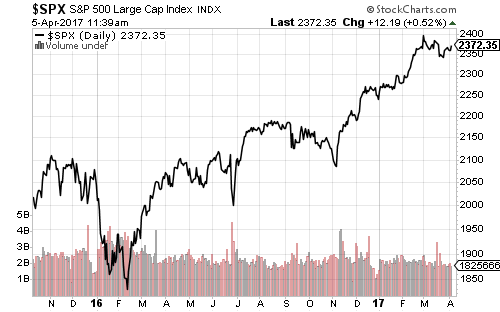

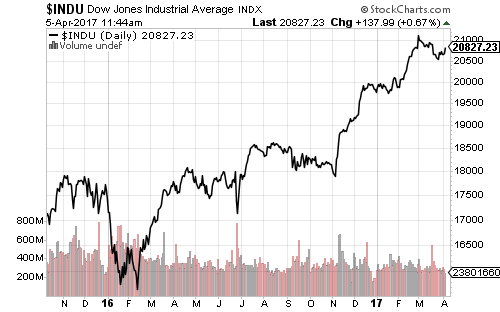

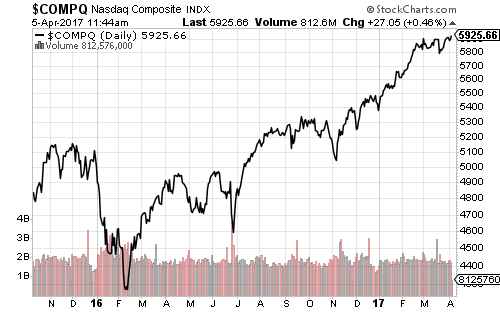

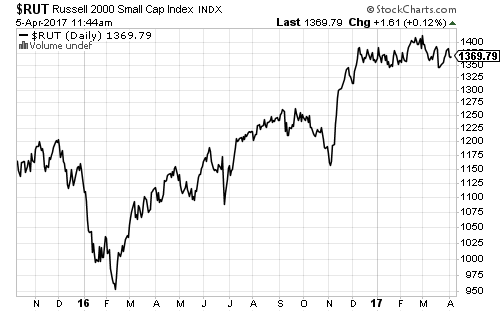

The Nasdaq hit a new all-time high over the past week, despite flat overall trading in the broader market.

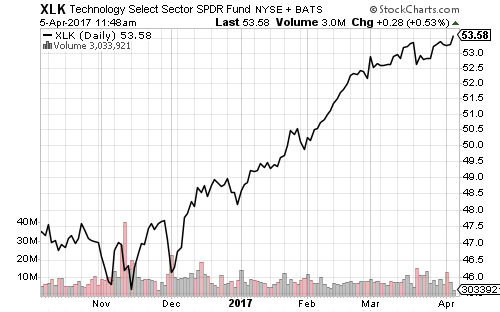

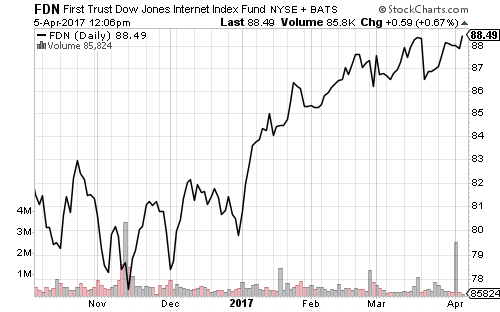

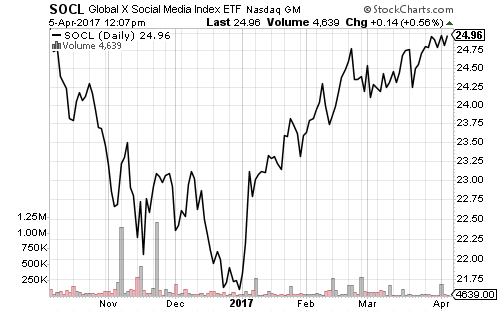

Technology also continues to trade at new highs, led by Internet and social media shares.

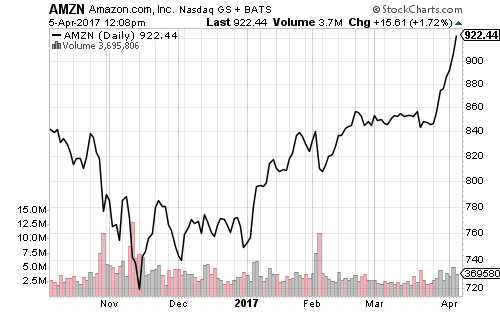

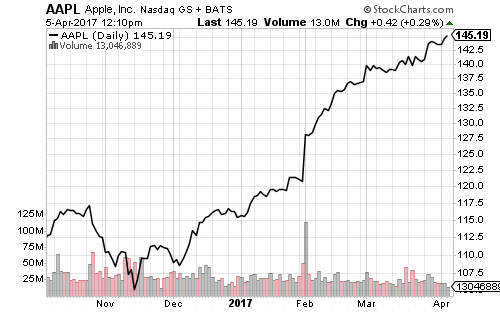

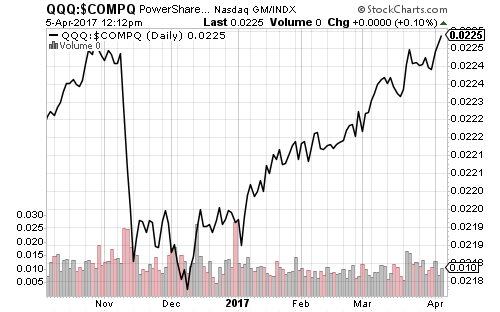

Amazon (AMZN) shares gained 9 percent in just over one week. Apple (AAPL) is also at a new high. The relative price chart of the Nasdaq 100 ETF (QQQ) versus the Nasdaq Composite shows the impact of large-cap tech companies on the index. QQQ has more than 19 percent of assets in the two stocks versus about 13 percent for the Composite.

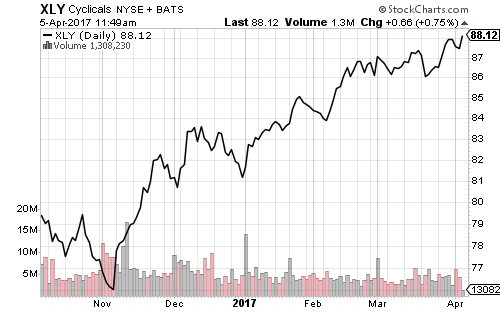

Consumer discretionary accounts for about 20 percent of the Nasdaq and it, too, is at a new high.

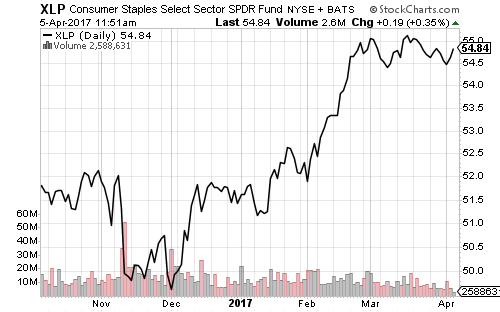

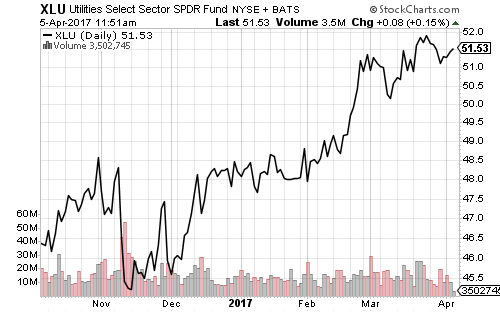

Utilities have remained relatively strong, considering recent interest rate increases. XLU bottomed relative to the S&P 500 Index in February and has been outperforming since. Consumer staples are much less rate sensitive than utilities. XLP followed the broader market higher in February though, and has been outperforming the S&P 500 Index for nearly three months.

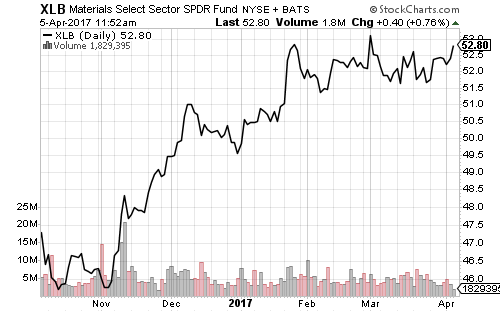

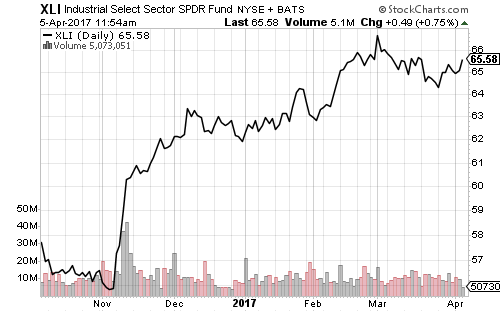

Materials have formed a saucer-shaped consolidation pattern in the past two months. A move above $53 per share will signal a breakout. Industrials are off their March high but remain in a clear uptrend.

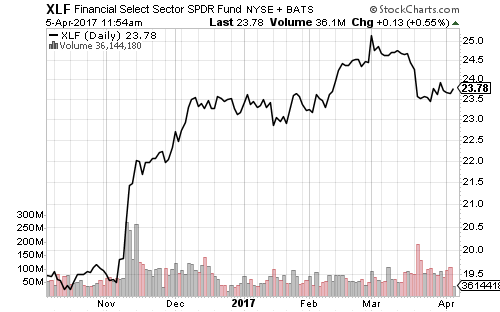

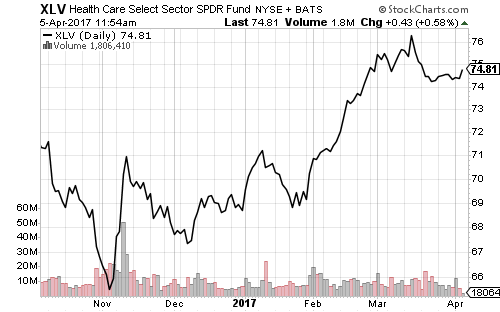

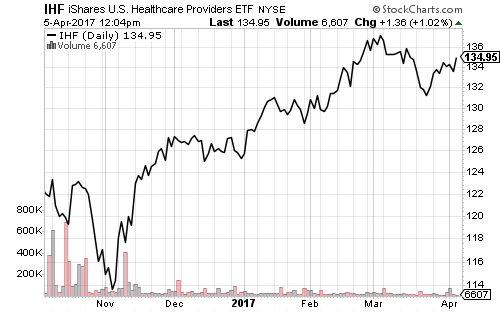

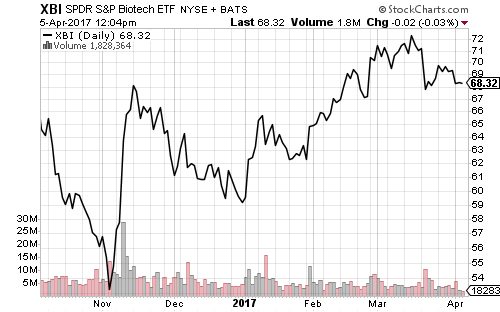

XLF is still trading above the prior resistance level. The bulls have firm footing above $23.50 per share. Healthcare was very strong in February and consolidated the gains in March as biotechnology and healthcare providers slipped.

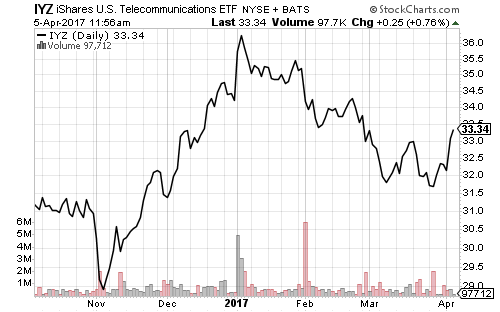

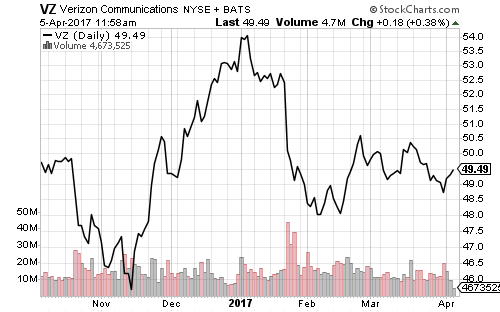

Aside from energy, telecommunications is the only major S&P 500 sector with a loss in 2017. Verizon (VZ) is responsible for much of the underperformance.

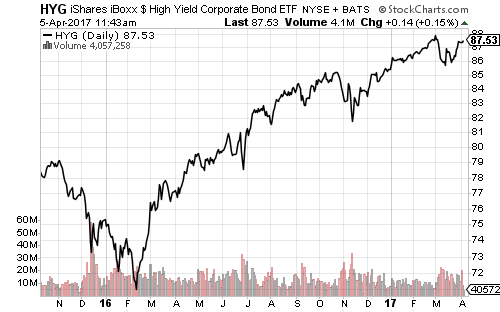

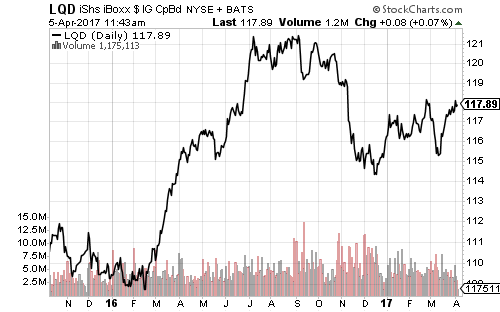

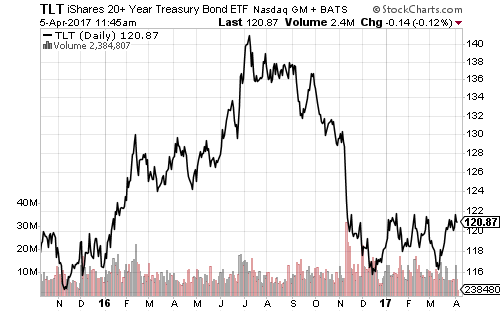

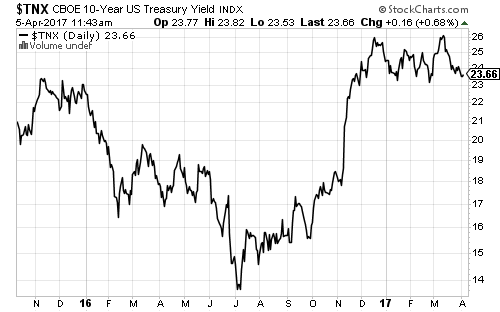

High-yield bonds recovered again last week. Investment-grade bonds, treasuries and treasury yields are all sitting near the edge of their trading ranges. The week ahead should bring either a breakout or a bounce back into the range.

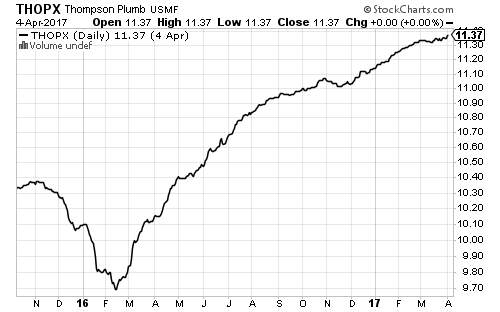

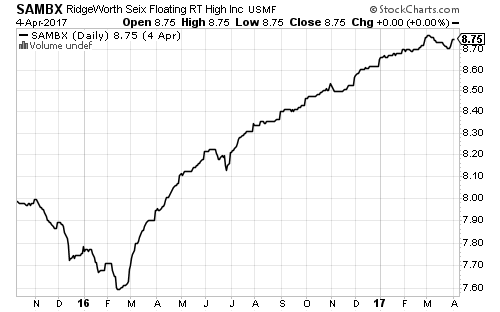

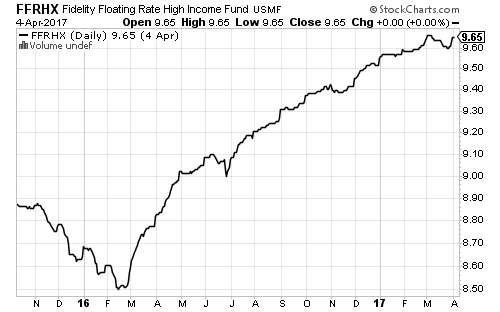

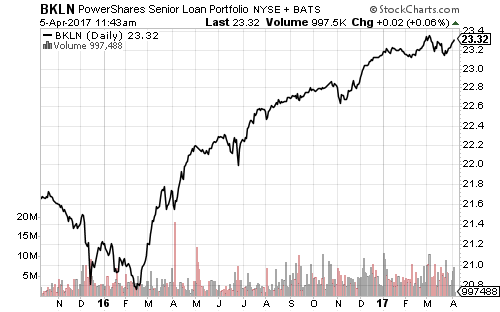

Thompson Bond (THOPX) keeps punching to new highs, while floating-rate funds steadied along with higher-yielding debt.

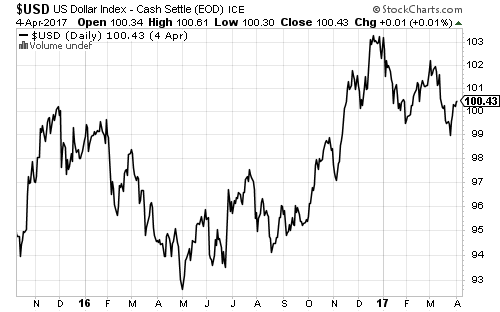

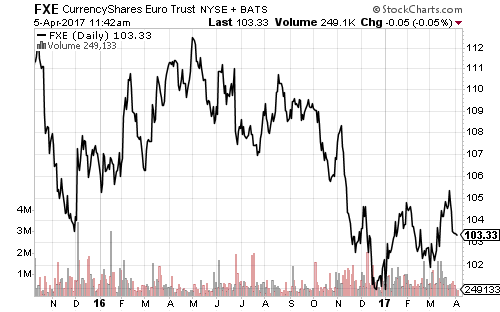

The U.S. Dollar Index rallied back above 100 last week. The dip to a new low at 99 leaves the chart looking bearish in the near-term, so long as it doesn’t break the pattern of lower highs and lower lows since the start of 2017. The euro remains the inverse.

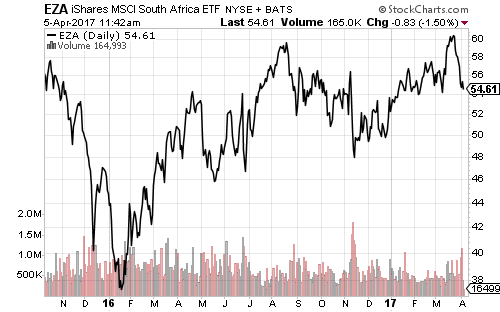

Emerging-market currencies remain stable, with periodic outliers. South Africa’s rand tumbled over this past week after S&P cut the country’s debt rating to junk.

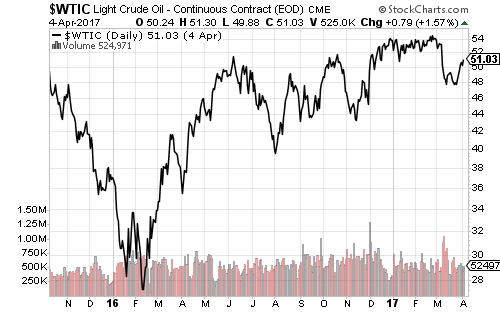

West Texas Intermediate crude oil rebounded above $51 this past week There’s resistance in the $53 area.

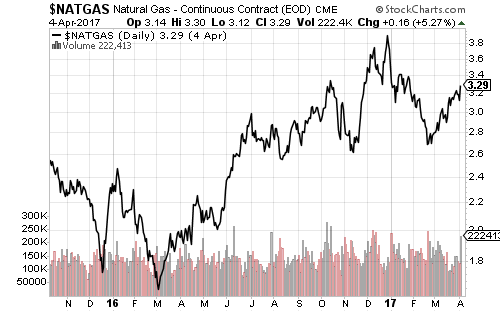

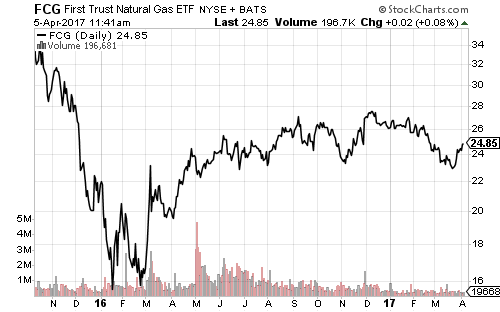

Natural gas remained in an uptrend last week and it finally carried over to natural gas producers, who are now outperforming the broader energy sector. Natural gas will probably need to hold above $4 for stocks to mount a significant rally.

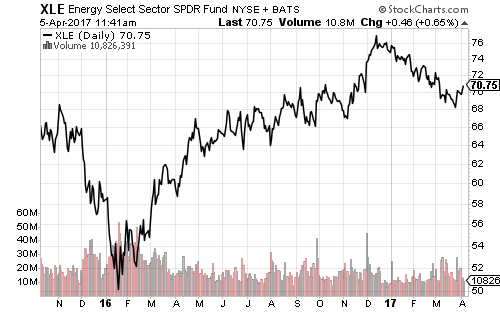

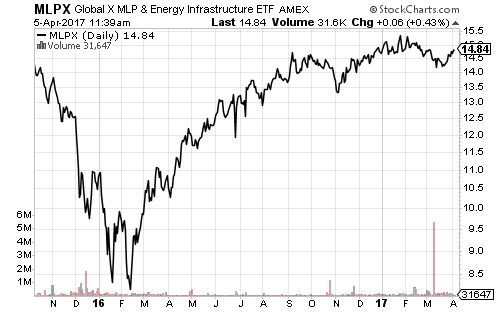

Even if energy prices fall, pipeline companies could see higher profits as domestic energy production rises, something that appears likely given the Trump Administration’s desire for more growth and employment in the United States.

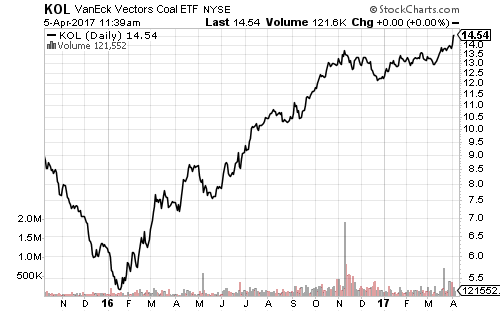

The Trump Administration also gave the coal sector a boost last week with rollbacks on some regulations, but Chinese shares pulled the coal ETF higher on Tuesday.

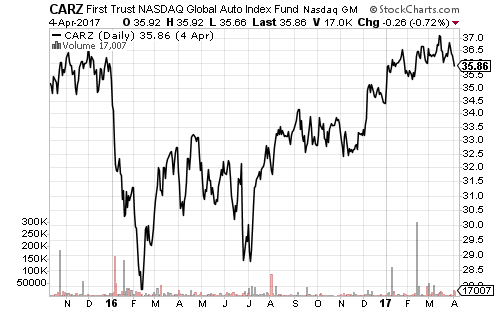

Car sales disappointed in March, hitting an annual pace of 16.6 million, below the 17.3 million expected. Investors sold automaker shares in response. CARZ also stalled at resistance around the $37 level, but has remained in an uptrend since early 2016.

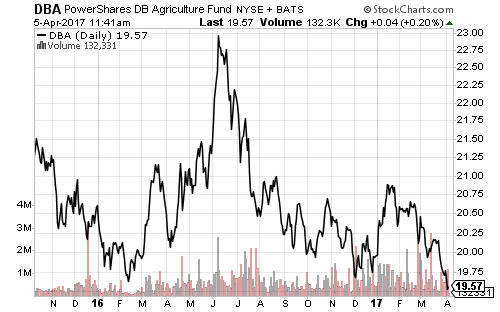

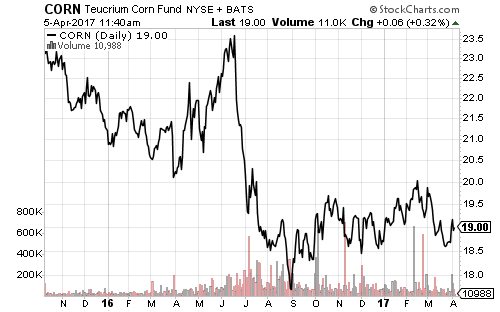

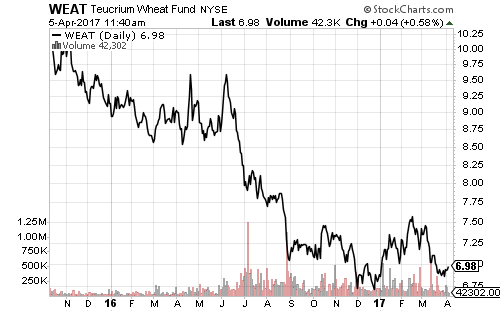

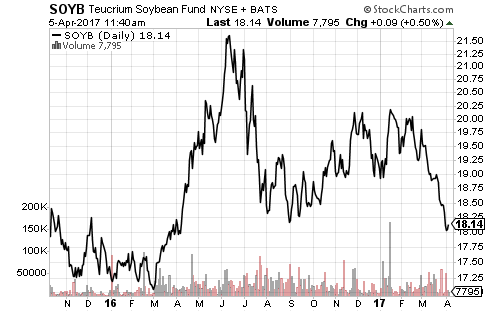

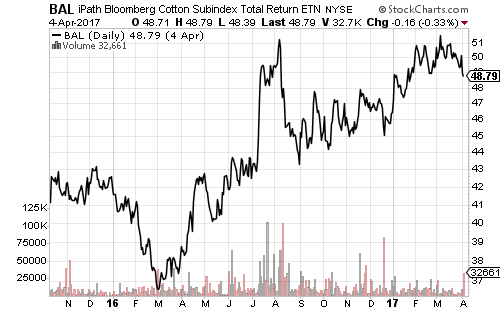

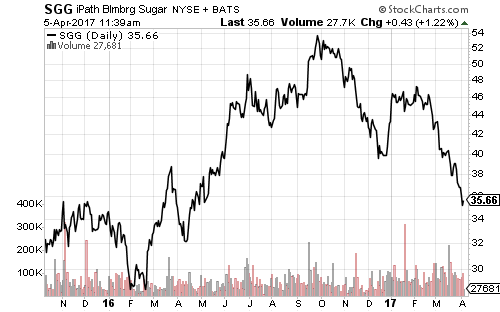

Agricultural commodities briefly participated in the commodities rally of 2016, but PowerShares DB Agriculture (DBA) made a new all-time low this week. Ag commodity funds are hitting new all-time lows or approaching new 52-week lows.