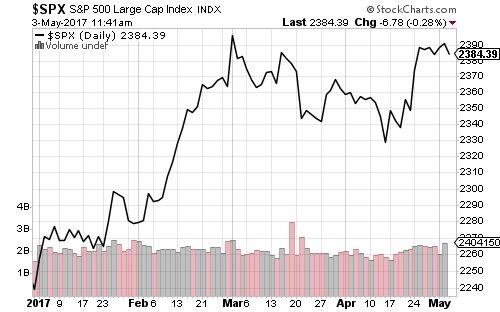

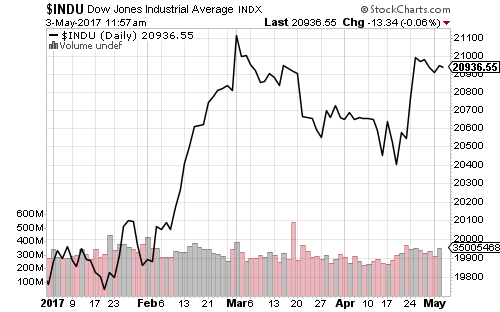

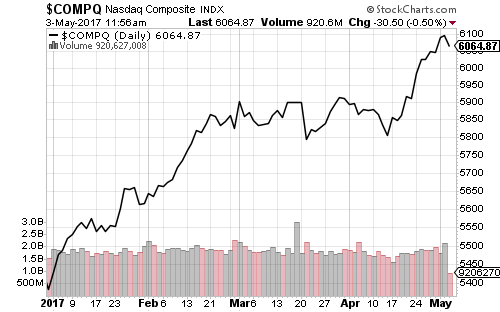

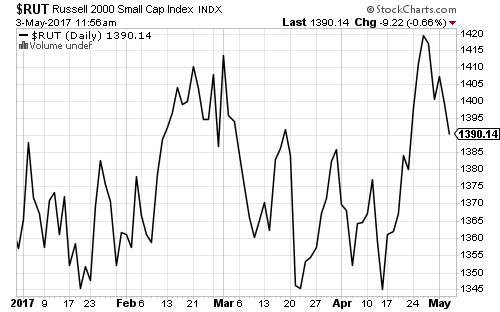

An S&P 500 rally of less than 1 percent would breach 2400 and another all-time high. The Dow Jones Industrial Average is also less than 1 percent from its all-time high, while the Nasdaq and Russell 2000 set new all-time highs last week.

Rising consumer confidence reflects the bullishness in the stock market.

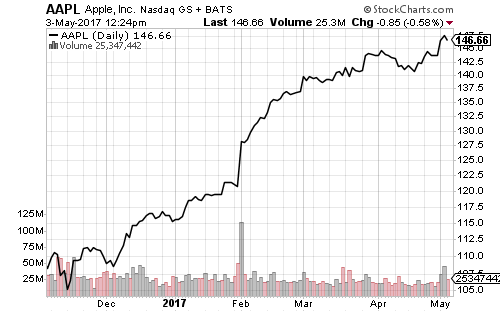

Apple (AAPL) grew earnings by 10 percent and revenues by 4 percent, but analysts focused on a drop in iPhone sales. Shares of Apple fell more than 2 percent overnight, but rebounded in Wednesday trading as optimistic investors looked forward to the iPhone 8 later this year.

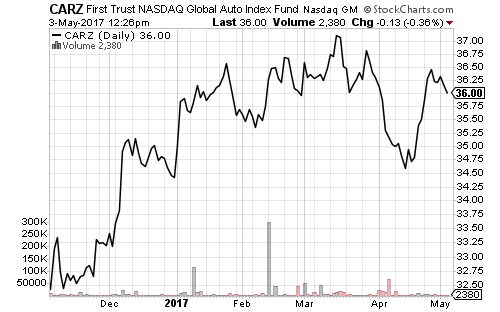

April car sales slipped to an annualized pace of 16.9 million, up from March’s pace of 16.6 million, but below expectations of 17.2 million. Shares of Ford (F) and General Motors (GM) fell on the day. This rate of car sales is consistent with a strong economy and high consumer confidence, but automakers spent more on incentives to move high inventory in April, cutting into profits.

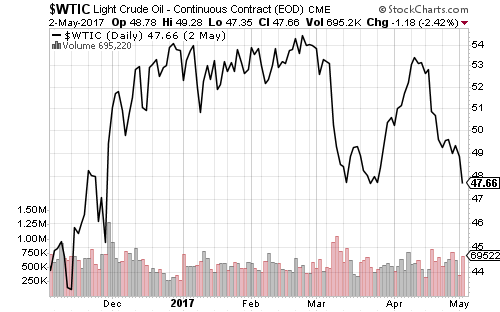

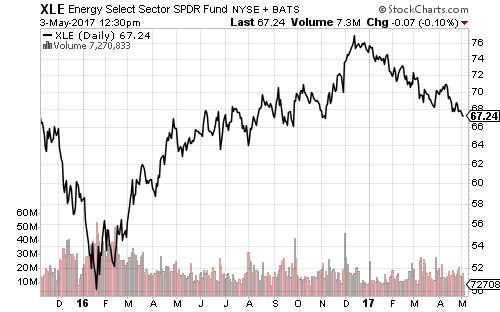

Energy stocks made a new 2017 low this past week as oil prices fell. SPDR Energy (XLE) is flirting with a new 6-month low.

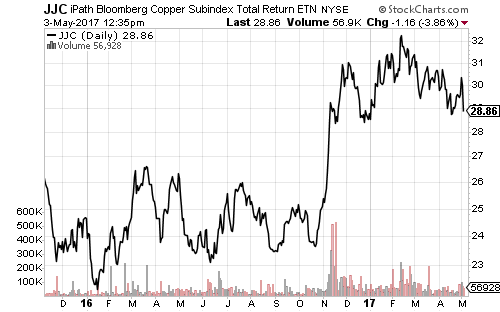

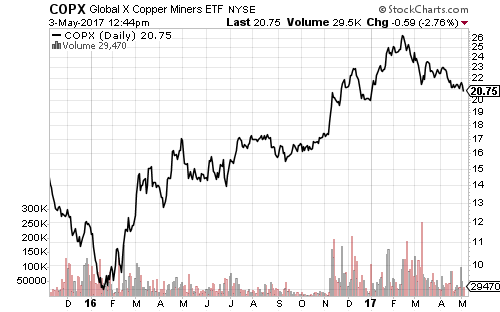

Copper tumbled more than 3 percent, near its 6-month low, on Wednesday after inventory jumped.

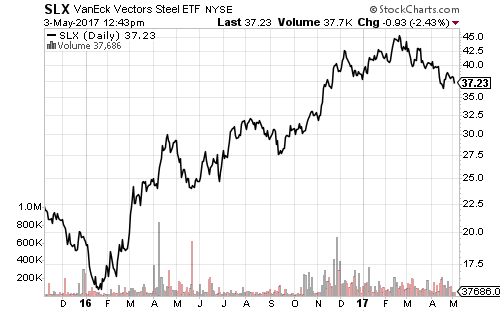

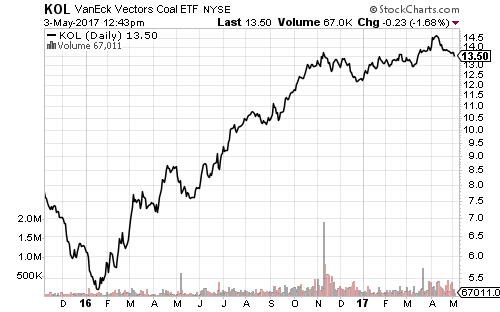

Steel and coal are also moving lower as China tries to cool its real estate market and simultaneously deleverage its financial system.

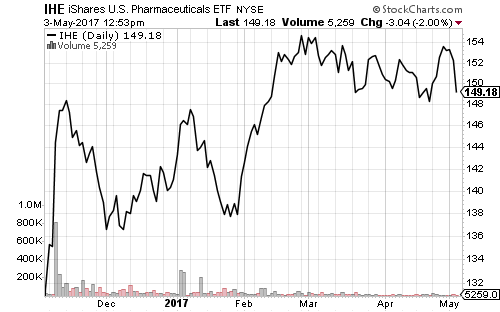

Earnings in the pharma sector were solid on Tuesday, with both Merck (MRK) and Pfizer (PFE) beating estimates. On Wednesday, however, offices of Perrigo (PRGO) were raided by the Justice Department as part of an investigation into price fixing. Other firms also under investigation, such as Mylan (MYL), declined in sympathy.

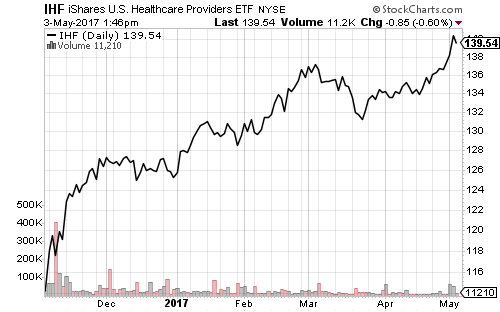

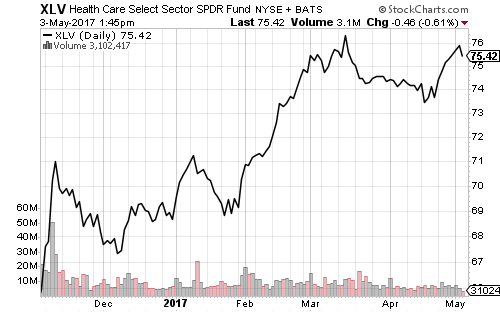

The broader healthcare sector is near its all-time high as Republicans continue to negotiate the amendment to revamp the ACA.

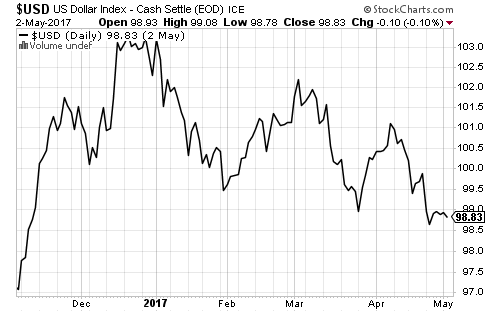

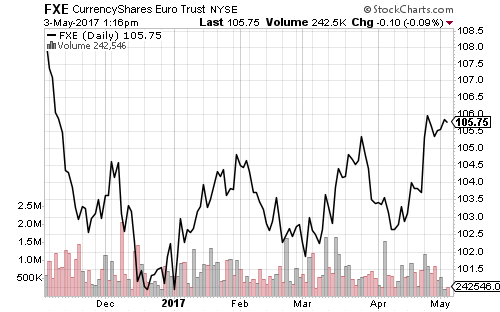

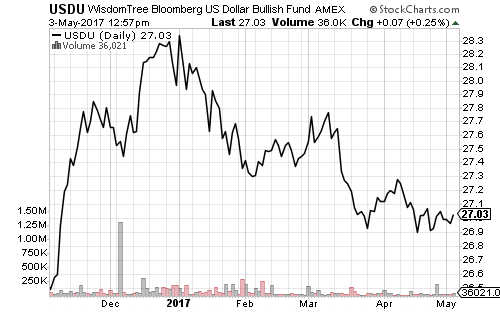

The U.S. dollar slumped against the euro on April 24, but has firmed in recent days. The Bloomberg U.S. Dollar Index has stabilized since late March. USDU has larger exposure to the Canadian dollar. The Canadian loonie (a one dollar coin) has fallen 3 percent over the past two weeks due to troubles at the country’s largest subprime mortgage lender.

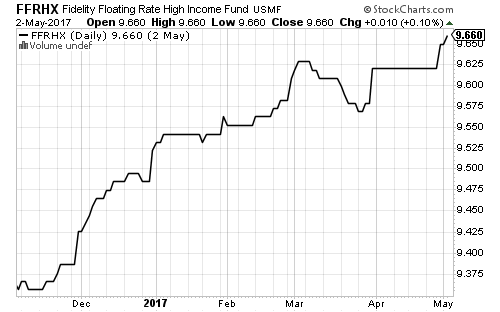

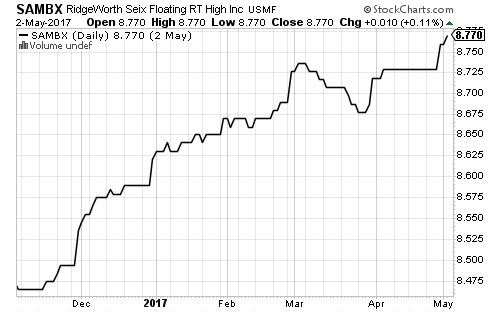

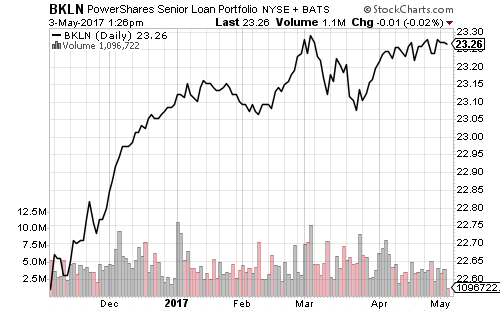

The Federal Reserve left rates unchanged, as anticipated, at today’s meeting. June rate hike odds are holding steady at 70 percent. Floating-rate funds started moving higher again as investors start banking on that hike.

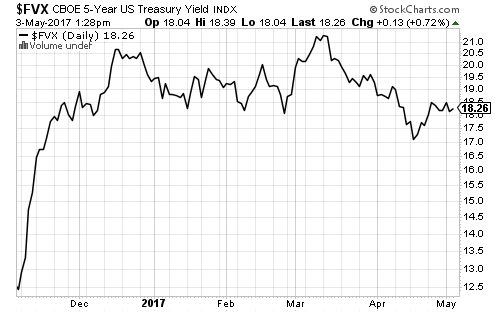

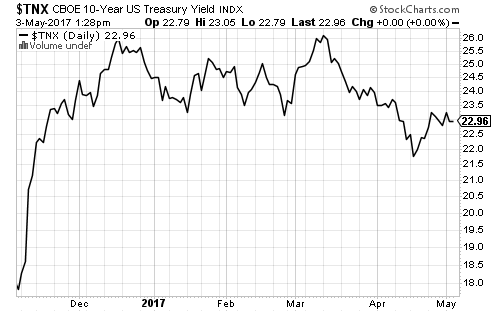

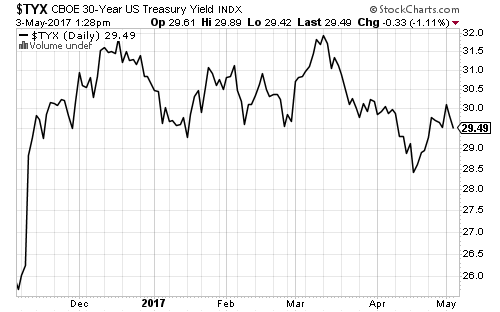

Longer-term bond yields such as the 5-, 10- and 30-year Treasury are back at the bottom of their 2017 trading ranges.

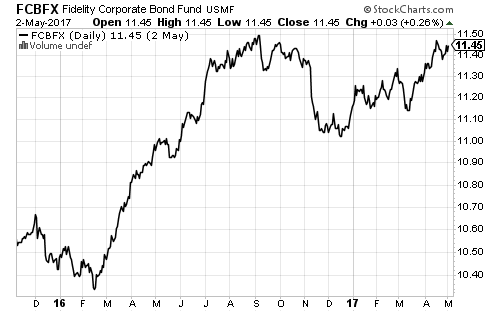

Corporate bonds are near their 52-week highs, and the high-yield bond ETF HYG has already hit a new all-time high.

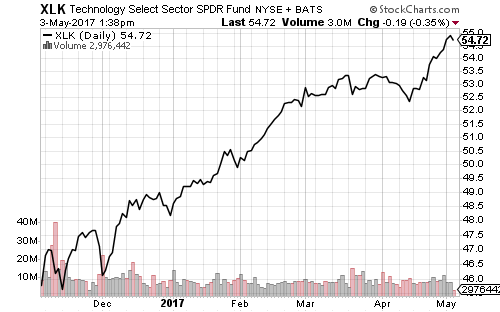

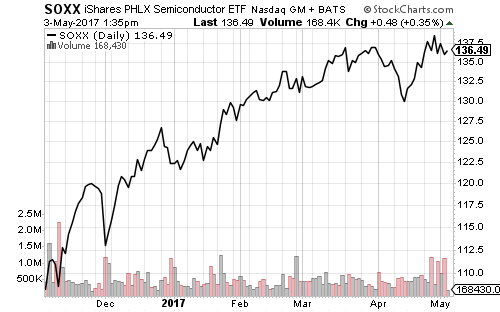

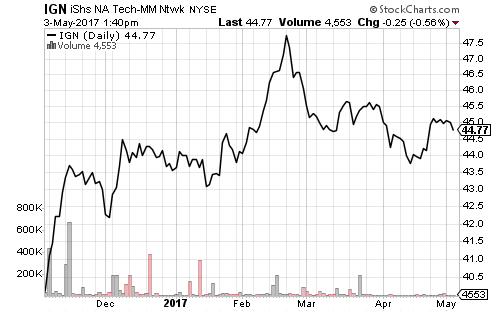

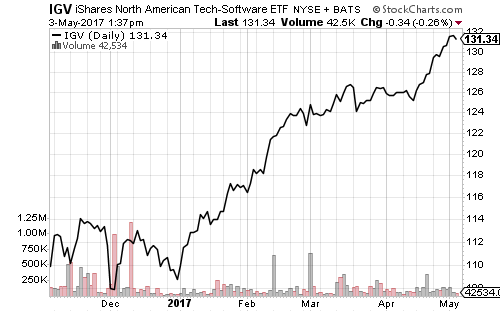

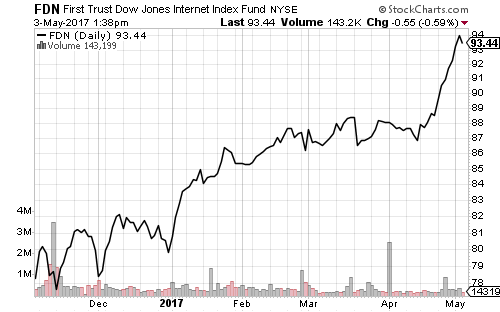

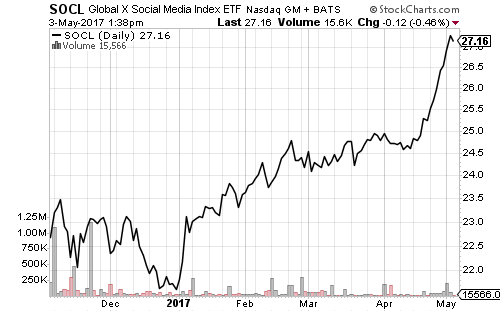

Semiconductors have led the tech sector for much of the year, but fell in April. Advanced Micro Devices (AMD) missed earnings estimates and networking stocks are also underperforming. In contrast, the software sector popped in mid-April and hasn’t slowed yet. Internet and social media shares are doing even better. The social media ETF has gained 10 percent in the past three weeks.

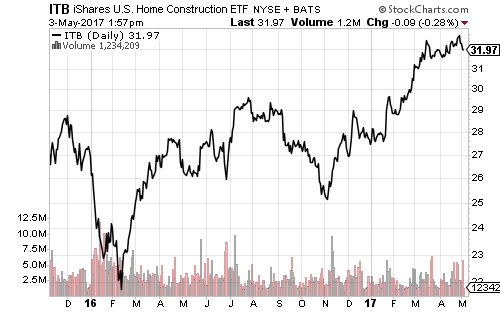

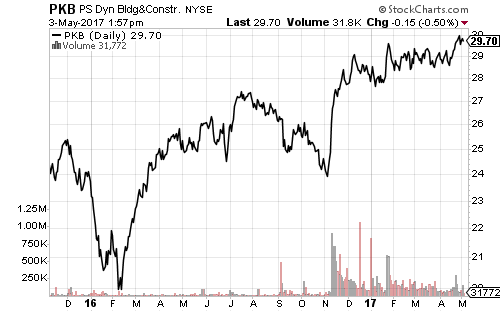

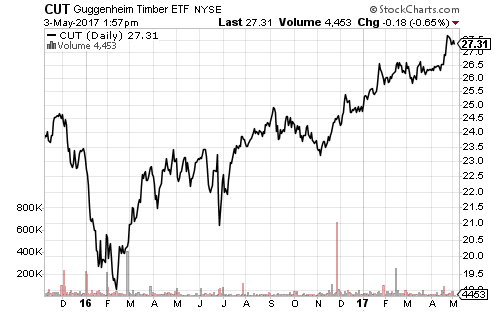

iShares U.S. Home Construction (ITB), PowerShares Dynamic Building & Construction (PKB) and Guggenheim Timber (CUT) all hit new 52-week highs over the past week. Strong earnings from Martin Marietta Materials (MLM) lifted the construction sector on Tuesday.