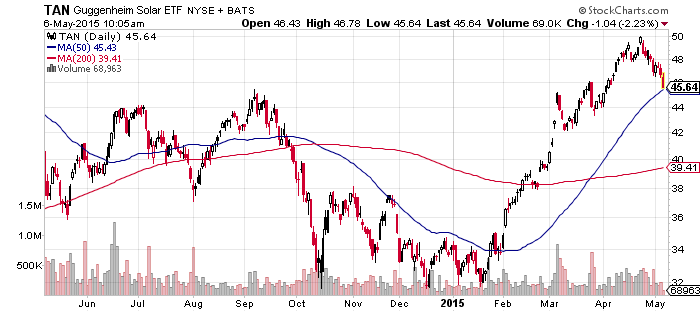

Guggenheim Solar (TAN)

Solar finally pulled back and is starting to consolidate after a very strong run from January through April. A test of the 50-day moving average is underway today. If TAN doesn’t fall below $44, it would signal this fund has significant support.

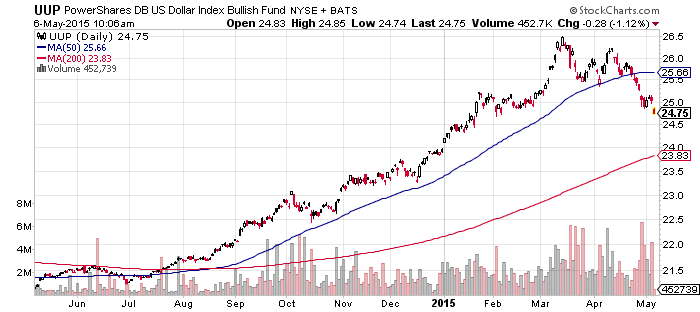

PowerShares U.S. Dollar Index Bullish Fund (UUP)

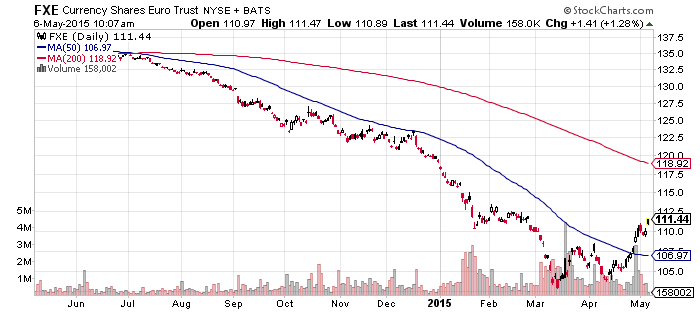

CurrencyShares Euro Trust (FXE)

Global X FTSE Greece 20 (GREK)

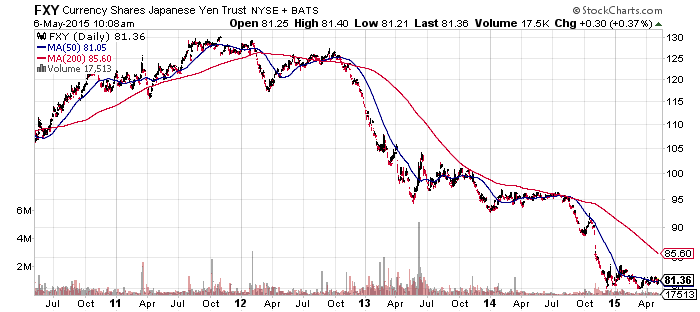

CurrencyShares Japanese Yen (FXY)

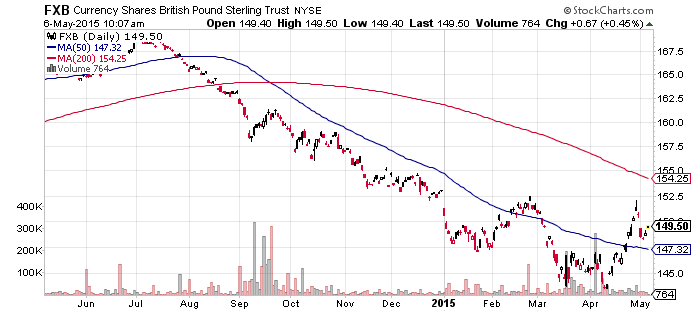

CurrencyShares British Pound (FXB)

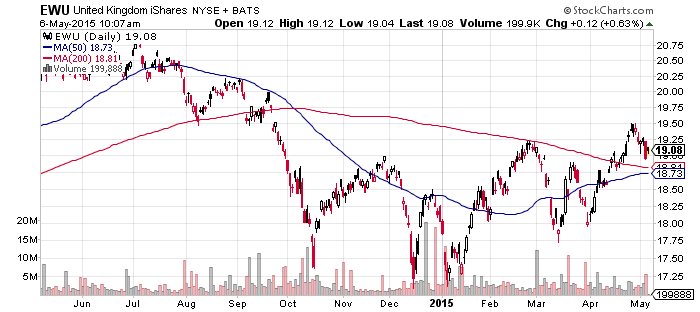

iShares MSCI United Kingdom (EWU)

Greece’s debt problems remain in the headlines as creditors are refusing to give the country aid until they’re satisfied with reforms. This has happened several times before, but it looks like things might be coming to a head as Greece is considering a tax on cash withdrawals from banks in a bid to stop money from exiting the financial system. Greek citizens are hoarding euros on concern the country will be effectively forced out of the eurozone.

With Greece as close to leaving the Eurozone as it has ever been, one might expect the euro to be falling. Instead it is rising to a new multi-week high. On the other side is the U.S. dollar, which is making a new multi-week low.

The yen remains locked in a trading range. Looking back over the past few years you can see the stair-step pattern. Whether the dollar continues to correct or stages another bull run may hinge on the yen’s next move.

There’s nothing particularly interesting about the pound or UK market this week, but there is a major election tomorrow that could change the balance of power. The final poll before the election shows the Conservatives with a very slight edge over Labour, but still within the margin of error. Parliamentary elections are similar to House elections in the United States, so national vote totals are not as important as winning individual seats. The main trend evident in the polls is that disaffected Conservative voters who were supporting the UK Independence Party appear to have shifted back in order to prevent a Labour victory. If the Conservatives win, there’s no change in UK policies, while a win by Labour would be seen as a rejection of “austerity” policies which have been in place over the past few years.

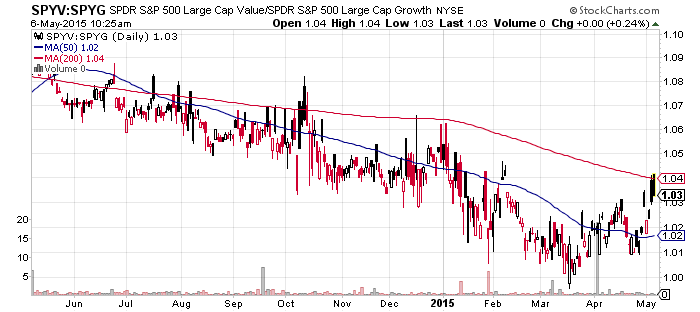

SPDR S&P 500 Large Cap Value (SPYV)

SPDR S&P 500 Large Cap Growth (SPYG)

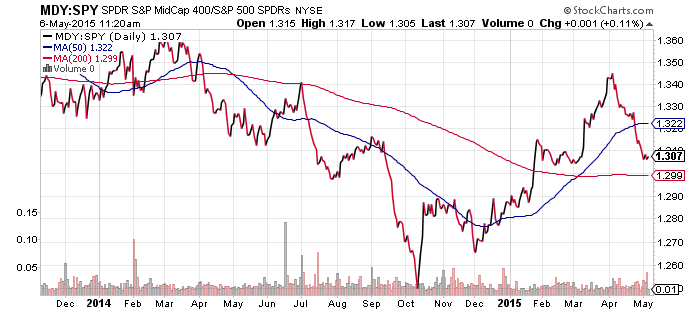

The move in financial stocks last week has pushed the value-to-growth ratio up to its 200-day moving average. This is very close to being a serious trend change. This reversal is being driven by the rise in financials, recovery in energy and the recent drop in healthcare and technology. Energy can continue to rebound strongly if oil prices rise, even though it wouldn’t signal long-term leadership. Financials is more interesting because a shift to rising rates would be a major turn for the market.

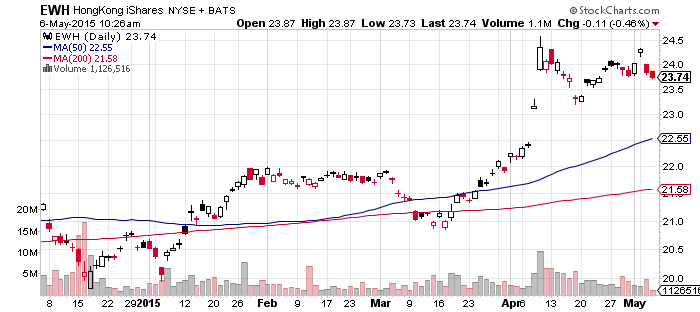

iShares MSCI Hong Kong (EWH)

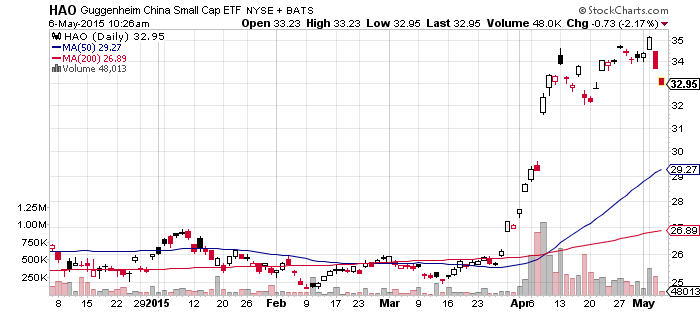

Guggenheim Small Cap China (HAO)

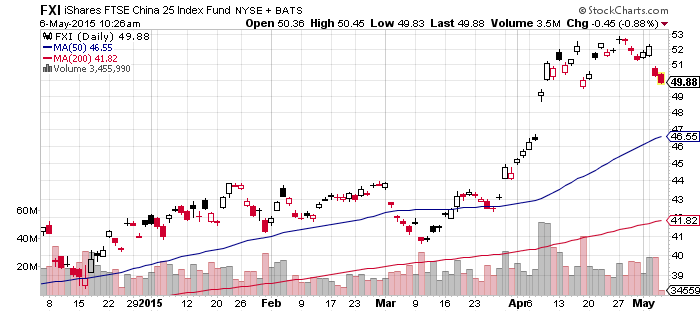

iShares China Large Cap (FXI)

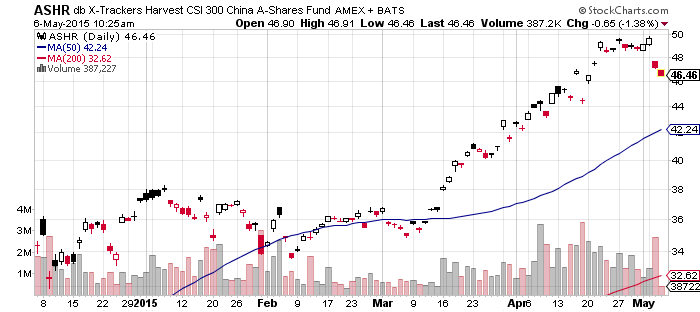

db X-Trackers China A Shares (ASHR)

China’s A-share market slumped 4 percent on Monday as various worries, typical of a market that has climbed over 100 percent in less than a year, blossomed. The Chinese market is floating on emotion and this type of volatility is not surprising for a market dominated by amateur investors. Given the preceding run-up, a correction of as much as 20 percent would not be remarkable.

iShares DJ Transportation (IYT)

IYT is in a trading range, but close to breaking down. A break below the April low would open up more selling. The rise in oil prices is a bullish sign in general because higher prices usually accompany faster growth, but in the very short-term, investors may sell transportation stocks on concern that higher oil prices also mean higher costs.

SPDR S&P 500 (SPY)

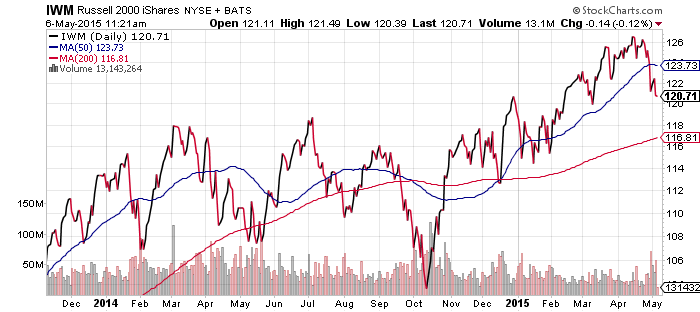

iShares Russell 2000 (IWM)

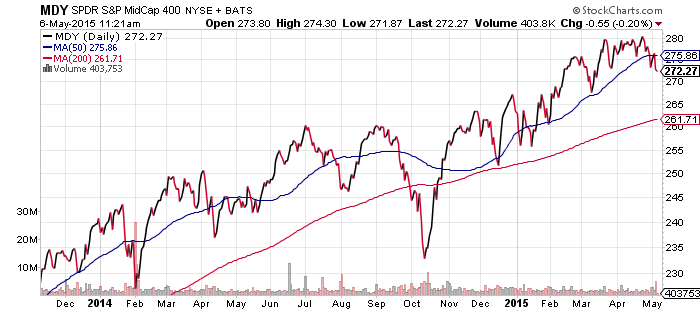

S&P Midcap 400 (MDY)

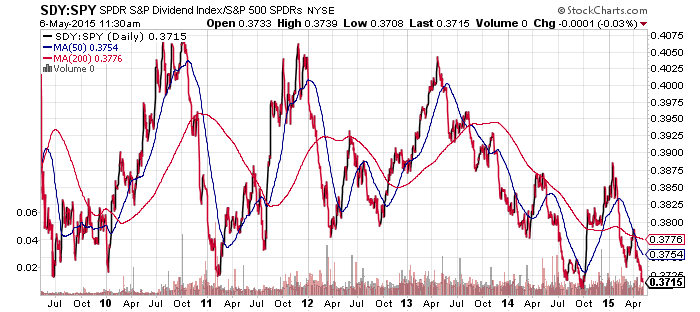

SPDR S&P Dividend (SDY)

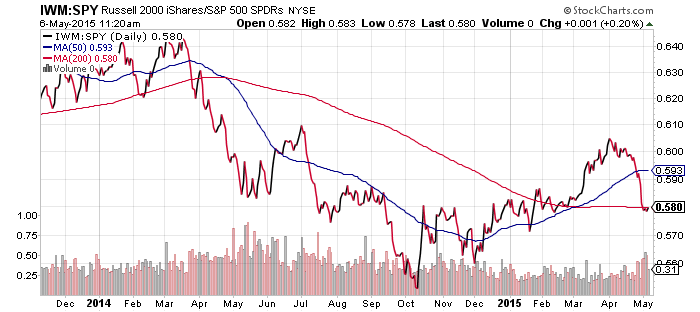

Small-cap stocks completely retracted their relative gains for the year and are now tied with large-caps in 2015. Mid-caps have pulled back as well, but they are still outperforming this year. Both MDY and IWM have broken their uptrends that stretch back to October 2014, which is bearish over the next week.

Dividend shares are at the bottom of their post 2008 range relative to the S&P 500 Index. Interest rates may be peaking here, in which case dividend shares should rebound. If rates continue marching higher though, selling of dividend shares may accelerate as more conservative investors shift from stocks to bonds.

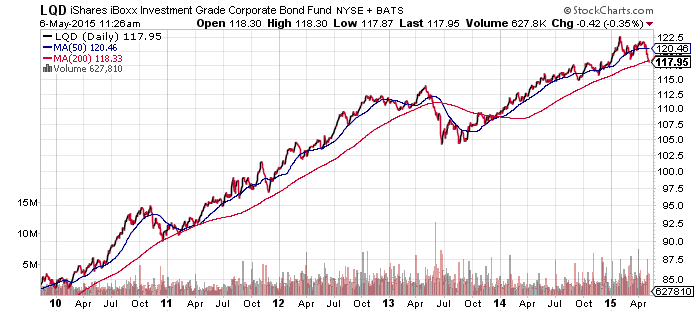

iShares iBoxx Investment Grade Corporate Bond (LQD)

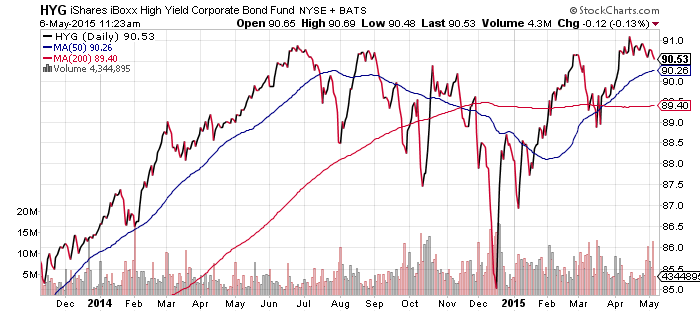

iShares iBoxx High Yield Corporate Bond (HYG)

While high yield debt markets are rebounding as oil prices recover, but the main reason for the resurgence relative to investment grade bonds are interest rates. Rising rates aren’t as big a problem for high yield bonds because for a given maturity, they have a lower duration. Investment grade bonds are on the verge of a serious breakdown if they continue falling through the 115 level. As it is, this is the worst sell-off in investment grade bonds since the spring of 2013.

Both the 10-year and 30-year bond yield are on the verge of breaking out to the upside.