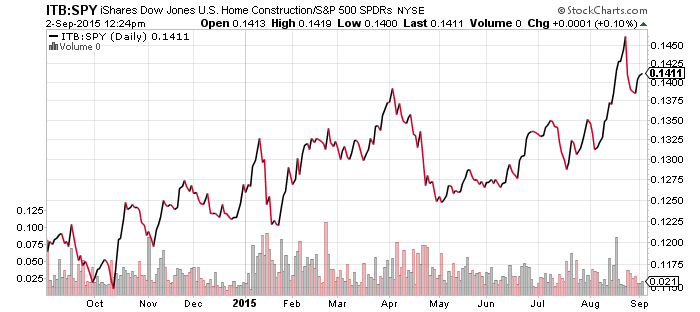

WisdomTree Chinese Yuan (CYB)

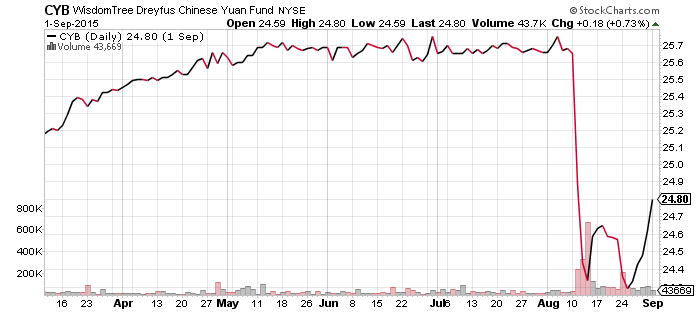

WisdomTree Bloomberg USD Bullish (USDU)

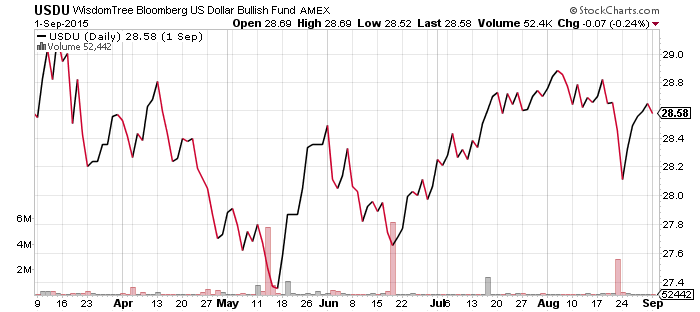

CurrencyShares Euro Trust (FXE)

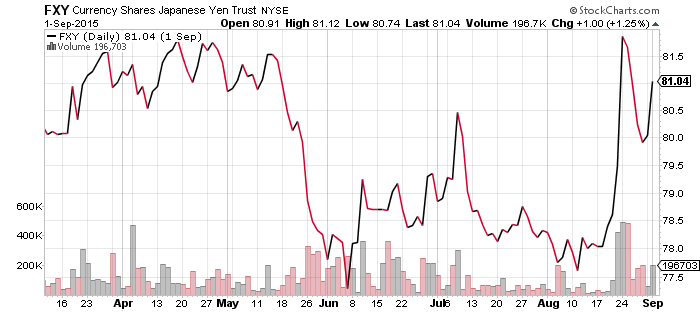

CurrencyShares Japanese Yen (FXY)

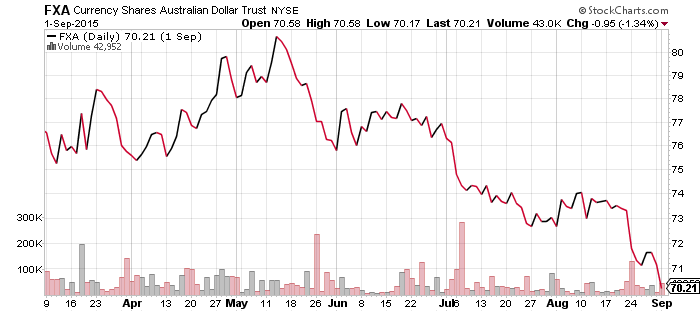

CurrencyShares Australian Dollar (FXA)

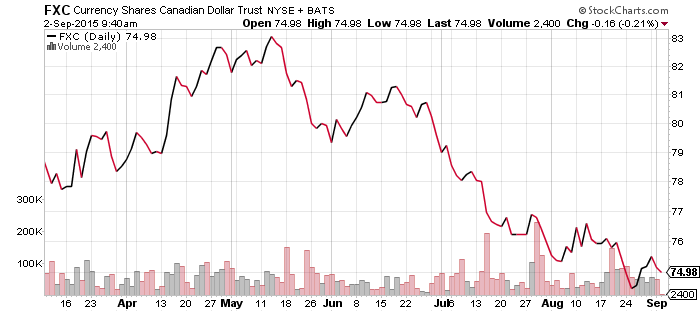

CurrencyShares Canadian Dollar (FXC)

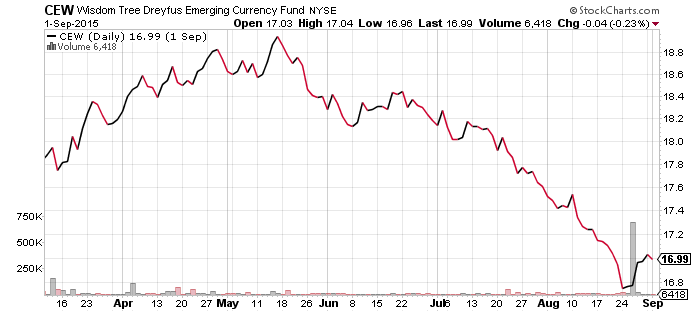

WisdomTree Emerging Market Currency (CEW)

Emerging market currencies and commodities rallied over the past week as China pushed the value of its currency higher. Two currencies tied to China’s economy that failed to rebound were the Australian and Canadian dollars. The Aussie dollar fell to a new 52-week low, while the Canadian dollar hovered near its 52-week low on news that Canada entered into a recession in the second quarter. Second quarter GDP contracted 0.5 percent, following a 0.8 percent decline in the first quarter.

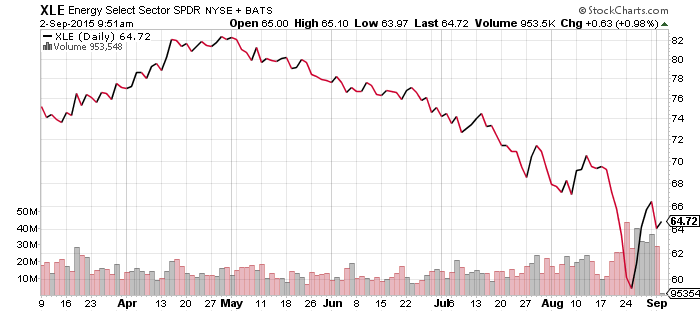

SPDR Energy (XLE)

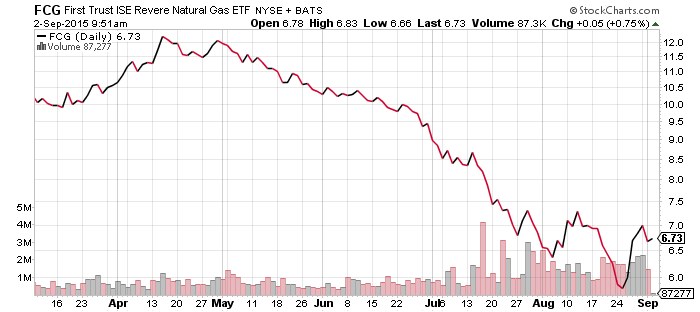

FirstTrust ISE Revere Natural Gas (FCG)

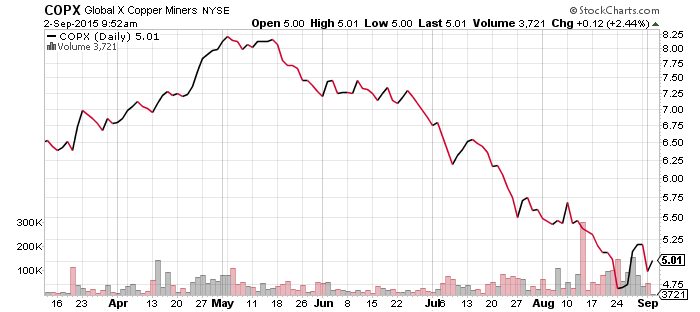

Global X Copper Miners (COPX)

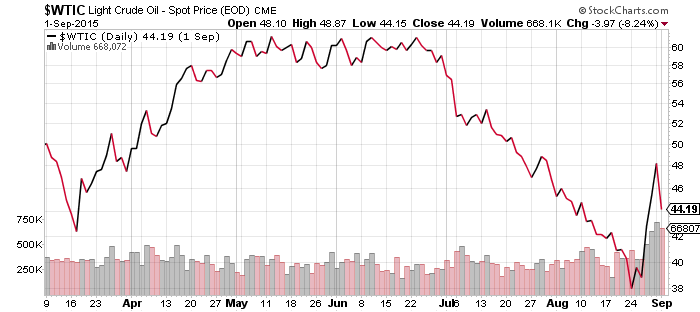

Oil prices experienced their biggest rally in decades over the past week, gaining more than 25 percent over the course of a few days. The last time oil prices spiked this rapidly was when Iraq invaded Kuwait in the early 1990s, as much of the world joined the U.S.-led effort to liberate Kuwait. The jump in prices was fueled by short-covering and investors didn’t price the jump into energy equities, betting prices will come down in the days ahead. This remains a key asset to watch as concerns about China’s economy grip the market.

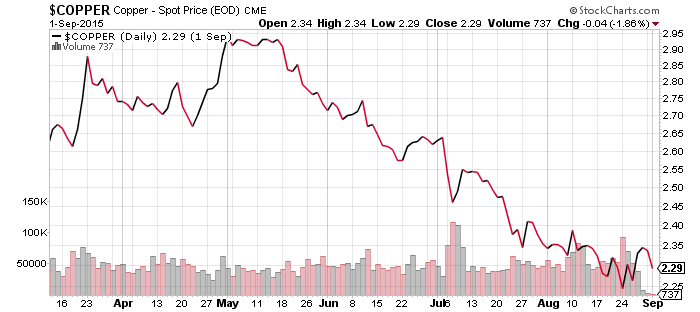

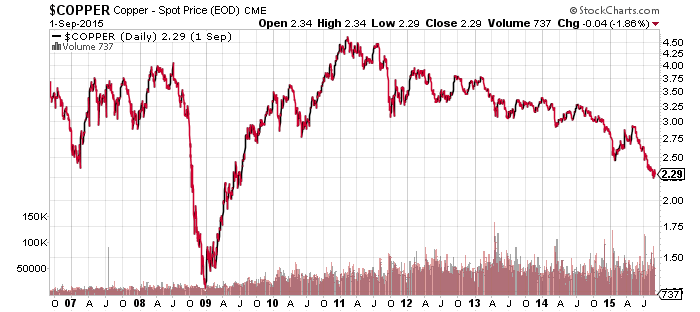

As for copper, it is still near the lows for the year. Doctor Copper has been warning of China’s slowing economy since 2011, but it’s only now that investors have decided to react to the global implications of this fact. Copper will continue to reach new lows as long as the global economy is weak, but it is a leading indicator and will likely bottom before the market realizes a recovery has begun. First, we’ll need to see some stabilization in price, but for now the downtrend since 2011is still in place.

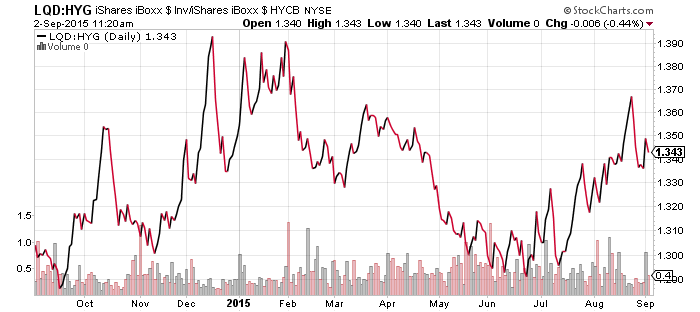

iShares iBoxx Investment Grade Corporate Bond (LQD)

iShares iBoxx High Yield Corporate Bond (HYG)

High-yield debt snapped back as the market rallied, though the short-term trend is still in place; investors are continuing to favor stronger credit at the moment. The area to watch for the price ratio is the 1.40 level. If LQD continues to outperform past that level, it would signal a more significant shift in investor sentiment. For now, this remains within the range of normal short-term fluctuations.

SPDR Utilities (XLU)

SPDR Pharmaceuticals (XPH)

SPDR Materials (XLB)

SPDR Consumer Staples (XLP)

SPDR Consumer Discretionary (XLY)

SPDR Healthcare (XLV)

SPDR Technology (XLK)

SPDR Financials (XLF)

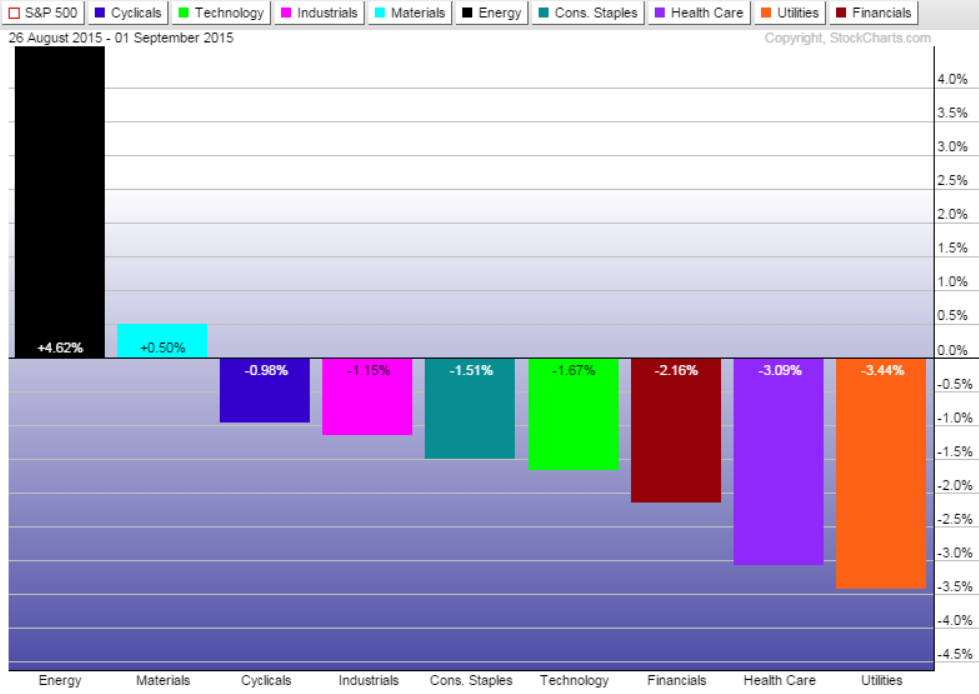

Energy was the big winner in the past week as oil prices sharply rebounded amid a short-covering rally. Materials joined in the rally, but still lagged far behind. Utilities saw the worst performance as interest rates increased and investors shed some of their defensive positioning.

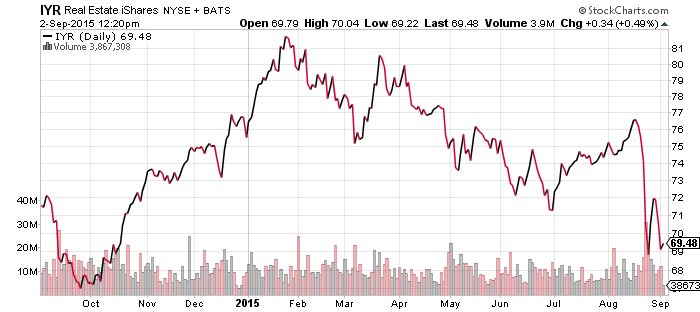

Real estate joined utilities in falling last week and both funds are close to breaking to new lows.

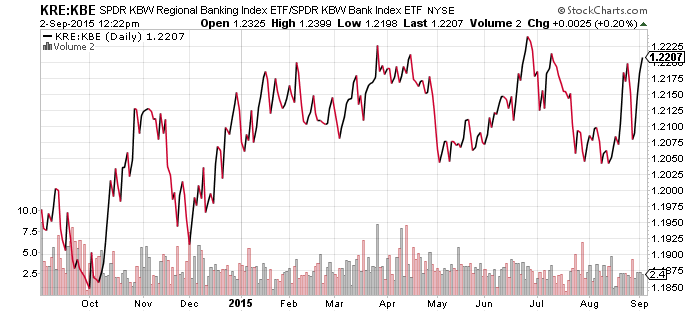

A chart we looked at last week focused on the relative performance of regional banks versus the large banks. Even though financials are struggling along with the rest of the market, regional banks outperformed again last week, a sign that investors are looking ahead to rate hikes.

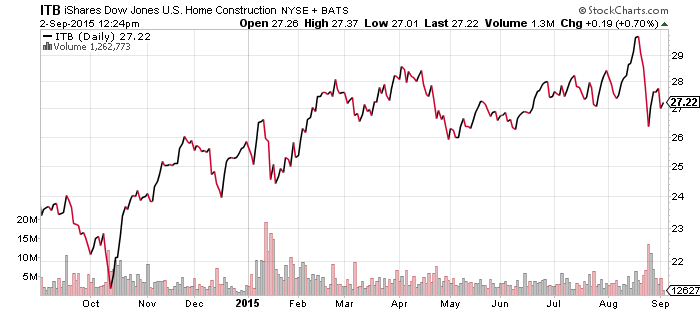

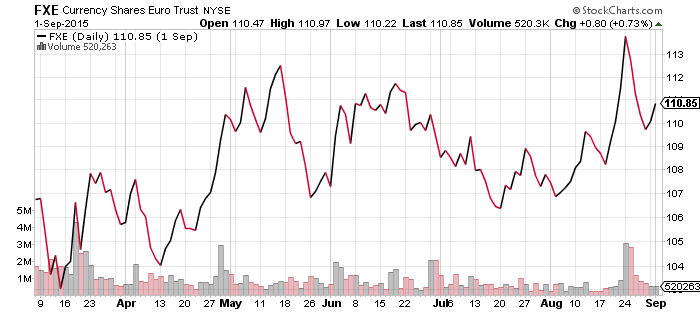

One of the brightest spots in the market, both in terms of performance and momentum, but also as a sign of general sentiment and the broader economy, is housing. ITB has been outperforming since October 2014, but the trend recently accelerated. The recent sell-off also failed to break the trend: investors who have been optimistic on housing. Investors typically worry that rising interest rates could hurt the overall weak housing market, but housing stocks are moving in the opposite direction, signaling investors are bullish about the prospects for the sector. One possible contrarian explanation is home buyers sitting on the sidelines will take a Fed rate hike as a cue to buy sooner, rather than later.