The odds of a March interest rate hike jumped to over 90 percent on Wednesday following a stellar ADP jobs report. Private employers created 298,000 jobs in February, with 66,000 new construction jobs and 32,000 in manufacturing. These numbers were the largest in 11 and 5 years.

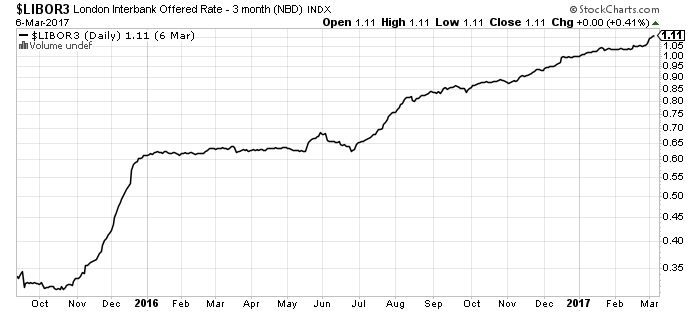

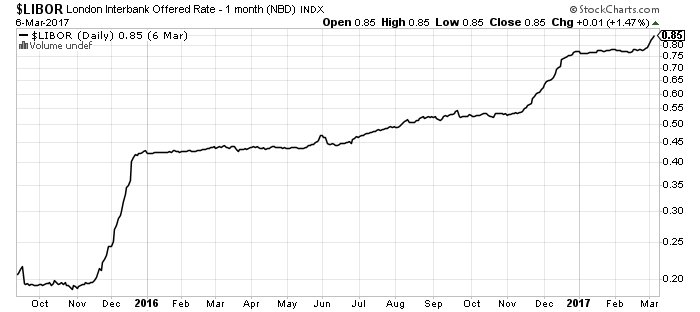

Investors are also pricing in the hike via Libor. One-month Libor hit 0.85 percent, which is 40 percent of a quarter-point hike. Three-month Libor hit 1.11 percent, as investors have also started to price in a second hike.

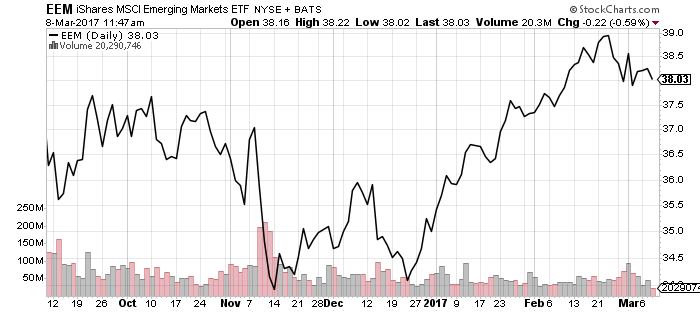

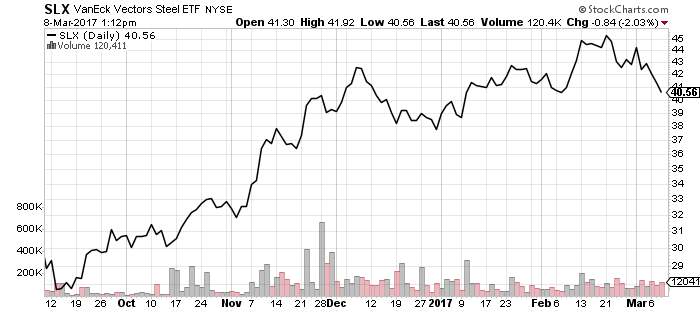

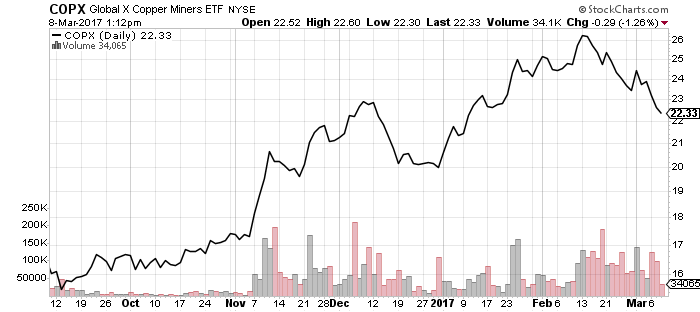

Higher interest rates have negatively impacted a few market areas. Emerging markets and steel have fallen for two consecutive weeks, while copper miners have fallen for three.

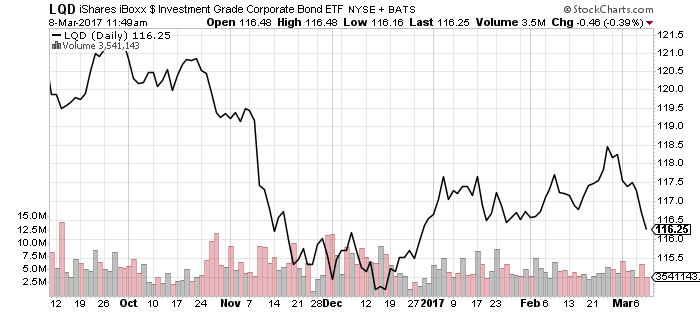

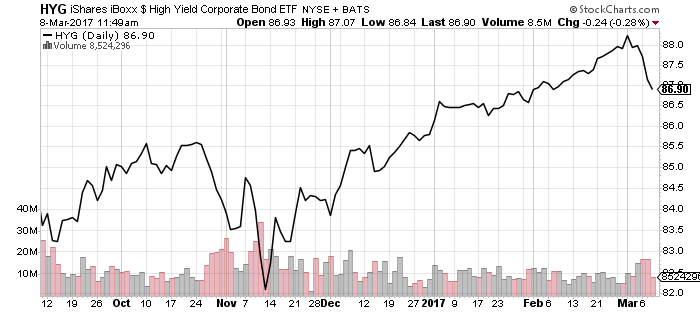

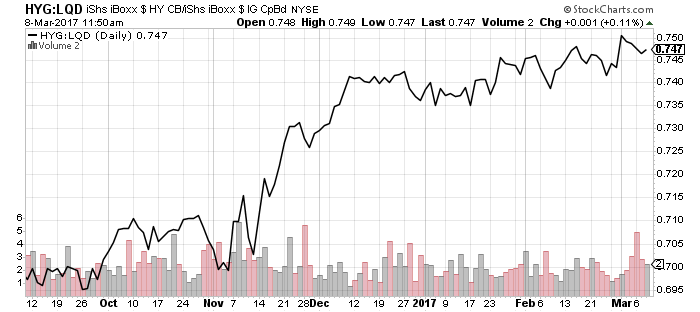

Investment-grade and high-yield bonds both followed bond prices lower. High-yield bonds are still in a relative uptrend, as is expected when credit risk is low or falling.

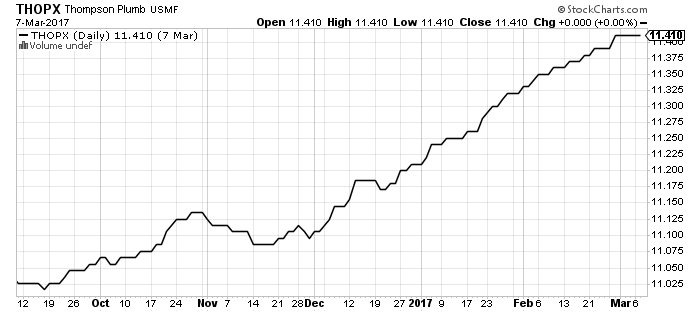

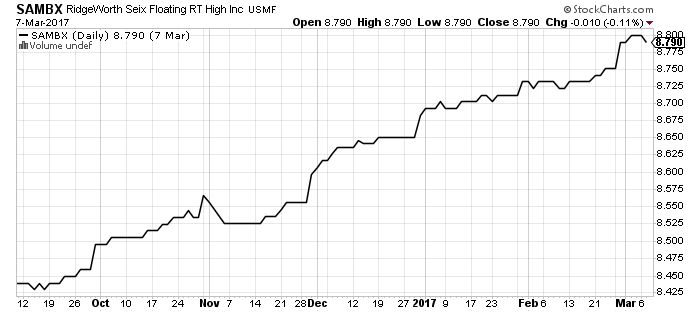

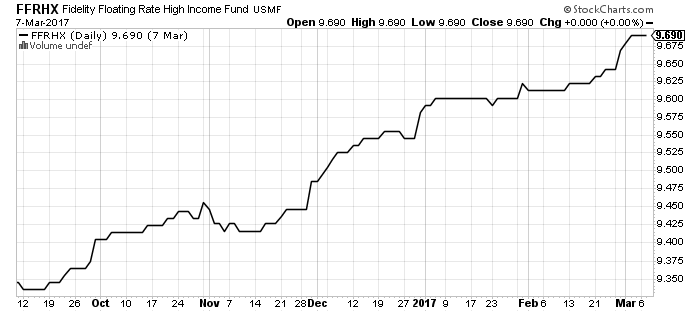

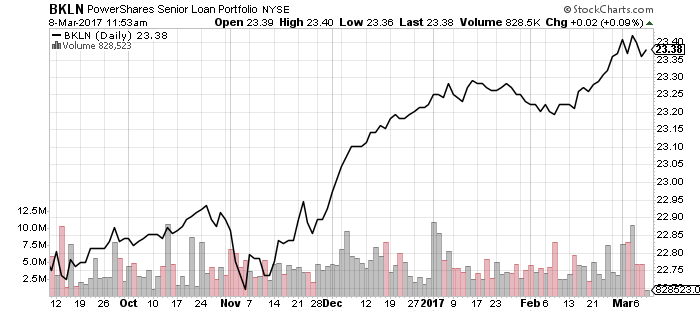

The jump in interest rates triggered a pause in Thompson Bond (THOPX). It is the first week without a gain since early December. Floating-rate funds also paused their ascent as markets priced in higher interest rates.

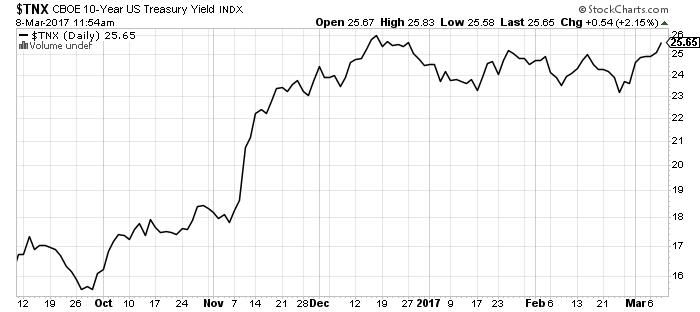

The 10-year Treasury yield is approaching its 52-week high of 2.6 percent.

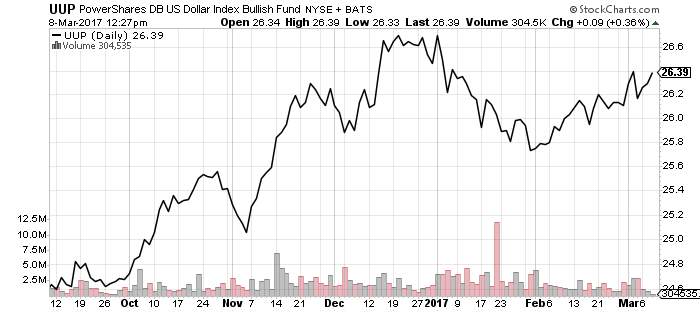

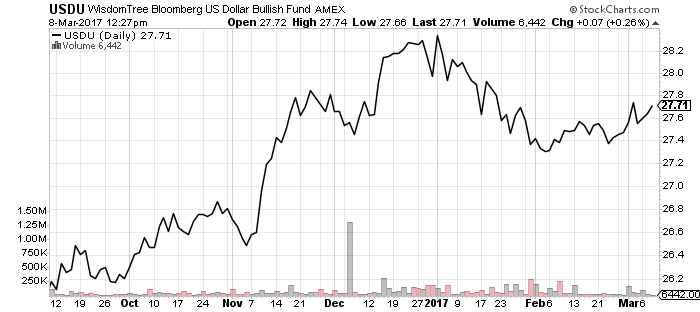

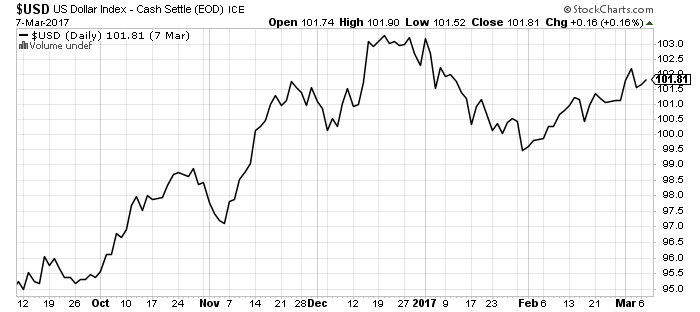

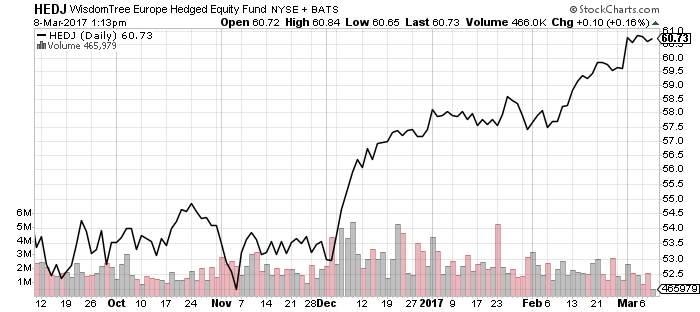

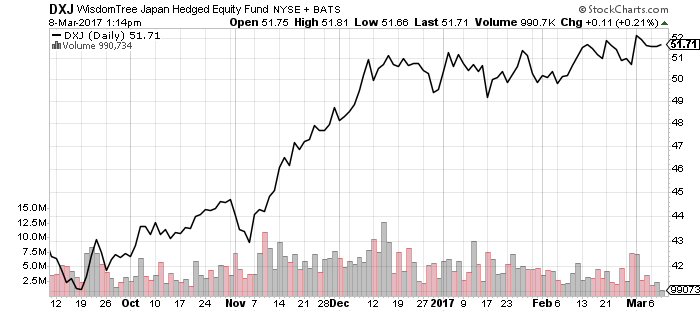

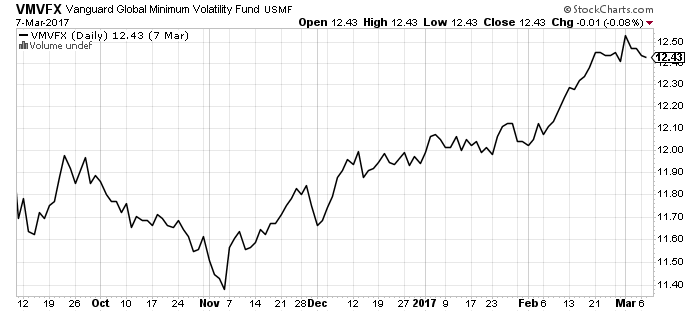

The U.S. Dollar Index rallied on rising rate hike expectations, but has yet to hit a new 52-week high. Currency-hedged funds are near their 52-week highs, but holding relatively steady with the dollar in a consolidation phase.

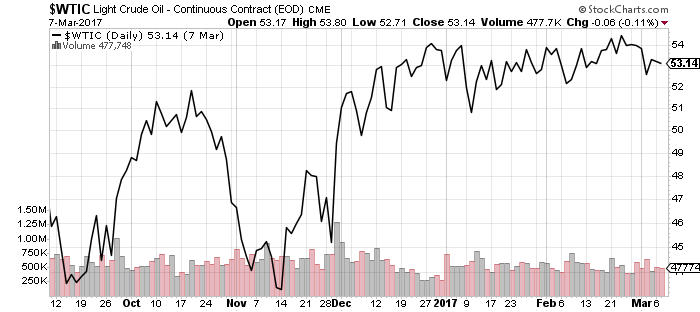

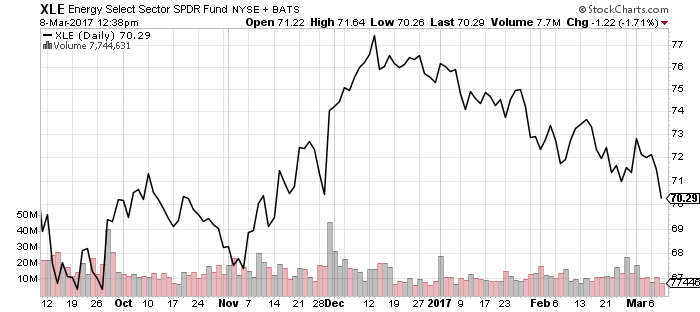

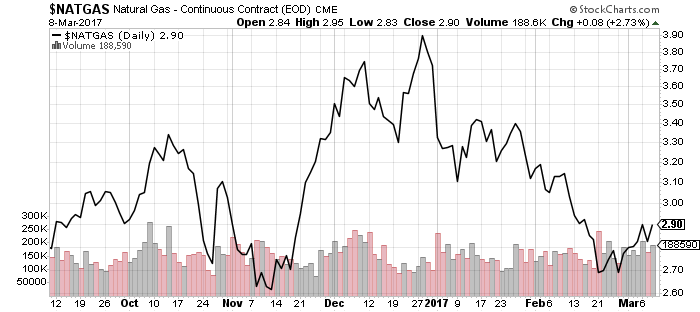

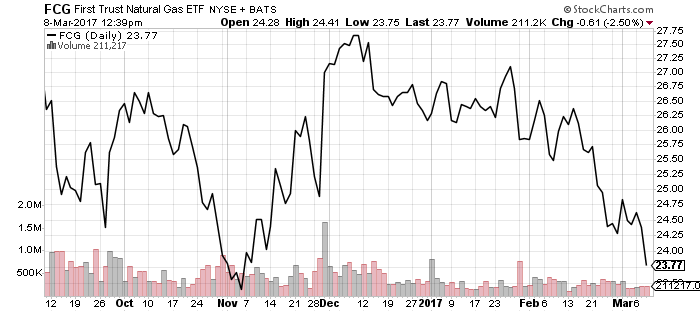

Oil inventories climbed for the ninth consecutive week, dropping oil to the bottom of its three-month trading range. West Texas Intermediate Crude oil has failed to break above $54 over the past three months. Natural gas recently bounced above its support.