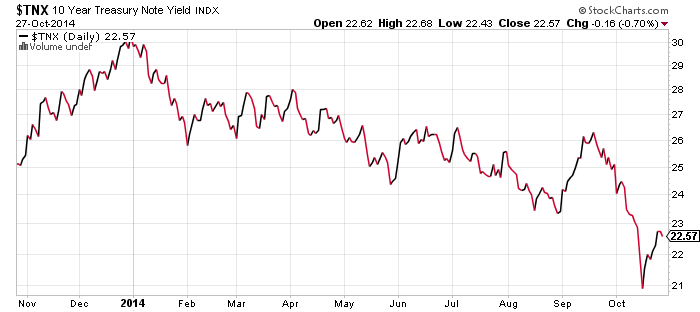

10-Year Interest Rates

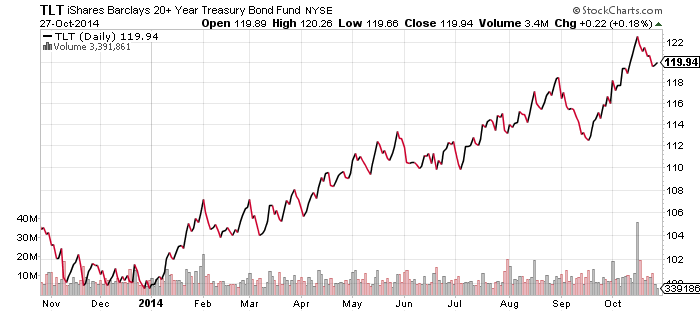

iShares Barclays 20+ Year Treasury (TLT)

The big news this week is the Fed’s policy statement on Wednesday. An exit from quantitative easing is widely expected.

Interest rates are at an important juncture. On October 14, interest rates gapped lower and then plunged intraday on the 15th before rebounding along with stocks. Interest rates are now sitting very close to the level they were at before the plunge. For technical traders, this is an important level. A move lower will signal this level is now a resistance line that marks a near term level of resistance. If interest rates push higher, it will be a sign the drop in rates may have been a one-off event.

Given the volatility that comes from Fed policy statements, it would behoove investors to ignore initial moves and wait for a trend to develop. Depending on how things shake out though, a short-term trend in rates may be evident by the end of next week.

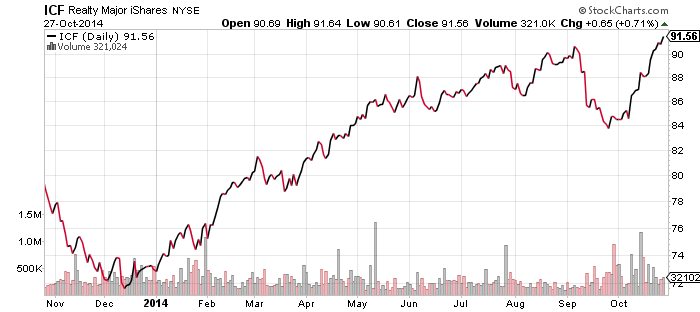

iShares Cohen & Steers Realty Majors (ICF)

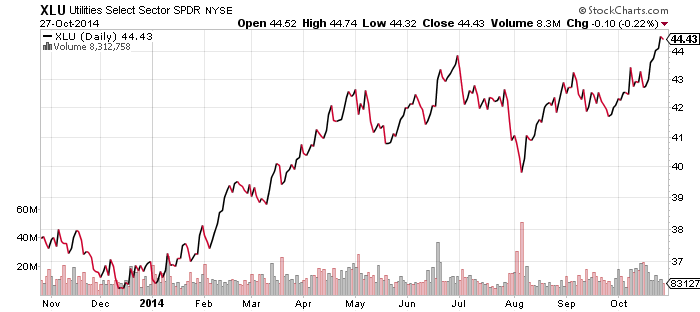

SPDR Utilities (XLU)

SPDR Consumer Staples (XLP)

Interest rate sensitive REITs and utilities continued to push higher last week, as did the consumer staples sector. The move in staples was the most impressive since Coca-Cola (KO) is down more than 8 percent since missing earnings estimates last week. KO is still 9.5 percent of XLP after the move, the second largest holding in the fund.

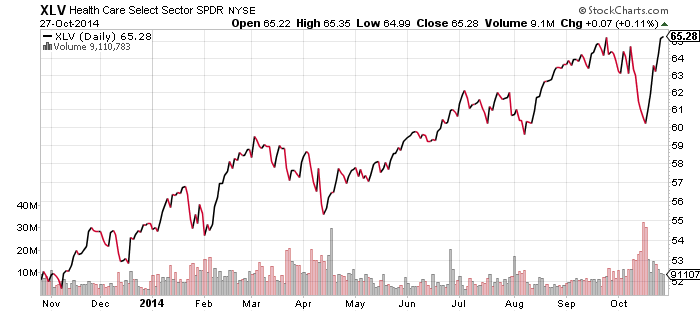

SPDR Healthcare (XLV)

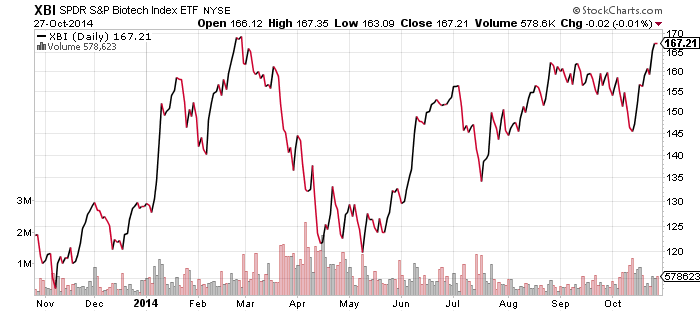

SPDR Biotech (XBI)

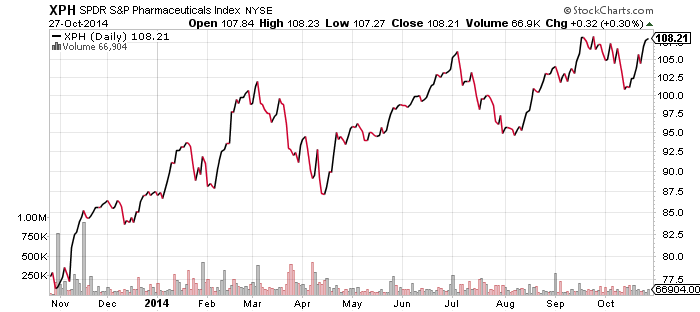

Of all the sectors, healthcare was far and away the best performing over the past week, up 2.42 percent more than the S&P 500 Index. The next best sector ETF, SPDR Industrials (XLI), only beat the broader index by 0.96 percent.

The move has pushed XLV to a new high for the year, while SPDR Biotech (XBI) and SPDR Pharma (XPH) are gaining ground.

This week is a big one for healthcare sector earnings. Gilead (GILD) and Amgen (AMGN), two big biotech firms, account for more than 10 percent of assets in XLV release earnings. Pfizer (PFE) and Merck (MRK), which account for more than 14 percent of XLV, also report. XPH and XBI have lower exposure to company specific news because they are equal weight funds.

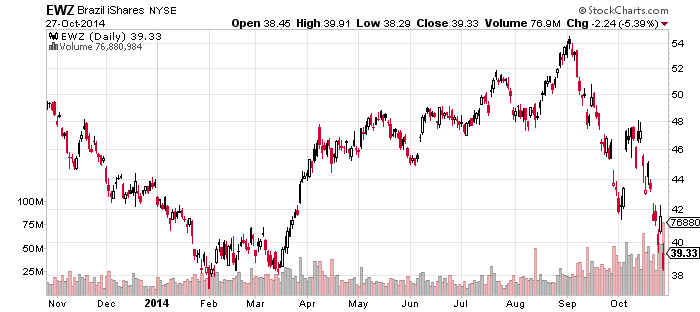

iShares MSCI Brazil (EWZ)

The Brazilian president was re-elected on Sunday. Investors dumped Brazilian shares and the currency in response, sending EWZ down near its lows for the year. The chart below is a candlestick chart, showing the trading low for the day on Monday came close to the lows for the year. Going strictly by the political event, this would probably mark a bottom for the fund. Since the U.S. dollar has been strong and growth has been slowing in key export markets such as China, the picture is less clear. A break below the lows earlier in the year would be bearish since it would invite traders to increase their bets against Brazilian equities.