European Quantitative Easing

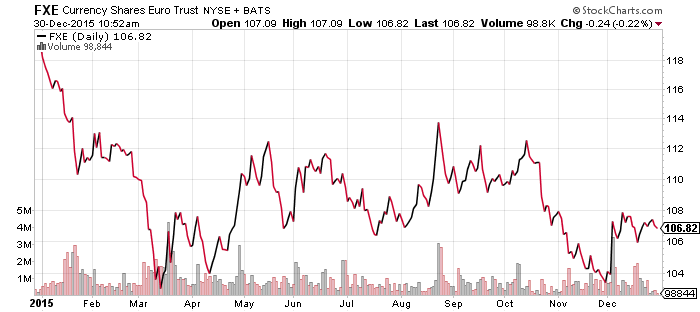

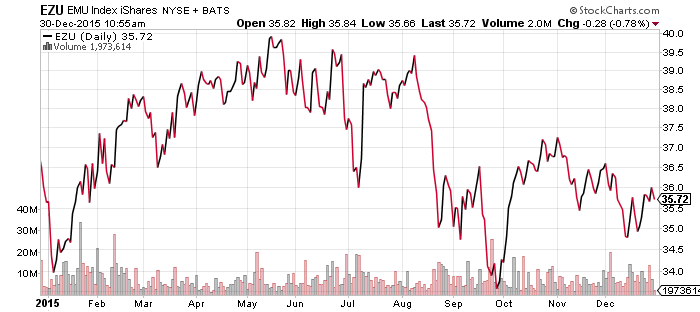

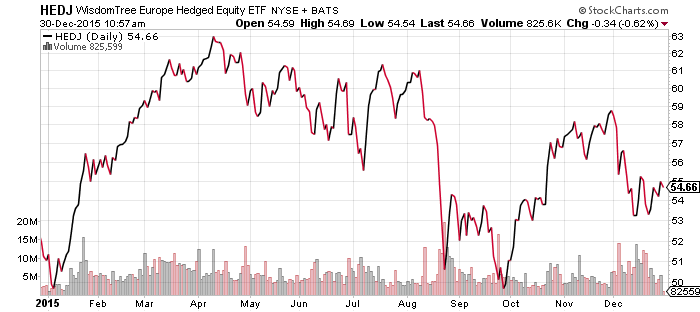

The European Central Bank (ECB) implemented a quantitative easing program in 2015 that benefited European equities, which rallied strongly despite a weakened euro headwind. From the announcement in January through implementation in March, the euro experienced an almost straight-line decline versus the U.S. dollar.

Investors with currency-hedged exposure fared even better. WisdomTree Europe Hedged Equity (HEDJ) rallied 26 percent following QE, versus about 17 percent for iShares EMU Index (EZU).

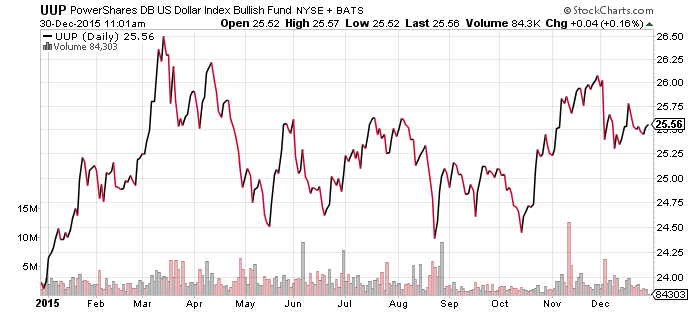

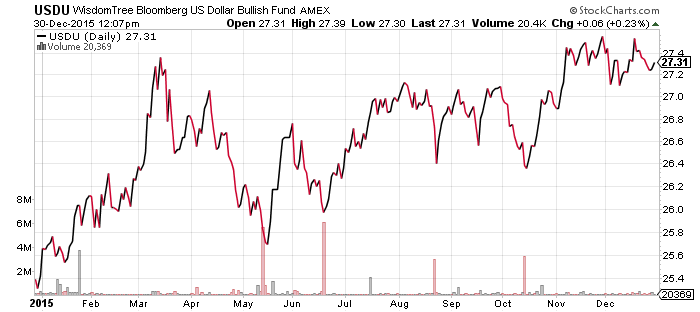

Accounting for 57.6 percent of the U.S. Dollar Index (tracked via futures by PowerShares DB U.S. Dollar Index Bullish (UUP), the QE program fueled a strong bull rally in the U.S. dollar.

The Bloomberg U.S. Dollar Index, tracked by WisdomTree Bloomberg U.S. Dollar Bullish (USDU), outperformed its popular Eurocentric counterpart tracked by PowerShares DB US Dollar Index Bullish (UUP).

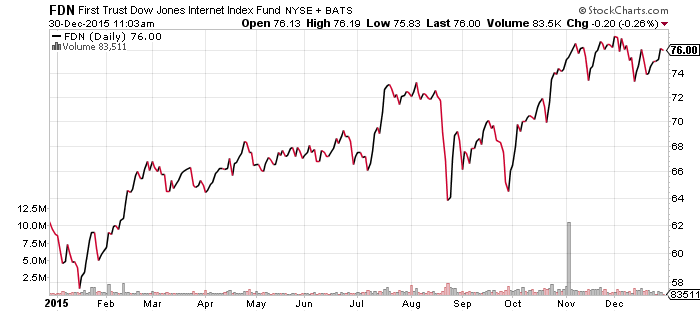

Internet Stocks

FANG, an acronym which stands for Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOG), wormed its way into 2015 market vernacular with impressive performances from all four brands. These household names dominated the stock market in 2015 and are largely responsible for the Nasdaq’s outperformance. They may also be solely credited if the S&P 500 finishes the year in the black.

FirstTrust Dow Jones Internet (FDN) counts the four among its top five holdings and is poised to finish the year with a gain of around 25 percent.

A driving force for the rally was the emergence of cloud services as a profit center. Growth in Amazon’s cloud services, which are a high-margin business as opposed to retail, raised investors’ assessments of the firm’s value. If the trend carries into 2016, shares of older tech stalwarts implementing similar strategies, such as Microsoft (MSFT), could benefit.

Interest Rates

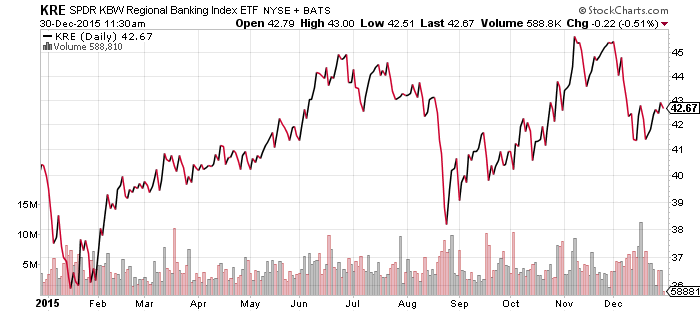

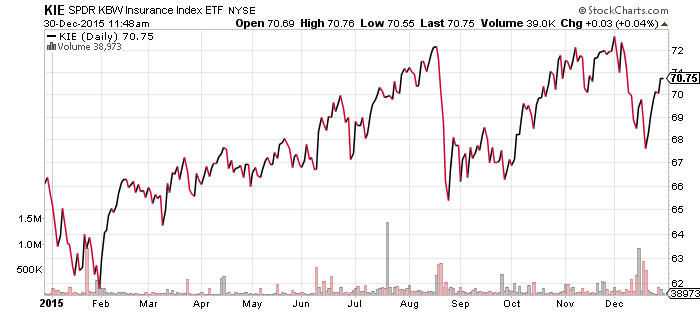

The Federal Reserve finally fulfilled analysts’ expectations with a much-anticipated and long overdue interest rate hike in December. The Fed passed on rate increases in June and September, frustrating investors and engaging rate-sensitive sectors in a period of watchful waiting and volatility. The delay gave investors time to price in the hike, thus muting the impact on financial markets, although a few sectors flourished with the December 16 announcement. Regional banks met our analysts’ predictions with substantial growth and fluctuations indicating their potential to thrive in 2016. Insurance companies also performed well. These sectors are both up mid-single digits for the year.

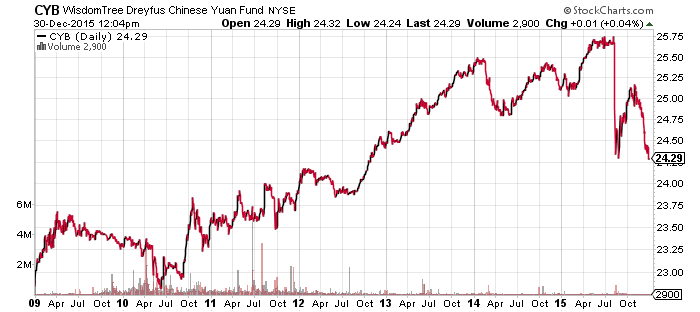

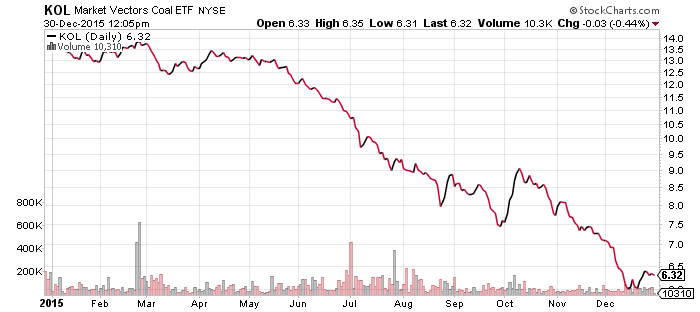

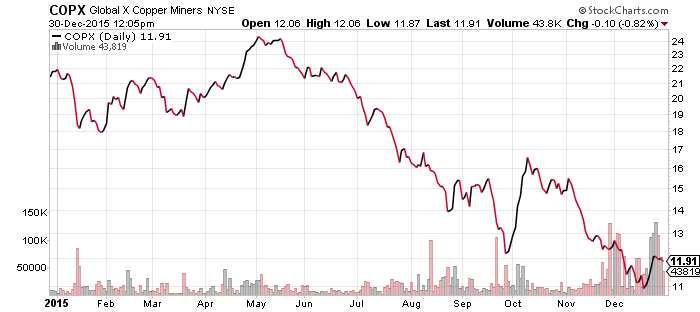

China

The slowdown in China’s economy and depreciation of the yuan led to market turmoil in 2015.

China’s economic growth has been slowing for several years, especially in the industrially dominant Northeast region. Coal and steel have been in decline since 2011. In late 2014, however, other industries such as cement protracted due to weakness in real estate. Infrastructure and housing investments initially served as a buffer to industrial erosion, but real estate investment fell steadily in 2015, leaving behind little to stimulate economic growth.

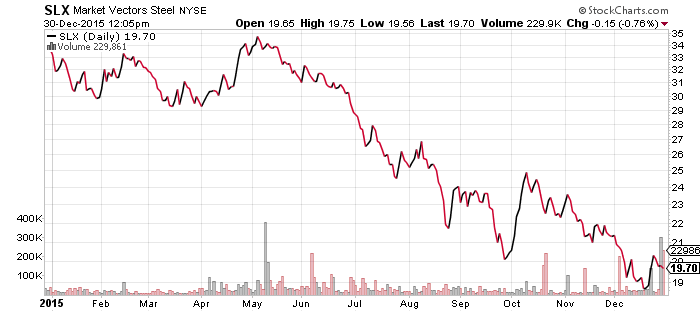

The impact was felt in global markets dominated by Chinese demand, such as copper and iron ore. Chinese steel mills compounded the problem by dumping excess steel into the global market as demand in China collapsed.

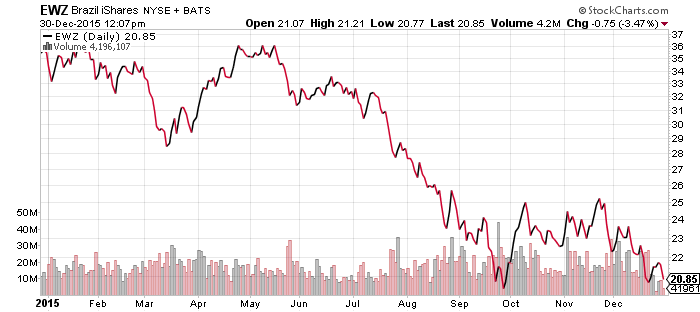

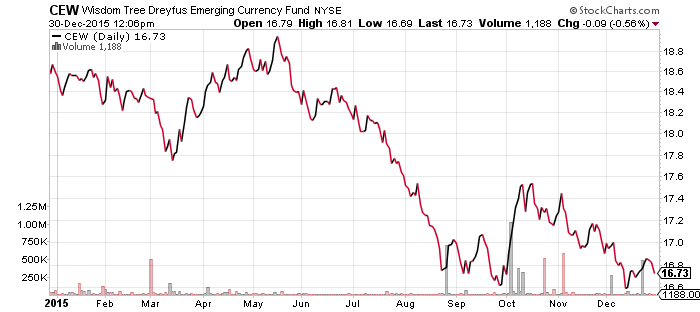

Export-dependent emerging markets, such as Brazil, suffered direct hits both from China’s slowdown and a decision to allow the yuan to depreciate in August.

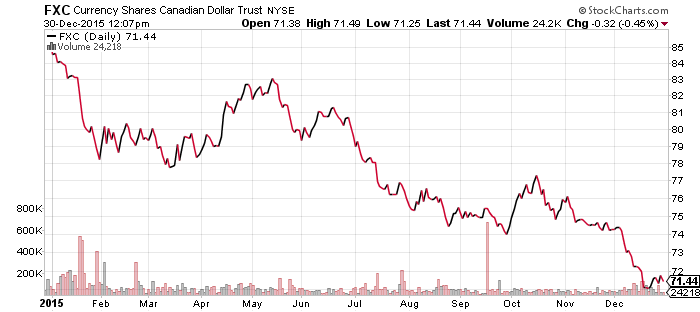

Developed-market currencies such as the Canadian dollar also suffered due to the drop in resource prices.

Oil Prices

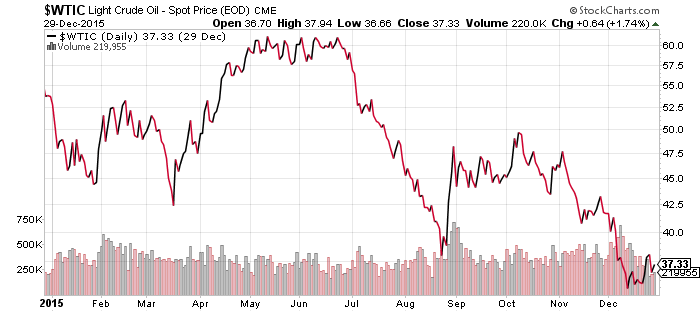

Pressure on oil intensified throughout 2015, resulting in December lows rivaling those reached during the 2008-2009 financial crisis.

China’s economic decline led to a global slowdown in oil demand. Although China continued to buy cheap oil to fill its strategic reserves, producers banked on strong, long-term global GDP growth that proved unsustainable. Additionally, Saudi Arabia grew market shares in an effort to capitalize on falling oil prices, hoping to increase sales at the expense of higher cost producers, such as U.S. shale. American producers did slash rig counts, but oil inventory increased as drillers ramped up output from higher quality. Financial stress in various nations from Russia to Venezuela also added to pressure on sellers. Finally, the Iranian nuclear deal paved the way for Iran to re-enter the global oil market. At the December OPEC meeting, Saudi Arabia and other Gulf states voted against cutting production to make room for Iran.

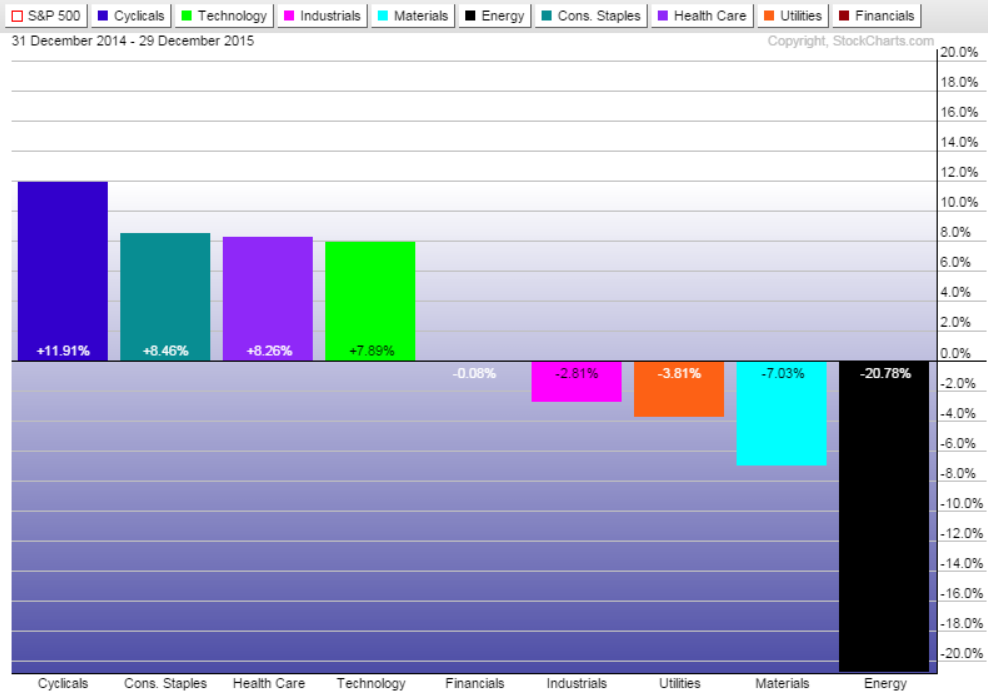

The drop in oil prices weighed on the energy sector and losses hindered the S&P 500’s growth.

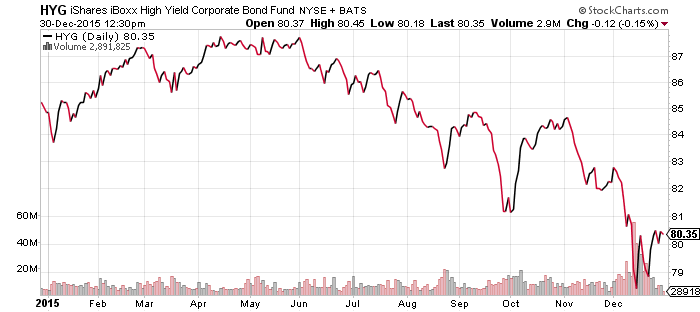

Weak energy prices also spilled over into high-yield bonds. Many shale oil producers made use of cheap debt to finance operations, resulting in exposure to the sector for many high-yield funds. The bonds portfolio of iShares iBoxx High Yield Corporate Bond (HYG) fell about 10 percent on the year, although interest payments remediated losses to about 5 percent.

Weak energy prices also spilled over into high-yield bonds. Many shale oil producers made use of cheap debt to finance operations, resulting in exposure to the sector for many high-yield funds. The bonds portfolio of iShares iBoxx High Yield Corporate Bond (HYG) fell about 10 percent on the year, although interest payments remediated losses to about 5 percent.