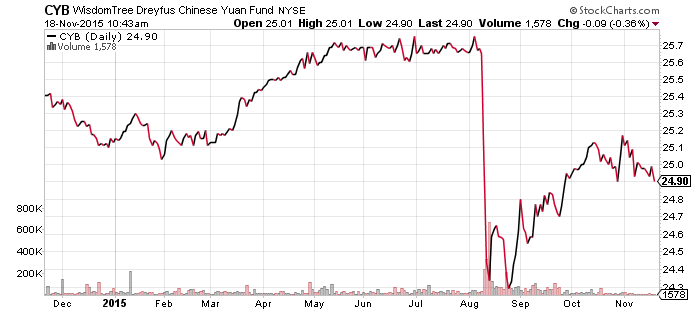

WisdomTree Chinese Yuan (CYB)

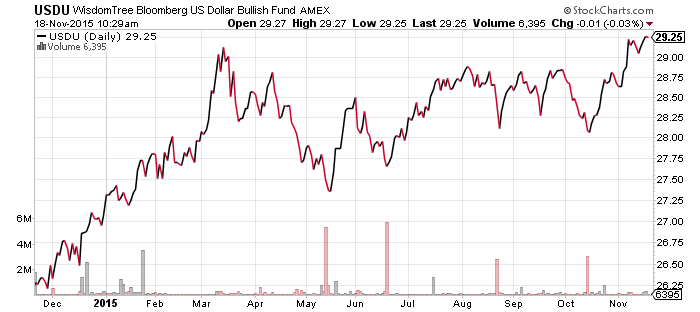

WisdomTree Bloomberg USD Bullish (USDU)

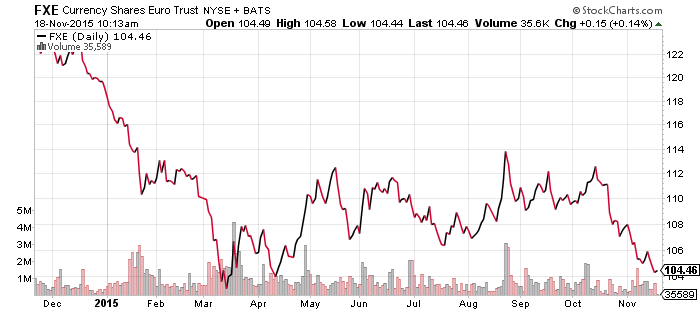

CurrencyShares Euro Trust (FXE)

CurrencyShares Swiss Franc (FXF)

CurrencyShares Swedish Krona (FXS)

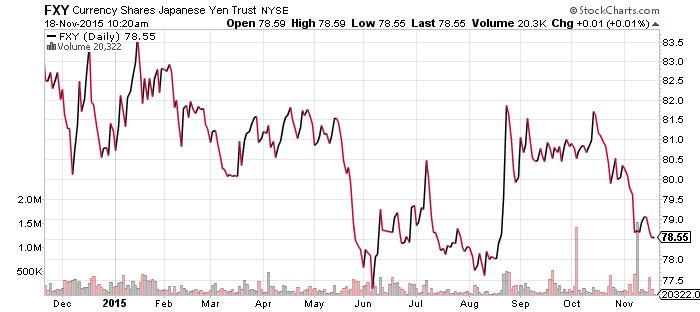

CurrencyShares Japanese Yen (FXY)

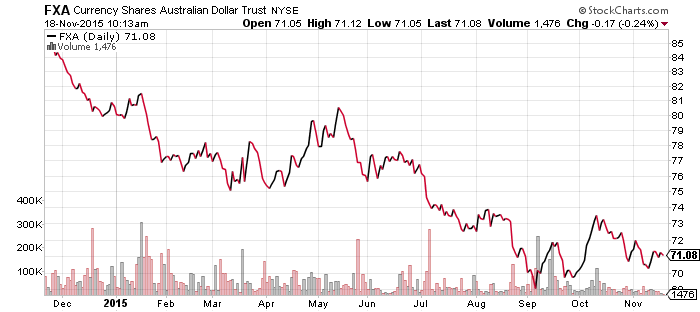

CurrencyShares Australian Dollar (FXA)

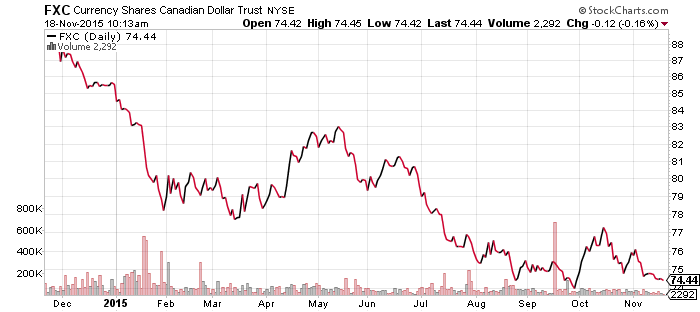

CurrencyShares Canadian Dollar (FXC)

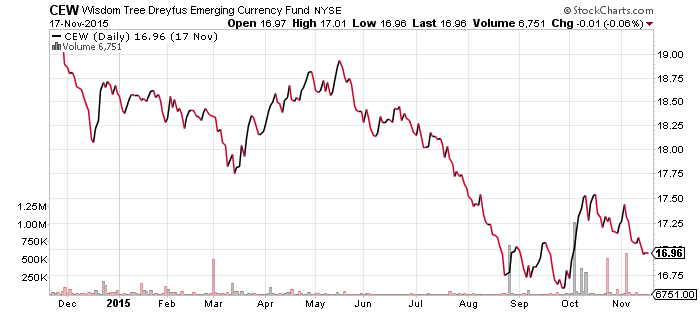

WisdomTree Emerging Market Currency (CEW)

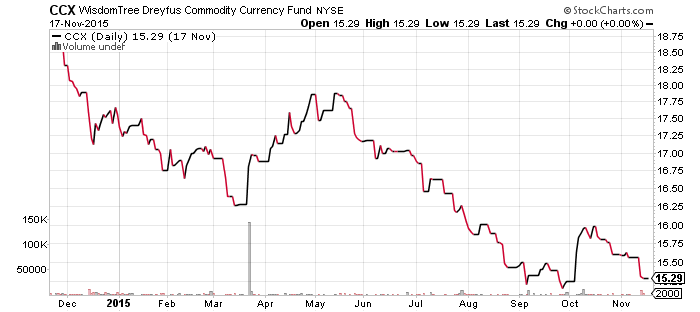

WisdomTree Commodity Currency (CCX)

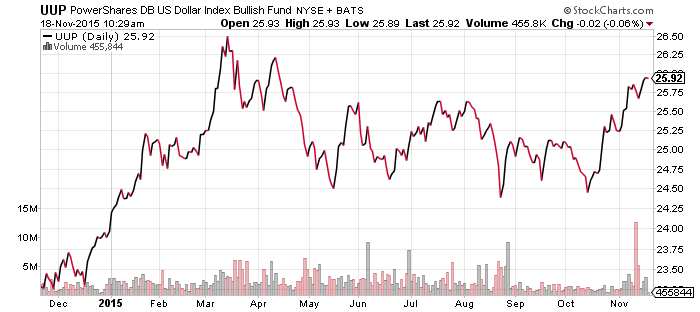

PowerShares DB U.S. Dollar Bullish Index (UUP)

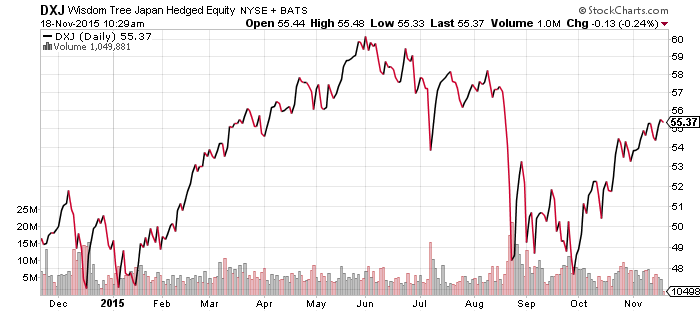

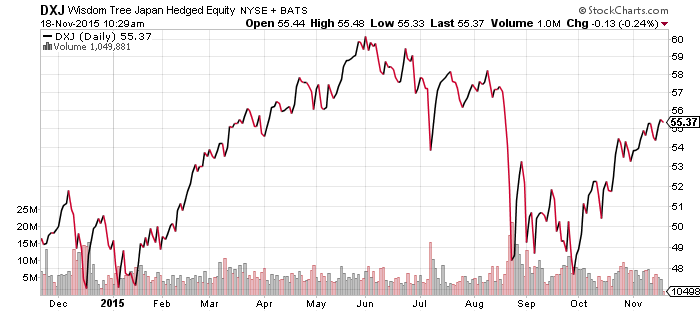

WisdomTree Japan Hedged Equity (DXJ)

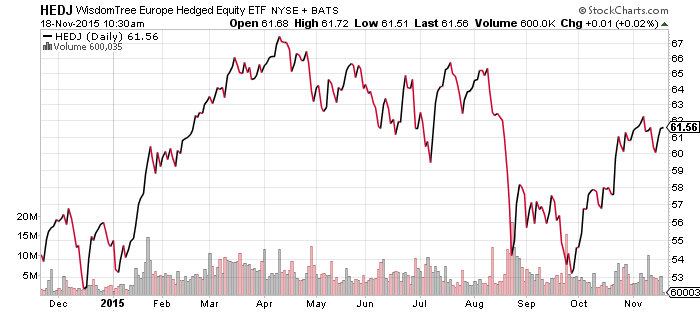

WisdomTree Europe Hedged Equity (HEDJ)

The U.S. dollar continued to grind higher over the past week, while the Swiss franc and Swedish krona are now on the verge of hitting a new 52-week low versus the greenback. Both currencies may triple-bottom. These two currencies carry psychological weight in the market due to their historically strong performance and conservative management. While they lack the influence to push the dollar higher, should they break new 52-week lows it could signal an extension of the bull market.

The Chinese yuan continues to evolve into the next era of its decline. It is likely to be added to the currency basket that makes up the IMF’s special drawing rights (SDR), but this is unlikely to impact its demand. The country may, however, be required to expedite the opening of its capital account under the terms of its inclusion. The yuan’s dependency on government regulation makes it vulnerable to further decline as China cedes some of its control to the IMF. The yuan is the key currency for emerging markets, so ETFs such as CEW may stay above their 52-week lows as long as the yuan hangs on.

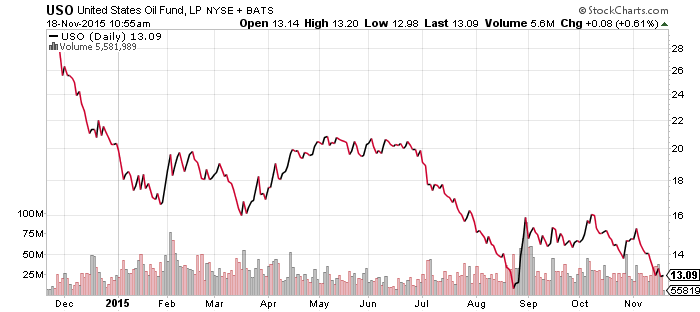

United States Oil (USO)

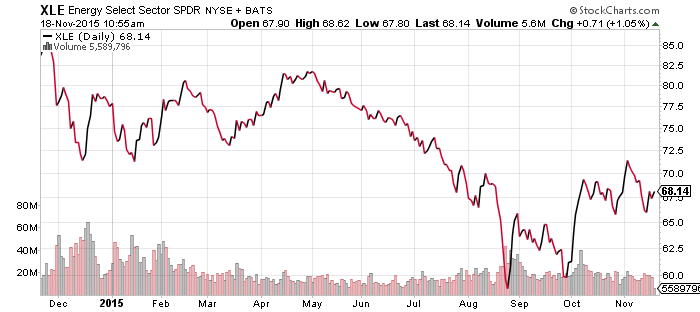

SPDR Energy (XLE)

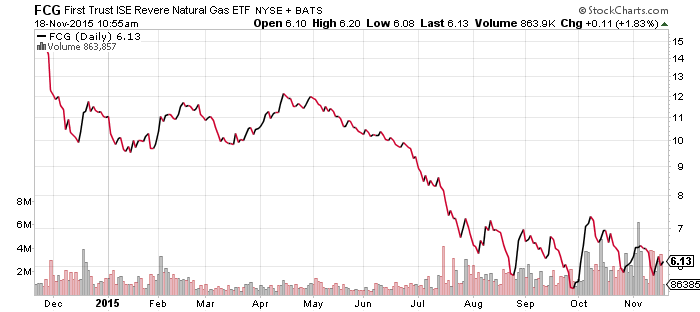

FirstTrust ISE Revere Natural Gas (FCG)

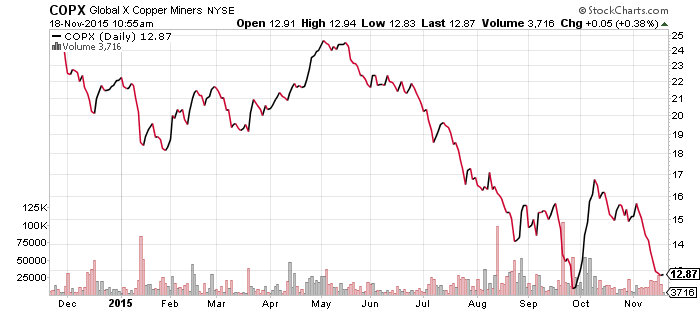

Global X Copper Miners (COPX)

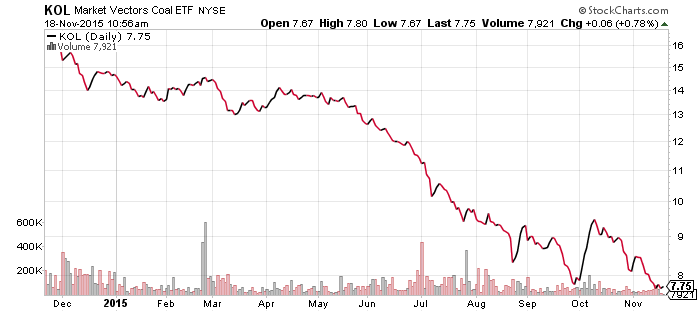

Market Vectors Coal (KOL)

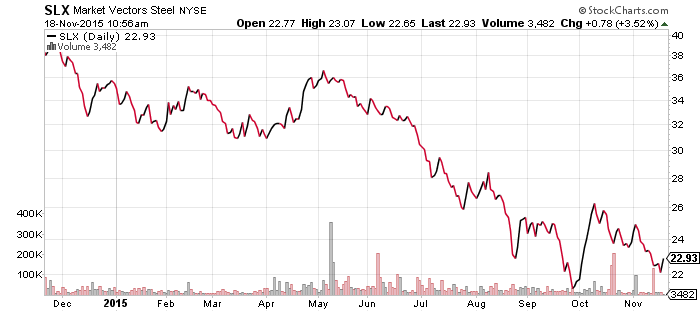

Market Vectors Steel (SLX)

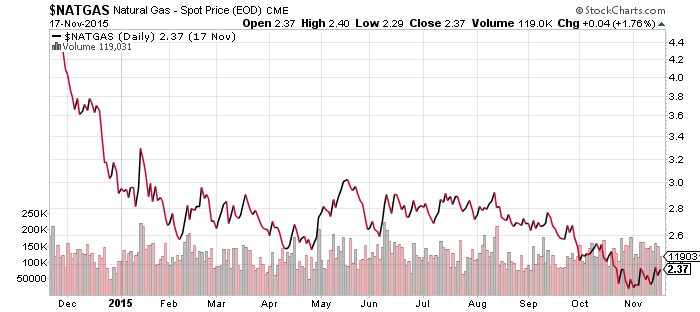

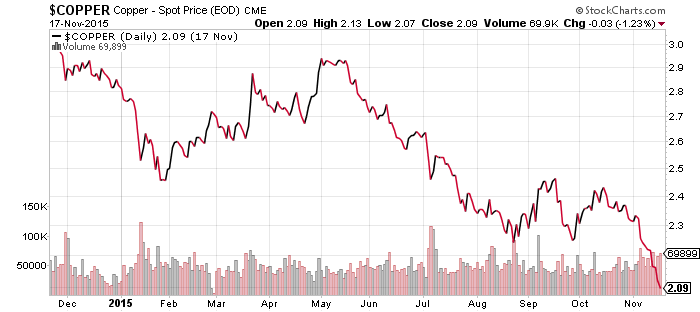

Oil prices briefly fell below $40 a barrel before stabilizing this morning and Copper sank to a new 52-week and 5-year low. The slide points to further weakness in the Chinese economy, which posted weak economic data in October. Industrial production, producer prices and real estate investment saw some of their weakest growth in 2015. Today we learned the rebound in home prices may be stalling. China’s steel industry still hasn’t made significant production cuts, but many fear it soon will and inputs such as iron ore and coal coke may finally bottom.

Commodity related equities have held on to this point, although KOL did move to a new 52-week low last week. Unless copper experiences a surprise rebound, look for other funds to head lower. Energy funds can maintain their positions, provided oil doesn’t break its low of $38 a barrel.

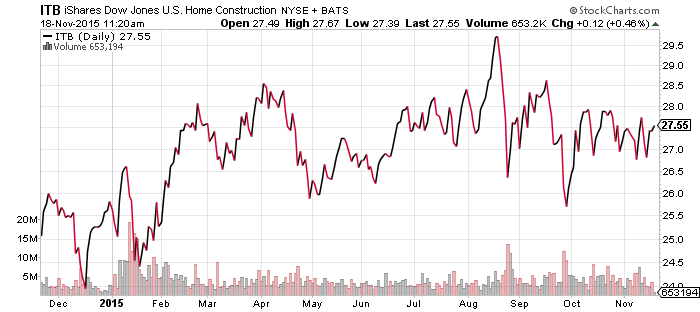

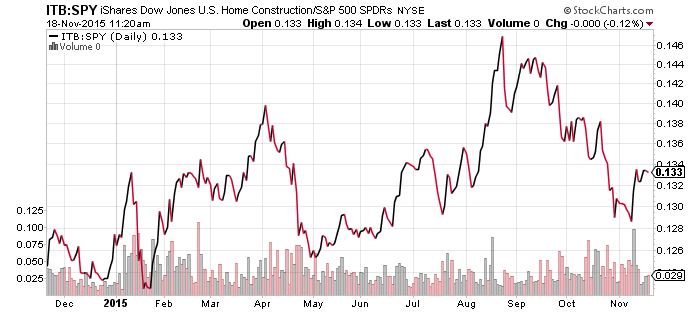

iShares US Home Construction (ITB)

Housing starts fell in October due to a drop in multi-family home construction.

We’ll keep an eye on this sector heading into the Fed meeting in December, though but unless something sparks this sector, it will likely trend lower over the coming weeks.

SPDR Utilities (XLU)

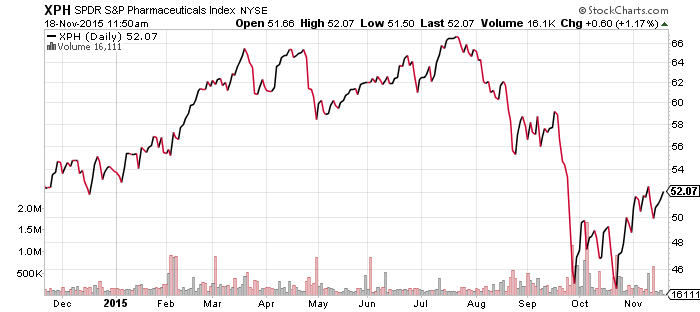

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

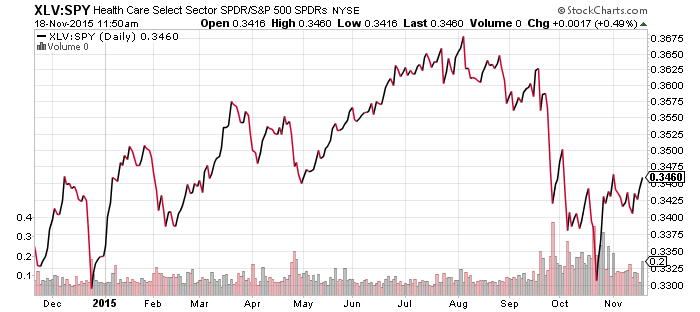

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

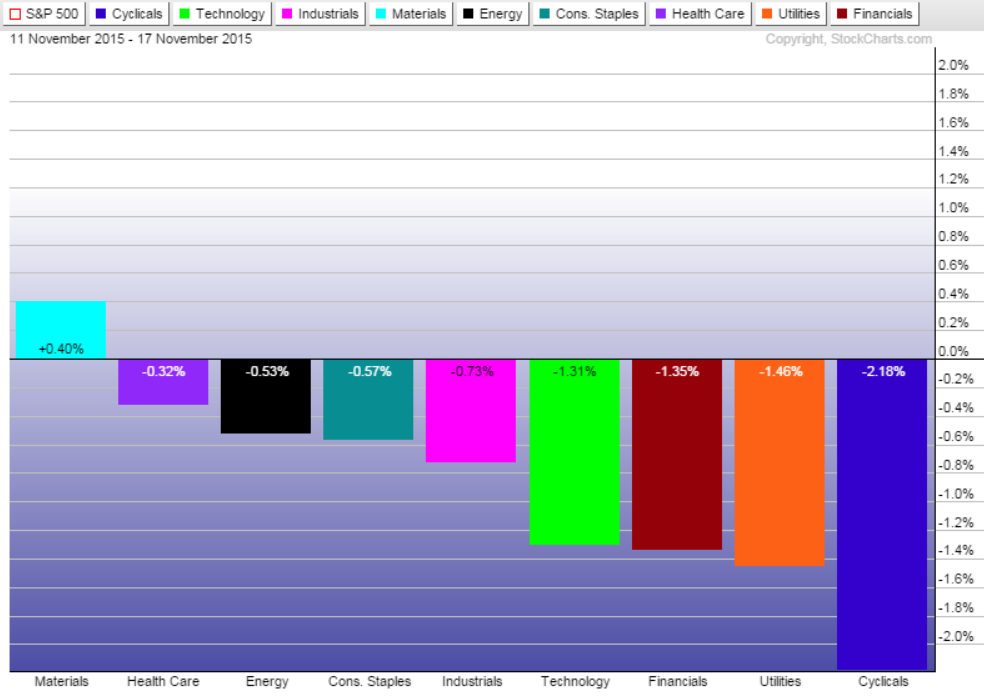

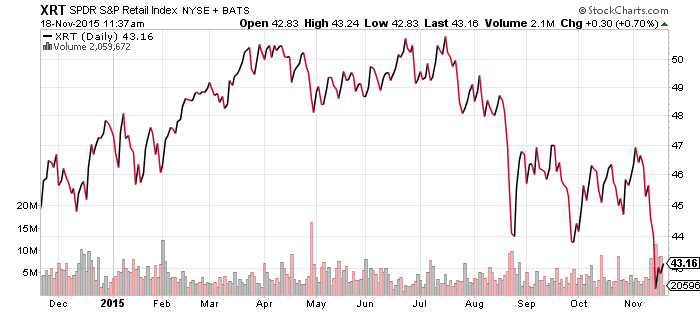

The market sustained losses over the past week, led by the consumer discretionary sector, which was pulled lower by the retail sub-sector. SPDR Retail (XRT) hit a new 52-week low on Friday, following a string of weak earnings reports or negative guidance from brick-and-mortar firms. Today, Target (TGT) met earnings expectations and raised guidance, but shares fell more than 4 percent as investors focused on shrinking margins. Wal-Mart (WMT) bucked the trend and rallied following its earnings beat yesterday, despite an earnings warning issued last month.

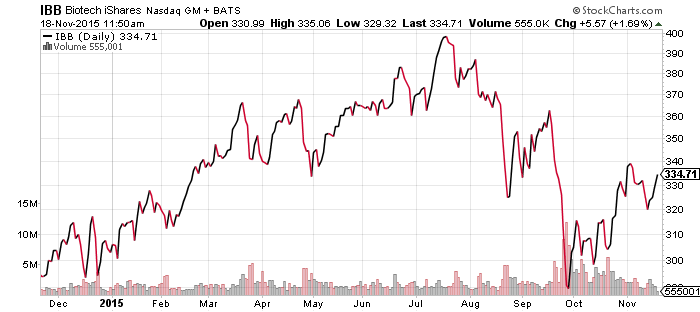

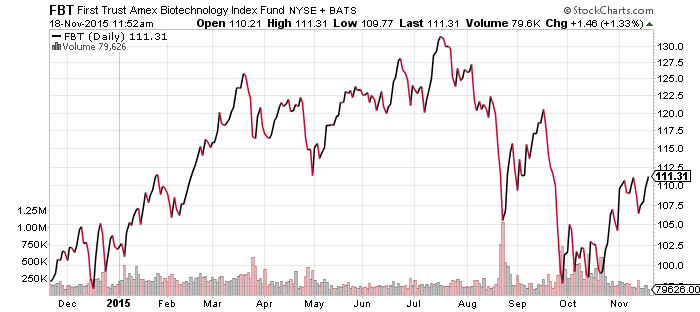

The healthcare sector rebounded last week. Biotechnology ETFs are still looking to make new post-August highs. Relative to the S&P 500 Index, healthcare has been lagging since August and even if the sector doesn’t regain its momentum leadership, a catch-up rally should follow.

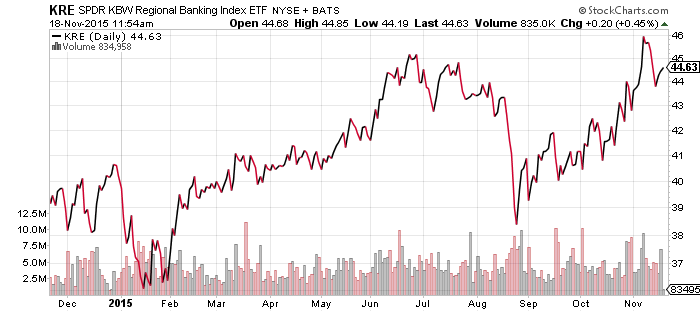

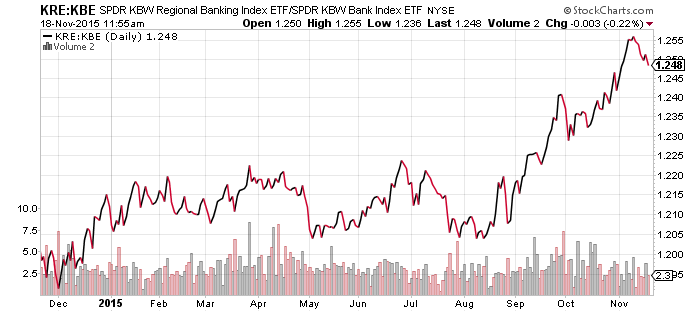

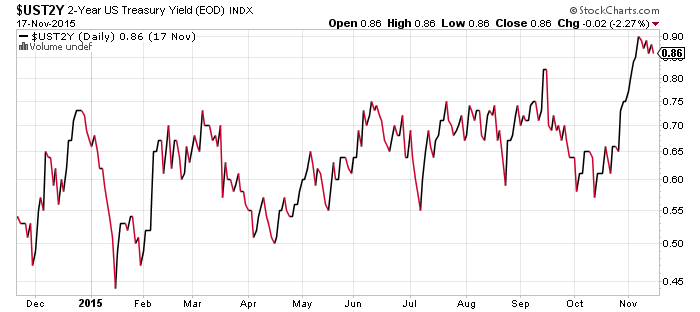

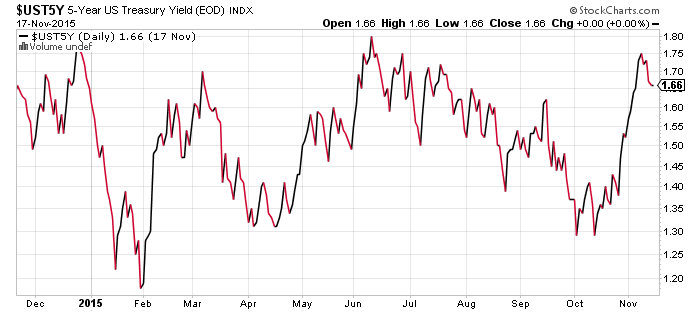

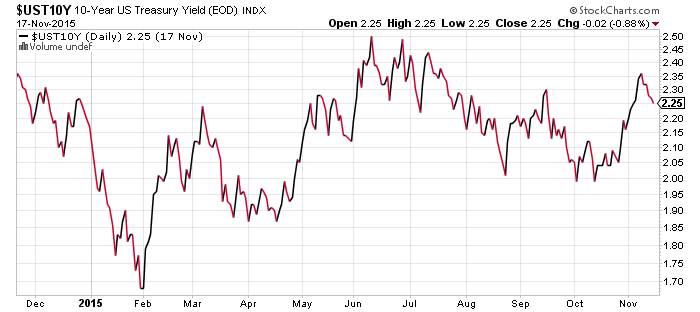

Regional banks finally pulled back last week and ended their three-month relative outperformance versus larger banks. KRE fell below its June high of $45 a share. Federal Bank of New York President Dudley said the Fed wants to hike rates in order to restore confidence in the economy. A hike will be good news for the banking sector and in particular, KRE.

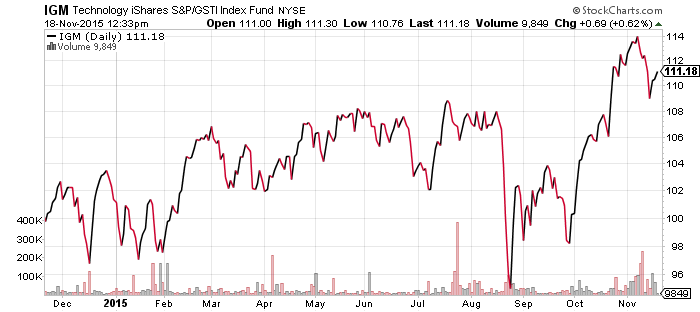

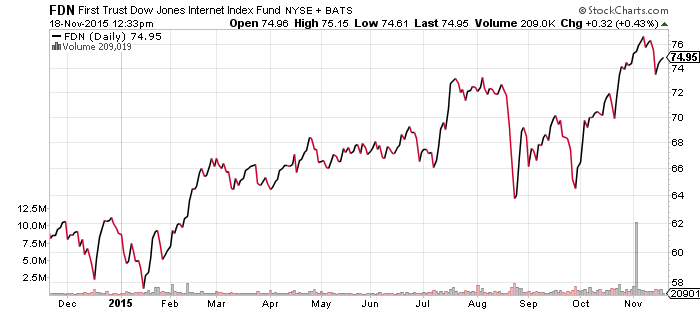

Technology pulled back along with the broader market, but many tech funds are trading near their highs of the year, particularly the Internet stocks and broad ETFs with solid exposure to these firms.

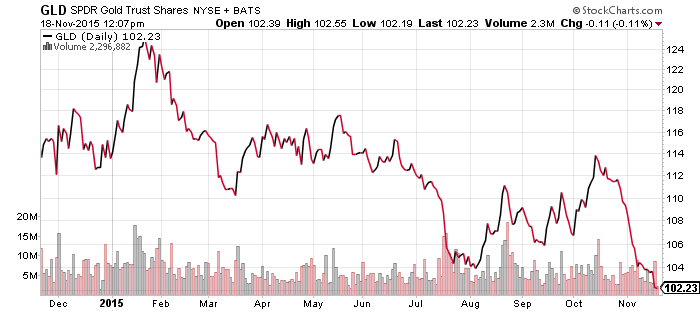

SPDR Gold Shares (GLD)

Along with copper, Gold also sank to a new 52-week and 5-year low last week. Gold can rebound if more monetary intervention is expected, but for now, investors seem to be more focused on a Fed rate hike, than the fact that Europe, Japan and China are all talking about more quantitative easing.

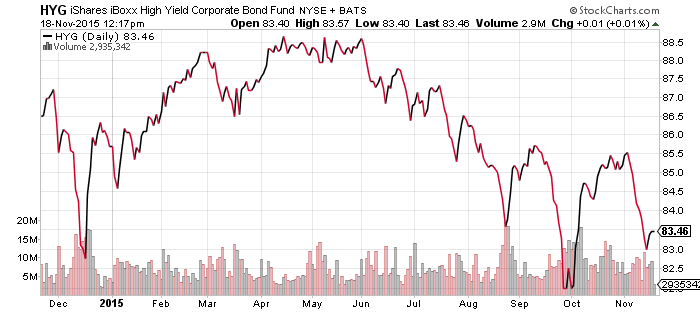

iShares iBoxx High Yield Corporate Bond (HYG)

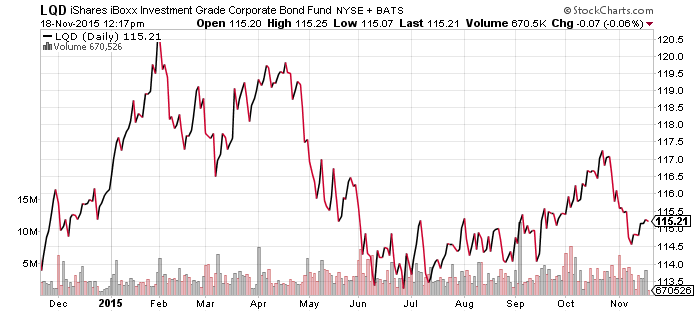

iShares iBoxx Investment Grade Corporate Bond (LQD)

High yield bonds slumped along with oil prices last week, while investment grade bonds rebounded as interest rates fell. The pullback in rates is only a small reversal of the large gains we have seen over the past month.

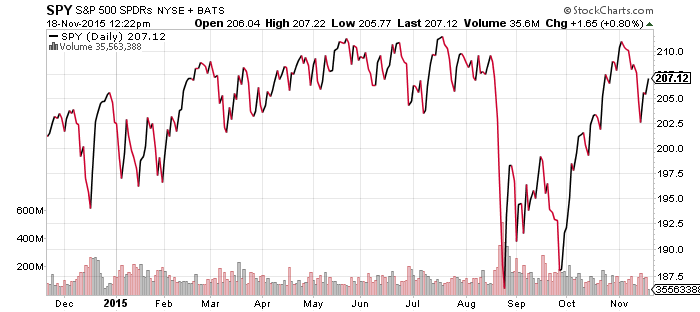

SPDR S&P 500 (SPY)

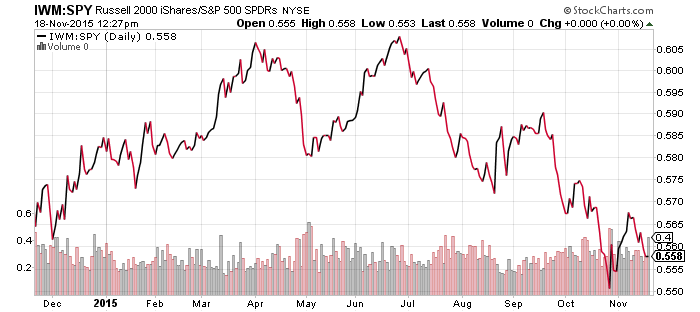

iShares Russell 2000 (IWM)

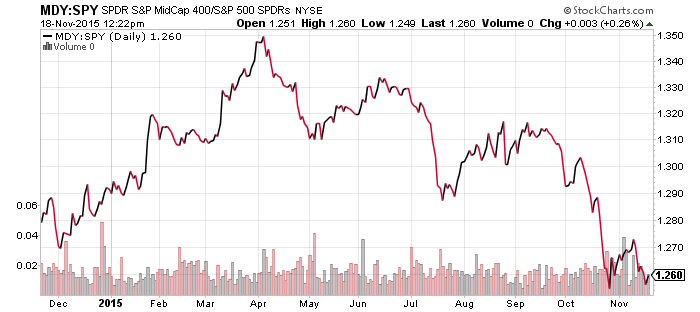

S&P Midcap 400 (MDY)

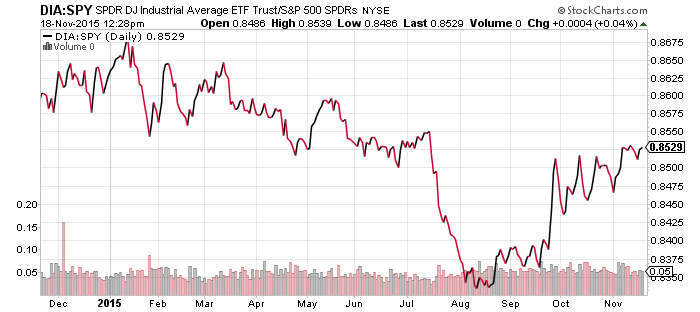

SPDR DJIA (DIA)

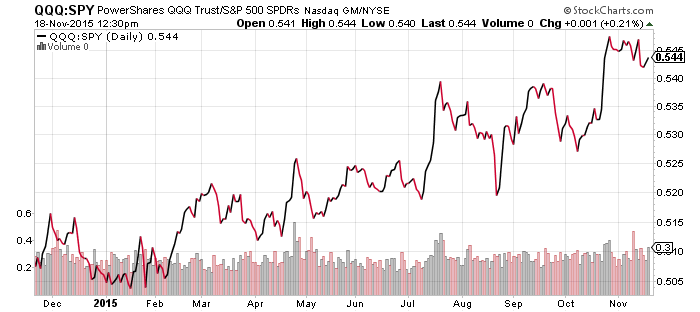

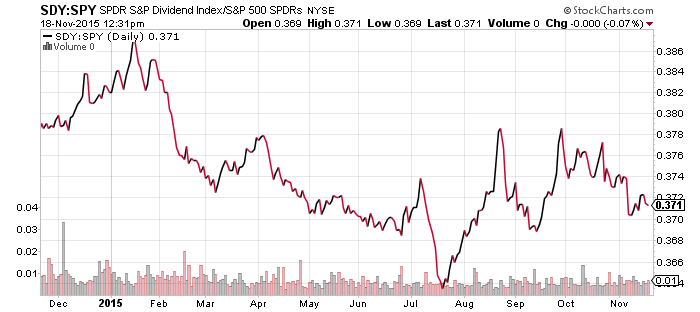

PowerShares QQQ (QQQ)

SPDR S&P Dividend (SDY)

Mid- and small-caps bounced off relative lows recently and look to rebound further if the U.S. dollar continues to gain strength. Even more, the rebound in the Dow Jones Industrial Average is still on course. The Dow is at its best levels, relative to the S&P 500 Index, since early summer. Strength in financials is helping, as is better performance from industrials. The tech heavy Nasdaq has been hanging on to its lead as well and it is the only major index in positive territory for the year right now. Dividend payers have been tracking with the broader market, but higher rates may have a slight impact in terms of relative performance over the short-term.