United States Oil (USO)

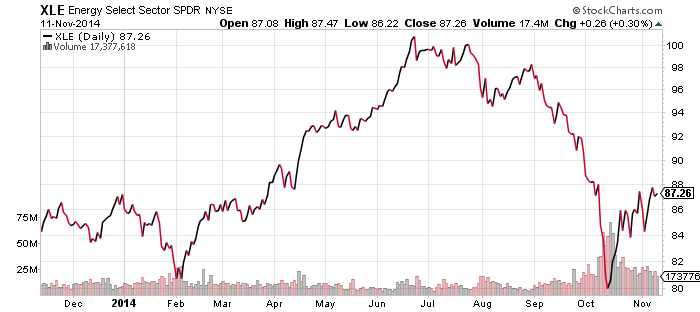

SPDR Energy (XLE)

United States Natural Gas (UNG)

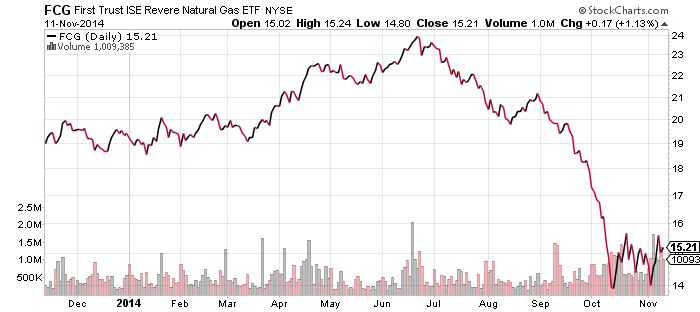

First Trust ISE Revere Natural Gas (FCG)

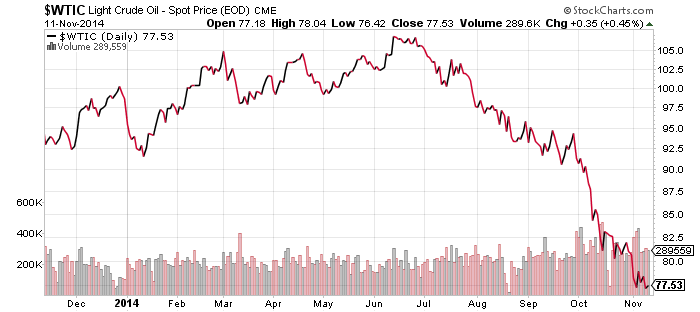

Oil prices have yet to find support. There is some long-term support in the mid-$70s, about where crude oil is now. However, if it breaks lower, there’s a lot of room for crude oil to fall into the $60 range. In contrast to crude oil, energy stocks have rebounded strongly along with the stock market. Energy is unlikely to sustain the move if oil prices break support though.

Another contrast to oil is natural gas prices, which have jumped sharply. Natural gas prices are set locally because most gas still travels via pipelines. A blast of Arctic air cooled temperatures in the U.S. and pushed up prices. Research shows that Siberian snow cover is correlated with winter weather in the U.S., and with snow in Siberia at levels not seen in decades, weather forecasters believe this winter could be much cooler than expected. FCG hasn’t followed natural gas higher though, and has also under performed XLE. This divergence is unlikely to last.

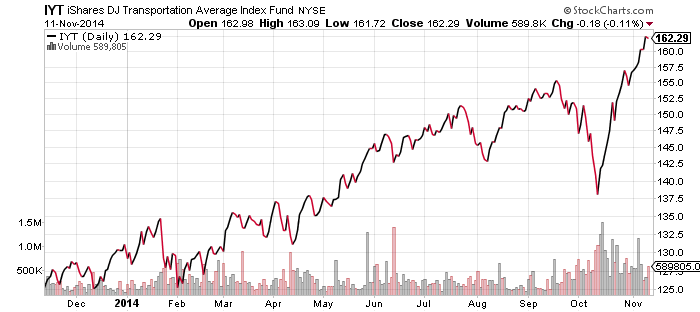

iShares DJ Transportation Index (IYT)

Transportation stocks have staged a massive rally over the past month. From the lows in October, the Dow Transports is up more than 15 percent. The catalyst for the move may be oil prices. Transportation stocks are often correlated with energy prices because a stronger economy demands more energy, pushing up prices. Lower oil prices tend to be associated with recessions. In the current environment, the U.S. economy is strong; weakness is overseas. A slowing economy in China, Europe and Japan has led to a glut of oil on the market, and there’s speculation that the Saudis are trying to force down prices to hurt U.S. shale oil producers. Others speculate the Saudis are doing it to help the U.S. weaken Russia. Whatever the reason, a decline in operation costs amid an otherwise strong economy is a big benefit to transportation companies domestically.

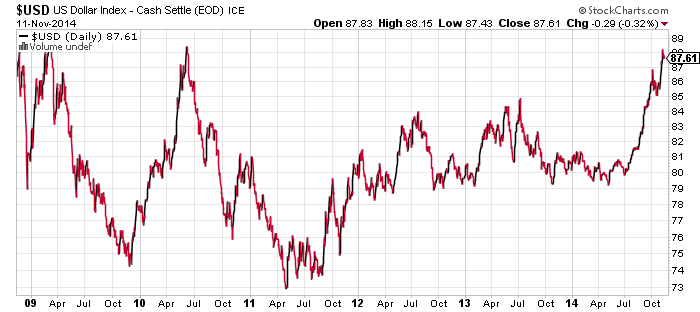

PowerShares U.S. Dollar Index Bullish Fund (UUP)

The U.S. Dollar Index is sitting at its highest levels in more than 4 years. Until 2012, the Japanese yen had acted as a brake on the dollar because it was appreciating against the greenback. Now the yen is the accelerator, pushing the U.S. dollar higher against Asian currencies as export nations chase the yen lower. Meanwhile, Europe is on the edge of recession and considering more central bank intervention, ahead of pivotal elections in key nations such as Greece and the United Kingdom that could reignite a political crisis for the currency bloc.

The last time the U.S. dollar was in this position was late 1996, and what followed were a U.S. stock market boom, a major U.S. dollar rally, and a currency crisis that took down much of Asia and eventually forced Russia into default.

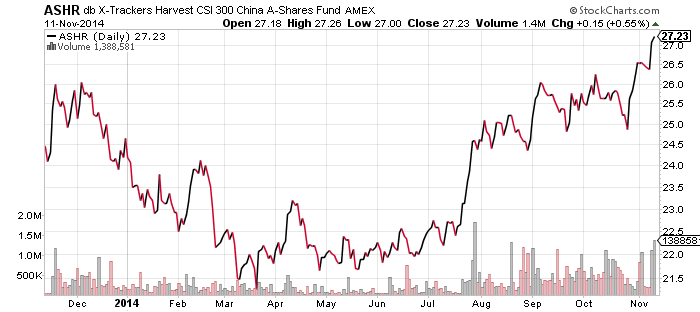

db X-Trackers Harvest CSI 300 A-Shares (ASHR)

Chinese stocks rallied this week after China announced the stock connect scheme linking the Hong Kong and Shanghai markets would begin on November 17. Chinese stocks are also seeing inflows from pension funds and trusts as they are refraining from putting new money into the cooling real estate market.

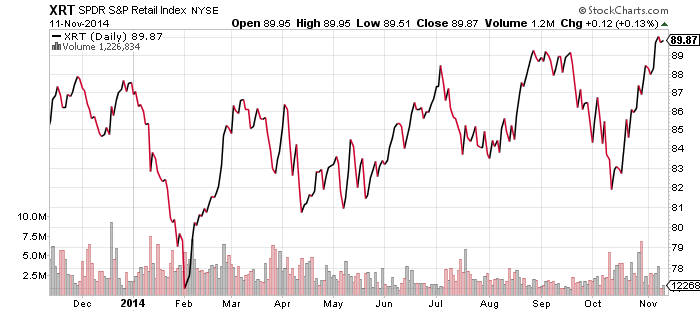

SPDR Retail (XRT)

Retailers begin the heavy part of their earnings season this week with Macy’s (M) and Wal-Mart (WMT) headlining. Consumer discretionary has been the weakest sector in the stock market this year and it’s the only S&P 500 sector to report a year on year earnings decline in the third quarter. Consumer data in the GDP report has been relatively weak as well. This doesn’t signal broader weakness for the economy, but it isn’t good news for the retail sector.

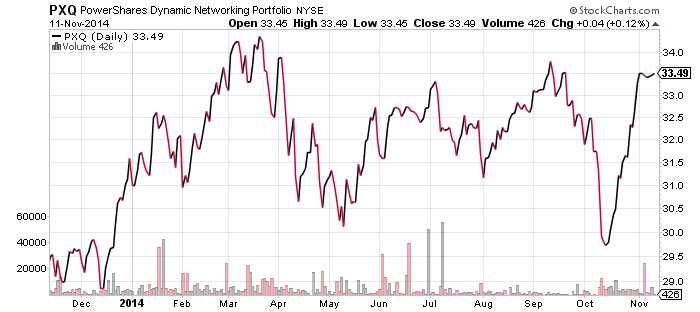

PowerShares Dynamic Networking (PXQ)

Cisco (CSCO) reports earnings this week. The networking giant reports after the close today and is expected to earn $0.53 per share, the same as the prior quarter, along with a small increase in revenues.

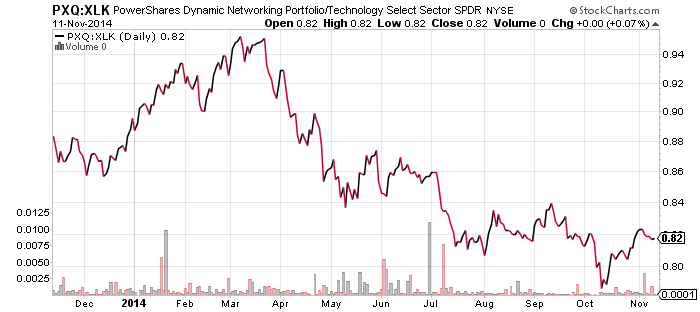

As the second chart shows, networking started underperforming the tech sector during the spring sell-off, and while tech has bounced back, networking has remained a laggard. Investors will be paying close attention to Cisco’s guidance for future quarters and if the sector is going to rebound relative to the rest of tech, it needs some positive guidance from Cisco.